Airbus: a protected past, but a commercial future

June 1999

At the Paris Air show in June Airbus will be celebrating the 30th anniversary of the launch of the first A300, the original widebodied twin–engine aircraft. This was the start of the family that would supplant the three–engined widebodies of Lockheed and McDonnell Douglas and move up to rival Boeing. These days the Toulouse–based consortium and Boeing are neck–and–neck for orders (see Aviation Strategy, May 1999), even if Boeing is still producing twice as many aircraft. If only Airbus could reorganise as quickly as it is catching Boeing, its outlook would be brighter.

In the first four months of 1999, Airbus claimed 152 firm orders (plus 109 commitments for its new small model, the A318), compared with only 41 sales made by Boeing. Last year’s orders for 556 aircraft, worth $39bn, represented a 30% rise in value terms and about 20% in volume. Boeing’s orders in 1998 totalled 656 units, and were worth $42bn. Yet only a few years ago Boeing had two–thirds of the market while Airbus trailed with one–third. So Airbus’s growing share of the order intake is a leading indicator of where it might be in relation to its Seattle rival in a few years’ time.

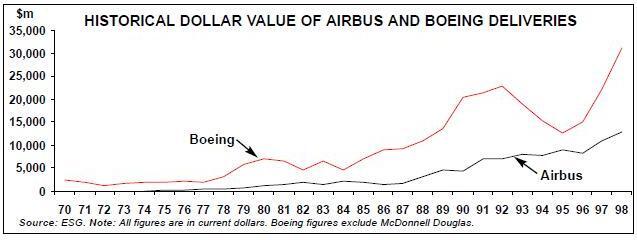

Even so, an order lead over Boeing even for a year can be meaningless. Over time the only measure that directly correlates to profits in commercial aircraft is aircraft deliveries: after all, most of the money is paid only when the delivery is made. And this year Boeing will deliver 620 aircraft, against Airbus’s 295. The current reality is that last year Boeing delivered 559 civil aircraft worth $36bn, while Airbus delivered 229 aircraft worth only $13.5bn.

Comparing profits is an impossible task because of the fundamentally different methods of accounting and Airbus’s continuing opaqueness when it comes to financial reporting. Nevertheless, Boeing reported an operating profit on commercial sales of just $63m last year. Airbus’s loss on its own manufacturing was put at $204m in 1998 (after write–offs) but “system” profit (the consortium plus the four partners’ sub–contracting work) was claimed to be around $650m.

While Boeing is signalling a downturn in sales caused largely by the Asian crisis, Airbus sees little sign of decline. It monitors its 1,300 order backlog to see if any of its customers appear to be heading into problems that could lead to cancellations. Airbus also keeps close to the leasing companies, which often want production slots at short notice.

Streamlining production processes

Airbus has also made significant progress in streamlining its production processes in order to shorten delivery cycles and respond to market fluctuations. The A320 family can now be made in nine months, down from over 15 months; the A330/A340s is down to 12 months from nearly 18.

But Airbus still suffers from very slow stock–turns because of its consortium structure. This means that work is not always done in the optimal sequence, because a partner frequently has to hand over its completed part of the aircraft with all sorts of fancy bits and pieces on it that would normally be added only at the last minute. Airbus’s stock–turn has improved from 1.7 (ratio of the value of turnover to stocks) in 1994 to 2.9 last year, but the aim is to push it up to at least 4, which would free up about $1bn of cash.

Speeding the stock–turn further would require the unified command structure of a single corporate entity (SCE). Such issues become more important as Airbus grows — this year’s 295 deliveries will be more than double its output in 1996, and it foresees production rising to about 350 aircraft a year. To its credit, however, Airbus has managed to ramp up production smoothly, even if it is not as efficient as it could be. Broadly, the consortium is within reach of its target of half the market in 2000.

SCE accounting

Noel Forgeard, the Airbus CEO, has other preoccupations. The vicious price war between Airbus and Boeing has brought profitless prosperity to both manufacturers last year. As mentioned above, Airbus as a $1’interêt é$2 made a loss of $204m last year, although the system as a whole, made a profit. This figure includes $326m that Forgeard insisted was written off to take into account aircraft sold at a loss in the price war with Boeing. He will ensure that the same amount is written off this year and maintains that the consortium no longer sells any aircraft at a loss.

The reason he is so keen to clean up the accounts is that he wants the process of conversion into an SCE to go smoothly when work on it re–starts (see Aviation Strategy, December 1998). This long–delayed project ground to a complete halt last autumn when the French partner, Aerospatiale, grew alarmed at the mooted merger of British Aerospace and Dasa, part of DaimlerChrysler. This would have given the Anglo–German pair a combined share of 57.9% of Airbus. The French insisted on parity, which would have implied an artificial inflation of Aerospatiale’s 37.9% share.

Forgeard’s best hope now is that the partial flotation of Aerospatiale, which is merging with part of the Lagardere group on June 4th, will open the door to a more commercial approach. Although the French government will continue to hold 48% of Aerospatiale, the decree which pronounced the privatisation specifically cites the SCE conversion as one of the aims. Even so, Forgeard admits that even if there is a resumption of discussions after the Aerospatiale Matra flotation in June, it could take until the autumn before the partners exchange valuations and a further year before the conversion could be made.

Betting on the A3XX

All this is very awkward, because Airbus is still going through this painful process at a time when it is about to bet its future on the A3XX. Forgeard is convinced that the consortium needs to launch a jumbo of its own, breaking the lucrative monopoly Boeing enjoys at the top end of the range — over 400 seats. It is now touting the latest version of this aircraft around a couple of dozen airlines, with the most likely candidates being British Airways and Singapore Airlines.

The basic 550–seater version will cost $10bn in non–recurring costs, according to Forgeard. There are two other versions — a A3XX–100R extended range model and a A3XX–200 higher capacity model with 650 seats in a tri–class format. He says that the partners have stepped up by 50% the work they are doing on the aircraft; there are now 1,000 people working on detailed proposals to start putting to airlines around the end of this year, with a view to landing launch orders in 2000. Even in the best case, the first aircraft would not fly until 2005. However, Forgeard is always careful to insert the caveat that this scenario is subject to the market condition being favourable.

While Boeing has always insisted the market for a super–jumbo is around 400, Airbus sees a market for 1,400, some 10% of the total number of aircraft it forecasts will be ordered over the next 20 years. By value, Airbus reckons the super–jumbos would be worth $300bn, 25% of the overall market.

Although half the potential customers are Asian airlines, suffering to some degree from the fall–out of the 1997 crisis, Forgeard maintains that global traffic growth of 5% a year is enough to ensure demand for the aircraft. The key pipeline routes between major hubs will need big double–decker aircraft, if only because of the limited room to expand capacity at these airports. So, while it also develops bigger and longer–range versions of its A340 for the point–to–point traffic in aircraft under 400 seats, it foresees a lucrative market over 400 seats, even if it has to share it 50–50 with Boeing.

Boeing itself appears to blow hot and cold on super–jumbos, but there is no doubt that it now has a twin–track approach. One is to quietly work away at an all–new aircraft; the other is to find ways of putting a new wing and fly–by–wire avionics into a revamped 747. The challenge that version faces is obtaining operating costs that are sufficiently low to compete with the all–new A3XX. For 10 years Boeing has wrestled with the problem of what to do when the 30–year monopoly of the 747 expires.

Launching that aircraft was betting the whole company back in the 1960s, when a syndicate of banks advanced loans secured on the company’s net assets. At one point Boeing proposed a joint working group with the Airbus partners to develop a joint aircraft, but that collapsed because the two sides could not agree on the market or on how they could work together. The Airbus CEO at the time, Jean Pierson, who was excluded from the joint project, always maintained it was merely a talking shop designed to stop Airbus pressing ahead with its own model.

The curious thing is that all these delays have worked in favour of Airbus. The consortium is in effect about to offer the market the product that presents itself as the successor to the 747, now visibly in decline. In April, British Airways, one of Boeing’s best customers over the years, took delivery of its last 747; production is down from 60 last year to 47 this year, and there are orders for only 15, and even three of those could fall away.

So Airbus executives find they are welcomed in the big airlines when they talk about the A3XX. Apparently, at least one airline boss wrote to Forgeard when the A3XX programme slipped two years asking for reassurance that it was still going to happen.

Tripartite funding

But making it happen may be more difficult than just impressing airlines with the numbers about its operating costs and potential yields. For a start there is the problem of coming up with the $10bn which will have to be spent before the first aircraft rolls out the hangar. Forgeard’s plan is that a third will be raised by the Airbus partners, a third by risk–sharing associate companies and a third by European governments advancing the money at market rates.

However, although governments may share the revenue risk they charge highly for doing so. One British Aerospace executive points out that it had an extremely difficult job prising launch aid from the UK Treasury for the A340, and sees no reason why the process should be any easier with the A3XX, especially since the sums are so large.

Significantly, British Aerospace recently raised some development money towards the new versions of the A340 from a syndicate of banks at a lower interest rate than the government charges it. Both banks and governments would be happier about financing the A3XX if the SCE conversion comes first, but that is looking less and less likely. If Airbus were already an SCE it might even be able to dispense with government launch aid in favour of private sector finance.

Lockheed to the rescue?

On the industrial third of the programme’s financing, Airbus is claiming lots of success already. Forgeard points to companies such as Fokker Aviation, Saab, Finavitel, Aerostructures, Alenia and an unnamed Japanese company (believed to be Mitsubishi) that are prepared to put up 30–35% of the $10bn between them. There is a distinct possibility that Airbus has an even more dramatic partner to unveil sooner or later. Lockheed Martin executives have apparently been meeting with their counterparts from Aerospatiale, twice in the past month.

On the agenda is the formation of an alliance between the American defence aerospace group and Airbus and Aerospatiale. Last September Lockheed said that it saw no large equity stakes being swapped in the near term, and in early May both Airbus and Lockheed denied a deal was imminent. Indeed that is probably the case, since it would be difficult for Lockheed to placate Wall Street if it formed an alliance with a consortium with no profit and loss account and no transparent financial reporting. Lockheed has enough problems in its own backyard without upsetting investors on this front. Wall Street analysts worry that defence margins in Europe are thinner than in America, so it would do Lockheed little good to invest in them.

But longer term it is likely that executives of Lockheed and the companies in Airbus are trying to put together two sorts of deals. It makes sense for Lockheed to have a stake in the civil aircraft business, given its growth prospects, because defence is a shrinking business. Airbus is a convenient way back into the business, providing a ready–made brand, product range and market access. All it lacks is capital, and Lockheed could get itself a good deal by buying into the A3XX in the future, once Airbus has become an SCE and is planning for a flotation.

Two and a half years ago Lehman Brothers investment bank did a study on Airbus which suggested that as a company it could be floated. Lockheed has shown interest in allying with Airbus before, but the then chairman Norman Augustine got fed up waiting for the SCE conversion that he saw as a prerequisite to any deal. But there are now voices within Lockheed urging that opportunities such as Airbus do not come along all that often and should be seized before it is too late. What better time to make a deal than just when Airbus is looking for industrial partners for the A3XX.

The military angle

The other deal that Lockheed would like to do with Airbus is in military transport. The Kosovo war has brought home to European governments that they are short of the right sort of aircraft to ship troops and tanks a long way to war zones. The Europeans have a design called the FLA, but it has many critics and the project has failed to get off the ground. Lockheed would be prepared to collaborate with Airbus on a military transport — just so long as it is not the FLA design, which the Americans think is rubbish.

Defence insiders think the momentum is building up for a deal. Charles Grant, director of the Centre for European Reform, a think–tank with close defence industry ties, says “there are interesting possibilities here to their mutual advantage for Lockheed and Airbus to collaborate either on a project such as the A3XX or on a military transport plane. Each would help the other to become more global with a foot in each other’s markets”.

The real point about Airbus is that, despite the repeated hiccups with its conversion to a company and the huge task it faces with launching the A3XX, Airbus is a success and is increasingly perceived as so. Conversion to a corporate entity will reinforce that perception because it will unearth the profits buried in the system. That in turn will make it easier to raise capital and realise value for the consortium’s members. At the outset Airbus had parents which were state–owned. As of June 4th, when Aerospatiale is floated, it will be mostly in private hands and raring to go.