JAL: Can it continue its recovery?

Jul/Aug 2008

Japan Airlines (JAL), Asia’s largest carrier, has staged a financial turnaround thanks to successful cost–cutting and restructuring over the past year. But can JAL maintain recovery momentum in the new fuel environment? Will its balance sheet be strong enough for post–2010 growth?

JAL embarked on a major new restructuring effort in February 2007 as part of its 2007–2010 "medium–term revival plan". The plan, which was examined in the May 2007 issue of Aviation Strategy, aimed to restore profitability and position JAL for post–2010 growth through measures such as staff and wage cuts, fleet downsizing, a shift to high–profit routes and the shedding of non–core businesses.

At that time JAL’s president Haruka Nishimatsu rather dramatically called 2007 the carrier’s "last chance for self–resuscitation". JAL had posted losses or weak results for many years — a reflection of high labour costs, a less efficient fleet than its rivals, uncompetitive route structure, a bureaucratic corporate structure, militant unions and poor morale. JAL had also suffered a series of safety lapses in 2005 and had lost domestic market share, particularly premium passengers, to ANA and other competitors.

JAL had not paid dividends since 2004. And its share price had collapsed in the spring of 2006, falling from the Y300–325 level to below Y200 (and subsequently never rising above Y275).

All of that had made JAL’s investors very unhappy. The key shareholders had forced out the previous president/CEO in early 2006, and a similar fate awaited Nishimatsu if he did not improve JAL’s results and restore dividends. The shareholders were also poised to demand radical changes, such as hiring an outsider as chief executive and bringing in a more entrepreneurial board of directors. Also, the financial community was baulking at providing additional capital that JAL needed to bolster its weak cash position.

The February 2007 plan had a mixed reception, with many analysts and bankers remaining sceptical that the plan was achievable and that it went deep enough. Nevertheless, the banks provided new funding to the tune of Y60bn (US$559m), which enabled JAL to launch the restructuring.

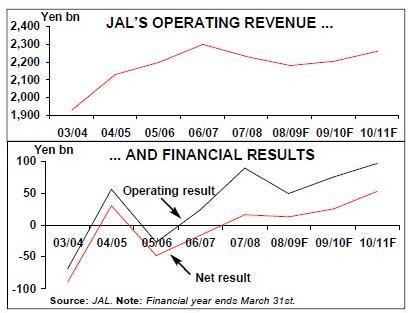

But, one year into the four–year restructuring effort, JAL has clearly turned the corner. After two loss–making years, the airline swung into profit in its latest fiscal year ended March 31st. Operating income almost quadrupled to Y90bn or US$838m (4% of revenues), and the Y16.9bn (US$157m) net profit contrasted with a similar Y16.3bn net loss in the previous year.

The profits significantly exceeded the targets set by the February 2007 plan. They were achieved despite a 55% hike in fuel prices, a 3% fall in revenues (due to asset sales) and Y18bn (US$167m) of special losses and provisions to cover US and EU antitrust fines.

JAL benefited from robust growth in international business traffic. The airline more than offset the hike in fuel prices through fuel surcharges, hedging, reduced fuel consumption and foreign exchange gains. Nonfuel cost cuts also exceeded expectations.

Staff numbers fell by 2,297 — more than triple the original target of 697. Annual labour costs were reduced by Y52bn (US$484m), compared to the target of Y50bn. JAL also boosted its cash position by selling a record volume of non–core assets.

The fiscal year wrapped up nicely when JAL secured a long–awaited capital increase in March. The company issued Y153.5bn (US$1.4bn) in preferred stock to financial institutions and business partners. There will be no near–term dilutive impact because the new shares cannot be converted into common stock for three years. The funds provided a useful boost to cash reserves and will enable JAL to reduce debt and meet capital expenditures associated with the revival plan.

Of course, just as the picture was brightening for JAL at long last, the external environment took a dramatic turn for the worse.Like its peers, JAL faces tough new challenges as a result of this year’s unprecedented run–up in fuel prices, coupled with a possible slowdown of the global economy.

Consequently, JAL had to go back to the drawing board. First, in February the airline announced a new three–year revival plan that "deepens and broadens" the previous plan and incorporates some new strategies.

Second, in early May JAL announced additional measures, including new ways to reduce fuel consumption, a 5% across–the board wage/benefit cut from October and a long–awaited deal to sell its credit card business (JAL Card Inc.).

The timing of the new plan is critical for JAL, because there will be major growth opportunities — as well as increased competition from LCCs — when expansion projects are completed at Tokyo’s Haneda and Narita airports in 2010. In particular, the opening of a fourth runway at Haneda in October 2010 will be a watershed event, because it will mean a dramatic 40% increase in slots at the congested hub (which is much closer than Narita to downtown Tokyo) and because some 7% of the 407,000 annual slots will be allocated for international flights.

To capitalise on those opportunities, JAL must restore decent profitability and repair its balance sheet.

JAL also needs to get in shape because de–regulatory pressures are growing in Japan. In late May the government’s top economic policy advisory council called for Japan to negotiate open skies agreements with the US and the EU and proposed allowing a greater number of international flights at Haneda. Japan has so far only signed limited open skies ASAs, excluding Narita and Haneda, with a number of Asian countries.

That said, even with the new slots coming on line in 2010, there will continue to be capacity limitations at Tokyo, and many believe that the government’s priority is to see a stronger JAL before making further significant deregulation moves.

The new revival plan

The new three–year plan for the 2008/09, 2009/10 and 2010/11 fiscal years, first of all, continues the core strategies of the previous plan: fleet renewal and aircraft downsizing, a shift to high profit routes and expanding the use of lower cost subsidiaries. Second, the new plan will expand "premium strategies" aimed at wooing business and top–tier travellers. Third, as the key new feature, JAL intends to tackle labour and other costs more decisively through a "group–wide cost reform".

On the labour front, JAL is looking to reform the basic structure of wages and allowances, "radically overhaul" work processes and manpower allocation, and achieve the aim of raising labour productivity by 10% a year ahead of schedule.

As with the previous plan, the new plan assumes no overall revenue growth in the three–year period — the result of modest growth in passenger and cargo revenues and a decline in "other" revenues. JAL hopes to restart growing from 2010, after it has completed the restructuring and when additional airport capacity will be available.

However, the new plan contains more optimistic profit projections. JAL has raised its FY2010/11 operating income target from Y88bn to Y96bn and its net profit target from Y37bn to Y53bn. But the 2010/11 operating margin would still be only 4.2% (compared to 3.8% previously), which seems very modest compared to the 10% operating margins that global carriers elsewhere strive for.

There appear to be two reasons why JAL is raising its profit targets at a time like this.First, given last year’s stronger–than–expected profits, the forecasts are from a higher base. Second, JAL believes that it can fully offset this year’s fuel price hike with countermeasures — the reason it has not revised the forecasts made in February, which assume the price of Singapore Kerosene averaging US$110 this year (which looks increasingly unrealistic).

JAL expects its operating income to fall significantly this year, from Y90bn to Y50bn, while net profit is projected to decline by 23% to Y13bn. But those results would still be higher than the February 2007 plan projections. Revenues are forecast to decline by 2% to Y2,184bn this year mainly because of asset sales.

JAL estimated on May 9th that its fuel costs would be about Y40bn higher in 2008/09 than the February 2008 plan estimate, or Y80bn higher than last year’s. However, the airline believes that it would be able to offset fully an Y80bn hike, with fuel surcharges and fare increases recouping about Y61bn, new "premium" strategies Y10bn, network restructuring Y5bn and other cost cutting measures Y4bn.

Because of its high business traffic content, JAL probably finds it easier than most other airlines to pass on higher fuel costs to customers. JAL has had fuel surcharges on international tickets since February 2005, and raising them has become a quarterly event (for which the airline needs government approval), with seemingly little impact on demand. The fuel surcharge on Japan–US and Japan–Europe routes went up by 18% to Y20,000 (US$180) on April 1 and will go up by 40% to Y28,000 (US$253) on July 1.

JAL also continues to benefit from hedging gains. About 66% of its 2008/09 fuel needs are hedged, though the airline has not disclosed the price level. JAL is seeking to reduce fuel consumption, among other things, through more frequent engine cleanings and a switch to less fuel–consuming routes. Of course, the aggressive fleet renewal programme will bring about a further meaningful reduction in fuel usage.

Labour cost reductions

The plan is to reduce the workforce by 4,300 or 8% (from 53,100 to 48,800) in the two years to March 2009 (a year ahead of the original schedule). The cuts are being achieved through natural attrition and an early retirement programme.

The official target is to reduce labour costs by Y50bn (US$466m) annually. Of the Y52bn savings achieved last year, Y15bn came from annual bonus reductions, Y20bn from retirement benefit reductions and Y17bn from the early retirement plan and productivity improvements.

The original plan envisaged no new wage cuts, though through 2007/08 JAL continued a temporary 10% across–the–board basic wage reduction introduced in April 2006. However, with those savings now eliminated, in May JAL announced a new plan to cut salaries and benefits for most employees by 5% from October. That move, which is currently being discussed with the unions, would reduce annual labour costs by Y10bn.

Fleet downsizing and renewal

JAL’s fleet plan calls for the phasing out of larger, older aircraft and bringing in more small and medium–sized aircraft. This means expanding 737–800 and 777 usage and adding 787s and E–170s, while reducing or removing 747s, A300s and MD–80s (some of the 747–400s will be converted to freighters).

The strategy, which is possible because of the increase in Haneda slots in 2010, is intended to cut operating costs by 10%. The current plan — before the impact of the 787 delivery delays — is to bring in 85 new aircraft and retire 64 aircraft in the four–year period ending 2010/11. Last year, JAL brought in 18 aircraft and retired 17, and this year will see 19 additions (737–800s, 767–300ERs and 777–300ERs) and 21 retirements (747 classic–types, 767–300s and MD–80s). The group’s fleet will grow from 272 to 291 aircraft in the four–year period, but all of the growth will be in 2009–2010. The biggest impact will be on international routes, which will see the ratio of fuel–efficient aircraft increase from the current 25% to 50% in 2010/11. The percentage of large size aircraft (747s and 777s) will fall from 52% to 38% of the international passenger fleet total.

As of April, JAL had 87 jet aircraft on firm order, including 28 737–800s, five 767- 300ERs, nine 777–300ERs, 35 787s (plus 20 options) and 10 E170s (plus five options). The 737–800, which was introduced in March 2007, is used on domestic routes out of Haneda and on short and medium–haul international routes. The 78–seat E–170, the first larger RJ type in the Group fleet, is scheduled to enter service with J–AIR in February 2009.

JAL now expects to receive its first 787s in the fourth quarter of 2009. The delays will clearly have significant negative impact, first, because JAL’s financial recovery strategy is heavily dependent on getting fuel–efficient aircraft in quickly. Second, like ANA, JAL now faces even greater delays for the shorter- range 787–3, because Boeing has pushed that model back behind the 787–9 (for 2012 or later) without even setting first delivery dates. The Japanese airlines need the 787- 3 for domestic operations because the wingspan of the regular 787–8 is too wide for many of the country’s airports.

In a May 9th presentation, JAL said that it would mainly respond by delaying 767 retirements, that the 747 classic retirements would proceed as planned and that it would consider acquiring substitute aircraft. JAL will obviously be able to collect significant compensation from Boeing.

Network restructuring and product upgrades

Network restructuring includes focusing on high–profit and high–growth routes, rightsizing aircraft in different markets and expanding the lower–cost subsidiaries. To maintain market share, JAL is speeding up implementation of premium product strategies.

The airline is seeking to strengthen Narita as a global hub, while building Asian international service out of Haneda.

JAL has reaped great benefits from its decision, made two years ago, to switch from 747s to 777s on its European routes — a process that is now complete. For example, switching from 747s to 777–200ERs on the Narita–Amsterdam route improved profitability by Y1.6bn (US$15m) annually. This summer JAL will extend the strategy to the US–Japan market, switching from 747s to 777–300ERs on the New York and San Francisco routes.

On the long–haul front, JAL has continued to boost frequencies in high–demand business markets such as New York and Paris, as well as in growth markets such as Moscow. The airline has also expanded code–sharing with European carriers, including BA and Air France.

In Asia, JAL continues to strengthen its position in markets that have high growth potential — especially China, India, Vietnam and Korea — with new routes, frequency increases and expanded code–sharing with the region’s carriers. Some weaker routes have been suspended. A key part of the strategy is to continue to down–gauge from 767–300s to 737–800s, especially on China and Korea routes.

Much of the future Tokyo–Asia growth will be out of Haneda. After inaugurating Haneda- Shanghai in 2007, this year JAL is adding Haneda–Beijing service for the Olympics and expanding charter operations. Narita will continue to see increased flights, particularly on business–oriented routes to China.

JAL is looking to strengthen Asia operations through a greater use of its subsidiaries JALways (JAZ) and JAL Express (JEX), which offer the same level of service as JAL but have 10% lower overheads. JAZ, which operates 747–400s and 767s using non- Japanese crews, will get more Asia resort and business routes. JEX, which currently operates only domestically, will from 2009 also fly 737–800s on business routes primarily to China. (In the meantime, Japan Asia Airways — JAA — will soon be integrated into JAL to eliminate duplication, because China- Taiwan relations have thawed sufficiently for JAL to operate its own flights to Taiwan.)Domestically, JAL is building a "business structure that generates stable income" in preparation for 2010. This has meant elimination of 11 routes over the past year.

The airline will continue to review weaker routes, expand in select markets, complete the retirement of MD–81s by 2010, continue to down–gauge with 737–800s and E–170s and give a more prominent role for JAL Express and regional subsidiary J–AIR.

Product enhancements are a key part of the aircraft down–gauging strategy, helping to retain premium and frequent flyer passengers and maximise revenues. JAL is extending the main initiatives launched in 2007 — domestic first class, international "premium economy" service and new seats in international first and business classes — to more markets this year. International "premium economy", which is currently offered on the London, Paris and Frankfurt routes and has received a good response, will be extended to New York and San Francisco this summer and later to other European routes. After becoming the first airline in Japan to offer three classes domestically in December (on the Haneda–Osaka route), this year JAL is extending the first class product to at least two more domestic trunk routes.

The positive effects of JAL’s membership of the oneworld alliance (April 2007) are likely to be felt in the long term and will include intangible benefits such as bolstering JAL’s image. JAL has reported a useful Y5bn (US$47m) benefit in the initial year, exceeding the Y3bn forecast.

The shift to high–profit routes, fare increases and strong business demand boosted JAL’s international passenger yield by 7.8% last year. As the full effects of the premium strategies kick in, JAL predicts a sharp increase in business class passengers and a steady rise in yields in the next two years.

The domestic environment is more challenging, with intensifying competition from new airlines and Japan Rail and sluggish demand trends (except in the Tokyo metropolitan area).

Nevertheless, JAL expects the restructuring, product enhancements and corporate sales efforts to result in steady yield growth.

The cargo division has seen overall declines in capacity and revenues, partly because fuel prices prompted JAL to retire five 747–200 freighters earlier than planned. The Pacific has been hit hard, but at the other extreme China demand is booming. JAL is in the process of reviewing its cargo business, with the aim of returning it to profitability. The current strategy is increasingly to deploy the 767F on China and Southeast Asia routes, while renewing the long–haul fleet and adjusting supply on the Pacific. The remaining six classic 747Fs will be retired this year and partially replaced with 747–400BCFs. Post–2010, JAL hopes to boost cargo demand with 24- hour operations at Haneda.

Improving balance sheet

JAL sold assets worth over Y80bn (US$745m) last year — slightly more than in 2006/07. It was all part of the strategy to concentrate resources on the core air transport business, but importantly the asset sales, together with the Y154bn stock offering proceeds and improved earnings from operations, have helped strengthen JAL’s relatively weak balance sheet.

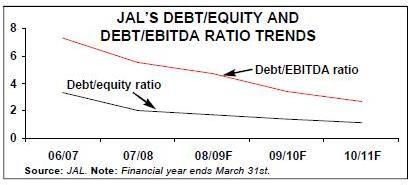

Over the past year, JAL’s cash position improved from Y199bn to Y355bn (March 31st), or from 8.6% to 16% of annual revenues — still some way off the 20%-plus considered adequate for global airlines these days.

JAL’s interest–bearing debt declined by 10.4% last year, from Y1,026bn to Y920bn, and another 12.5% reduction to Y805bn is forecast for the current year. This would mean the D/E ratio falling from 3.3 to 1.7 in the two–year period. The latest revival plan has more aggressive targets than the previous one, aiming to reduce interest–bearing debt to Y598bn and the D/E ratio to 1.1 by 2010/11.

Reducing debt and improving cash flow are prerequisites for the plans to resume growth from 2010. But JAL also needs to tap into the March equity offering proceeds and raise additional funds to meet its cash outflows — capex averaging Y137bn and debt repayments Y110bn annually — in the next three years. The sale of JAL Card, effective July 1, will bring in Y42bn. There are also tentative plans to list shares in JAL Hotels Co. in the next year or two, but otherwise asset sales will play a much lesser role from now on.