AirAsia: expanding out of the downturn

Jan/Feb 2009

AirAsia shows no sign of slowing its aggressive expansion plans despite reporting a net loss in the July–September 2008 period – its first quarterly loss since going public in 2004. Is that quarter’s result a one–off, or is Asia’s largest LCC heading for troubled times?

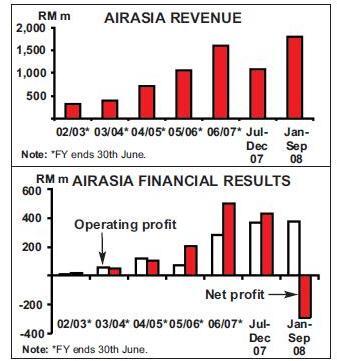

Undoubtedly July–September 2008 was a bad quarter for AirAsia – despite a 42.6% year–on–year rise in revenue to RM 658m (US$197m), operating profit at the core Malaysian operation fell 37.2% to RM 92m (US$28m), and a net profit of RM 180m in July–September 2007 turned into a RM 466m (US$140m) net loss in July- September 2008.

AirAsia’s first quarterly net loss was due primarily to two items, the first of which was a large RM 293m (US$88m) finance charge, comprising higher interest charges on increased borrowings and a RM 213m (US$64m) exchange loss due to the weakening of the Malaysian Ringgit against the US Dollar (see Aviation Strategy, March 2008). Secondly, the airline suffered a RM 215m (US$65m) exceptional charge for unwinding fuel contracts that had been signed at prices in excess of the current spot price, as well as for the anticipated non–recovery of hedging deposits held with Lehman Brothers, which went bankrupt in September 2008.

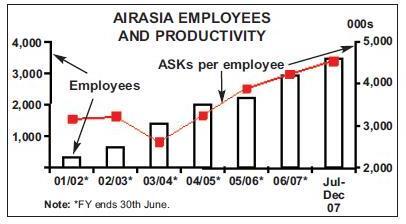

In the July–September quarter the Malaysia operation carried 3m passengers (24% up on a year earlier) but capacity (ASK) growth of 33% was ahead of a 27% traffic (RPK) increase, resulting in a 3.9 percentage point drop in load factor, to 75.4%. In the first nine months of 2008 the group carried 13.5m passengers (compared with 11m in the January–September 2007 period), and it expects to carry around 19.5m passengers in full 2008.

AirAsia describes the exceptional losses as “short–term pain for long–term gains” and says that both its medium- and long–term prospects are good. The October–December period is traditionally AirAsia’s strongest quarter, and with the price of fuel dropping (AirAsia and AirAsia X removed all fuel surcharges in November 2008) the airline expects to post “satisfactory” results for this period. AirAsia is seeing “more passengers switching to LCCs as their primary travel option”, although the Ringgit is continuing its weakness against the US Dollar, which will again hit the net result.

The AirAsia group is thus still intent on expanding its way out of the downturn, with Tony Fernandes, AirAsia group CEO, saying that “we have always taken the contrarian approach and gone against conventional wisdom”. Indeed AirAsia believes the downturn is beneficial, as business customers that flew on legacy carriers are now switching to AirAsia in order to cut costs.

The group now operates 110 routes, with more than 30 of these launched in 2008. Its network covers 11 ASEAN countries and serves 70 southeast Asian destinations, and these are operated with a fleet of 76 aircraft. There are 121 A320s on order, to be delivered by the end of 2013, and the group also has options to buy another 50 aircraft at a heavily discounted price.

Malaysia strength

The question that needs to be asked is just where AirAsia will place these aircraft? This is particularly pertinent given the problems AirAsia is having in expanding operations into other Asian countries outside of its Malaysia home. The Malaysian market remains the heart of the group’s operations, accounting for 60% of group capacity. The last 737–300 was taken out of service on Malaysian AirAsia in October 2008 and the carrier now operates a fleet of 44 A320s. AirAsia has the advantage of using Kuala Lumpur airport’s Low–Cost Carrier Terminal (LCCT), which has fees around half of that charged at the main terminal, and this low cost base has been key to AirAsia’s success. However, although the facility was only opened in 2006 it is already operating at full capacity, and despite recently being extended to handle 15m passengers a year in 2009, this again is not sufficient for AirAsia’s plans.

So in December 2008 the Malaysian government announced that it had given permission for AirAsia to build its own low cost airport in Kuala Lumpur. The new airport would have been separate from the LCCT and Kuala Lumpur International Airport (KLIA), although it was to be called KLIA East. The US$0.5bn facility would have been built by a local conglomerate called Sime Darby, with AirAsia managing and owning the airport. With 70 aircraft stands and handling up to 30m passengers a year, work was scheduled to begin in the first half of this year, with a completion date of March 2011

Unlike the LCCT, the new airport would have had rail links to both Kuala Lumpur city and KLIA (and be closer to KLIA’s main terminal than the LCCT, which is 20km away), allowing easier connections (than possible between the LCCT and KLIA) between AirAsia flights and those of other airlines. But state–owned Malaysia Airports — which operates KLIA and LCCT — was unhappy about the new airport, and in late January the Malaysian government abruptly withdrew permission for the development. It may be that AirAsia’s plans were designed to force Malaysia Airports to develop KLIA in the way AirAsia wants, but whether it happens through this route or via a new airport, AirAsia appears determined to keep driving its operating costs down further.

AirAsia apparently no longer sees Malaysia Airlines as its key competitor, with Fernandes saying that the “battle with MAS is over”, given that it has now been allowed onto key MAS routes. This may be a little presumptuous, as MAS is cutting costs and the difference in fare levels between MAS and AirAsia is now starting to narrow.

AirAsia is likely to put many of its incoming aircraft onto new international routes out of Kuala Lumpur, and key target markets are China and India. AirAsia currently serves seven Chinese destinations out of Kuala Lumpur, the latest being Guilin (a tourist destination in the southern part of China, close to Beijing), which started in September 2008. AirAsia’s first route to India began in December 2008 with a daily flight on Kuala Lumpur–Trichy (also known as Tiruchirapalli) — in the south of India — and the airline aims to open 10 more routes to India over the next 18 months.

Thailand and Indonesia woes

AirAsia has taken full advantage of access onto the lucrative Kuala–Lumpur–Singapore route, now fully liberalised after being previously dominated by Singapore Airlines and MAS. The process began in early 2008 when rivals to MAS and SIA were allowed for the first time, and through the year AirAsia experienced load factors into the 90s on the route. AirAsia’s service rose from two to seven round–trips a day from December 2008, once the route was completely opened up in order to comply with the Association of Southeast Asian Nations agreement that required unlimited passenger flights between capital cities of member nations by the end of that year. Of course this has also meant increased competition from others (e.g. Jetstar Asia, Tiger Airways and from SIA subsidiary SilkAir), but AirAsia is confident that it can make a substantial profit on the route. Elsewhere, however, the group is facing difficulties, and the Thailand and Indonesian operations (in each of which it owns a 49% stake) continue to rack up losses, although AirAsia says that “operational losses have reduced substantially” at these subsidiaries recently. The Thai operation made a THB 250m (US$7m) loss in the July- September 2008 period, 44% down compared with April–June 2008, while the Indonesian subsidiary lost IDR 12bn (US$1.3m), 88% down on the previous quarter.

Indonesia AirAsia is attempting to reduce unit costs through phasing out its 737–300s – it received its first A320 in September last year and a fleet of 32 A320s is expected by 2013, when its current 12 737s will have all gone. It carried around 2.5m passengers in 2008 and is expanding onto new routes and destinations around Asia as the A320s come on stream; for example, it launched its first service to Singapore in August 2008. Indonesia AirAsia is also being helped by the closure of Indonesian LCC Adam Air in early 2008.

The Indonesian operation appears to be doing better than Thai AirAsia, which postponed its plans to IPO in Thailand last year thanks to the economic downturn. It operates to 20 domestic and international destinations (and has an estimated 40% market share of the domestic market), but political unrest in Thailand has affected the carrier significantly, with passengers carried in 2008 expected to be around 0.5m less than the targeted 4.6m. The airline currently operates to 11 domestic destinations, and future expansion is focused entirely on international routes.

Thirty of the group’s A320s on order are destined for the Thai subsidiary and are due for delivery by 2013, by when the airline will have an all- A320 fleet. It currently has eight A320s and eight 737s and at least the new A320s have enabled Thai AirAsia to improve its punctuality, which has previously been a problem when operating ageing 737–300s. Fernandes insists that the Thai subsidiary will break even this year, and this target will be helped by contraction of key Thai LCC rivals Nok Air (39% owned by Thai Airways) and One–Two–GO.

Elsewhere, the group has also long had plans (announced in 2007) to launch a Vietnamese subsidiary, in partnership with the state’s Vietnam Shipbuilding Industry Corp. However, AirAsia appears to be having problems obtaining the necessary approval from the Vietnamese government, and this plan has stalled.

AirAsia X ambition

The Philippines remains another possibility, and a lower priority is to launch another subsidiary in the northeast of Asia, such as out of Macau, to which AirAsia already operates four routes out of Malaysia, as well as to/from Bangkok via Thai AirAsia. Though not formally part of the AirAsia group, AirAsia X operates to destinations that are more than four hours flight time away from Kuala Lumpur, leaving the shorter routes to the AirAsia group carriers. 48% of AirAsia X is owned by Aero Ventures (controlled by Tony Fernandes), with the Virgin Group and AirAsia each having 16% and the Bahrain–based Manara Consortium and the Japanese lessor, Orix Corporation each acquiring 10% in February 2008 for approximately RM 125m (US$39m) each.

AirAsia X currently operates four routes out of Kuala Lumpur, to Hangzhou, Perth, the Gold Coast and Melbourne, which, the airline says, are “performing well”. Despite the global economic situation AirAsia X remains bullish about its plans, and indeed the airline now wants to become the first global, long–haul LCC. Azran Osman–Rani, AirAsia X chief executive, says that it has “no legacy base to cutback from” and will instead use the current opportunity to expand into other routes as other airlines contract, on the assumption that many business trips and leisure demand will hold up, albeit it at the cheapest fares possible.

Despite this ambitious statement, the majority of new AirAsia X routes in the short–term are likely to be to the Asia/Pacific and Middle East regions, with a key factor being that new destinations will be chosen primarily because they have the potential to feed into other AirAsia flights out of Kuala Lumpur. Also, AirAsia X prefers airports and local authorities that are willing to promote new air services.

India is a priority with AirAsia X too, as in November 2008 Malaysia and India updated their bilateral to allow more flights to Indian cities. AirAsia X is looking to launch flights to Delhi, Mumbai and Amritsar, at least one of which will be served by a new route in 2009. Altogether AirAsia X will launch around five new routes in 2009, and as well as one Indian destination other possibilities are a fourth Australian city (probably Sydney), a second one in China (likely to be Beijing or Tianjin), and potentially destinations in Taiwan, Japan or Korea. AirAsia X is also looking at the Middle East, with Dubai, Abu Dhabi, Sharjah, Jeddah and Bahrain all being considered — although the earliest those routes would be launched is 2010.

The only intercontinental route to be launched in 2009 is to London Stansted, which will commence in March. However, AirAsia X still has to decide its overall strategy for Europe, with Fernandes saying that the key decision is whether “we put all our efforts into London, which becomes our hub for Europe, or whether we have a hub in central Europe and eastern Europe, for example”. The short–term goal, however, is to increase frequency on Kuala Lumpur–London to two services a day, although there is talk of this eventually increasing to five flights a day via a “shuttle service” linking hubs at either end of the route. The initial five flights a week service will be operated with an A340–300 leased from Orix, and it will have a break–even load factor of the mid- 70s, although AirAsia X is looking for a figure in the low–to–mid 80s. Although 20% of the London routes have seats at £99 (one–way, excluding taxes and charges), it also has premium seats that recline fully from £549.

The A340 is a stop–gap while the carrier decides on either the 787 or A350 XWB, with the latter believed to be the preference at the moment. Whichever model it chooses, approximately 25 aircraft are likely to be ordered; Fernandes says the airline is in “active discussions” with the two manufacturers. At least two further A340s will be leased in the short–term,

AirAsia X received its first new A330–300 in November 2008 and this was used immediately on the Kuala Lumpur–Perth route that was launched the same month. A second aircraft arrived in December and the 24 other aircraft on order will be delivered over the period to 2013 (with three due for delivery in 2009, four in 2010, six in 2011 and 2012, and the rest in 2013).

AirAsia X operates the A330 with nine crew per flight, as opposed to the 13 to 15–strong crew used by other airlines. AirAsia X claims its overall costs per ASK are around 4 US Cents, which is at least half that of legacy long–haul carriers, and that this will go down to 3.5 US Cents once all the A330s are delivered. Also contributing to low unit costs are the facts that AirAsia X has no interlining, in–flight meals are paid for and (most crucially of all) the carrier is looking to get 18.5 hours utilisation out of its aircraft – a rate that few (if any) long–haul airlines have achieved.

The future

AirAsia X’s plan is to operate to around 50 destinations in Asia/Pacific, Indian–sub continent, Europe and — in the longer term — North America (with Los Angeles a potential destination). An IPO is planned for 2010, although some analysts are making comparisons with Oasis Hong Kong Airlines, which launched as a long–haul LCC in October 2006 with routes to Vancouver and London Gatwick, but which closed down in April 2008. Fernandes says such a comparison is not valid, as unlike Oasis AirAsia X has a well–known brand and has a large amount of Asian services into Kuala Lumpur’s LCCT, which will ensure feed for the long–haul flights. More importantly perhaps, it has the backing of shareholders with relatively deep pockets. AirAsia’s net loss in July–September 2008 must be seen as a short–term blip, as the fundamentals for the group look reasonably sound. The new airport in Kuala Lumpur will help drive unit costs down further, and other cost saving measures include the opening of a new call centre in Kuala Lumpur in February, which will handle all bookings across the group. Ancillary revenue is also developing well – in the third quarter of 2008 it totalled RM 69.7m (US$21m) at the Malaysian operation, 88% up on the previous year, with average ancillary expenditure growing 52% in a year, to RM 37.1 (US$11.1) per passenger. This was due partly to the introduction of a checked baggage fee in April 2008. And in the short–term AirAsia says that forward contracts to buy US dollars mean that it could enjoy gains of as much as RM 365.6m (US$110m), based on the current exchange rate.

Operationally AirAsia is still profitable, and its strategy of expansion while other airlines contract and/or increase fares is sensible (though not without risk), so it should be in a good position whenever the economic downturn recedes. Fernandes says that the current recession is just the latest in a series of crises that AirAsia has successfully gone through: “We have experienced SARS, terrorism, the bird flu and the Bali bombing. The worst was SARS, but we found a way to get out of it.”

AirAsia expects passengers carried to grow by 25% this year, and that appears a realistic ambition. Although accurate figures are difficult to obtain in Asia, LCCs account for an estimated 10% of passengers carried in the Asia/Pacific region, compared with the approximate 30% carried by LCCs in Europe and North America, and so there appears to be plenty of room for expansion for the AirAsia group — even if short–term may be tricky. The only question is whether the group really needs to set up subsidiaries in other countries. The Thailand and Indonesian subsidiaries have racked up losses for the AirAsia group and the wisdom of this strategy is doubtful, since the only real advantage that can be gained by formally having other Asian subsidiaries is being able to enter domestic markets. In India or China this would be sensible, but the wisdom of setting up subsidiaries in Vietnam or Thailand can be queried.

The other concern is that AirAsia’s debt has risen in order to pay for the large order book. While cash and cash equivalents stood at RM 774m (US$232m) as at the end of September 2008, long–term debt stood at RM 5.5bn (US$1.7bn) – some RM 2.1bn higher than at the end of 2007, and this is producing a significant increase in interest charges.

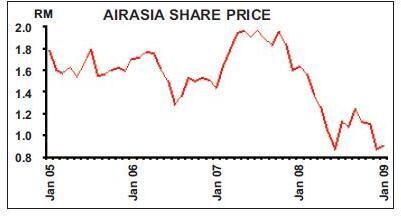

Nevertheless, given its strategy and the longer–term prospects, AirAsia — and particularly its majority owner Tune Air — is bullish. Indeed Tune Air believes that AirAsia is undervalued: in 2004 it floated at RM 1.4, reaching a high of RM 2.11 in May 2007 before a steady slide to well under RM 1 in June 2008 (see graph) – and it was reported that a Cayman Islands–based hedge fund called Nomad started buying AirAsia shares once the price went under RM 1.

AirAsia’s shares recovered in the last few months of 2008 after oil prices started to subside significantly from September onwards, and due to news that Tune Air (owned by Tony Fernandes and deputy chief executive Kamaruddin Meranun) wanted to buy out other shareholders and de–list the airline from the Malaysian stock exchange. Tune Air currently owns 30.7% of AirAsia, with the Employees Provident Fund – the largest private pension fund in Malaysia – owning 8.9%, and with 43.5% floated. But by December this plan collapsed, due to an inability by Tune Air to find acceptable finance. Tune Air had indicated it would offer RM 1.35 per share, which would have meant raising up to RM 2.2bn (US$660m) to buy out the remaining shareholders, but this simply wasn’t possible in the current economic climate.

In early February the shares were still trading at under RM 1, and whether Tune Air will try again to raise the finance to take the airline private remains to be seen. There were reports in late 2008 that AirAsia and Qantas’s LCC Jetstar Asia were in merger talks, but this was denied by both Jetstar and AirAsia, and a tie–up between the two airlines would have little obvious benefit to AirAsia.

In December Tony Fernandes somewhat mischievously suggested that one day he would like to make a bid for Singapore Airlines — but that was largely a side sweep at reports that MAS may enter a strategic alliance with BA and Qantas. A more likely possibility is that a legacy airline makes a bid for AirAsia – particularly if it agrees with Tune Air’s assessment that the airline’s shares are undervalued and that the future for the group is sound.

| Fleet | Orders | Options | |

| AirAsia (Malaysia) | |||

| A320-200 | 44 | 121 | 50 |

| Thai AirAsia | |||

|---|---|---|---|

| A320-200 | 8 | ||

| 737-300 | 8 | ||

| Indonesia AirAsia | |||

| A320-200 | 2 | ||

| 737-300 | 12 | ||

| AirAsiaX | |||

| A330-300 | 2 | 24 | |

| Total | 76 | 145 | 50 |