Will inter-alliance competition supersede hub competition?

July 1998

The message coming from the US majors is: “Previously we competed via our hubs, but in the future the industry will see inter–alliance competition”.

The airlines are concerned primarily with two audiences. Firstly they have to persuade the regulators that the effect of the proposed code–sharing alliances between American/ US Airways, Delta/United and Northwest/ Continental is not to halve the number of competing hubs in the US but somehow to increase domestic competition. Secondly, they have to persuade the financiers and stock–market analysts that these alliances will translate into greater profits. The two messages are not necessarily compatible.

In a recent presentation to investors US Airways developed an analysis aimed mainly at the latter audience. This is our interpretation of the argument.

Passengers develop loyalty to an airline based on many factors but principally on the breadth of the service provided (the number of destinations) and the depth of service (the frequency of service). For example, take the passenger based, inevitably, at Des Moines and wishing to travel to somewhere other than a US major’s hub. He or she has seven logical hubs to connect over — Minneapolis and Detroit (Northwest hubs), Denver and Chicago (United hubs), Cincinnati and Atlanta (Delta hubs) and Dallas (American hub). And as United’s hubs provide the best access to the most destinations — despite the proximity of Northwest’s hub at Minneapolis and TWA’s St. Louis base — United takes about 33% of the originating traffic from Des Moines, with TWA in second place with 19%, and Northwest and American both capturing 11%.

What then are the implications of this type of travel pattern for the new US alliances?

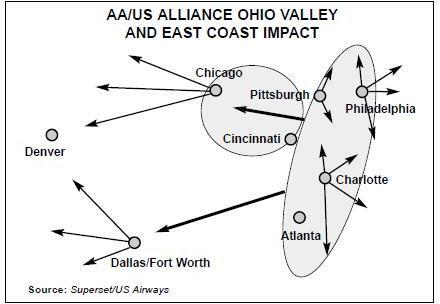

In the case of US Airways/American the major impact will be fleet in two regions — the Ohio Valley, which accounts for $6.6bn of total annual originating revenue and the east, which accounts for $20.6bn of total annual revenue.

For passengers originating in the Ohio Valley there is no reason for any one carrier to predominate — Northwest, American and United would be the strongest carriers on routes to the northwest and west; American and Southwest to the southwest; Delta, Continental and US Airways would take southeast traffic; and finally Delta and US Airways would capture northeast–bound passengers.

And the traffic data confirms the diversity — United, Delta and American are not too far apart in terms of traffic shares. But the effect of the proposed alliance is to create a superpower in the region — UA/DL which would be two and half times the size of the nearest competitor. The AA/US alliance, however, creates an entity that should have the size and, more importantly, the connecting potential to compete effectively with UA/DL.

Of course, to succeed in this market AA/US will have to steal traffic away from UA/DL, and this will also be the aim of NW/CO.

The east of the US is US Airways’ home territory and in the intra–east market, worth about $8.8bn/year in revenues, it has a dominant position, accounting for 36% of the traffic. Adding American doesn’t make too much of a difference, boosting the AA/US share to 40%. Similarly, because United and Northwest have tiny presences in the intra–east coast market the UA/DL and NW/CO shares are not much bigger than previously.

US Airways is not the first choice for transcontinental travel from the east — a $11.8bn market. Delta with its Atlanta hub and American at Dallas are bigger players in this market. Consequently, US Airways’ share of the total east–originating market is depressed, although it is still the largest single player. It would, however, be outranked by the UA/DL alliance in the market. But AA/US would claim a 36% traffic share against UA/DL’s 31%.

The implications of this analysis are then:

- Once one alliance between two US majors was formed it became impossible for the other not to follow suit;

- The alliances may create new competitive dynamics by changing the balance of power in regional markets, though for the overall market alliances remain a zero–sum game;

- The airlines’ claims that consumers will benefit because the alliances will be able to offer a wider range of destinations and schedules still does not sound convincing — surely this implies a degree of schedule and capacity (and fare?) co–ordination which should be unacceptable to the antitrust authorities; and

- Whether or not one buys the message that airlines are now competing via alliances rather than hubs, the prime tool for capturing passengers will remain the new joint Frequent Flyer Programmes, which were originally introduced as a means of persuading passengers to accept semi–circuitous routings over hubs rather than direct service.

Route suggestions for new entrants

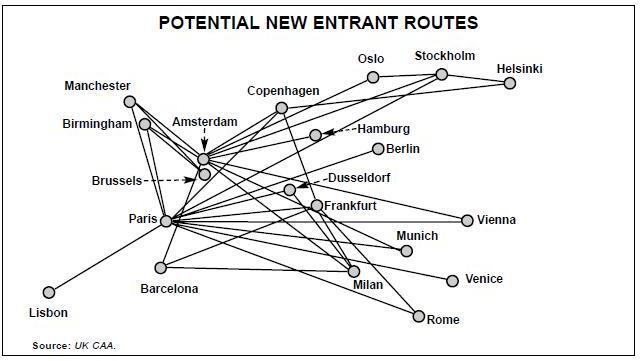

Back in 1993 the UK CAA helpfully identified continental European routes that it thought could or should have new entrant competition. Now in its latest report on progress in the liberalised European market it has updated the analysis.

The CAA originally identified some 33 routes with potential for new entry, but new entrants stubbornly refused to take up the suggestions. Virgin Express moved onto Brussels–Milan, Brussels–Madrid and Rome- Madrid, Lauda–air entered Milan–Barcelona while Finnair/Maersk and KLM have begun two intra–Scandinavian services.

We have taken the CAA’s new list of 31 routes — assessed on criteria such as attainable passengers per flight, possible market share, etc — and presented them as a route diagram.

There would appear to be four main bases which would sustain a new entrant operation — Paris, Amsterdam, Frankfurt and Milan (in the previous study Brussels too would have been one of these bases). Few new entrants have the resources to break into these hubs at present.

One might have thought that BA would have the opportunity to use TAT/Air Liberté to compete on more intra–European routes from Paris. But then DBA attempted to break through into the Frankfurt market, and it was soon forced to withdraw.

| Airline | Alliance shares | ||

| United | 19.9% | UA/DL | 35.7% |

| Delta | 15.8% | AA/US | 22.0% |

| American | 13.8% | NW/CO | 15.2% |

| Southwest | 9.4% | Others | 27.1% |

| US Airways | 8.2% | TOTAL | 100.0% |

| Northwest | 8.1% | ||

| Continental | 7.1% | ||

| TWA | 4.1% | ||

| Others | 13.6% | ||

| TOTAL | 100.0% | ||

| Airline | Alliance shares | ||

| US Airways | 35.9% | AA/US | 40.3% |

| Delta | 26.6% | UA/DL | 27.6% |

| Continental | 8.8% | NW/CO | 9.3% |

| American | 4.4% | Others | 22.8% |

| Southwest | 2.7% | TOTAL | 100.0% |

| TWA | 1.1% | ||

| United | 1.0% | ||

| Northwest | 0.5% | ||

| Others | 19.0% | ||

| TOTAL | 100.0% | ||

| EAST-RESTOF US TRAFFIC SHARES, 1997 | |||

| Airline | Alliance shares | ||

| Delta | 21.7% | UA/DL | 35.5% |

| American | 15.4% | AA/US | 30.6% |

| US Airways | 15.2% | NW/CO | 18.0% |

| United | 13.8% | Others | 32.1% |

| Continental | 9.5% | TOTAL | 100.0% |

| Northwest | 8.5% | ||

| TWA | 4.5% | ||

| Southwest | 3.3% | ||

| Others | 8.1% | ||

| TOTAL | 100.0% | ||

| TOTAL EAST TRAFFIC SHARES, 1997 | |||

| Airline | Alliance shares | ||

| US Airways | 26.1% | DL/UA | 31.3% |

| Delta | 24.3% | AA/US | 35.7% |

| American | 9.6% | NW/CO | 13.4% |

| Continental | 9.1% | Others | 19.6% |

| United | 7.0% | TOTAL | 100.0% |

| Northwest | 4.3% | ||

| Southwest | 3.0% | ||

| TWA | 2.7% | ||

| Others | 13.9% | ||

| TOTAL | 100.0% | ||