Air France: proudly introducing SkyTeam

July 2000

With the publication of the results for the year ended in March, Air France has confounded its critics and shown that it is now a restructured and revitalised airline, at the centre of yet another global alliance — SkyTeam.

In the past decade it has gone through near–bankruptcy, received restructuring help from the French government, agreed by the EC under the one–time last–time rules, and the management has completely turned round the sluggish operations–led carrier to one which is fast approaching being customer- focused and market–led. In that, it is probably very much in the same stage of corporate development that BA was in the mid–1980s, and that Lufthansa was in the early 1990s, respectively before their own privatisations.

Air France finally came to the stock–market in February 1999, amid much criticism domestically. With a Communist Minister of Transport it was politically inexpedient to refer to the operation as a "privatisation", and the IPO was officially called an "ouverture de capital".

The criticisms at the time among other things related to the lack of a global alliance membership (despite the promises that it would announce the major partner within the year), the remaining majority government ownership, and, despite the successful shares for wages swap deal with the pilots' unions, what appeared to be an attitude of confrontation on labour issues.

As 1999’s summer season progressed and as the overcapacity on the Atlantic became exacerbated, further criticism was heaped on the carrier for expanding capacity so strongly in the search of "market share recovery".

Air France increased capacity by 11% overall in the year to March 2000, and by a massive 19% on the Atlantic. Unlike any of the other carriers in Europe, however, it has been able to show a strong increase in unit revenues (up 3.4%). Unit costs only grew by 2% (almost all of which was due to the increase in fuel).

The company announced that for the full year it had achieved a 14% increase in revenues to €10.3bn, and a 42% increase in net income to €354m. The figures for both years include abnormal items. In June 1998 Air France suffered a very damaging pilots' strike which cost it some €200m. In December 1999, there were some very severe storms over Paris which disrupted operations badly and in addition the fuel suppliers at the airports suffered a strike — these two events had an impact of some €32m.

The Euro weakened considerably in the period. This movement was particularly hurtful against the Yen — and the company had to mark to market its yen–denominated debts (this is particularly galling as the debt is long term and the cash inflow in yen more than covers the liability over the remaining portion of the loans). This movement cost the airline another €98m, up from €13m in the prior year period. Overall underlying net income grew by a healthy 12% — or 72% if one were to assume that the rise in fuel prices was abnormal.

A strong base of operations

So where is this this success coming from? The overriding asset of Air France is its base hub of operations at Paris CDG. Like BA at Heathrow, it has a very large natural catchment area for a good base of point–to point traffic. By contrast, Lufthansa and KLM are based at airports with relatively small local population areas and consequently have had to build hub–and–spoke transfer operations through their airports.

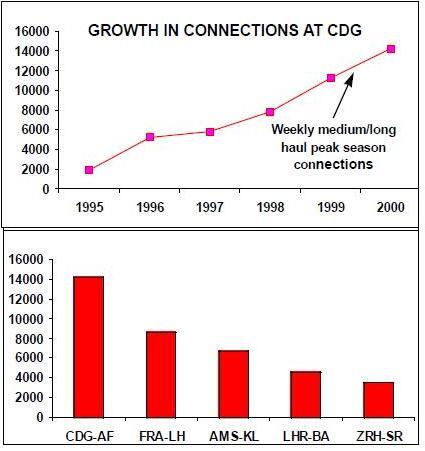

Moreover, Air France has the unique position of being based at a large airport where there is the political will and backing to provide expansion: the third runway opened in April 1999 and the fourth is due to open in April 2001. Consequently it is in the position to develop the transfer markets on top of its natural point to point markets.

A revitalised product

Since implementing the hub strategy with a six wave system in 1998, it has expanded the potential market its network can reach by double. In the current main summer season the carrier is able to offer into the market some 14,000 weekly short to long haul connections through its hub (with 45min to 2hour connections). This is now nearly twice that on offer by Lufthansa through Frankfurt. In the year ended March, Air France had increased capacity by 11%, and achieved an overall increase in revenues of 14%. However, the revenue from connections through CDG improved by 17% and the income from high yield connecting traffic jumped by 24%. In the restructuring process of the past five years, the company has concentrated on getting its operations together. It has cut a significant number of non–performing routes, intensified frequencies on performing routes — with the aim of at least daily on long haul and at least three times a day on short haul. It has significantly increased the proportion of non–stop flights cutting out unnecessary stopping services wherever possible, and it has realigned its schedules to ensure consistency of timing and aircraft type.

Domestic market

As a result its product has improved to the point where it is now at least on a par with any of the other majors in Europe. In its major expansion phase last year it increased the relative size of the premium cabins (partly through the introduction of 777s). As a result traffic revenue grew by 27% on the Atlantic routes while capacity was up by only 19%. On Asian routes, there was a much lower 8% growth in capacity, but as a result of the improving regional economies, it achieved a 23% increase in revenues. France enjoys the largest domestic market within Europe, ahead of Germany and Spain. Air France controls a 70% share of the market — and a near 80% share of the main trunk routes into and out of Paris. In the past few years it has developed franchise links with a series of regional players to ensure feed and market presence in the smaller routes that it does not want to operate itself — and to this end recently acquired Régional Airlines.

Unlike Germany, the next largest domestic market, France is highly centralised — with all roads and routes leading to Paris. Consequently the domestic hub operations at Paris Orly, and the Paris hub–bypass hub at Lyon are central to the strategy of accessing the market. Given its high share of the domestic services it has an important base of frequent flyers to retain.

A new US bilateral, a new alliance

However, it does have some competitive pressures — primarily from the TGV, which provides the "low fare" alternative, but also from the independent airline sector. This may intensify now that SAirGroup has acquired major stakes in AOM, Air Liberté and Air Littoral — but forming these three quite high cost and very different airlines into a coherent new version is going to be a very difficult challenge for Swissair. When the company was trying stave off bankruptcy in the early 1990s, France rescinded the bilateral air service agreement with the US. Consequently for a period of 8 years service between the two countries were operated under the principle of comity (in effect before taking off the captain radioed ahead to see if it was OK for him to land). Thus while the bilateral was in abeyance, it was impossible for Air France to be able to sign a deal with any US carrier.

The new bilateral was finally signed and came into effect in June 1998. Air France then started code–share operations with both Continental and Delta. The new bilateral leads to open skies on the Atlantic (for services between the two countries) within five years. Last June the company decided to settle on Delta for its transatlantic partner in its new global alliance.

And on June 22nd this year, Delta, Air France, Aeromexico and Korean Air formally unveiled their long–awaited global alliance, SkyTeam. The launch had evidently been further delayed by news of the KLM/Alitalia breakup and the proposed United/US Airways merger, and it has drawn little response from outside parties as merger talk has continued to dominate the US and European scenes.

The immediate offerings of the new alliance include reciprocal lounge access, frequent–flyer base mile accrual and redemption and an expanded network of flights. Additional benefits will be phased in through the end of 2000, followed up by development of cargo cooperation. A global multimedia branding campaign is expected to be in full swing by the autumn, and the Skyteam logo will begin appearing on partner airlines' literature later this year.

There are no plans for cross–equity holdings. However, senior Air France executives have said that, in light of the possible consolidation phase in the industry, equity links are not ruled out.

At this stage the airlines have chosen not to release any specific forecasts of revenue benefits expected from Skyteam. After all, many such attempts in the past have proved wildly inaccurate. Nevertheless, Delta CEO Leo Mullin has suggested that the benefits could be "substantial", given that Delta already generates $400m annual revenues from its existing alliances. Air France estimates it achieved additional benefit of some €76m already from its Delta links, half way to its targeted €150m.

SkyTeam hopes to differentiate itself from the other alliances by focusing on the customer. It will strive to provide "a consistent level of performance, quality and detailed attention to customer service" and will offer full reciprocity for elite–status frequent–flyers (similar to Star’s but more generous than oneworld's).

The airlines say that customer research indicated that "many travellers believed there was something missing in previous airline alliances — attention to the individual passenger". This is easy to believe as, even though travellers appreciate the benefits of FFP linkages, other surveys have shown that the public perception of alliances generally is not very favourable.

The SkyTeam campaign features the tag–line "Caring More About You". Advertisements, which take the form of multi–cultural jigsaw puzzles with the piece showing a passenger’s head missing, ask "What’s missing in airline alliances?" , the answer to which is "You".

Whatever the passenger makes of this advertising hype, the emphasis on service is a politically astute move (at least in the US, where declining service standards continue to be hot items on lawmakers' and regulators' agendas), getting it successfully implemented is a tough task. As previous alliances have shown, the real problems are motivating employees to perform and achieving uniformly high standards — a process that can take years.

With its combined 174.3m annual passengers and 6,402 daily flights to 451 cities in 98 countries, the four–member SkyTeam is much smaller than Star and somewhat smaller than oneworld. But the new grouping benefits from a potentially powerful hub structure.

In addition to CDG, SkyTeam has Delta’s hub at Atlanta, the world’s largest, Aeromexico’s Mexico City hub, Latin America’s largest, and Seoul’s new Inchon Airport, Korean’s future base.

The growth potential enjoyed by Korean at its Seoul base makes it an attractive Asian partner for a global alliance — in terms of access to the north east Asian market and connections from the US to the south east Asian market. The first phase of the new Inchon airport is due to open in March 2001, and when the third phase is completed by 2010, the airport will have the capacity to handle 200m passengers a year. Inchon also offers potential as a cargo hub.

Another plus–point for Skyteam is that the core team has already mutual experience gained from previous code–sharing and other cooperative ventures. Delta, Aeromexico and Air France have code–shared since the mid–1990s and, in many ways, see SkyTeam as a "natural evolution" of their partnership.

A worrying aspect is Korean’s poor safety record — three fatal crashes since 1997 and numerous smaller incidents. A year ago Delta stopped placing its own passengers on Korean’s flights (though Korean puts code–share passengers on Delta flights).

Nevertheless, Delta now says that full code–sharing with Korean will resume "fairly soon" as Delta is satisfied with the progress made by Korean with safety issues. A respected ex–Delta executive, David Greenberg, has been in charge of Korean’s flight operations.

SkyTeam expects to be in contact with a "limited number" of candidates and announce additional members before the end of the year. One of the most likely early entrants is Czech airline CSA, which has expressed strong interest.

The gaps in SkyTeam’s global coverage are South America and southern Asia. The problem is that there are no unattached strong airlines in either of those regions that could be immediate candidates.

While Aeromexico’s coverage of Latin America will be adequate in the short term, a strong partner in a major South American country like Brazil would be desirable. One interesting option is a possible future combination of TAM and Transbrasil — the third and fourth largest airlines which have signed an operational agreement as a potential first step towards a merger.

One possible Southeast Asian candidate is Thai, which is currently a Star member but whose future privatisation could lead to a shift in global alliances. Air France and Delta combined are likely to make a bid for 10% of the airline to ensure its membership of SkyTeam.

Air France has also continued to publicly express interest in cooperating with Alitalia (following their unsuccessful talks three years ago). The "de–merger" of KLM/Alitalia has now vastly improved Air France’s and SkyTeam’s chances of luring Alitalia.

SkyTeam aims to move quickly into the number two position and hopes to eventually catch Star. Overtaking oneworld and keeping Wings firmly behind may not be that hard — as long as those two alliances remain separate.

| Year to | Year to | % | |

| Mar. 99 | Mar. 00 | change | |

| Revenues | 9,100 | 10,324 | +13.5% |

| EBITDAR | 1,201 | 1,436 | +19.7% |

| Gross Profit | 978 | 1,176 | +20.2% |

| Operating income | 267 | 358 | +34.1% |

| Net Income | 249 | 354 | +42.0% |

| - 1998 Pilots' strike | 198 | - | |

| - Oil suppliers' strike | |||

| and storms | - | 32 | |

| - Disposal of subsidiaries | |||

| and affiliates | (156) | (184) | |

| - Foreign exchange impact | 13 | 98 | |

| - Profits on aircraft sales | (61) | (27) | |

| Underlying net income | 243 | 273 | +12.3% |

| - Impact of fuel price rises | - | 145 | |

| Underlying net income | |||

| before fuel | 243 | 418 | +72.0% |

| Capacity | Rev. | |

| N. America | 18.8% | 21.4% |

| Europe | 10.3% | 17.8% |

| Asia | 5.0% | 17.0% |

| Mid East/Africa | 11.8% | 14.2% |

| DomTom | 9.7% | 14.2% |

| France | 5.7% | 8.6% |

| S. America | 14.7% | 5.7% |

| Total | 11.2% | 15.0% |