Asia: traffic much better, restructuring still imperative

June 1999

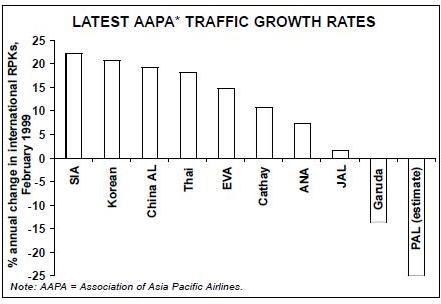

Looking at the traffic graph below we see a familiar picture. Most of the Asian airlines have now resumed their traditional double–digit growth rates (the data refers to international RPKs in February this year). In reality, of course, this traffic rebound is only bringing passenger numbers back to 1998 levels.

Nevertheless, there are some encouraging signs. Much Asian capacity has been moved semi–permanently out of the market either through sales or parking. Consequently, load factors have been very strong — in February the average for AAPO airlines was 71.6%, 5.7 points up on a year ago.

However, these traffic volumes have been maintained at the expense of yield. Average yield for the AAPO airlines this year is expected to be 20% below that of the recent peak year 1996. According to an authoritative forecast from the Singapore office of Deutsche Bank, no increase in yield is expected up to 2002.

Consequently, the financial recovery in the region is muted. Following a net loss of US$844m in 1998, the 19 AAPO airlines should produce a net profit of about $300m in 1999, which Deutsche Bank estimates will gradually increase to $1.2bn in 2002.

For Cathay Pacific and Singapore Airlines a BA–style yield enhancement strategy is just not feasible at the moment because so many Asian companies have made permanent decisions to reduce the amount of business travel and put their executives into economy class.

In fact SIA’s strategy is now the opposite of BA’s. It is relying on growth in order to return to its former level of profitability (its results for 1998/99, a net profit of US$609m — albeit boosted by aircraft sales — were very respectable). It is explicitly planning to grow through acquisition and is looking for new investment targets beyond Ansett.

Cathay’s situation is more problematic. Last year it made its first loss (US$70m) since 1963 and now appears to be in a strategic vacuum, in danger of becoming a junior oneworld member like Canadian. Its international advertising now concentrates on promoting its economy class, but it is not at all clear whether economy class yields can support Cathay’s high operating costs.

Recovery would be faster if the region’s two airline financial disasters were allowed to disappear and the Asian industry consolidated, but the future of Garuda and PAL is unlikely to be that simple. Garuda has now put together some form of turnaround plan in conjunction with Lufthansa Consulting. But the plan does not seem to have any element of downsizing; on the contrary the airline’s CEO, Abdulgani, has stated categorically that he intends to keep the current route structure intact. So that plan looks doomed.

The PAL saga may be coming to a close. The Philippine Securities and Exchange Commission (SEC) and the airline’s creditors have refused the chairman and majority owner, Lucio Tan, any further extensions to a June 4th deadline by which he has to raise some US$200m in new equity. Unless new funds appear, as rumoured, from a mysterious Middle East consortium, the banks and credit agencies will finally call it a day. Expect a flurry of aircraft seizures.