Western capitalist colonialism in Asia

June 1998

In the boom years Asian airlines generally eschewed alliances, which appeared to be irrelevant in a market where traffic growth of 10% p.a. was the norm. They were perceived as a Western strategy, a means by which airlines could grow through increased market share on mature and sluggish routes. Equity–based alliances were even more improbable because management independence was jealously guarded and stock market ratings were high compared with Europe or the US.

Now the situation seems to be changing radically. Recent reports of alliance and sales activity include:

- Lufthansa and SIA making a joint offer for 25% of Thai;

- BA and Qantas making a bid for part of Thai;

- Northwest being a front–runner for a stake in Thai;

- Northwest being heavily involved in sales discussion with Lucio Tan, chairman and major shareholder in PAL;

- Swissair cashing in its now irrelevant small stake in SIA and considering an investment in MAS;

- BA and American opening negotiations with Cathay Pacific over membership in its alliance and perhaps more;

- China Airlines, suffering badly from customer reaction to its latest crash, perhaps offering shares to Western investors;

- ANA entering the Star alliance and JAL linking up with BA/AA;

- Asiana putting all its assets up for sale.

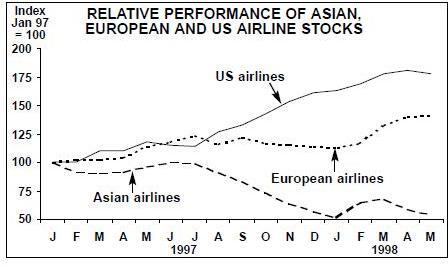

From the perspective of a Western airline there would seem to be strong incentives for investing in Asian aviation. The stock–market price of many Asian airlines now reflects little more than net asset value and would appear to offer the prospect of bargain buys. Their valuations have halved over the past 18 months while those of European carriers have risen by about 40% and those of US airlines by about 80% (see chart, below).

Also, linking up with Asian carriers could be a means of facilitating the transfer of surplus aircraft from there to currently more productive markets in the West (continued on page 2).

But perhaps more importantly, Asia is becoming a proxy battleground for the global alliances. The Lufthansa/SIA interest in Thai was largely triggered by the possibility of BA/Qantas setting up a hub at Bangkok and also the likelihood of Thai quitting the Star alliance.

For American and Delta an important consideration is establishing Southeast Asian alliances to develop their connections beyond Tokyo, where they are gearing up transpacific operations following the completion of the liberal Japan–US bilateral. The competition is United and Northwest, which have extensive beyond rights from Tokyo.

Northwest’s possible connection with PAL could be regarded as a strategy to protect its Southeast Asian originated and destined traffic in the face of the new competition at Tokyo — Manila is the most westerly Asian hub from which non–stop service to the US can be offered.

Cathay could fulfil a different strategic aim for an allying or investing partner — a position in the main gateway to the China market. Also, the brand new airport at Chek Lap Kok is a major attraction (as is Sepang for those interested in MAS).

Pitfalls abound

But just as there are opportunities for Western airlines so also are there major barriers and pitfalls.

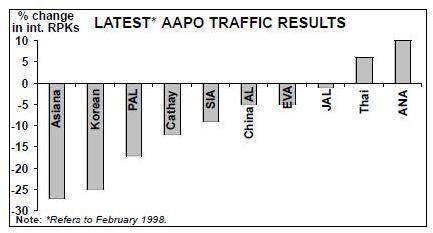

First, no one is quite sure that the Asian traffic decline has touched bottom. The RPK numbers on this graph look horrendous enough, but there are further concerns about the state of the Japanese economy and the repercussions of the fall of Suharto in Indonesia. Up to now intercontinental routes have held up fairly well while intra–regional traffic has collapsed, but the surge in transpacific frequencies offered by the US majors is threatening market balance in this sector.

Second, airlines should be extremely wary of entering business, cultural and governmental environments they are unfamiliar with (note the many failures in bridging national gaps in all–Western alliances). To gain any sort of management control at Thai a Western airline would have to reach accommodation with the powerful air force faction in Bangkok. The plan whereby MAS Capital was to dispose of the airline’s surplus assets was a very imaginative piece of financial engineering which now has been suspended.

To buy into Cathay would necessitate either CitIc or the Swire Group diluting their shares — both remote possibilities. Korean and Asiana remain firmly entrenched in the $1 system of highly–leveraged, cross–linked industrial conglomerates, which, although weakened, are resisting change to the bitter end.

Third, alliances do not solve the Asian carriers’ immediate need for cash. Any funds that are invested will go to existing shareholders or governments. And the aircraft management role is being undertaken by the major leasing companies — GECAS and ILFC — which are very active in taking surplus aircraft off the Asian carriers and leasing them into Europe and America.

Many of the deals being concluded involve tying the Asian carriers into future new aircraft deals — when the delayed new aircraft orders are finally delivered these leasing companies will be the financiers.

Fourth, Asian airlines have their own ideas for resisting Western capitalist colonialism — intra–Asia alliances, for instance, or even longer term strategies for centring a global alliance in Asia (see next story).