SAS fighting battle to retain independence

Jan/Feb 2009

It seems often to be forgotten in all the hype about industry consolidation in Europe that it was in fact SAS — Europe’s fourth largest legacy carrier by passenger numbers — that was the first to forge a true multinational cross–border airline.

Back in 1947, the national carriers of Sweden (AB Aerotransport and Svensk Interkontinental Luftrafik AB), Norway (Den Norske Luftfartselskab) and Denmark (Det Danske Luftfartselskap) first joined forces to operate transatlantic services. In the early 1950s the three governments and four companies — after much political wrangling — set up a consortium effectively merging their scheduled operations, to be named the Scandinavian Airline System; ownership was split 3/7ths to the Swedes and 2/7ths each to Norway and Denmark.

Ironically, it appears that they had also hoped at the time to include Finnair in the negotiations — but in that icy post–war period it was obviously difficult enough to have four companies and three governments at the negotiating table and — by all accounts — an agreement was only reached after some heavy–handed tactics from the Wallenberg family (shareholders in SILA). To get past the national ownership restrictions inherent in the Chicago convention, the four companies effectively derogated their route rights to the operating consortium — the four companies each retaining their respective ownership structures — with the natural insistence that fleet registrations, employment and resources would be split according to their share of ownership in the consortium.

Geographical advantages

The industry has changed much over the past 60 years — through most of the time Scandinavian Airlines being remarkably commercial, profitable and run with little state intervention. It was finally at the turn of the millennium that the management persuaded the governments to agree to modernise the ownership structure; initially the separate company shares were aligned and then a single share class and a holding company structure was created: the SAS Group. Historically the airline’s strength has been its position on the northern periphery of Europe. Each of the three Scandinavian countries have relatively small populations individually, but collectively they boast 20m inhabitants. The geography of the area, and the superior standards of living, generate an above average propensity to travel by air (most notably in Norway) while the close ties between the three nations encourage significant levels of business (and travel) between the major centres. Taking advantage of de–regulatory pressures, SAS nearly managed to sew up its domestic markets — through first the acquisition of Swedish domestic carrier Linjeflyg in the 1980s and then of long–term rival Braathens SAFE in Norway in 2002 — and continues to boast a 40% share of traffic in the region (and 60% in Norway).

In the regulated era SAS successfully developed Copenhagen as a hub — for regional, European and long–haul operations — while pioneering shortest journey time connections (it was one of the first to develop polar routings, however difficult that is to market to the public at large).

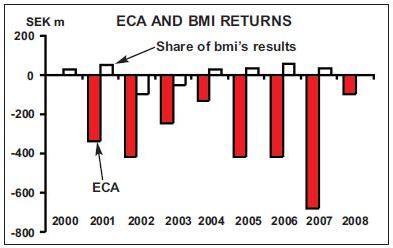

As deregulation spread its populist wings SAS expanded out of its home base — building a 40% stake (now reduced to 20%) in British Midland in the UK; creating Spanair in Spain in the 1990s; developing Blue1 in Finland; and acquiring stakes in airBaltic and Estonian to try to expand its base to the whole of the Nordic region.

Operational difficulties

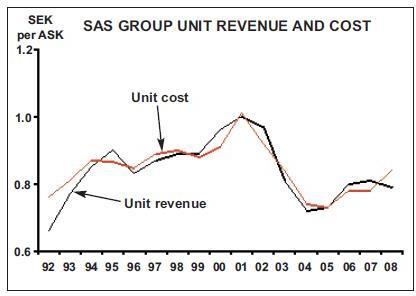

It has tended to be at the forefront of industry innovation — from the introduction of polar routings in the 1950s to the development of an intra–European business class in the 1980s. Under the dynamic leadership of Jan Carlzon it was one of the first to develop the zest for international alliances, creating “air bridges” between Copenhagen and New York with Continental (along with an ill–fated 20% equity stake in Texas — remember them?) and Bangkok with Thai International. With all the fall out from the initial alliance turmoils of the 1990s and on the rebound from the failed Alcazar merger negotiations with Swissair, KLM and Austrian, SAS ended up as a founding member of the Star alliance, along with Lufthansa, United and its old friend Thai. Since the onset of full deregulation in Europe in 1992 however, SAS has not fared so well financially, and the erstwhile strength of its position in Scandinavia has turned into a significant opportunity for others. It did manage to achieve record levels of profitability in 1995, but since then — and especially since the disasters of 2001 — operational performance has been exceedingly difficult.

In particular its rescue acquisition of Braathens in 2002 (and the consequent ban on the use of frequent flyer programmes on domestic Norwegian travel) created the opportunity for low cost carrier Norwegian Air Shuttle to attack the near monopoly this created; and despite apparent “dirty tricks” (a court case is coming again to appeal this year), Norwegian has managed to claim 40% market share within Norway and is extending its attack to Sweden (see Aviation Strategy, December 2008) in co–operation with arch–enemy Finnair. The prime reason — as always — for this disappointing performance is that the legacy carrier’s costs are just too high and productivity too low. In SAS’s case this is further exacerbated by the nature of its route structure: the average trip length hovers around 1,000km — the shortest of all the legacy carriers in Europe.

SAS has tried to respond — with reasonable success at least up to 2007. It reorganised its structure completely; the former Scandinavian Airlines System was broken into three constituent and virtually standalone “national” carriers — SAS Norge, SAS Sverige and SAS Danmark — while the longhaul services were placed into a new SAS International operation. This was designed to give the separate entities greater flexibility, accountability and visibility in order to generate greater operational efficiency. The group re–emphasised its belief in core operations — with hotel business Radisson SAS sold in 2006.

True to historical form, SAS was one of the first legacy carriers to start fighting back at the new generation LCCs in offering one–way fares while (accepting that still 60% of its traffic is travelling on business) scheduling operations far more closely linked to daily, weekly and seasonal demand.

By the end of 2006 it had achieved some reasonable progress; most indicators were showing improved signs of underlying profitability, albeit still below the sustainable cash flow returns on investment it needed to renew its fleet. 2007 brought in a new CEO — Mats Jansson — a new(ish) strategy, a new cost saving plan, a series of strikes and a disaster requiring the grounding of most of the Dash–8 Q400 fleet. 2008 proved worse — with the roller–coaster of oil prices, the accelerating economic downturn and the fatal Spanair accident in Madrid in August.

The new “Strategy 2011” (see above) is fairly basic: concentrate on core activities, which is defined as aviation in northern Europe. Underlying SAS’s strategy is the need to boost earnings towards a 7% operating margin that would provide the returns on investment necessary to cover the cost of capital and provide for the long–term fleet renewal: this translates into a medium–term aim of generating earnings of around SEK4bn (€400m) — against the SEK1.2bn earned in 2007.

Initially this strategy envisaged generating annualised cost savings of SEK2.8 bn — given the poor results in the past year this has been extended to try to create additional savings of some SEK4bn on top of the SEK1.5 bn emergency effort in the attempt to rescue results for 2008.

One of the core elements of the strategy is to encourage a “cultural turn–around”. The management started the process of improving relations with the unions at the back end of 2007, and started intense negotiations in November last year. This has at last culminated in an agreement signed this January, with the main unions providing a new collective agreement that should generate some 12% saving on the unionised salary bill — partly through salary reductions (the pilots have apparently accepted a 6 % reduction in salaries that has been matched by the management and even the board of directors) but mostly from working practice changes — creating an annual SEK1.3 5bn cost savings and a one–off benefit of SEK156m from reversal of pensions in SAS Norway.

Portfolio changes

A second — but perhaps more worrying — aspect of the strategy is the apparent aim to grow into cost savings, with a target to increase total passenger numbers by 20% over the four years to 2011; this means an average annual growth rate of 5%. The structural reorganisation is well under way even though some of the plans have taken longer to come to fruition because of the economic background. The group sold its Spanish ground handling operation (very imaginatively called Newco), put up for sale its stakes in bmi, Spanair and Air Greenland; and put in question its ownership of airBaltic and Estonian failing a majority ownership.

It also gave its hitherto uncompetitive ground handling operation SGS an effective ultimatum — to turn round the profitability by mid–2009 or be sold. In the past month it has sold its involvement in airBaltic (for SEK22 0m) to the management, having failed to persuade the government to pursue full privatisation, and come to an agreement to sell AerBal ( a 717 feeder to Spanair).

Initial statements of interest in Spanair proved apparently somewhat below SAS’s expectations — mainly because of the mess in the Spanish domestic market — and SAS having put it on the “for sale” list, (so it did not have to consolidate the numbers in the 2007 accounts) then re–consolidated the company midway through 2008.

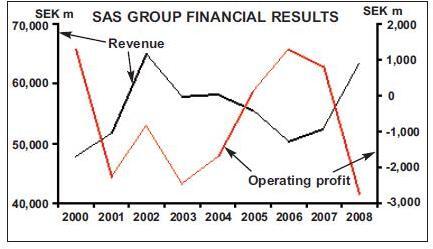

A disastrous year

In the middle of December the group finally reached an agreement to sell a majority stake to Spanish investors. The opportunities for selling the stake in bmi, however, are even more fraught. Last year Michael Bishop cannily exercised his option to put his 50%+ stake in Heathrow’s second largest carrier to 30% holder Lufthansa for €400m. SAS is left as a minority 20% holder in a private company, albeit a subsidiary of its long–term partner, and (always depending on what Lufthansa decides to do with bmi) with only one possible buyer for its stake. It is apparently trying to insist that Lufthansa buy out its stake at the same exercise price to generate a useful €160m in cash — much to Lufthansa’s chagrin. One of the major problems in looking at the SAS Group is that the company puts out so much information to help financial analysts that it is sometimes difficult to differentiate the spruce from the forest. Nevertheless, whichever way you interpret the numbers, 2008 turned out to have been a truly disastrous year. For the full year total revenues (of continuing operations) were up by 3%, with a reasonable improvement in underlying yields even though passenger numbers were at the same level as the previous year (having fallen by 9% and 8% respectively in the last two quarters).

Mainly because of the fuel price movements earlier in the year, EBITDAR for the period fell by a quarter to SEK3.9bn and the group reported an underlying operating loss for the year of SEK395m against a profit of SEK1.2bn in the prior year — the real underlying deterioration was even worse as this excluded the losses from the bmi ECA agreement (although for some reason some SEK100m losses crept into the last quarter of the year) as well as the effects of the prior year strikes and some slightly reduced additional leasing costs attributed to the grounding of the Q400 fleet.

On top of all this, SAS has finally come to an agreement to sell the majority of its stake in Spanair (for a nominal €1), and this has once again been reallocated to “assets held for sale”. Under the increasingly inane accounting policies this means that SAS does not have to report all the gory details of the skeletons and can treat everything as “below the line”.

However, the Spanish subsidiary managed to lose yet another SEK560m in the final quarter, giving a full year operating loss of SEK1.3bn. In addition, on top of a SEK1.9bn charge SAS had written off in the first nine months against goodwill, there was a further allocation of SEK1.6bn for restructuring costs and capital loss on the sale of its investment. As a result, all skeletons and various kitchen sinks included, the SAS Group reported a bottom line net loss for the full year of a whopping SEK6.3bn, compared with a net profit of SEK636m in the prior year period.

Hardly surprisingly, the group needs to restore the damage to its balance sheet and — at the same time as the results announcement — revealed plans to raise some SEK6bn through a rights issue (incidentally on the same day that Qantas decided to do the same). This is apparently done with the full backing of the three governments as well as the Wallenberg Foundation. To provide some incentive, the group has outlined yet another new strategy: under the soubriquet of “Core SAS”.

In one sense this is an extension to the earlier “Strategy 2011”, with the aim of concentrating on the core Nordic region and trying to bring the cost base closer to that of its competitors by an additional SEK4bn. Under this plan the group will retreat completely from all but airline operations in the Nordic region — with further acceleration of plans to dispose of non–Nordic, non–core investments (keeping Blue1 but selling Estonian, Air Greenland etc), slimming down and selling and/or outsourcing the uncompetitive ground handling operations and MRO activities outside the main bases.

Instead of trying to grow the business into cost reductions, the group will now dramatically cut capacity, withdraw from a plethora of unprofitable routes (for a possible net benefit of SEK800m) and — SAS always says this when it gets into trouble — focus more intensively on profitable business routes, with even greater emphasis on the business passenger. SAS states that it plans to cut the total number of city pairs operated by some 40% and capacity (as measured by ASKs) by 20%, while disposing of (or presumably parking) 20 aircraft.

As a result there will be a mass of redundancies — hopefully, following the recent collective agreements, without strike action — with 3,000 going from the SAS companies while the asset disposals will account for another 5,000 staff leaving the group, out of a current staffing complement of 24,600.

Far more importantly, the group is tearing up the organisational structure it put in place three years ago: the three national SAS airlines will be reintegrated into a single operating company and SAS International will disappear as a separate reporting unit.

Continuing independence?

This will come at a cost — with an anticipated restructuring cost of around SEK0.9bn — but is all anticipated to improve underlying operating profitability by some SEK700m. This new (even more) improved strategy might work. However, while growing into cost savings is the favoured industry approach (and rarely really works), cutting unit costs is always exceedingly difficult to achieve while slashing operations to such a dramatic extent. The deep–seated problem for SAS, however, is the very constitution of its avowed core competency: its business passengers on its core business routes also fly on holidays to tourist destinations; an airline seat is a commodity and in a commodity market the lowest cost producer will win. The least that may happen is that the erstwhile pioneer of globalised network operations retreats to become a regional, marginal European legacy network carrier.

The unanswerable question is whether SAS has the ability to push through this strategy to generate the returns to allow it to survive beyond this economic downturn as an independent entity — or at least put it in a position to be sold in the next upturn. The local stock markets seem to have the idea that SAS will be looking to combine with another company in much closer co–operation — with a significant recent out–performance of its shares against peers — at least until the rights issue announcement.

The natural choice for a rescuer might appear to be Lufthansa — but it also has its own problems (apart from anything else, facing the questions of Austrian, SN Brussels and bmi) and has already been able to garner benefits from the alliance link with SAS over the years, not least of which comes from the monopolistic joint venture on German–Scandinavia routes.

Ironically the other day Finnair raised its head from across the Baltic suggesting — and maybe masking its own strategic shortfalls — a truly Nordic solution. That could really upset the alliance structures in Europe. In the end, with the governments still owning 50% of the SAS shares, the outcome will no doubt come down to politics.

| Fleet | Orders | Options | ||

| A319 | 4 | |||

| A321 | 8 | |||

| A330 | 4 | |||

| A340 | 7 | |||

| 737-600 | 17 | |||

| 737-800 | 4 | 4 | ||

| MD-80s | 44 | |||

| CRJ900 | 2 | 8 | 17 | |

| Total | 90 | 12 | 17 |