Capacity up at Lufthansa - but yields suffer

June 1999

The first quarter of 1999 saw what could be the start of a worrying trend at Lufthansa — capacity and traffic increases, but at the expense of yields.

ASKs rose 7.2% in 1Q99 compared with 1Q98 and RPKs increased by 10.5%, resulting in a 2.1 point increase in load factor to 70.5%. But the price for this was heavy — yields fell 7% in Deutschemark terms quarter- on–quarter.

So although Lufthansa did manage to increase turnover by 5% in 1Q99 and posted an operating profit of $91m, net profits in the first quarter of 1999 were just $64m, compared with $223m in January–March 1998.

Playing the capacity game

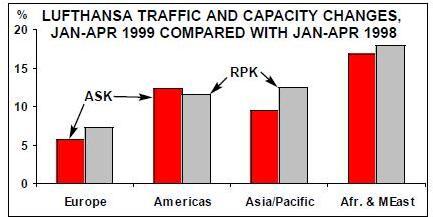

Lufthansa’s load factor rise and yield decline is a result of an ambitious capacity increase plan for 1999. As can be seen in the chart below, Lufthansa has been aggressive in launching extra capacity into its longhaul routes — in particular to Asia/Pacific and to the Americas.

Lufthansa’s move is being mirrored to a greater or lesser extent by other European airlines on long–haul routes, and confirms a real danger of overcapacity in certain markets (see Aviation Strategy, April 1999 for a full analysis of the overcapacity problem). The problem is that each individual airline has its own “unique” case for increasing capacity — even though airlines know that as a whole industry capacity increases can be ruinous. In Lufthansa’s case there is the stated goal of adding destinations and frequencies in 1999 after years of “only” growing at about half the rate of British Airways.

Yet Lufthansa is vocal in its calls for restraint from other airlines — CFO Karl- Ludwig Kley says that: “Competition has sharpened where some rival carriers — in crass contradiction to their solemn announcements — are obviously continuing their expansionist policy undiminished.” This may seem like a case of double standards to many observers, but Lufthansa is determined to keep increasing capacity on longhaul in an effort to catch up with British Airways.

On Asian routes Lufthansa expects traffic to fully recover by the end of 1999, although here again yields will keep on falling.

Prospects for the full year

If yields maintain their downward direction, then 1999 is unlikely to be a good year for the German airline. And given Lufthansa’s stated expansion strategy, it will be difficult to maintain yields — particularly if the competitive reaction from other European airlines in terms of capacity continues to be upwards.

Lufthansa in recent years has gained a major strategic lead over British Airways through the advanced development of the Star alliance, which has enabled it to steal business traffic away from BA and its partners. Now British Airways is trying to change the rules of the game with its zero–growth yield enhancement strategy. Lufthansa definitely will not change its immediate plans, but it will probably be forced to put more emphasis on its cost–cutting programme and the outsourcing of domestic operations to CityLine.

The other element of Lufthansa’s strategy is to diversify — again in contrast to BA, which is a core business focuser. This is like a real life experiment in different business models.

| $m | 1Q99 | Change |

| Operating revenues | on 1Q98 | |

| Traffic | 2,015 | 3.4% |

| Cargo | 514 | 0.9% |

| Other | 772 | 12.4% |

| Total | 3,301 | 5.0% |

| Operating costs | ||

| Staff | 780 | 7.2% |

| Fuel | 182 | -19.1% |

| Fees & charges | 535 | 6.6% |

| Depreciation | 251 | 18.1% |

| Other | 1,462 | 9.2% |

| Total | 3,210 | 6.8% |

| Operating profit | 91 | -34.3% |

| Other income/interest | -55 | -20.0% |

| Extraordinary result | 98 | -54.6% |

| Pre-tax result | 134 | -15.2% |

| Tax | -70 | -42.8% |

| Net result | 64 | -65.7% |

| ASKs (m) | 25,445 | 7.2% |

| RPKs (m) | 17,942 | 10.5% |

| Load factor | 70.5% | +2.1pts |