Ryanair bets on growth through recession

Jul/Aug 2008

Despite a warning that Ryanair may only break even during 2008/09 — thanks to rising fuel prices and an error of judgement by management over the need for hedging — the Irish LCC plans to keep growing through the aviation downturn. Is this a sensible strategy and, if so, will Ryanair be focused enough to see it through?

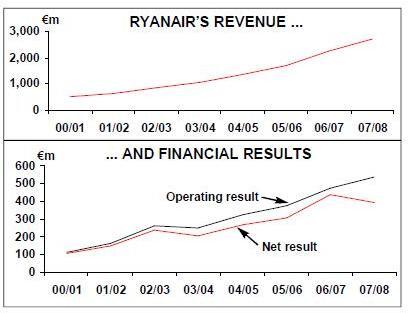

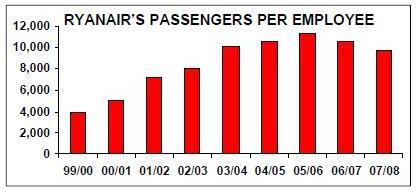

In the 12 month period ending March 31st 2008, Dublin–based Ryanair posted a 21.3% rise in revenue to €2.7bn, based on a 19.8% rise in passengers carried to 50.9m and a 13.8% increase in operating profit to €537m (see charts, below), even though fuel costs rose 14.1% in 2007/08, to €791m. Net profit fell 10.3% in the 2007/08 financial year, to €391m, thanks to a €91.6m write–down on the value of its stake in Aer Lingus, although excluding extraordinary items, underlying net profit rose 10.4% to €480.9m.

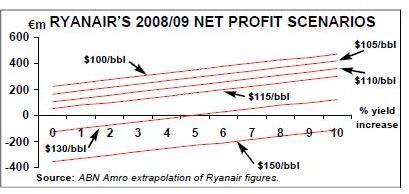

But at the same time as it released its 2007/08 results, Ryanair warned that if oil prices remain at an average of $130/bbl then it would only break even in 2008/09 — and even that would only happen if it could raise fares (including baggage and check–in fees) by an average of 5% over the same period. If oil prices are higher, or if the fare increase can’t be achieved, then Ryanair will make a loss in the 12 months to the end of March 2009 — although Michael O'Leary, chief executive at Ryanair, says that this "will be relatively little compared with our competitors".

While O'Leary sometimes overestimates the potential doom and gloom that his airline faces in a downturn (as he did in 2004), the warning came as a shock to some analysts — particularly as the underlying reasons for it were not all external to Ryanair.

At the moment Ryanair is confident that oil prices will come down this year, and O'Leary calls the current price of oil irrational, as there is no imbalance between supply and demand. Yet sometimes the oil price is irrational (and for sustained periods of time) and O'Leary’s statements can’t hide the fact that Ryanair made an error by not hedging its fuel needs sufficiently for the current financial year.

Whereas the Irish LCC hedged at least 90% of its 2007/08 fuel needs at $65/bbl, it closed very few positions for the 2008/09 financial year, with — as at June — reports that it had hedged just 10% of its July–September 2009 fuel requirements, at $70/bbl. Essentially, through late 2007 and early 2008 Ryanair’s hedge specialists were reluctant to lock themselves into high–price contracts as the fuel price rose, and they "gambled" that prices would come down. But they haven’t, and this leaves the LCC’s bottom line dangerously exposed to the full effects of rising spot prices through 2008/09.

While Ryanair admits it made a mistake, O'Leary says that Ryanair will never introduce fuel surcharges, even if oil hits $500/bbl; (interestingly, in June Gazprom — the state–backed Russian energy giant — said that prices could hit $250/bbl in 2009). While $500/bbl or even $250/bbl appears highly unlikely in the short–term, Stephen Furlong of Davy Research calculates that every $1 rise or fall in the price of a barrel of oil affects Ryanair’s costs by €13m, while a 1% change in yield affects the bottom line by €25m. Another analyst says that if Ryanair had hedged its 2008/09 fuel needs at$100/bbl, then the year’s net profits would come in at €350m. As can be seen in the graph, below, Ryanair’s earnings are now very sensitive to fuel prices, although in June ABN Amro forecast €222m of net profit at Ryanair in the 2008/09 financial year, based on its expected outcome of a 3% rise in yield and an average oil price of $110/bbl in the 12 month period.

But what magnifies the error of Ryanair’s lack of hedging is the fact that many of its rivals have been hedging very successfully. For example, as of June Air France/KLM reportedly has hedged 75% of 2009 needs at $71/bbl, while easyJet has hedged 40% of its current financial year needs at $75/bbl.

Ryanair’s mistake is made even worse because the LCC has reportedly hedged 90% of its US dollar exposure in the 2008/09 financial year at $1.40/€ — which is significantly higher than the current exchange rate. Clearly, Ryanair’s hedging experts are having a bad run.

Cost focus

From Ryanair’s point of view, what is done is done, and the only logical response going forward is to intensify cost–cutting in all other areas of its operation. While the conventional wisdom is that a super–efficient LCC such as Ryanair must have already reduced costs as much as possible, that’s something that Ryanair’s management does not accept.

Indeed Ryanair launched a major cost saving programme at the start of the year, which aims to cut €400m off the cost base, equivalent to the anticipated €400m rise in fuel costs in the current financial year. Measures include:

- The closing of its Dublin call centre in May, with the loss of up to 40 jobs. Telephone booking now account for just 1% of all sales (with all other bookings coming from the internet) — although Ryanair will maintain call centres in Germany and Romania, which are up to 60% cheaper than the Dublin operations;

- Meeting with 60+ airport operators, although how much further Ryanair will be able to reduce airport charges from the already low deals it has remains to be seen;

- A pay freeze for all 40 senior managers;

- The introduction of automated check–in facilities to more airports across Europe; and

- Renegotiation of deals with other suppliers (e.g. maintenance).

Though not part of this new cost–saving plan, in the short–term Ryanair is also continuing to sell some aircraft, as second–hand values for 737–800s remain strong. In fact the price it is getting for the model is more than the price of new aircraft on order, so the LCC is selling around one or two of its oldest aircraft each month as suitable opportunities arise.

But the renewed cost–cutting effort will not affect the outstanding order book, which stands at 135 737–800s, to be delivered over the period to 2012. That’s despite the airline’s plan to ground around 20 aircraft (12% of its current fleet, which will grow from 164 now to more than 190 as at the end of March 2009) over the 2008/09 winter season, 5–7 of which will be based at Dublin and 12–15 at London Stansted.

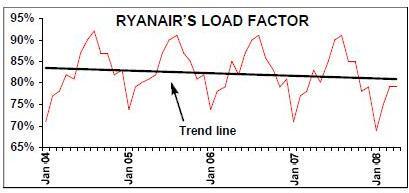

Ryanair says the aircraft are being grounded at those bases because they have the highest airport charges (Ryanair grounded seven aircraft in the winter of 2007/08, all of them based at Stansted), although this will result largely in frequencies being cut back on routes out of these airports, rather than cancelling routes themselves. The action will reduce costs, allow fares to rise on the remaining frequencies and thus reduce losses on the Stansted routes that dip traditionally into the red over the winter schedule Indeed overall, despite these groundings, Ryanair forecasts a 17% increase in passengers carried in the current financial year, to around 60m. This increase is part of Ryanair’s strategy to grow through the aviation downturn, in order to "put more pressure on competitors", according to O'Leary.

In June Ryanair unveiled its winter 2008/09 timetable, which included 40 new routes out of 10 bases (Bergamo, Bristol, Brussels, Frankfurt Hahn, London Luton, Madrid, Bremen, Bournemouth, Glasgow and Marseille). This is the largest–ever expansion in a single season by Ryanair, and a clear sign that the LCC is serious about its target of 82m passengers a year by 2012.

Even more bases…

To achieve this, the airline will double its fleet to around 360 aircraft over the next five years, with the launch of new bases in Spain, France, Italy, Germany, UK, Ireland and eastern Europe. But Ryanair says it will be flexible on expansion, as it will seek to take advantage of airports looking to offer the best deals to attract replacements for the airlines that Ryanair believes will go bankrupt during the current down cycle. Certainly with some airports now desperate to retain or attract LCC business in the downturn, Ryanair sources say that they are being offered some "rock–bottom" deals.

While Ryanair only opened its first continental European base in 2001 (at Brussels Charleroi airport), it currently operates from 24 bases in Europe to more than 130 destinations. But as the new aircraft arrive, the same question remains: just how easy will it be for Ryanair to find profitable routes to operate and cheap airports to station aircraft at. Among the areas being combed over by Ryanair analysts are:

- France Ryanair’s first (and so far only) base in France was launched at Marseille Provence in 2006, utilising the innovative low–cost terminal MP2. Although 23 routes are operated out of Marseilles and the Irish LCC also serves 22 other French airports, Ryanair is substantially behind easyJet in France, which has an estimated 5–6% market share of passengers carried to/from the country, second only to Air France (with an estimated 60% share).

Among the airports that are being considered for new bases by Ryanair are Paris Beauvais, Carcassonne, Biarritz, Grenoble and Nantes.

Ryanair is being helped by the French government’s willingness to encourage more aviation competition, and the LCC’s first domestic route — between Beauvais and Marseille Provence’s new LCC terminal — opened in May this year. Ryanair is also looking at the new low cost terminal at Bordeaux airport, which will open in 2010, and where a Ryanair presence would be a major challenge to easyJet, which already operates out of the airport.

- Italy Ryanair currently operates to 24 airports in Italy, with bases at Milan (Oria al Serio), Pisa (Florence) and Rome. Most urgently Ryanair is analysing the launching of a base at Milan Malpensa, capitalising on Alitalia’s controversial withdrawal from the airport. Plans for up to 12 aircraft and 60 routes (10 of which would be domestic) by 2012 have been drawn up, although — as ever — this depends on what deal can be struck with the airport operator (SEA), based not just on low charges, but whether it can also offer quicker turnaround times for LCC operations. In parallel, Ryanair would develop its existing base at Bergamo (which is located to the east of Milan), where its existing four aircraft could be expanded to 10 by 2012.

- Spain Spain is also a key development market for Ryanair. It currently has five bases there — Madrid, Valencia, Alicante, Girona and Reus.

At Girona (90km to the north of Barcelona) it is increasing aircraft from nine to 14 as it targets carrying 8m passengers a year at the airport by 2012. This summer Ryanair launched its fifth Spanish base in Reus, which is 80km to the south of Barcelona. The LCC is stationing two aircraft there, operating 12 routes (up from the current six) and with a target of more than 1m passengers a year. Ryanair’s bases at both Girona and Reus will pile more pressure on the LCCs operating at Barcelona’s El Prat airport, which include Vueling and Clickair.

- UK Ryanair’s 24th base was opened at Bournemouth in the UK in April this year, and the 25th was launched at Birmingham in June, with two 737s stationed there initially (which may increase to as many as 10) that will serve up to 30 new routes on top of the existing services to Dublin and Shannon. Ryanair has a target of 5m passengers a year by 2012 to/from an airport that O'Leary says has been "woefully under–served".

Another important country for Ryanair is Germany, in which the LCC has three bases: Frankfurt Hahn, Bremen and Dusseldorf (Weeze). Ryanair’s first domestic route — between Frankfurt Hahn and Berlin Schonfeld — was launched in May, and this is targeting 0.2m passengers a year.

A question of focus

Despite O'Leary’s misplaced optimism on the price of oil, there’s little doubt that Ryanair will be able to get through the aviation downturn relatively unscathed, even if it does dip into the red slightly in 2008/09.

Ryanair is very strong financially — as at the end of March 2008 it had long–term debt of €1.9bn, lower than cash and cash equivalents of €2.2bn, and O'Leary is right to say that: "The airlines who will survive this period of higher oil prices and industry downturn are those with new and cheaper fuel efficient aircraft, lower costs, substantial cash balances, low net debt and management who are ready to exploit downturns to drive costs lower and increase efficiency." Of course, those are all criteria that Ryanair has.

And further good news is that it looks entirely feasible that Ryanair will achieve the 5% increase in fares it is targeting in 2008/09: in January Ryanair raised its charges for checked–in baggage and airport check–ins, and further increases are likely.

Ryanair adds that the recession is encouraging passengers to look for lower fares, and that as of early June Ryanair’s forward bookings were 2% higher than at the same time in 2007; in turn this means that the LCC has had to discount less, which will further help it achieve its planned 5% rise in achieved fares.

However, it’s interesting to note that it was only in February this year that O'Leary said that: "There can only be one competitive response to any consumer uncertainty and that is for Ryanair to slash fares and yields, stimulate traffic, and encourage price sensitive consumers." Obviously that opinion has now changed, but even a 5% rise in average fares will still leave the Irish LCC considerably cheaper to fly with than all of its major rivals (excluding fellow LCC easyJet). John Mattimoe of Merrion Capital says that even a 5% rise in average fares would only return Ryanair’s fares to the same level they were in 2000.

And of course Ryanair continues to look for ancillary revenue at every opportunity. In the 2007/08 financial year Ryanair’s average fares (including baggage fees) fell by 1% to €43.7, although ancillary revenue rose 34.8% to €488m. Initiatives this year include the trialling of in–flight mobile communications, which allows passengers to use their mobiles and Blackberries on flights, as well as the launch of Ryanairvillas.com, which offers rental properties across Europe. In June Ryanair also launched a service to deliver flight information to mobile telephones for a fee of €3.

O'Leary says that while Ryanair may not make much profit this financial year, "it’s definitely going to lay the basis for a much stronger position for Ryanair across Europe over the next three or four years".

While its hard to disagree with that statement, the key challenge for the LCC over the next few years is not so much financial as that of maintaining managerial focus — i.e. the need to devote considerable resources to the necessary but time–consuming trawl for potential new bases and routes in Europe in which to place its new aircraft profitably.

Strategic value

Ryanair has been forced to write down the value of its 29.4% stake in Aer Lingus by €91.6m, which appears to be a rare misuse of its assets. However, the Aer Lingus stake does have strategic value: a further deterioration of the Irish flag–carrier’s share price might well cause the remaining independent shareholders to reconsider the attractiveness of an accommodation with Ryanair and put pressure on the Aer Lingus board and Irish politicians. Aer Lingus’s senior managers are being forced to operate with a significant minority hostile shareholder looking over their shoulders. And they are in the invidious situation of knowing that if they implement successful policies and boost the company’s share price again, one–third of the benefit will flow directly to the airline’s bitterest rival Ryanair continues to pursue the merger issue, even though its bid for the Irish flag carrier was blocked by the EC in June 2007 on the grounds that it would be anti–competitive. Ryanair naturally appealed against the verdict, and last year Ryanair also tried to call an EGM at Aer Lingus in order to try and overturn the flag carrier’s closing of the Shannon- London Heathrow route. The legal battle hasn’t stopped there though.

This March a European court blocked an attempt by Aer Lingus to stop "interference" by Ryanair in its affairs, and Aer Lingus has appealed against the judgement by the EC last year that it could not force Ryanair to sell its shares in Aer Lingus.

Ryanair is also engaged in many other legal battles, most particularly in battling with the EC over the airline’s agreements with airports, the latest front of which was opened earlier this year when the EC said it was investigating the deal between Ryanair and Slovakia’s Bratislava airport, which followed similar action launched late last year against a deal with France’s Pau airport.

Ryanair is currently appealing against a European court judgement on Ryanair’s agreement with Brussels Charleroi airport, and the opening of new investigations infuriates Ryanair, which continues to fight against aid to flag carriers (with a complaint against the EC’s alleged "inaction" over state aid to Alitalia being lodged at the end of last year, which joins at least four other legal complaints by Ryanair against the EC and other airlines).

As ever, Ryanair is at the forefront of the battle to break up the power of BAA, and — unusually — earlier this year Ryanair teamed up with other airlines (easyJet, Virgin Atlantic and bmi) to protest jointly at the CAA’s decision to allow BAA to increase charges at Heathrow and Gatwick by more than 20% in 2008/09. Ryanair is also battling the building of a second terminal at Dublin airport due to open in 2010, which the LCC claims is far too expensive.

O'Leary says "We're not paranoid but Brussels really do have it in for us." Maybe there is a grain of truth in this, but Ryanair needs to grow up and pick and choose its battles more carefully, rather than take on everyone and everything it doesn’t agree with through expensive and distracting legal challenges.

But unless he is side–tracked by some of these numerous other items, O'Leary (who owns 4.5% of Ryanair and has been chief executive since 1994) should see guiding the airline’s growth through the recession as his last major challenge at Ryanair.

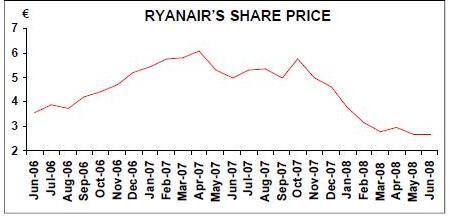

The airline’s share price has been falling steadily since last year (see chart, left), and this is a real concern to investors. Although Ryanair spent €300m last year in buying back shares and may spend another €200m this year doing the same, the shares may only regain fundamental strength when the airline’s management puts real focus onto its ambitious growth plan.

| Fleet | Order | Options | |

| 737-800 | 164 | 135 | 132 |

| Total | 164 | 135 | 132 |