Cycle-logical state of the industry

June 2000

The airline industry is beset by cycles — from the very short term through the day, through the week, by month and season to the longer range equipment cycle — although the industry has not been around that long to discover whether it adheres to any of the very long term Kondratieff cycles.

The industry also has the misfortune to be a highly capital intensive one with long life assets while the product itself has a very short shelf life (once the doors are shut, you generally cannot get any more passengers on board). Meanwhile, the competition for the marginal passenger is very intense. In addition so much of an airline’s operations are well outside the control of management and a small change in one extraneous variable can have a disproportionately large impact on profitability.

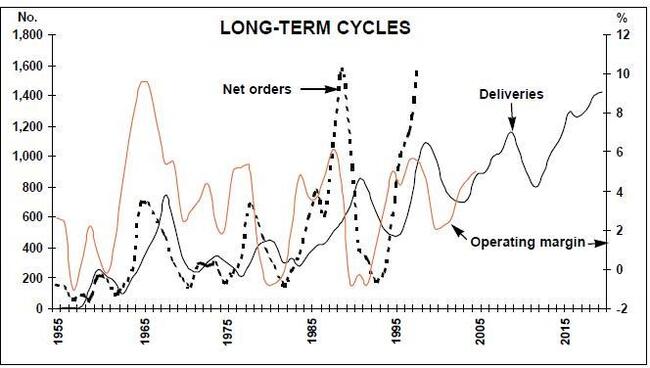

Past profit cycles in the industry have tended to follow a distinct pattern. When the industry makes money, the airlines start to order aircraft to provide expansion. Historically there would be a delay of 18 months to two years before the aircraft could be delivered. By the time the aircraft are delivered, something happens to upset the demand and the industry slips into a position of over–capacity, and subsequent losses.

At this point the first thing to be done is to cancel outstanding options and orders for aircraft where possible and wait for the supply/ demand environment to improve. As it does, the industry makes money again and starts to order equipment.

In the mid–90s, so many commentators and industry participants said that this time the cycle would be different. The argument went that with the long–range single supplier flexible orders from the larger carriers there was for the first time a large element of flexibility in the potential introduction of capacity. Secondly, as the industry consolidates into the global alliances there would be a greater level of co–ordination. Thirdly. that there was a very significant level of flexibility implied by the introduction of the Chapter 3 noise regulations.

What happened was the crisis in Asia. As a result of this there was a massive switch of long haul capacity from Asian and Pacific routes onto the North Atlantic. At the same time, those European carriers emerging from restructuring put a lot of capacity on to the Atlantic to "recover lost market share". The result was a decimation of profits in the Asian region, while generally reasonable profits were still to be made in North America buoyed up by the strong domestic environment and a modest dip in profitability overall for the Europeans — not helped by the war in Kosovo.

Improving supply/demand balance ?

However, the erstwhile very profitable BA and KLM were aggressively hit by the resurgence of competition in Europe. On top of everything else fuel prices doubled from the nadir. As a result industry profits dipped from the peak seen in 1998. Now however, the supply / demand equation appears to be improving. Asia is recovering reasonably well and the freight markets have continued buoyant through the Y2K watershed pointing to good world economic background. The US economy continues in its unprecedented positive run and the Euroland economies continue to show reasonable improvement. Deliveries of 747s, the long haul workhorse have virtually dried up and although North Atlantic capacity this year appears set to increase by around 8% overall, this is half the rate experienced last year. Fuel prices remain a problem: although some carriers are hedged at reasonable rates for the current year, there will be a strong increase in the fuel bill for most.

However, as normal, the carriers are able to pass on the cost increase to its passengers in select markets, and there has been a modest improvement in the yield environment since the beginning of the year, so that although one might have thought that a doubling in the cost of fuel would have wiped out margins entirely, the net result is unlikely to be as bad as that. All other things being equal we might see a further dip in industry profits this year — but not as far as to push the industry into loss as a whole — which could ironically turn out to be the bottom of the cycle.