Leveraging the customer's perception of control

January 1998

Completing his look at the five segments of the airline service process (see Aviation Strategy November & December 1997), McGill University’s Louis Gialloreto considers the benefits of improving pre–flight and post–flight services to customers.

Of the five–stage airline service process, it is the pre- and post–flight areas that have received the most attention from airlines on a global basis over the last five years. A combination of airport privatisation and a focus by some airlines on airport–based services has lead to the updating and overhauling of many pre- and post–flight customer service areas.

Airports do matter

The non–airport part of the pre–flight process includes primarily reservations, and the major changes here have been the maximisation of automation and some segregation of lines per class of traveller. Alas, most of the changes in these areas have been in terms of tangible hardware, rather than improvements in the soft spec, and this is a problem that is seen throughout the airline service process. There is the odd exception — the biggest staff smiler every month at Dubai airport receives a month’s pay as a bonus. Is there a lesson for airlines here? Not surprisingly, it is the ground–based parts of the service process that airlines feel that they have the greatest control over — after all, business lounges are rarely delayed due to bad weather or French air traffic control. And from the customer’s perspective, they often feel more at ease in this primary ground–based portion of the trip than they do on the actual flight. Psychologically at least, part of the reason that many do not fly is that they do not relish the lack of control they feel over their immediate environment. But passengers are in control in the pre–flight lounges. This being the case, they not only notice but use more of the pre–flight tools and amenities than those that are available in–flight.

This argument goes against some of the traditional airline service doctrines that stipulate that one should focus maximum expenditure on those parts of the process which take up the highest percentage of elapsed trip time — the in–flight portion. In fact airlines should spend less time and effort on in–flight techno–gadgetry and other marginal service amenities than on services that can relieve in advance the inevitable stress that travelling causes.

On–site shower rooms, games rooms and beds are all aimed at minimising the physiological effects of air travel. This is very much tied up with the process of reducing the perceived total elapsed time a journey may take. Keeping passengers in touch with offices and other work sites during the pre–flight process is a key way of reducing the perception of wasted time. And if an airline can reduce perceived time loss it will win considerable brand awareness among customers.

How to spend wisely

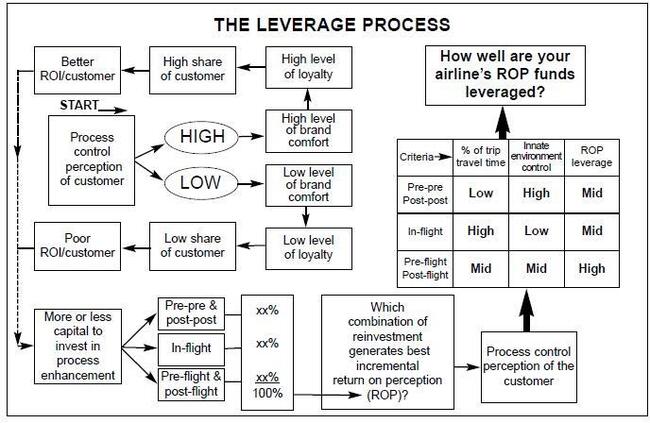

When an airline combines successfully the two parts of the pre- and post–flight processes — customer control over his or her environment with reduced perceived elapsed time of the journey, a new vision of ground services can truly be realised. It seems a complicated process (see diagram, right), and somewhat intangible given that we are talking about soft spec improvements, but the bottom line is that airlines can significantly increase customer satisfaction — and hence brand loyalty — via better pre- and post–flight processes.

Indeed, if one assumes an incontrovertible cognitive relationship between the customer’s perceived control of the air travel process and brand comfort (leading to brand loyalty in cases of sustained positive feeling), then planning the service process of the future becomes much simpler. But the part of the positive brand spin which is so hard to attain is to deliver the expected brand feeling on a consistent basis. Once again it must be noted that ground–based parts of the experience are more easily delivered on a consistent basis than are other parts. It is becoming increasingly clear that in the medium- to long–run those airlines that manage to start and build a consistently improving brand feel will attract a disproportionately high percentage of frequent fliers in their areas of geographic market influence. (And this becomes even more important when customers become FFP insensitive due to over–endowed mileage accounts.)

Post-flight neglect

While airlines have been spending inordinate amounts of money trying to strengthen pre–flight, the post–flight part of the process has only seen limited improvement. For example, there has not been any measurable improvement in baggage delivery systems during the current aviation cycle upturn — and in fact standards may even be perceived to be deteriorating after the Denver airport fiasco.

Most seasoned travellers know that the logistical accuracy of baggage systems has not improved and, to make matters worse, airlines are now cracking down on carry–on luggage. This is partly due to increasing load factors, but the result is that many frequent fliers are losing what they have been trained to perceive as an acquired right of higher yield travel.

There has been some counterbalance via the segregation of custom line–ups by class of service at some locations, which directly contributes to a measurable reduction in elapsed process time. But while some parts of the post–flight process take less time for some customers, others — such as baggage — take the same or more time. And since baggage reclaim is the last step in the post–flight process, the perception is that overall elapsed time — and thus service quality — has not changed substantially.

Overall, therefore, airlines have to get better at recognising the importance of the post–flight phase. Together with improved pre–flight service to customers, successful leverage of these two components will lead to better brand loyalty in the medium–term — and that means bigger profits for positively differentiated airlines in the long–term.