Europe's charter industry consolidates into two giants

Jan/Feb 2008

Following the continued structural decline of the western European package holiday market, four large tour operators consolidated into two giants in 2007:

Thomas Cook/MyTravel and TUI/First Choice. In the second part of our analysis of the European charter industry, Aviation Strategy looks at the new TUI Travel group and the handful of other charter airlines in Europe.

TUI Travel

In the mid–1990s the European Commission didn’t allow Airtours (now known as MyTravel) to acquire First Choice, but the EC now says that market conditions have changed substantially since that decision, and so permission was given for TUI and First Choice to merge in early September 2007, when TUI Travel made a debut on the London stock exchange.

Now based in London, TUI Travel is owned 51% by TUI and 49% by former First Choice shareholders. If the Thomas Cook Group is big, then TUI Travel is even bigger, with the group employing 48,000 staff worldwide, owning 3,600 travel agency outlets and having revenue of €18bn, generated from 30m customers a year in 20 markets, who travel to more than 180 countries around the globe. But as with TCG, TUI Travel’s merging companies — TUI AG and First Choice Holidays — had different AIT strategies, and again in the short–term the new group is having to navigate tensions between the two former managements. Peter Long, CEO of First Choice prior to the merger and now CEO of TUI Travel, is adamant that the AIT market is changing rapidly through the rise of the LCCs and a reduction in demand for fixed duration package holidays, and that this attitude will have to spread through managements at the various former TUI AG assets.

But given that First Choice had wanted to sell off its mainstream business to Thomas Cook or MyTravel as late as January 2007, the merger with TUI can be seen as a very poor Plan B for First Choice. While it could be said that the largely mainstream businesses of TUI are complemented by the specialist holidays and long–haul business that First Choice has been building up, a more critical assessment is that TUI brings a huge overhang of vulnerable, low margin mainstream holidays to the new business.

Pre–merger, TUI’s margin of 2% contrasted markedly with the 5% at First Choice, and having to deal once again with a wider portfolio of AIT businesses is probably the last thing that First Choice’s executives want to do. So while First Choice has halved the number of short–haul holidays over the last few years, suddenly the new TUI Travel group has added a whole raft of mainstream package holiday businesses, such as the UK’s Thomson brand.

Thomson is the market leader in the UK, with around a 25% market share in AIT packages, but has been sluggish to respond the new realities of the AIT industry. Thomson has now, belatedly, started to change itself from a mainstream tour operator into a company that is a "one–stop–shop" for self–assembling holidaymakers, and a €10m advertising campaign was launched in the autumn of 2007 that promoted a variety of properties and the Thomson website — but the difference in approach between Thomson and First Choice is stark.

Again, this has direct consequences on the group’s airlines. TUI Travel now has a combined fleet of 141 aircraft (see table) — the 27 of First Choice Airways and 114 of TUI, the latter split between TUIfly (46 aircraft), Dutch carrier ArkeFly (five), French carrier Corsairfly (six), Belgian airline Jetairfly (10), Thomsonfly (42) and Swedish–based TUIfly Nordic (five). TUI also leases three ATR 42/72s and a single CRJ 900, and owns 40% of Moroccan LCC Jet4you. The largest former TUI AG airline in the UK is Thomsonfly, which dates back to the 1960sbut which was relaunched as a "low cost leisure airline" by TUI in 2004 before incorporating Britannia Airways in 2005. It currently operates a fleet of 42 aircraft out of Coventry, Doncaster and Bournemouth, and carries around 8m passengers a year, but its future is in some doubt (see below).

From the start of 2007 TUI had already begun to integrate all its airlines under a single brand — TUIfly — initially via the combining of charter carrier Hapagfly (previously called Hapag–Lloyd until 2005) and LCC Hapag- Lloyd Express (also known as HLX), which was completed in April 2007.

The current TUIfly has a fleet of 46 aircraft and increased capacity by 25% in summer 2007 compared with the previous year, with 13.5m passengers expected to be carried in the whole of 2007 (compared with 11.5m in 2006). TUIfly benefits from the marketing experience of HLX to target 60% of revenue via direct bookings, with the other 40% coming from traditional charters.

The other five airlines owned by TUI (Thomsonfly, Corsair in France, Arkefly, Jetair and TUIfly Nordic) are scheduled to be rebranded as TUIfly in 2008, and the integration of the former TUI airlines into a single branding and operation is forecast to benefit TUI by at least €50m. However, there is a major question mark over TUI Travel’s airline strategy, since it’s still not clear if TUIfly and First Choice Airways will remain separate or be merged into one airline. And if they are merged, it’s also uncertain as to which brand the combined airline will adopt, since there have been hints that TUIfly may be axed as a brand. At the end of 2007 reports came out of Germany suggesting that TUI Travel was in advanced negotiations with Lufthansa over a potential merger of TUIfly with Germanwings, the flag carrier’s low–fare subsidiary (which is owned by Eurowings, in which Lufthansa owns 49% and businessman Dr Albrecht Knauf 51%). Germanwings is based at Cologne/Bonn airport and operates a fleet of 26 A320–family aircraft from German airports to more than 70 European destinations (see Aviation Strategy, January/February 2007), carrying 8m passengers in 2007.

This rumour was confirmed at the end of January when TUI announced it has signed an MoU with Lufthansa and Knauf to explore the merger of TUIfly, Germanwings and Eurowings (Lufthansa’s Dortmund–based regional operator, which has a fleet of 32 CRJs and BAe 146s), although it was stressed that negotiations were at an early stage, and any agreement would be subject to regulatory approval. A combined group would have more than 100 aircraft, but if it does happen, there is no indication as yet as to whether the airlines will keep their own brands or come together under one of the three existing identities — and whether any of the other TUI airlines would be included.

James Halstead of Dawnay, Day Lockhart says that: "If this deal comes to fruition it should be viewed as a very positive move for both Lufthansa and Air Berlin; and virtually confirms what may be described as a 'comfortable' duopoly in the German market". He adds that TUIfly has tended to be the "price maverick in the domestic market — putting much pressure on yields (particularly damaging for Air Berlin) in the attempt to gain scheduled market presence".

For the moment, the airline currently known as First Choice Airways is based at Manchester airport and operates 27 aircraft to more than 60 leisure destinations from 15 airports in the UK and Ireland.

The carrier was launched as Air 2000 and swallowed Leisure International Airways before being renamed as First Choice Airways in 2004. It carried 5.5m passengers in 2006 for FirstChoice Holidays and other UK tour operators.

First Choice Airways also has 12 787s on order, which will significantly increase its long–haul capacity. The airline first ordered 787s back in 2004 (it is the European launch customer for the model) and the first two aircraft will be delivered in 2009, with the rest arriving by 2013. The order signalled the shift to long–haul holidays for First Choice, and joins the 11 787s on order by TUI AG, which the pre–merged company placed in December 2006, the same time as it ordered 50 next generation 737s, for delivery through to the end of the decade.

Recently–announced delays in the delivery dates for the 787 model should not impact operations, says TUI Travel, with 18 of the 23 787s arriving by 2012. Altogether the new TUI Travel has 69 aircraft on order, and what has been stated clearly is that the combined fleet will be reduced — although details are sketchy as to how this will happen.

What is known is that the group will reduce its fleet in Germany for the summer 2008 season by eight aircraft, from 55 to 47 aircraft (all coming off leases), and although these are largely on city–pair, scheduled (seat–only) flights, there will be some impact on charter capacity, largely due to a reduction in demand of business from third–party tour operators. Five more aircraft are coming out of the UK fleet (representing 12% of UK capacity) and two from the continental fleet outside of Germany this summer, bringing to 15 the number of aircraft that will be taken out of the fleet in 2008. Eight further aircraft will go in 2009 and another 18 in 2009, but an unknown number of these aircraft will be replaced by the outstanding orders for 46 737s. Paul Bowtell, CFO of TUI Travel says that: "we have got some flexibility around when those aircraft come in, so there are significant opportunities to build in flexibility into the fleets, which is clearly of significant importance if we are going to start rebuilding some of the margins".

Overseeing the fleet strategy going forwards is Christoph Mueller, previously CEO of Hapag–Lloyd and then head of TUIfly, who became responsible for all TUI Travel’s airlines in September (and in turn being replaced at TUIfly by Roland Keppler, who was previously head of HLX). However, his hands will be tied by the overall strategy of TUI Travel, whose new emphasis is copying the First Choice strategy by building up "asset–light" non–mainstream holiday business such as independent travel and financial services, where the group sees significant growth opportunities. This means that TUI Travel has to reposition itself strategically in Germany and try to overcome its dependence on low margin mainstream products there. For the TUI Travel fleet, in the medium- and long–term this will mean a greater emphasis on long–haul capacity, with much more flexibility in the short–haul fleet as it gradually cuts mainstream capacity in order to increase average prices and margins.

Peter Long, CEO of TUI Travel, says that the German business is doing well and does not need to be changed (structurally at least, although not in terms of strategy), but that the UK businesses need to be restructured. Premerger, at the end of 2006, TUI announced the cutting of 3,600 jobs (including 2,600 in the UK and 400 in Germany) in an effort to save €250m. But the merger is leading to additional cuts in the combined UK operation, with TUI Travel initially targeting €134m in annual synergies over a three–year period, most of which will come through savings in the UK market. This figure was upgraded to €205m at the end of January 2008, with TUI Travel stating that the integration process was doing better than expected. Against this, however, TUI Travel will take a one–off restructuring cost of up to €240m. Any savings from the potential merger of TUIfly with Germanwings and Eurowings are not included in these forecasts.

However, all group businesses outside Germany and the UK underwent a so–called "100 day review" that was completed on January 29th, and although details have not yet been released, the future of some of them must be open to doubt. For example, Nouvelles Frontières, the famous French tour operator that was established back in the 1960s, is still making a net and operating loss, and TUI Travel will want to switch investment from traditional tour operations into other areas. TUI Travel made around a dozen acquisitions in 2007, including asiarooms.com (an online B2C retailer of Asian room capacity) as well as four different activity holiday companies, an online car broker and an online package holiday review site.

Mixed 2007 results

Unaudited, pro–forma results for TUI Travel for the year to the end of September 2007 were released last December, but are somewhat complicated by the fact that First Choice’s financial year previously ended on October 31st, while TUI’s year–end was formerly December 31st.

In the "new" 2006/07 financial year, TUI Travel provisionally reported a 5.4% rise in revenue to £12.8bn, with operating profit up 4.7% to £287m. The provisional net profit for 2006/07 is £7m, compared with a net loss of £381m in 2005/06, and the net figure was arrived at after a huge £174m extraordinary charge in 2006/07, largely comprising restructuring costs, provisions and advisor fees. Staying at the operating profit level, TUI Travel’s overall figure for 2006/07 disguises wide variations in the various parts of the TUI Travel empire.

As can be seen in the table below, TUI Travel’s mainstream holiday business is dragging group results down significantly, with two out of the three parts of this business seeing their margins being reduced in the 2006/07 financial year compared with 2005/06, while the third only broke even. It should be noted that TUI Travel’s Northern Europe division includes the results from First Choice Airways, Thomsonfly and TUIfly Nordic, while TUIfly is in the Central Europe segment.

Alongside other factors, TUI Travel partly blames the poor showing of the key Northern Europe segment to £27m of losses incurred in the scheduled flying operation of Thomsonfly. Ominously, in its profits statement TUI Travel immediately adds that it has "recently stated that we intend, where possible and within certain time constraints, to exit unprofitable lines of business and therefore expect these losses to be eliminated over a period of time" — which may be a none–too subtle hint that Thomsonfly has no future within TUI Travel. In a conference call with analysts, Paul Bowtell, CFO of TUI Travel, said that it would be a "three–year project to get Thomsonfly back to zero", but whether TUI Travel will be that patient remains to be seen.

In Central Europe, TUI Travel states that profitability was "primarily impacted by the competitive environment within the German flying sector", with excess capacity in the market being compounded by "the impact of the TUIfly rebranding on a number of the airline’s customers". This resulted in many third–party tour operators becoming unhappy at putting their customers into TUI–branded aircraft, so they simply handed back a significant number of seats during the peak of the summer 2007 season. Paul Bowtell admits that TUI Travel "scored some own goals" in Central Europe in 2007. As mentioned earlier, the TUIfly brand may go anyway if the merger with Germanwings and Eurowings goes ahead.

In contrast, TUI Travel’s non–mainstream businesses all increased what were already healthy operating margins in 2006/07. It’s interesting to note that if TUI Travel purely focussed on non–mainstream holidays, while its operating profit would fall to £128.6m, its operating margin would leap to 6.7%, a percentage that is almost unheard of for any major tour operator. Of course this is a theoretical exercise, because — as much as it may want to — TUI Travel simply cannot exit from its mainstream businesses overnight. As First Choice’s fruitless attempt to offload its mainstream business at the end of 2006/start of 2007 proved, there are simply no buyers in the market for low–margin mainstream holiday businesses that have little or no long term future. Of course TUI Travel is cutting costs hard at its mainstream business, and says that mainstream sales have been "particularly strong in the period following the Christmas holiday", with mainstream margins expected to improve in 2007/08. However, it may be that TUI Travel’s only realistic long term strategic option is to build up non–mainstream businesses as fast as it can (which may lead to a bidding war with the Thomas Cook Group for non–mainstream companies that come onto the market), and gradually wind down its mainstream business, while shoring up the margins there in the short–term as best as possible.

Looking forward to the summer 2008 season, TUI Travel is furiously "exiting unprofitable lines of business, particularly in the short–haul segment in the UK and Germany".

Though it is still relatively early in the selling season for 2008, TUI Travel is "pleased with trading to date", and is optimistic given that 2008 bookings are being helped both by the UK’s poor summer in 2007 and a strengthening economy in Germany. As the table, above, shows, the latest detailed trading statement released by TUI Travel (in mid- December) reveals that the group has executed massive cuts in capacity out of the UK and Germany for the upcoming summer season (note that TUI includes the UK market in its definition of Northern Europe, while Germany is within Central Europe). In Northern Europe for example, TUI Travel has knocked 11% from its summer 2008 capacity for TUI mainstream holidays sold in the UK.

Frustratingly, TUI Travel does not break down its 14% capacity cut in its Central Europe segment, but the group is likely to be making double–digit cuts in capacity out of Germany too.

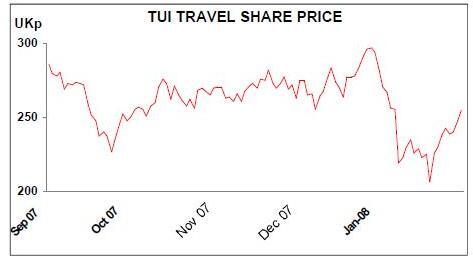

Although there has been a recent revival, the TUI Travel share price has been volatile (see graph) since a debut in which the issue price of 300p fell to 293p at the end of the first day’s trading (September 3rd). It reached a low of 222p before recovering to above 240p towards the end of January.

TUI Travel was admitted to the FTSE 100 index on Christmas Eve 2007 (along with Thomas Cook Group), but Paul Bowtell, CFO of TUI Travel, says that "concern in the markets about a number of issues …is partly rumour, speculation and outright scare mongering".

That’s a slightly patronising attitude to shareholders, which have genuine concerns about what will happen to TUI Travel over the next few years given the structural changes in the AIT market.

As for the others…

There are still a handful of charter airlines outside the ownership of TCG and TUI Travel, but almost all of these are now owned by tour operators. Due to the structural decline of the AIT market, independent charter airlines have to find specialist niches. The consolidation of the large tour operators into two giants will only exacerbate the difficulties for the last few independent charter airlines.

The largest airline not aligned with either TCG or TUI Travel is Monarch Airlines, which operates to more than 90 destinations for UK tour operators with a fleet of 31 Airbus and Boeing aircraft. However, Luton–based Monarch has been switching its emphasis away from charter flights, and today around 60% of capacity is provided as scheduled services, with the company promoting direct seat sales via its website. The airline also has six 787–8s on order (placed in August 2006) for delivery in the early 2010s.

Monarch Airlines is owned by the Monarch Group, which employs 2,800 staff and also owns a number of tour operators, including Cosmos. Significantly perhaps, Tim Jeans — previously managing director of Monarch’s scheduled division — became managing director of the entire airline from the start of February 2008.

Gatwick–based XL Airways UK operates a fleet of 12 aircraft, carrying 3.2m passengers in 2006 from 12 UK airports to more than 50 destinations in Europe, North Africa, North America and the Caribbean. Its parent is XL Leisure Group, the third largest tour operator in the UK, which employs 2,000 and has an annual turnover of around €1.4bn. The carrier has had a varied history, starting life as Sabre Airways back in 1994 but being rebranded as Excel Airways in 2001 after Cypriot tour operator Libra Holidays took a majority stake. Air Atlanta Atlantic acquired 40.5% of the airline in 2004, before the Avion Group — Air Atlanta’s holding company and an investment company that specialised in transport — acquired the company in 2005.

Only a year later the airline and associated tour operator (now known as XL Leisure Group) underwent an MBO, and the new owners rebranded the airline as XL Airways UK in December 2006.

The airline expects to carry 5m passengers in 2007 and aims to have 26 aircraft by the summer of 2008. Six 737–800s arrived on eight–year leases in 2007, while two leased 737–900ERs are being delivered in May 2008. XL Leisure Group also rebranded its other airlines in December 2006, with French–based Star Airlines and Germany’s Star Europe becoming XL Airways France and XL Airways Germany. The French airline was launched in 1995 and today operates three A320s, a single 737–800 and four A330s, while the German airline started in early 2006 after Avion acquired the assets and air operator’s certificate of German charter airline Aero Flight, which ceased operations in November 2005 (and was itself formed from the assets of charter airline Aero Lloyd, which collapsed in 2003). XL Airways Germany operates an A320 out of Frankfurt, Cologne, Düsseldorf and Stuttgart to European destinations for a variety of German tour operators, and aims to expand to eight aircraft by the summer of 2008.

Düsseldorf–based LTU International Airways operates 26 aircraft to more than 20 destinations, but the future of the charter airline as a standalone brand is bleak now that it is part of Air Berlin. The airline was founded in the 1950s and survived ownership by the SAirGroup in the early 2000s until being bought by an investment company, which then sold the airline on to Air Berlin in August 2007 for €140m plus the assumption of €200m in debt. Air Berlin has announced that the LTU name will disappear on all services other than long–haul leisure flights (see Aviation Strategy, November 2007), with medium- and short–haul flights being operated under the Air Berlin brand.

Other charter carriers include Germania, based at Berlin Tegel airport. Following the death of owner Hinrich Bischoff in 2005 most of its business is now wet and dry leasing of its five 737s to other airlines, although there is still a rump of charter flights operating to a handful of destinations in the Mediterranean and North Africa.

In October Aer Lingus sold its remaining 20% share in Futura, a Spanish charter airline, for €11.3m to the airline’s management and a UK private equity company called Hutton Collins. The Palma–based airline operates a fleet of 11 737s aircraft and carried 3m passengers in 2006.

In November 2007 the Icelandair Group was cleared by the local regulatory authority body to buy 50% of Czech charter airline Smart Wings and its parent tour operator Travel Service (with an option to buy at least another 30% from private investors over the following 12 months). Smart Wings operates 10 737s and carried 1.8m passengers in 2006, with revenue of just under €200m.

Icelandair Group has been steadily accumulating charter assets in central and eastern Europe, and in 2006 bought Latvian–based Latcharter, which operates two A320s on charter routes, as well as two 767–300ERs on behalf of Virgin Nigeria Airways on a London- Lagos–Johannesburg route.

UK business airline Silverjet (see Aviation Strategy, July/August 2007) bought charter airline Flyjet in October 2005, primarily in order to acquire immediate access to (leased) aircraft, but when it closed down Flyjet’s charter business a year later it stated that there were "insufficient returns" in the charter airline industry, and that the market was facing a challenging time due to "ongoing consolidation of the big four tour operators, the decline of the traditional package holiday market and excess capacity from the low cost carriers".

Despite that assessment, there are a handful of new charter airlines starting up. Orbest is a new Portuguese charter carrier that was launched last summer by Spain’s Orizonia Group, which also owns Spanish charter carrier Iberworld Airlines. Orbest uses an A330 borrowed from Iberworld and operates out of Lisbon to long–haul destinations in the Caribbean and South America, while Iberworld operates nine A320s and A330s for charter flights out of Spain. And last summer a new charter airline called Transavia France launched routes out of Orly with four 737- 800s to a range of Mediterranean and North African destinations. Air France owns 60% of the carrier, with the remainder owned by Transavia, the LCC airline in turn owned by KLM. The airline will add another three 737- 800s to its fleet this summer, when the number of destinations served will rise to 12.

Perhaps the only hope for the charter industry is eastern Europe, which may provide a few years of AIT demand before it too becomes more sophisticated in its holiday needs. However, AIT revenues in eastern European countries are far more likely to be won by local companies than by western European tour operators, although that may not stop TUI Travel and the Thomas Cook Group from at least trying to establish their brands in these emerging markets. In April 2007 Russian airline S7 ordered 10 737–800s (and took another 10 options) for delivery from 2010 for a new charter business called S7 Charter. The carrier operates out of Moscow’s Domodedovo airport with 12 leased 737–400s and 737–500s transferred across from its parent. The mainline S7 carried 1m passengers on charter services in 2006, and the group believes there is lots of growth potential in the Russian holiday market, in which the other main charter carriers are VIM–Avia and Atlant–Soyuz.

| First | |||||||

| Choice | TUIfly | ||||||

| Airways | Thomsonfly | TUIfly | Jetairfly | Corsairfly | Nordic | ArkeFly | |

| F.100 | 1 | ||||||

| A320-200 | 4 | ||||||

| A321-200 | 3 | ||||||

| A330 | 2 | ||||||

| 737-300 | 10 | 2 | |||||

| 737-400 | 4 | ||||||

| 737-500 | 2 | 1 | |||||

| 737-700 | 8 (20) | ||||||

| 737-800 | 7 | 36 (26) | 3 | 3 | 1 | ||

| 747-400 | 4 | ||||||

| 757-200 | 13 | 17 | 2 | ||||

| 767-200ER | 1 | 1 | |||||

| 767-300ER | 6 | 5 | 1 | 4 | |||

| 787-8 | (12) | (11) | |||||

| Total | 27 (12) | 42 | 46 (57)* | 10 | 6 | 5 | 5 |

| Operating profit (£m) | Operating margin | |||

| Change on | ||||

| 2006/07 | 2005/06 | 2006/07 | 2005/06 | |

| Mainstream holidays | ||||

| Northern Europe | 113.2 | -19% | 2.4% | 3.1% |

| Central Europe | 47.8 | -21% | 1.1% | 1.5% |

| Western Europe | 0.6 | 103% | 0.0% | -0.9% |

| Total mainstream | 161.6 | -12% | 1.5% | 1.8% |

| Specialist holidays | 47.2 | 32% | 4.5% | 3.5% |

| Activity holidays | 32.3 | 44% | 7.7% | 6.3% |

| Online businesses | 49.1 | 35% | 10.8% | 10.2% |

| Other | -3.2 | -3% | N/A | N/A |

| TOTAL | 287.0 | 4.7% | 2.2% | 2.3% |

| Change on summer 2007 | |||

| Capacity | Customers* | Revenue* | |

| Mainstream holidays | |||

| Northern Europe | -11% | 4% | 11% |

| Central Europe | -14% | 9% | 8% |

| Western Europe | 5% | 29% | 23% |

| Specialist holidays | 21% | 13% | |

| Activity holidays | 11% | ||

| Online businesses | 53% | 63% | |

| XL Airways | XL Airways | ||||

| LTU | Germania | Germany | UK | Monarch Airlines | |

| A300-600 | 4 | ||||

| A320-200 | 10 | 1 | 2 | 6 | |

| A321-200 | 4 | 11 | |||

| A330 | 12 | 2 | |||

| 737-300 | 1 | ||||

| 737-700 | 4 | ||||

| 737-800 | 6 | ||||

| 737-900 | (2) | ||||

| 757-200 | 2 | 7 | |||

| 767-300ER | 2 | 1 | |||

| 787-8 | (6) | ||||

| Total | 26 | 5 | 1 | 12 (2) | 31 (6) |