McKinsey on LCCs: a European gold rush?

June 2002

In this article consultants from McKinsey challenge the "conventional wisdom" surrounding European low–cost carriers.

"The potential for low-cost carrier growth in Europe is enormous"

The analysis usually used to explain why so much low–cost carrier growth can be expected in Europe is a comparison between low–cost penetration in the US (25–30%) and in Europe (10%). The problem is that this neglects the fact that Europe has a very large, low–price charter airline industry, which currently accounts for 35% of intra–European air transport. From this perspective, low–cost penetration is already higher in Europe than in the US.

Given the fleet orders already placed, there is no doubt that the European scheduled low–cost market will continue to see high growth, which should give this niche market a 15% share of the overall intra- European air travel market in 2004/5. Together with the charter market, the total European low–cost segment will then have achieved 45–50% of intra- European air travel. However, there are several open questions concerning future growth.

• What will be the impact of competition between low-cost carriers?

Competition between low–cost carriers in Europe is still fairly limited: there are now 17 routes (compared to 8 in 1999) where two low cost carriers compete, against 111 destinations with only one low–cost carrier. While a low–cost entrant can count on a substantial traffic stimulation effect, creating new demand among the most price–sensitive segments, a second low–cost entrant is not likely to generate further additional traffic. Inevitably, this will result in competition between low–cost carriers for market share in their segment (normally not good news for profitability). Consolidation among low–cost carriers will limit this effect, especially if the remaining players have slightly different strategies (lowest cost and market creation in the case of Ryanair, low cost and alternative to traditional carriers in the case of Easyjet).

• How attractive are large domestic markets?

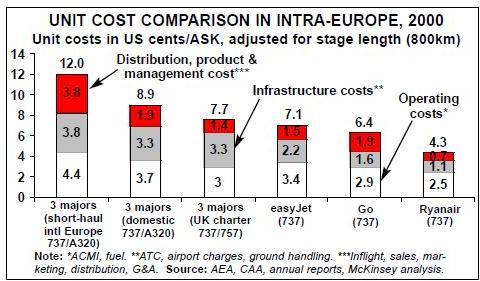

The domestic markets in France, Italy and Germany may not represent the ideal platform for low–cost entrants. Flag carriers' domestic unit costs are on average 25% lower than their international unit costs, due to lower product specifications (higher seat density, reduced in–flight service, one class only, higher direct sales penetration, etc.) (Exhibit 1- see below). In the case of Air France and Alitalia, the unit cost difference can reach 35%. This leaves a unit cost differential of 20–30% for most low–cost carriers, which might not be enough to undercut current prices enough to generate additional substantial traffic.

So new entrants are going to be getting into markets that are already quite efficient, with yields below international levels (on the French trunk routes, the lowest Y–class fare is €70 round trip). On routes with high–speed trains it will be even tougher for low–cost carriers to gain a foothold. Only Ryanair seems to have the cost structure to successfully enter large domestic markets, with an average unit cost differential of 50% (which is the unit cost difference enjoyed by Southwest against US major carriers in US domestic markets), but that would require operating from secondary airports, which would not appeal to business passengers.

• Are there enough non-served markets with latent demand?

Low–cost carriers are increasingly entering non–served markets: the share of routes where a low–cost carrier is the only airline has increased from 22% of all operated routes in 1999 to 33% in 2002. The incumbents' current networks are largely based on network feeding logic and need a minimum share of business traffic. Point–to–point leisure markets with potentially high latent demand have obviously been neglected and are currently being developed by low–cost carriers. However, some schedule changes suggest that it is becoming increasingly difficult to select sustainable routes: as an example, Buzz withdrew from Oslo, Milan and Vienna, Go from Zurich, Madrid, Lisbon, and Ryanair from Rimini and Lubeck.

All in all, low–cost carriers withdrew from 31 routes over the past four years, representing a surprisingly high 24% of total 130 routes (in 2002), a sign that it is getting increasingly difficult to find viable routes out from the existing bases.

•How competitive are low-cost carriers against charter carriers for pure leisure destinations?

There are significant product similarities between the charter and the low–cost models, and charter airlines are increasingly offering seat–only sales for individual travellers, especially during the mid and low seasons. However, most charter capacity is marketed through integrated tour operating companies and forms an integral part of a package deal with the traveller.

So a significant part of this leisure market, at least to the traditional leisure destinations, cannot be captured by the low–cost airlines. With a high share of leisure passengers booking a package tour, this portion remains the domain of the large travel groups (in addition, the key players control key hotel/resort assets in privileged beach locations that cannot be booked anywhere else). Furthermore, leisure groups have already consolidated heavily and integrated vertically: the top four leisure groups control two–thirds of the European tour operating market revenue, and 63% of the total charter capacity in Europe is controlled by six leisure groups (TUI, MyTravel, Thomas Cook, REWE, Nouvelles Frontières, First Choice).

• How will traditional carriers' international products develop over time?

The unit cost gap between the international and domestic products of traditional carriers shows what "slim down" improvements can be made on international routes. The lower the unit cost differential between incumbents and low–cost carriers, the lower the growth opportunity for the latter. Thus, much of the room for further low–cost growth is in the hands of traditional carriers. Increased seat density (possibly one class of service), increased aircraft utilisation, reduced fleet complexity, reduced crew complement, and in–flight/ ground service, and more direct sales: this is the recipe for 20–30% lower unit costs on international flights, depending on the starting point (as an example, Easyjet and Go have 35% more seats in their 737–300s than KLM). The announcement by BA of a lower–cost short–haul offering from Gatwick and SAS’s decision to switch to one class of service on all intra–Scandinavian markets are steps in this direction.

"Low-cost carriers have a superior business model, financially highly attractive and robust"

The low–cost business model is fundamentally the same as any traditional carrier's: capacity is bought or leased medium to long–term, a schedule is put together, and revenue (the passengers and the average price they pay) must exceed costs. Lowcost carriers have to manage capacity, costs, load factors, and yields to be successful, just like any other scheduled airline. As an example, wet–lease operators, charter airlines and fractionally–owned business jets do have a different business model (as their revenue streams have different mechanics, with product bundling, etc.), but not low–cost carriers.

What is different is their strategy and value proposition: the "how" and "where" they compete.

It should be pointed out that the low–cost airline segment has destroyed value in past years: with the exception of Southwest, Ryanair and easyJet, all other players in the low–cost segment have accumulated losses of almost $1bn in the period from 1996 to 2001 in the US, (with many bankruptcies, like ValuJet, Carnival Air, Kiwi, PanAm II, Western Pacific, Midway, and Sun Country), and losses of almost $300m in the period from 1996 to 2001 in Europe (with Colorair, Debonair and AB Airlines going bankrupt).

There is obviously a start–up effect to be considered, but this gap between the performance of the leaders and the others might also suggest that there is only space for a handful of players in the low–cost market, some kind of "winner takes all" dynamics. Even for the leaders it may be tough to deliver against the expectations of the capital markets:

Ryanair’s share price implies a high long–term growth rate of 12% at sustained high operating margins (24% in average over the past five years).

If these expectations are not met at some point in time, the share price is likely to plummet.

"Incumbent carriers will suffer heavily and eventually withdraw from markets with strong low-cost presence"

BA’s short–haul network is suffering from the effects of fierce low–cost competition, and other flag carriers are likely to face similar problems in the near future. Is the short–haul market going to be dominated by low–cost carriers in Europe? The available evidence suggests that the answer is "No, but...".

Low–cost carriers lack a global network and flexible booking (e.g., re–booking to another airline if you miss the flight); in most of their markets they fly one to two frequencies per day, often at unattractive times of day, and they fly into secondary airports that are sometimes as much as 100 km away from city centres (like Frankfurt–Hahn).

This makes them not particularly attractive to business travellers, especially frequent, global travellers.

This is one of the reasons why many traditional carriers on the Continent see little change in their route economics after a low–cost entry. Revenue and load factors might even go up. The main reason is that traditional carriers and low–cost carriers seem to be complementary: the low–cost carrier stimulates new traffic, and captures most of it, but there is little cannibalisation of the incumbent’s traditional customer base. This is also confirmed by the fact that only on a handful of occasions has the incumbent withdrawn from a particular route, and often the incumbent concerned was a secondary or non–hub carrier (Alitalia on London–Venice, British Midland on London–Frankfurt, Air France on Nice–Geneva, and Braathens on London–Oslo).

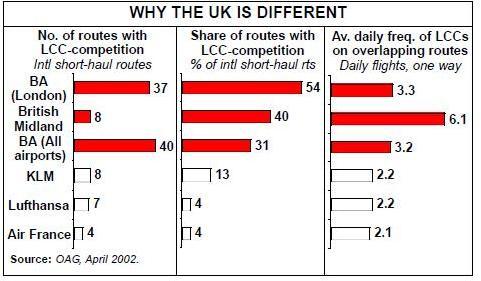

The situation can change if three or more flights a day to key airports at attractive times can be offered, as this clearly represents an attractive product for business travellers who frequently fly such routes. Some London–based low–cost carriers that fly into major European airports claim a share of 30- 50% of business passengers on their flights, and this is the reason why the US majors and BA are having much more trouble than other traditional carriers, as many of their markets are large enough to allow low cost carriers to operate a critical level of frequencies (graph left). In Europe, the UK is and will remain the largest low–cost market by a wide margin, since it encompasses well–balanced business and leisure traffic, has no significant seasonality, traffic flows in both directions and a metropolitan area with five airports and is simply the largest and most concentrated air travel market in Europe.

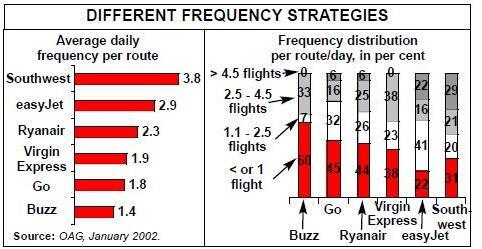

A comparison of the strategies of the five leading low–cost airlines in Europe, and the extent to which they might pose a real threat to traditional airlines, reveals significant differences in market selection and the number of frequencies offered (below left). While Easyjet operates only 20% of all routes with one flight a day or less, and averages 3 flights per route per day, Buzz operates 60% of all routes with one daily flight or less, including weekend flights to the seasonal destinations, leaving the total average frequency at around one flight per day.

The cumulative share of low–cost flights with at least three daily flights per route is around 30%, and highly concentrated on UK routes, so at this point it does not threaten the business travel share of continental incumbents. There are also different route network/ airport strategies: Easyjet has higher frequencies and flies into main airports and is therefore more likely to take share from incumbents than Ryanair, which focuses on thin markets to and from secondary airports.

In summary, there is no doubt that Europe provides scope for further growth in the low–cost sector, but there are also structural limits, and these limits may be reached sooner than in the US. Europe has a less favourable demand structure, with less VFR (few families dispersed across Europe); there is still a large proportion of "national businesses"; there is a well–developed charter industry; traditional carriers are relatively efficient in large domestic markets; and there is no year–around vacation area (except possibly the Canary Islands).