THY and the delights of privatisation

July 1999

THY (Turk Hava Yollari), the Turkish national airline, is located on the edge of Europe and has also been on the edge of a privatisation for the past five years. It has succeeded in joining the Qualiflyer alliance but the actions of the Turkish government have not been very helpful.

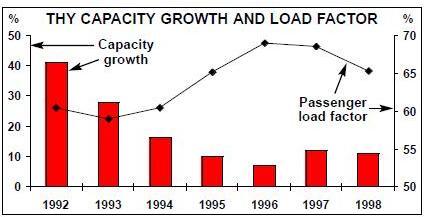

THY has been one of the fastest growing of the AEA carriers, doubling its capacity over the past five years and carrying more than 11m passengers in 1998. The Turkish economy has also grown at rates twice that of the main European economies (albeit from a much lower base and at the expense of very high inflation).

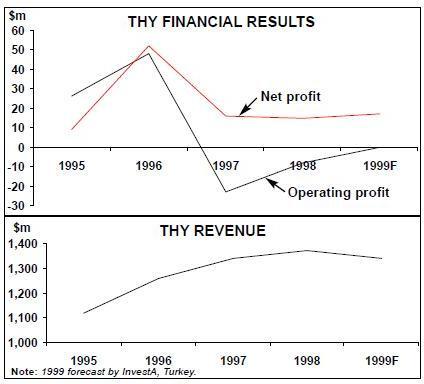

THY’s financial results have been unexciting (see graphs, right). In 1998 it made a marginal loss at the operating level (the equivalent of US$8m) but was able to report a $15m net profit mainly because of exchange rate gains. InvestA, an Istanbul–based stock–brokerage, forecasts roughly the same results for 1999.

THY and the PA

Currently 1.8% of THY’s stock is quoted on the Istanbul stock exchange, and the other 98.2% is owned by the Privatisation Authority (PA), the government body charged with selling off state companies. With such a small float, stock–market capitalisations are almost always misleading, but for the record THY was being valued at the equivalent of US$1.9bn at the end of June.

There have been various false starts with the THY privatisation during the 1990s, but the latest strategy is to find a trade investor for about 30% of the airline prior to an IPO. Credit Suisse First Boston has been appointed as global co–ordinator for the sale, and the PA circulated another tender to ten investment banks for additional advisory work.

THY’s management has to refer all strategic decisions to the PA and cannot make any significant change without the authority’s permission. Relations between THY and the PA have not been particularly smooth, and there are two main areas of contention.

First, the Privatisation Authority has frozen THY’s full participation in Qualiflyer and put on hold various plans including a joint cargo operation and a joint regional airline operation with Swissair. The logic behind this action is that THY cannot be allowed to enter into a major alliance during the pre–privatisation process as this would deter bids from other trade investors.

Second, THY has a socio–political role to play, which the PA is supposed to help subsidise. THY is obliged to provide services to cities in the southeast of the country that are under a state of emergency because of the Kurdish separatist movement. On these routes — officially referred to as the OHAL routes — THY has to offer 50% fares to government officials and their families and then is supposed to recover the other 50% from the PA.

The PA, however, does not have the cash available and has told THY to track down the money in the various ministries whose officials use the flights. But before THY can even begin to do this it needs official approval from the state planning organisation, which so far has not acted. Turkish bureaucracy is evidently a challenge. Yet the sums involved are significant — the receivable is estimated as at least $21m, nearly one and half times THY’s reported net profit in 1998.

Domestic operations

THY has a monopoly in the domestic market of over 6m passengers a year, achieves a load factor in excess of 75% and is able to set fares on a monthly basis in US Dollar terms on the trunk routes. Despite all this THY says that it makes a serious loss on these operations.

The reason is the mix of uncommercial routes — not just the OHAL routes — with some that must be profitable or indeed very profitable. According to the airline, there are six profitable routes in THY’s domestic network — from Istanbul to Ankara, Antalya, Bodrum, Dalaman, Gaziantep and Izmir.

Prior to the PA’s intervention THY’s strategy for the domestic market was based on spinning off these operations (except for Istanbul- Ankara) to a subsidiary, which was to have been based at Ankara. The subsidiary would have operated all the other domestic routes, buying services like reservations, passenger handling and maintenance from the parent.

The main shareholders in this domestic airline were to have been Crossair, the Swissairowned regional carrier, and Park Express, a start–up that had ordered five Avro RJ100s and was headed by a former chairman of THY. Unfortunately, in March this new regional airline had to postpone the start–up of its operations for about 12 months because government loans that it was expecting failed to materialise as state lending was curtailed before the national election in April.

Nevertheless, it is clear that THY needs a specialist, lower cost airline to cover its domestic operations. The alternative is for a new private enterprise to take all or part of them over. TURSAB, the local travel agencies association, has announced that it is considering establishing a company to bid for the domestic franchise.

The Turkish influence zone

When it is finally set up, the subsidiary airline will probably also take over some international operations, in particular those to central Asia. The collapse of the Soviet Union has greatly widened Turkey’s zone of economic and political interests. Newly independent countries like Turkmenistan, Kazakhstan and Kirgizistan have substantial historical, cultural and Turkic language links.

These countries also have oil and gas reserves but they remain painfully poor and economic recovery from the Soviet planning system is going to be a long process. It is unlikely that THY is able to justify its fairly extensive network to these countries on commercial grounds, but these services could be fulfilled by a specialist subsidiary.

THY owns 50% of KTHY, the airline of northern, Turkish–occupied Cyprus. As well as posing some very delicate political questions, KTHY is a also a financial mess. THY took over KTHY’s management in 1997 and acquired its 50% stake by converting receivables into equity. It is still owed another $25m.

The European holiday market

Turkey as a holiday destination has in recent years grown in popularity while Spain and Greece have stagnated. The total market in 1998 is estimated at about 9m, a doubling over the past five years. But the country’s proximity to the Middle East, its links with the Balkans and the repercussions from the Kurdish conflict means that it is very vulnerable to short–term fluctuations in demand.

The market is highly seasonal — THY carries about 3m passengers annually in the European market, but it has twice as many passengers in the third quarter of the year as it does in the first quarter. The main traffic flows are to/from Germany, both for tourism and for VFR (there is a huge Turkish gastarbeiter population in Germany), though tourism from the UK and France has been growing quickly.

So THY faces the problems of competing as a scheduled carrier, albeit a relatively low cost one, against northern European charters — LTU, Hapag, Britannia, Monarch, etc. — which are fully adapted to seasonality and whose cost structures are extremely low.

In addition, there is a substantial Turkishbased charter airline sector. Seven airlines operate some 50 passenger jets ranging from 737s to A300s. This is roughly the same capacity as THY’s own medium–haul fleet, although two of these carriers are joint ventures with THY — KTHY and Sun Express, which is 40% owned by Condor, Lufthansa’s charter subsidiary. As a result, THY’s share of international traffic is only around 21%, compared to 35% for other Turkish airlines and 44% for foreign carriers.

THY will inevitably face more competition in this market as the charters increasingly operate as semi–scheduled airlines, transporting tourists whose requirements no longer fit neatly into the standard two–week, one location packages, and providing regular low–cost links for the overseas Turkish population. And in order to compete for higher–yielding business traffic THY has to attempt to match the product offered by the main European scheduled airlines.

In this regard THY’s acceptance into Qualiflyer was a major achievement for the Turkish flag–carrier. It has been given credibility through its code–sharing and joint flight arrangement with Swissair on Istanbul to Zurich and Geneva, and with Austrian on Istanbul–Vienna. Moreover, participation in the alliance–wide FFP means that it should be able to capture a reasonable share of the Turkish business market.

The full benefits of the Qualiflyer alliance will come from the planned co–ordination of the partner airlines’ sales and marketing networks, essential for the reform of THY’s rather unwieldy distribution system. Cost savings are also expected from the consolidation of the member airlines’ ground handling services. However, as noted above, full activation of the alliance has been put on hold.

Before THY can play a proper hubbing role within Qualiflyer (or another of the alliances) major infrastructural improvements will have to be made. An additional terminal and a third runway are being built at Istanbul Ataturk airport, and construction of a new airport at Istanbul is due to start soon and should be completed in 2002. The competitive airport threat in the region comes from the all–new Athens Spata airport, which will open in 2001 or 2002.

The long-hauls

From an outside perspective it is difficult to assess THY’s long–haul network. It operates a fleet of six A340–300s, with another one to be delivered in the next 12 months, on long, thin routes to which they should be ideally suited. But both its load factors and its utilisation (61.3% and 13.2 block hours/day in 1997) are low by AEA standards.

This productivity would make it very difficult for THY to break even on its long–haul operations as low revenue plus high finance costs would normally outweigh low operating expense. This is despite the fact that THY’s flying crew costs are well below European scheduled norms — for example, cockpit crew salaries are about a third of the AEA average and crew utilisation is about 10% above.

However, the long–haul network is an unusual mixture of destinations — New York, Chicago, Johannesburg, Capetown, Bangkok, Singapore, Karachi, Tokyo, Shanghai and Beijing. Some of these routes have been selected for political reasons — for example, the Chinese services, started in June, are designed to foster Turkey–PRC relations and are unlikely to be commercially viable.

THY’s challenge on the long–hauls is to achieve better loads and to push up yield — which means getting into a global alliance so that its does not lose business passengers to competitors who can provide smoother connections and the vital FFP miles. THY has made a breakthrough here, establishing a code–share with JAL, but the North Atlantic market looks problematic.

Delta would have been the obvious partner as it is the only US carrier to operate from New York to Istanbul and so some form of joint service would have been possible. Also, THY’s expansion plans include a service to Atlanta. However, in the wake of the Delta/Air France alliance, Swissair’s relationship with Delta is in jeopardy and this in turn has negative repercussions for the other Qualiflyer members, including THY.

Fleet plans

THY’s fleet plans revolve around the replacement of its 26–unit 737–400 fleet with 26 new generation 737–800s. Eleven have already been delivered and most of the rest will be taken over the next 12 months, while 19 of the -400s will be returned to their lessors.

Including the two A340s (one just delivered, the other due in 2000), THY’s total expenditure on new equipment amounts to around $1bn. Eximbank credits cover 85% of the 737–800 order.

The concern for THY is whether the continuing depreciation of the Lira, which has lost 90% of its value against the US Dollar over the past five years, will result in an escalation in its financial charges. THY, however, points out that it is naturally hedged against this development as some 83% of its revenues are in Dollars, Euros or other hard currencies.

Outlook

THY’s management must feel somewhat frustrated by the block on full activation of its Qualiflyer membership. Also, Swissair is by far the most likely candidate to take equity given its recent spending pattern. Nevertheless, THY could market itself effectively to the leading European airlines in the other alliances.

Lufthansa already has an ownership link through Condor and Sun Express, and might be willing to contemplate an investment in THY given the strong economic links between the two countries and the volume of the VFR traffic. A renovated and expanded Istanbul airport could fit into British Airways’/ oneworld’s strategy of developing different types of hubs for different purposes throughout Europe. Athens’ Spata might seem to be the first choice given the new Speedwing management contract at Olympic, but many obstacles have to be overcome before that airline is turned around. Finally, Air France might be interested in THY simply because of a shortage of other candidates to join its new alliance with Delta, and, as mentioned above, Delta would probably be the best US partner for THY.

| Current fleet | Orders (options) | Delivery/retirement schedule/notes | |

|---|---|---|---|

| 727-200 | 1 | 0 | |

| 727-200F | 3 | 0 | |

| 737-400 | 26 | 0 | To be returned to lessors by 2004 |

| 737-500 | 2 | 0 | |

| 737-800 | 11 | 15 (23) | 5 in 1999, 7 in 2000, |

| 1 in 2001, 2 in 2002 | |||

| A310-200 | 7 | 0 | |

| A310-300 | 7 | 0 | |

| A340-300 | 6 | 1 | Delivery in 1999 |

| BAe 146/RJ100 | 9 | 0 | |

| BAe 146/RJ70 | 4 | 0 | |

| TOTAL | 76 | 16 (23) | Average current fleet age = 7 years |

| Current fleet | Orders (options) | Delivery/retirement schedule/notes | |

|---|---|---|---|

| Air Alfa | |||

| A300B4 | 3 | 0 | |

| A321 | 2 | 1 | Delivery in 1999 |

| Anatolia | |||

| A300B4 | 3 | 0 | |

| 727-100 | 1 | 0 | |

| Istanbul Airlines | |||

| 737-300 | 3 | 0 | |

| 737-400 | 9 | 0 | |

| 737-800 | 1 | 0 | |

| Kibris (KTHY) | |||

| 727 | 4 | 0 | |

| A310 | 1 | 0 | |

| Onur Air | |||

| A300 | 2 | 0 | |

| A320 | 1 | 0 | |

| A321 | 1 | 0 | |

| MD80 | 5 | 0 | |

| Pegasus Airlines | |||

| 737-400 | 8 | 0 | |

| 737-800 | 1 | 0 | |

| Sun Express | |||

| 737-300 | 3 | 0 | |

| 737-400 | 2 | 0 | |

| 737-800 | 0 | 5 | Delivery in 2000 |

| TOTAL | 50 | 6 |