Singapore Airlines: ready to face the deluge of Asian LCCs?

June 2004

Singapore Airlines (SIA) has recovered quickly from the impact of SARS and a few weeks ago reported an operating profit of S$680m (US$400m) for the 2003/04 financial year. Now, however, SIA faces a longer lasting and much more dangerous challenge — the low–cost carriers.

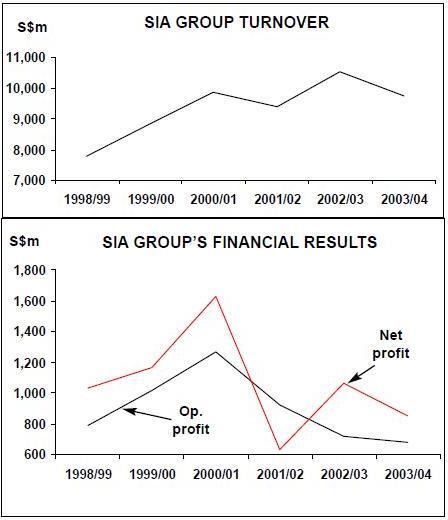

Singapore’s flag–carrier, created in 1972 from the former Malaysian–Singapore Airlines, today operates to 60 destinations in Asia and around the world. Historically, SIA has racked up year after- year of continuous profits, and though September 11 and the Bali bombing of October 2002 hit traffic at the main airline, earnings from elsewhere within the SIA group mitigated the effect on the bottom line. In 2002/03 (SIA’s financial year runs to the end of March) operating profit fell 22% to S$717m (US$416m), but net profit increased by 69% to US$626m, partly due to a one–off tax write–back of US$164m after a cut in Singapore’s tax rates.

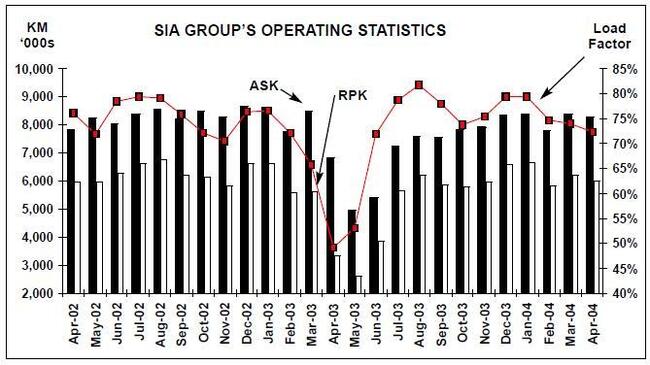

A bigger challenge to SIA came from SARS. The outbreak caused SIA’s traffic to collapse in April and May 2003 (see chart, page 14), and in April–June 2003 the SIA Group reported its first–ever quarterly losses. Revenue fell 35% in the quarter and operating losses totalled US$215m, compared with a US$139m profit in the same period in 2002. Net losses totalled US$178m, compared with a US$273m net profit in April–June 2002.

SIA responded to SARS by cutting capacity by more than 30%, reducing management pay by 27%, forcing cabin crew to take unpaid leave and putting a freeze on recruitment. In June 2003, SIA made more than 400 staff redundant, around 1.5% of the 29,000–strong group workforce, and the first time that SIA had laid off staff since the 1980s. But this still wasn’t enough, and in July another 180 staff were let go.

Over the same period management persuaded unions to accept substantial wage cuts: pilots agreed to salary reductions of 11%-16.5%, engineers to 7.5% and other staff to between 5%- 11%. In return SIA agreed to refund the salary reductions depending on results for 2003/04. The agreed formula was a 25% refund if profits reached S$200m (US$114m), 50% for profits of more than S$300m, 75% for >S$400m, 100% for >S$500m and 115% for >S$600m.

The salary cuts were controversial, with the greatest opposition coming from ALPA–S — the pilots' union. Management had wanted a cut in pilots' pay of up to 22.5%, but after the union resisted the matter was taken to arbitration and the eventual reduction was slightly less.

The deal with the pilots was to remain in force until a new collective agreement was signed in the first quarter of 2004. However, considerable unease about the deal within the pilots union was fuelled by misgivings about management’s wish that the new collective agreement should link part of pilots' pay to SIA’s financial performance permanently.

This resulted in the pilots' union members sacking the entire union leadership at the end of 2003, in favour of representatives that would take a tougher stance with management in the 2004 collective agreement negotiations.

The Singaporean government — renown for its tough line on industrial dissent — stepped in and put pressure on the pilots to come to a quick agreement in 2004 by declaring it would amend the existing Trades Union Act so that leaderships of trades unions would no longer have to get approval from their members for any deals they signed.

Some observers felt the government was bullying the pilots, and with SIA’s handling of the redundancies criticised for being heavy–handed, tensions rose between the two sides. However, SIA CEO Chew Choon Seng wrote to all employees in February 2004 to say the airline was on target to report more than S$600m of profit (which it did) — thus triggering a refund of the 2003 wage cuts plus a 15% bonus on top. In a more conciliatory approach, SIA management now promises to share information about SIA’s performance with its workforce and develop a better relationship with unions.

Altogether, the wage reductions cut costs by just over US$100m a year, and with traffic recovering in June and July 2003, SIA has now reversed its capacity cuts. In November 2003 SIAstarted recruiting again, rehiring some of the staff it made redundant earlier in the year.

Although revenue fell 6.4% in July–September 2003, SIA posted an 18% increase in operating profit to US$180m in the period. Recovery continued into the third quarter of SIA’s financial year, with operating profits for October–December up 174% to US$279m. For the full 2003/04 financial year, although SIA Group revenue fell 7.2% to US$5.7bn compared with the previous year, operating profit decreased by just 5.1%, to US$401m. In fact operating profit would have been US$95m higher but for an unexpected extra bonus of two months' salary to staff, on top of the 15% bonus they earned under the schedule agreed with unions. Without the extra two months' salary, operating profits would have increased year–on–year by an impressive 17.4%. Net profit was 20.2% down at US$501m. In the 2003/04 period, SIA Group passengers carried fell by 13.4% to 13.3m. RPKs were down by 12.8% and ASKs fell by 11.4% over the financial year, with load factor dropping 1.2 points to 73.3%.

The SARS crisis and the uproar over redundancies were an unpleasant welcoming present for Chew Choon Seng, who became SIA CEO in June and replaced Cheong Choong Kong, who had been in charge for 20 years. Following its first ever loss, Seng wasted little by appointing LEK Consulting in August to help him with a wide–ranging review of the company and to "re–examine what we do" — though SIA insisted that the review was planned before the outbreak of SARS.

Although the outcome of the review has not been revealed publicly, cost cutting appears to be close to the top of the agenda for SIA in 2004.

This year the airline is looking to save up to another S$1.6bn (US$950m) a year from further cost cutting initiatives, part of which will come from newer, more efficient aircraft.

Fleet changes

SIA currently operates a fleet of 87 aircraft, the bulk of which are 747–400s and 777–200ERs. The 747 fleet has an average age of more than eight years, and many of them will be disposed of over the next couple of years. Requests for proposals (RFPs) had been issued in early 2003, but these were withdrawn after the SARS crisis.

In September 2003, SIA considered re–issuing them, but again they were postponed. Finally, in February 2004, SIA issued RFPs to Boeing and Airbus for aircraft to replace not only the older 747s but also its retired A310s. SIA may not only order up to 10 new long–haul aircraft, but also medium/short–haul aircraft as well, which traditionally it has not operated following the launch of SilkAir (see below). The choice would be between the A321, the 737–900 or even the 7E7. Boeing hopes an SIA order would give the new aircraft the same type of boost as SIA gave to the A380 project. However the earliest the 7E7 would be in service is 2008, a timescale that doesn’t address SIA’s medium–term aircraft needs.

Boeing is likely to be competitive on the 7E7 price, though it is unlikely to repeat the type of deal it agreed back in 1999 when it acquired 17 A340–300s from SIA in order to secure an order for 10 777–200ERS — it was only in September 2003 that Boeing finally sold the last of these aircraft.

The need for new aircraft is becoming acute, as SIA’s disposal of its 747s is gathering pace. In April SIA announced that two unidentified airlines had signed LoIs to buy eight 747–400s over the period 2006–2008, which will be converted into cargo aircraft using Boeing’s "Special Freighter" conversion programme. One of these is believed to be Dragonair, which will buy five aircraft.

SIA is also disposing of A310s and the remaining A340–300s that were taken out of service after the SARS outbreak. These have partially been replaced by the arrival of five A340- 500s in 2004 (although they were originally going to be delivered a year earlier), which have been put onto non–stop routes to the US. In February 2004 SIA launched a non–stop service to LosAngeles, and in June 2004 it will launch a nonstop route to Newark with the A340–500s, replacing existing services via Amsterdam. The 18–hour Newark flights will take over from SIA’s LA flights as the longest commercially operated non–stop route in the world.

As for the A380s, they are on target for delivery in 2006. Meanwhile, SIA Cargo — which was spun out as a separate company in October 2000 — operates 13 747–400Fs and has three more on order, for delivery in 2004 and 2005. In April 2004 SIA Cargo sold and leased back for 10 years a 747–400F to Aviation Financial Services. The main SIA airline also uses sales and leaseback, and has arranged deals for almost 20 of its 747- 400s since the late 1990s.

SIA Cargo is also looking to add capacity, most probably via converting 747–400s to freighters, or via an order of A380–800s. Though the A380s could only be used on a handful of routes, they are attractive thanks to unit operating cost advantages over the 747–400F. SIA has an option to convert its A380 order into freighters, but the earliest a cargo version could be delivered in 2008 or 2009, which indicates a stop–gap order of up to six converted 747–400Fs for delivery in 2006–2007, probably from SIA’s own 747s–400s.

Cost cutting at the SIA Group is likely to be accompanied by disposal of assets and outsourcing, a policy that the Singaporean government (which still owns 53% of SIA) is "encouraging". Lee Kuan Yew, a Singapore minister, said that: "SIA will have to transform its business plan. This is already taking place elsewhere ... airlines are beginning to disaggregate their various components." Sales could include Singapore Airport Terminal Services, which SIA owns 87% of, and SIA Engineering, which SIA also owns 87% of.

In the last few weeks SIA has insisted it wants to keep hold of both these subsidiaries, though continuing government pressure to offload them will be hard to resist. And if the baggage–handling subsidiary is sold, it would raise between US$0.6bn–US$1.2bn, as it has a 75% market share in Singapore.

Whether the money raised from disposals will be used for investment elsewhere remains to be seen. SIA already has a substantial war chest — in 2001 it raised US$515m through a bond issue, and in 2003 authorised (but has not yet carried out) another US$570m worth of bonds, which will be used for future growth. This could include acquisitions, a strategy that has been core to SIA over recent years — though there have been more failures than success. SIA has aborted efforts to buy or buy into Ansett Australia, South African Airways and Air India, and its 25% stake in Air New Zealand has now been diluted down to 4.5%. Its only investment success has been Virgin Atlantic Airways, in which it bought a 49% stake in for US$975m in March 2000.

If there are new acquisitions, they are likely to be strategic and located in growth markets such as India and China. SIA has previously considered a joint venture with the Indian group Tata, but nothing materialised. Until the aviation regime further liberalises, SIA may content itself with adding more services. It has increased frequencies to Mumbai and is adding a new route to Ahmedabad in July, bringing total Indian cities served to six.

Following an updated air services agreement between the respective governments, SIA is also launching new services to China. Alongside existing services to Beijing, Guangzhou and Shanghai, in January 2004 SIA launched the first international route into Shenzhen in southern China, while services to Nanjing were launched in March.

Australia is another market that interests SIA.

At one point SIA considered launching an airline in Australia, but again this came to nothing and instead SIA is now concentrating on obtaining rights to operate beyond services from Australia to the US. The Singaporean government has been pressing Australia to sign an "Open Skies" agreement ever since 2000 — though some analysts believe the Australian government is trying to protect Qantas for as long as possible. In September 2003 the two countries agreed to allow unrestricted frequencies between Singapore and Australia, but SIA is urging the government to go further.

The LCC challenge

But though SIA has considered launching airlines in many different, large markets, it is a missed investment opportunity in a smaller country — Thailand — that SIA may rue most of all. In 2003, SIA declined an invitation from the Thai government to set up an LCC in Thailand, to be based at Chiang Ma in the north of the country.

At the time, SIA’s management was sceptical whether LCCs could establish themselves in Asia, given restrictive air service agreements and the absence of suitable secondary airports. SIA also stated that: "The project will demand considerable resources which SIA is not able to commit at the present time because of SIA’s other needs".

SIA’s hesitation allowed Malaysia’s AirAsia to step in and fill SIA’s position in the proposed carrier.

Thai AirAsia launched in February 2004 and operates domestically and on Bangkok–Changi, using aircraft leased from its parent, AirAsia, which was launched in 1996 and operates 17 737–300s domestically and to Thailand. In October 2003 AirAsia launched a mini–hub at Johor Bahru’s Senai airport, which is just a bridge away from Singapore. The airline plans to raise US$200m by selling a 25% stake in an IPO in 3Q or 4Q 2004, which will fund a doubling of the fleet.

There is also speculation that Virgin Blue is interested in taking a stake in AirAsia.

But AirAsia is not the only LCC competition SIA is facing. Singapore–based ValuAir was launched by ex–SIA managing director and deputy chairman Lim Chin Beng in May 2004.

It operates to Jakarta, Hong Kong and Bangkok with two A320s leased from Singapore Aircraft Leasing Enterprise, and has expansion plans elsewhere in the region, including China and India. However, it does offer some frills, such as in–flight catering.

ValuAir sold a 10.8% stake to Asiatravel.com, an internet hotel reservations company, for $4m, and is raising further money at present. Elsewhere, Sky Asia — Thai Airways International’s new LCC — has plans for regional routes, while in November 2003 Indonesia’s Lion Air launched a Jakarta- Singapore route.

Perhaps most worryingly of all, in April Qantas announced it was investing US$30m in setting up a LCC in Singapore by the end of 2004, to be called JetStar Asia. It will initially have a fleet of four A320s or 737–800s — growing to 20 aircraft — and serve a range of destinations across Asia, possibly to include China and Vietnam. Qantas will own 49.9% of JetStar Asia, with Temasek Holdings, the Singaporean government’s investment vehicle (which controls SIA), having 19%.

Even to SIA’s conservative management, the trend is obvious. The new wave of LCCs are taking advantage of creeping liberalisation in Asia and are likely to put pressure on SIA’s yields — for example, AirAsia’s Bangkok–Singapore route undercuts SIA fares by a third.

At some point in late 2003, the challenge of the LCCs forced SIA to do a strategic U–turn, and management started to analyse the LCC business model. The most obvious route was to convert SilkAir, the SIA Group’s regional subsidiary that operates to more than 20 destinations across Asia with a fleet of four A319s and seven A320s (with five A320–family aircraft on order).

In 2002/03 the airline recorded an operating profit of US$16m, and it is expected to post a profit for 2003/04 despite the effect of SARS — in the nine months to December 2003, SilkAir posted an operating profit of US$6.6m and a net profit of US$5.4m. Capacity grew by 20% in 2003, and the airline is looking for even bigger growth in 2003, including new routes to China, despite the new competition from LCCs.

After analysis of SilkAir and the LCC business model, SIA decided against turning it into a low cost carrier on the grounds that conversion from a conventional airline would be too problematical.

Instead, in December 2003 SIA decided to launch a new Singapore–based LCC called Tiger Airways.Tiger will start operations in August 2004 out of Changi airport and operate to destinations within a four–hour range of Singapore with an initial fleet of four leased A320s — two to arrive in July and two in December — that could rise to 25 aircraft within three years. The A320 was chosen after an apparent lack of 737–700s and -800s available for lease in the summer.

SIA holds a 49% stake in Tiger, with 24% held by US company Indigo Partners (co–founded by US investor David Bonderman), 16% by Irelandia Investments (controlled by the family of Tony Ryan, the founder of Ryanair, and the man who appointed Michael O'Leary as CEO) and 11% by Temasek Holdings, the Singaporean government’s investment vehicle. Indigo managing partner and ex- America West CEO William Franke is the chairman of Tiger, and Patrick Gan — a pharmaceutical executive with no airline industry experience — has been appointed CEO. The management team insists Tiger will operate completely independently of SIA, and the airline’s plans were given a boost in March when the government confirmed it would build a dedicated terminal for LCCs at Changi (the fourth largest airport in Asia in terms of passengers carried). The terminal will be completed by 2005 and will have lower charges than the existing Changi terminals. However the move will also encourage other LCCs, particularly AirAsia, which is reluctant to launch more routes into Changi because of its high charges.

But will Tiger Airways be successful? Costs in Singapore are higher than in Malaysia and Thailand, home of the challenger LCCs, and whether Tiger can get its costs down to the 2.3 cents per ASK that AirAsia is achieving remains to be seen. And will restrictive bilaterals hamper the development of LCC routes out of Singapore?

On the other hand, if Tiger is a success it may cannibalise revenue elsewhere in the SIA Group. At the main SIA airline, less than 10% of revenue comes from short–haul or leisure travellers, and Tiger may help to stem the leakage of that traffic to rival LCCs. But the biggest impact of a successful Tiger is likely to be on SilkAir.

In January 2004 SIA appointed Mike Barclay, SIA’s general manager in Germany, as the CEO of SilkAir, with a mandate to meet the challenge of the LCCs by refreshing the airline and keeping costs under control. SilkAir insists it will continue to serve what it calls the "middle–market" segment — essentially secondary destinations that have low or medium traffic flows — and that half its traffic comes from interline passengers, who will not transfer over to LCCs. But this still leaves 50% non–interline traffic, and if a LCC segment does exist to/from Singapore, then SilkAir is likely to be squeezed between SIA and Tiger/ValuAir.

But with other LCCs launching regardless of SIA’s plans, the SIA Group may feel it has no alternative but to launch an LCC of its own, even if it does contribute to the downfall of SilkAir. In his letter to employees in February, SIA CEO Seng said that SIA had to face increasing competition from LCCs, and

"unless SIA’s costs are well managed, profits will come under pressure and SIA’s continued growth and survival will be at risk" In April 2004, Merrill Lynch downgraded SIA from buy to neutral on the back of worries over the impact of the new LCCs — though in May, Deutsche Bank recommended buying SIA shares as its "valuation [is] near crisis levels".

SIA’s management know they are in a real battle with the LCCs to preserve the historically high profits levels at the airline.

| SIA | SIA Cargo | SilkAir | |||||||

|---|---|---|---|---|---|---|---|---|---|

| On order | On order | On order | |||||||

| Fleet | (options) | Fleet | (options) | Fleet | (options) | ||||

| A319 | 4 | 2(1) | |||||||

| A320 | 7 | 3(1) | |||||||

| A340-500s | 5 | (5) | |||||||

| A380 | 10 (15) | ||||||||

| 747-400 | 30 | (6) | |||||||

| 747-400F | 13 | 3 | |||||||

| 777-200ER | 44 | 3 (6) | |||||||

| 777-300 | 8 | 4 | |||||||

| Total | 87 | 17 (32) | 13 | 3 | 11 | 5 (2) | |||