LOT buys Condor:

Perfect fit for PGL?

Jan/Feb 2020

In a surprising move, the Polish Aviation Group (Polska Grupa Lotnicza or PGL), parent company of LOT Polish Airlines, has emerged as the preferred acquiror of Condor, Germany’s largest inclusive tour airline, following the failure of its parent company Thomas Cook Group in September 2019. The deal is expected to close in April 2020 once competition authority approvals are obtained. It is unlikely that this will be a problem.

The German Government and the State of Hesse had guaranteed an emergency bridging loan of €380m to keep Condor flying through the winter season. Under the terms of the deal it appears that this loan will be repaid in full, and for the moment at least PGL will continue to operate Condor on a stand-alone basis. There are few other details of the acquisition deal.

Rafał Milczarski, LOT and PGL CEO, stated that the Condor acquisition “fits perfectly into PGL’s strategy” while Ralf Teckentrup, chief executive officer at Condor, said “the acquisition has made PGL one of the largest aviation groups in Europe”. That may be a bit of hyperbole: each carry around 10m pax a year and the combined 20m pales into insignificance against the top four European airlines. What precisely is PGL’s strategy?

PGL is the Polish state-owned holding company that operates the national flag carrier LOT Polish Airlines, with other subsidiaries involving ground handling and maintenance. In a way it mirrors the perfect McKinsey group airline structure developed for Lufthansa, Air France and Swissair in the 1980s.

LOT has been through some tough times in the past two decades. It found it difficult to compete with the incursion of low cost carriers — Ryanair, Wizz and norwegian — and had seen its share of intra-European traffic into and out of Poland fall from over 30% to 18% by 2014, not being able to cope with the demand for low fare traffic after Poland joined the EU and Polish nationals demanded cheap fares to access the work and leisure opportunities that membership had provided. Between 2008 and 2013 it lost a total zł800m at the operating level.

In 2012 it was rescued by a capital injection of zł800m (€200m) from the state. Despite objections, the EU granted that this was allowable under its “one time, last time (every ten years)” rules finally giving credit that the state’s restructuring plan might work. The route network was slashed. The fleet renewed: aged 767s replaced with new 787s, 737 classics gradually replaced with 737 new gen and later 737MAX. There were swingeing cuts: a 35% reduction in ground staff; it changed employee compensation from a salary-based structure to payment by the hour.

LOT returned its first operating profit in six years in 2014, and once the breaks were off from the constraints of restructuring began to grow strongly from 2015. Since then it has doubled turnover from zł3bn to zł6bn, passengers carried from 5m to 10m and, remarkably, achieved operating profit margins averaging 5% a year.

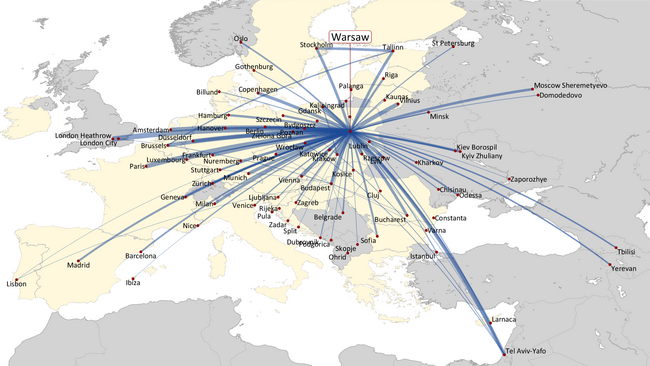

In the process it has also significantly increased the number of destinations to which it operates, both regionally and intercontinentally. As it has grown its widebody fleet of 787s (from nine to fifteen in the last two years) it has expanded long haul scheduled destinations from four (New York, Chicago, Beijing and Toronto) to 14 adding Newark, Seoul, Los Angeles, Tokyo, Singapore, Miami, Delhi and Colombo since 2015, with operations to Washington and San Francisco planned for 2020.

While building this network it has achieved some reasonable success in pushing 787 operations into the long haul charter market out of Poland to satisfy ad-hoc tour operator demand — and is reputed to have achieved 787 utilisation of over 19 hours a day.

It has also opened long haul routes from Budapest — to Seoul and New York — in the absence of an Hungarian national flag-carrier following the demise of Malév in 2012. However, it lacks short haul feed into Budapest which would normally be needed to make such routes truly viable.

LOT also established a regional network of sorts based in the Estonian capital Talinn — with a 49% stake in that nation’s flag carrier Nordica. This was effectively closed down in June 2019.

Within Europe and on short haul it has doubled the number of destinations from Warsaw from 42 in 2015, and has increased capacity by an annual average 23%. Much of this is provided by service on regional aircraft: LOT has only 16 737 narrowbody jets in its fleet (including five 737MAX8s currently on the ground, and eight on order) but 35 ERJ170/190s and 12 Dash-8s.

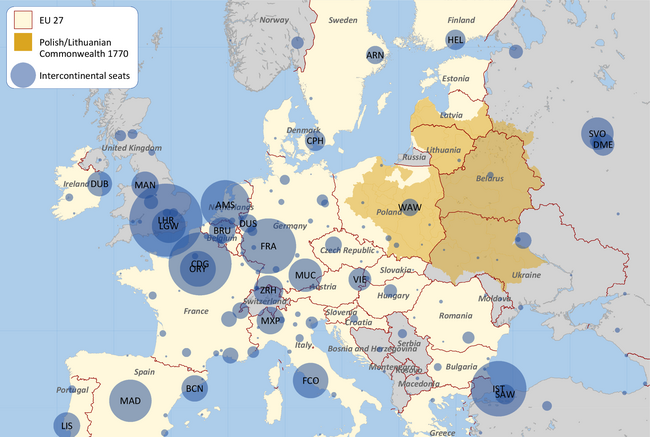

The strategy appears to be to build a network connecting hub in Warsaw, focusing on connections from other Central and Eastern Europe (CEE) countries to North America, and Europe as a whole to Asia. Already 50% of its traffic through Warsaw’s Frydryk Chopin airport connects.

Is there room for another intercontinental hub in Europe? Warsaw is half way between Frankfurt (Lufthansa’s base and the third largest hub in Europe) and Moscow (which Aeroflot is attempting to establish as a transfer point between Europe and Asia) — each 1,000km away. It also competes with Finnair’s eastward facing hub in Helsinki. LOT’s fellow Star Alliance partner Lufthansa is following a policy of targeting traffic from CEE countries through its group hubs in Frankfurt, Munich, Vienna and Zurich to points east and west. But LOT is excluded from the Anti-Trust immune joint venture that Lufthansa has with United and Air Canada on the North Atlantic.

Following the UK’s exit from the EU, Poland is now the fifth largest nation in the bloc with a population of 38m. But its economy is outperforming the stagnant economies of Western Europe. GDP growth in 2019 is expected by the IMF to have been a bit over 4% in real terms, and is forecast to grow by between 2% and 3% a year over the next five years.

On the announcement of LOT’s acquisition of Condor Poland’s prime minister, Mateusz Morawiecki, stated that “Polish companies from all sorts of sectors are expanding, but this expansion of LOT is really symbolic. In the past, foreign companies bought up precious Polish assets. It fills my chest with pride that Polish companies can... effectively take over foreign assets.” As the Financial Times pointed out this is a comment that smacks of political symbolism and not necessarily economic reality. Poland’s ruling Law and Justice party (Prawo i Sprawiedliwość, or PiS) came to power in 2015, and was re-elected in 2019, with an outright majority — the first time this had happened in Poland since the fall of communism. It is described as a right wing conservative populist party, and, according to the New York Times, achieved its popularity by offering to “make Poland great again”.

The Polish state gained independence in its current form after the Treaty of Versailles and the end of World War I having been under foreign control for the previous 125 years. But in the 16th and 17th centuries it, as the Kingdom of Poland and Grand Duchy of Lithuania, had been the largest country in Europe. It is unlikely that the PiS is really harking back three hundred years to former glory, but Poland has historical and cultural links that pervade the current CEE region.

Warsaw’s Frydryk Chopin airport (with a current throughput of 19mppa) is reaching design capacity. Poland has plans to replace it with a greenfield new build airport. Nominated the Centralny Port Komunikacyjny (Central Communication Port), the initial design concept is for an airport with two runways and capacity of up to 45mppa on opening in 2027, with an eventual design plan for four runways and a capacity of 100mppa. Located half way between Warsaw and Łódź, 40km outside the capital city, it is envisaged that it will act as a major intermodal hub providing interconnections between rail and road for passenger and freight transport. It is possible that this will then provide LOT with a real base to establish a powerful hub to compete effectively on trade routes between Europe and Asia, and a platform for further strong growth.

So how does the acquisition of Condor fit in with the Polish flag carrier’s strategy?

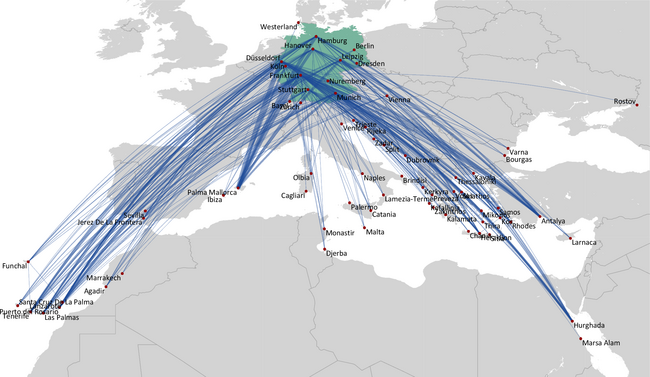

Not much it seems. Condor is a leisure airline heavily dependent on the German inclusive tour market. Under ownership of Thomas Cook it relied on its parent company to provide 50% of its traffic. That source of demand has disappeared, but will no doubt be replaced by other tour operator companies. However, its business risks will increase as it becomes more dependent on a more disparate customer base. It has been described as profitable: but with €54m profits on €1.7bn of revenues in 2017/18 that profitability represents a dismal 3% margin and would have been heavily dependent on its parent company transfer pricing policies.

The German market is decentralised, all due to the federal nature of the country. As a result Condor’s operations involve sourcing flights from each of the Länder capitals. Its major destinations are determined by the programmes of its tour operator customers and involve the major 4S destinations (sun, sea, sex and sand) in the Canary Islands, Mallorca, and Greece. German tourists are some of the more adventurous in the world and it also has a wide ranging set of routes (but at limited seasonal frequency) to destinations in the Americas, Africa and South East Asia. Its largest base of operation is out of Frankfurt, where up to now it has had a cosy relationship with its former owner Lufthansa, and has been able to arrange feeder connections. That relationship will disappear: Lufthansa has clearly stated that it will defend its “home territory” of the tedescophone countries.

Condor probably has a basis for continued existence in its current form under LOT ownership. The German consumer is conservative, and the trends in other countries that has seen the decline of Inclusive Tour holidays has been protected to an extent by local laws prohibiting pricing differential between on-line and high street travel agency pricing.

But Condor has an aged fleet with no commonality with that of LOT: a short haul fleet of 19 20-year-old A320 family aircraft, one A330 and 31 ancient 757 and 767 aircraft. These will need to be replaced, and the cost of that replacement is unlikely to be cheap.

Is the ultimate aim of this mini-conglomerate actually privatisation? If so it will add to the colourful history of Eastern European aviation.

| In Service | Avg Age | |

|---|---|---|

| 737-400 | 1 | 23.0 |

| 737-700 | 1 | 17.1 |

| 737-800 | 7 | 13.1 |

| 737MAX8 | 5 | 1.7 |

| 787-8 | 8 | 5.7 |

| 787-9 | 7 | 1.1 |

| Dash 8 | 12 | 8.3 |

| ERJ170 | 16 | 12.9 |

| ERJ190 | 19 | 7.7 |

| Total | 76 | 8.5 |

| In Service | Avg Age | |

|---|---|---|

| A320 | 9 | 20.9 |

| A321 | 10 | 5.7 |

| A330 | 1 | 6.0 |

| 757 | 15 | 20.3 |

| 767 | 16 | 24.4 |

| Total | 51 | 18.5 |

| Revenues (€m) | Operating Profits (€m) | Passengers (m) | Aircraft | |

|---|---|---|---|---|

| LOT | 1,426 | 52 | 10 | 76 |

| Interflug | Expired 1990 | |||

| Balkan Bulgarian | Expired 2002 | |||

| Malév | Expired 2012 | |||

| ČSA | 1,195 | 12 | 3.0e | 14 |

| TAROM | 306 | -28 | 2.75 | 25 |

| JAT | Expired 2013 | |||

| Air Serbia | 288 | 12 | 2.48 | 20 |