Air Malta: Hub or hubris?

January 2003

The likely accession of Malta to the EU and the present Maltese government’s programme of privatisation confront one of Europe’s smallest state–owned airlines with a dilemma: what route to choose?

Malta’s incumbent centre–left Nationalist Party has promised a referendum on EU membership early next year. Opinion polls show a split but also a large number of "don’t knows". A yes vote is expected to result in an early general election with the government confident of victory; a no vote would see the election delayed until the last minute — late this year or early 2004.

At the same time Malta is in the middle of a privatisation programme: a 40% stake in Malta International Airport (MIA) was sold in May to a consortium, Malta Mediterranean Link (MML). This comprises Vienna International Airport with 54%, SNC Lavalin (a quoted Canadian construction and facilities management firm) with 36%, and a Maltese firm with 10%. SNC Lavalin, which previously worked on the development of Vancouver International Airport, values its MML share at Can$24m. A former Austrian Airlines and Vienna International Airport executive, Peter Bolech, was appointed the new MIA chief executive.

The sale to MML proved controversial as another bidder, Alterra Partners, half -owned by Singapore’s Changi Airport, threatened to sue the Maltese government for breaking a promise to award it the 65–year airport concession. The government had insisted the successful bidder could not also be involved with other Mediterranean airports, which it regarded as competitors. MML and Alterra were both bidding for the contract for Cyprus' Larnaca and Paphos airports, but only MML was prepared to accede to the government’s wishes.

The Maltese government has yet to make any announcement specific to Air Malta. The airline itself says it is in a queue of state assets for sale, but not at the front of the queue. With a further 20% of the airport recently sold to institutional investors, the continued state–ownership of Air Malta, former operator of the airport and its main user, creates a slightly anomalous situation.

The airport and airline are seen as crucial elements in Malta’s tourism industry, which accounts for around 25–30% of GDP. The same restrictions, which applied to the sale of the airport, when Cyprus was seen as major competitor in tourism, are likely to be used in the airline privatisation under which it is expected a "strategic investor" will be offered 40%.

Air Malta is still working out its modus vivendi with the airport since, while they subscribe to the same goal of boosting tourism, the airport wants to bring in more airlines to compete with Air Malta. Passenger handling and ground handling are also due to be liberalised, exposing Air Malta to further competition.

The Maltese government is officially keen to project the country as a "Mediterranean hub" in a number of areas. The airport, currently handling 3m passengers a year, is seen as a hub for passengers and cargo, while the airport and Air Malta will be part of a "cruise hub", linking flights with cruise ships using Malta as their base for Mediterranean links (at the moment they only call at Malta for six–hour stopovers).

The airport is a member of a consortium developing a new cruise terminal and waterfront in Valletta’s Grand Harbour, while the airline, already an owner of hotels, travel agents and tour operators, is planning to invest in cruise ships. SNC Lavalin is credited with helping Vancouver develop as a flycruise hub for North America, while Vienna International Airport brought its own "eastern Europe hub" credentials to the Maltese airport deal.

While such grandiose schemes are being nurtured, Air Malta, in the run–up to privatisation and EU membership, has recently made the following decisions.

- In January this year it formed a joint venture maintenance company with Lufthansa Technik (Lufthansa 51%) to which Air Malta engineering staff were transferred

- In May the airline, currently operating a mix of 737–300s and A320s, decided to move to an all–Airbus fleet over the next six years. To achieve this, it entered into a sale–and leaseback deal with International Lease

- Finance. ILFC bought and leased back Air Malta’s existing fleet of two A320–200s and three 737–300s and arranged the lease of 12 new CFM56–engined Airbus aircraft — seven 141–seater A319s and five 168–seater A320s with an option to upgrade one to a 200–plus seat A321

Results and competition issues

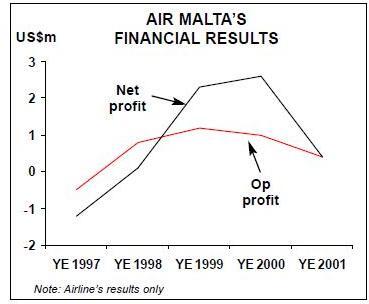

- In October it, or rather the government, appointed a former Swissair executive, Ernst Funk, as chief executive, the first non- Maltese to hold a senior position, indeed the first time a CEO as opposed to chairman position had been created at the airline. The airline claims to have made a loss in only two years since it was established in 1974 and to have never received government subsidies. In 2001, the Air Malta group made a pre–tax loss of LM3.7m (US$8.9m) on turnover of LM124m (in 2000 a LM6.2m pre–tax profit on the same turnover). Air Malta ostensibly refrained from making any staff cutbacks despite September 11.

It had an operating profit of LM3m (US$6.5m) but made losses of LM4.3m on subsidiaries and associates, notably 49%- owned Italian domestic airline, Bergamobased Azzurrair, which made an LM6.8m operating loss (Air Malta’s share of losses and provisions was stated at LM4.7m). The Italian regional operator, with a fleet of eight Avro RJ85s and RJ70s, has a franchise agreement with Alitalia. Air Malta is trying to sell its stake in Azurrair.

Air Malta’s services are dominated by the UK. It flies to three London airports (Heathrow, Gatwick and Stansted), plus Birmingham, Manchester, Newcastle and Glasgow. It carried 536,000 passengers on the UK–Malta routes last year.

Other EU countries — mainly Italy, Germany and France -provide the bulk of the rest of the airline’s business. With 1.6m passengers in total last year, Air Malta claims to carry 50- 60% of all tourist traffic (60–70% if counting only scheduled services). Forays by the airline outside its traditional area in the past have not proved successful, most notably its attempt to fly the Atlantic in 2000 with a wet–leased 757.

Air Malta has not faced the same degree of competition from the charters as other Mediterranean flag–carriers, because Malta is not a mass tourism destination (there are few sandy beaches). It is, however, a perfect short–break destination, and so the market will be targeted by the LCC subsidiaries of the charters and maybe the LCCs themselves.

Malta’s ambitions to become a hub (alternatively "a gateway" for the EU to Libya and other north African countries) may have been fired by the success it has had with a sea container transshipment terminal, in effect a Mediterranean hub, which is also being privatised (CMA–CGM, a French shipping line and the terminal’s biggest user, is set to acquire control.) A shipping hub maybe, but in aviation its aim sounds a little hubristic.