Legacy issues worldwide

January 2004

Legacy has now become an aviation industry buzzword with severe negative connotations.

In the US, the major network carriers are now intolerably burdened by their labour/pension funding cost legacy. The extensive analysis carried in the last issue of Aviation Strategy ("Why the US Majors are in such trouble") has now been presented to Transportation Secretary Norman Mineta, and its implications are being absorbed as the Administration prepares to introduce legislation to alleviate statutory cash pension contributions now falling due (the $1 being serious union concessions?).

How many of the US legacy carriers will survive partly depends on how much of the domestic market moves to point–to–point or quasi–network carriers from established full–network carriers.

The hub and spoke model in the US domestic market is supposed to have a firm foundation because a high proportion of the traffic is to/from secondary cities that can only be served using hub/spoke connections. The problem may be that, as the LCCs capture the thicker routes, the thinner connecting routes become more unviable, and the whole economics of the network disintegrate.

There are other dynamics at work. As LCCs increasingly come into direct competition with each other, maintaining Southwest–type levels of profitability may become increasingly difficult. Which is why Southwest might just be considering altering some of its strategies that have worked for almost 30 years (see pages 7–11 of this issue).

In Europe there is no significant internal connecting market, which in theory creates even greater opportunities for LCCs.

This may partly explain why there are so many LCC start–up projects at present. The other reason is that the European market is still segmented on national and social lines, so that there appear to be opportunities for developing LCCs in regional niches. The overall implication, though, is a high casualty rate and/or a high level of merger and takeover activity in a few years time.

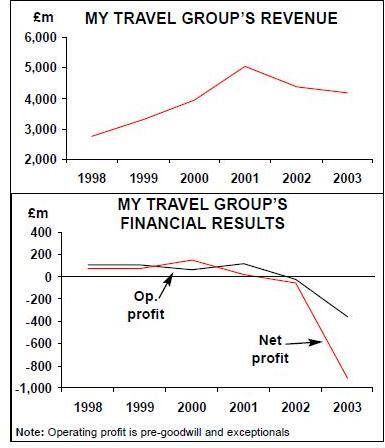

Europe has another type of aviation legacy — that of the traditional charter carrier. The issues facing MyTravel, which, as Airtours, used to be one of the strongest operators in this sector, are explored on pages 2–6 of this issue.

LCCs are now hitting Asia. Air Asia, driven by entrepreneurial ownership and ex–Ryanair management, is expanding rapidly, having adapted an LCC model to local conditions. Virgin Blue’s capital raising exercise has proved very successful, but it is not clear if this carrier is a genuine LCC in terms of its strategic model and its operating efficiencies. Singapore Airlines has decided to set up a LCC subsidiary, Tiger. But will it be able to avoid the cannibalisation problem BA encountered with Go? And what will it do with Silk Air?