Airtours: restoring its fortunes after the German adventure

February 2001

Airtours, the world’s leading provider of air–inclusive holidays and the UK’s largest tour operator (TO) suffered a serious setback last year when its German expansion went awry. This year it is resolving its German problems, but the distribution power of its larger rivals there is a potential threat. The UK holiday market looks as if it will again produce a steady profit stream. Its purchase of US–based travel distributor is key to developing its e–commerce strategy. Although two profit warnings last year undermined investor confidence in Airtours, from a long term perspective the company has been a major stock–market success story. Floated in 1987 for £28m, its stock–market valuation rose nearly a hundred fold to £2.7bn in 1999 before dropping to the current level of around £1.3bn. (This is a 50–fold increase; for comparison, British Airways' stock, which was floated at roughly the same time, has increased by just over three times). Founder and chairman David Crossland has remained in control throughout this period, and rumours last year of his possible retirement have so far proved unfounded.

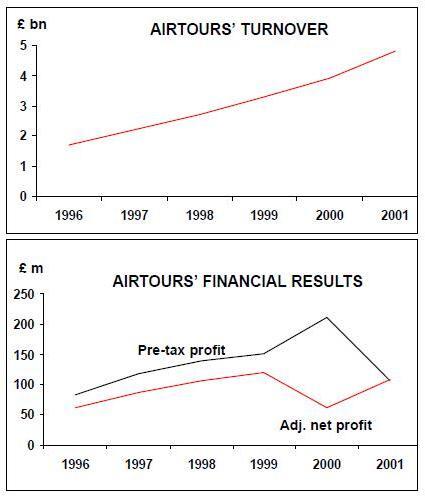

Its reported pre–tax profit for 2000 (year to end September) was £211m on revenues of £3.9bn, a rise of 40% from the previous period, but £137m of the profit was exceptional, coming from the sale of Costa Cruises. The UK and Scandinavian TO business was profitable at the operating level to the tune of £104m but £47m was lost in Germany and a further £7m in North America.

Airtours bought about 36% of the German tour operator Frosch (FTi) in 1998 and 1999, having been frustrated in its attempts to merge with UK TO First Choice. Its investment forms part of a broader trend of cross–border consolidation which has seen Preussag buy Thomson Travel/Britannia and C&N take over Thomas Cook (see Briefing, December 2000).

Unfortunately, the M&A activity and intense market share struggles resulted in serious overcapacity in the German market and poor trading conditions for all the main competitors. However, Airtours' problem were exacerbated by serious strategic errors at FTi.

The problems with FTi

Airtours' purchase of FTi represents a stark example of what can go wrong when buying into a business in a new country market without taking full operational control, detailed in a comprehensive report on Airtours by Deutsche Bank*.

FTi’s basis strategy was to go for extremely fast growth — doubling the customer base from 1m to 2m. In this it succeed but at huge cost — a loss for the whole company of about £100m. It is now clear that FTi management did not take advantage of the purchasing power of the Airtours Group. FTi felt that it was in a weak negotiating position with the major resort hotel groups and so had to guarantee the vast majority of its accommodation requirements at an early stage (this cost element accounts for about 35% of a TO’s total costs). But then the expected level of demand did not materialise and the "spot" price of beds plummetted. Overall, Deutsche Bank estimates that the cost of a hotel bed to FTi in summer 2000 was around 25% higher than the negotiated rates of the rest of the Airtours group.

In addition to the high level of guarantees given for accommodation, FTi also paid substantial deposits to resort hotel groups in order to achieve these guarantees at all. This had a cash flow impact for the business, and resulted in interest income being lower than should have been achieved.

Finally, FTi suffered from operational problems with its aircraft. Fti’s attempts to maximise utilisation meant that the flying schedule was too ambitious, resulting on knock–on delays following any disruption. The situation was not helped by the fact that FTi flew out of 16 German airports in summer 2000.

The management team at FTi has now been replaced (the new CEO, Georg Eisenreich, comes from TUI), and David Crossland himself is taking a hands–on role in Germany. But the most significant move by Airtours in was the decision to take 100% ownership of Fti, which should enable it to achieve the synergy benefits that will be gained from negotiating at the Airtours Group. Unfortunately some of the accommodation contracts run through 2001 so there is still some pain to bear in this regard. After that its is estimated that £35–40m a year of saving will be made. Rearranging schedules and reducing the number of airports operated from will produce a more streamlined charter airline operation. Overall, the capacity in FTi’s charter business has been reduced by 20–30% for summer 2001.

FTi will probably still lose around £30- 40m this year, though Airtours has stated that it believes that the company can be brought back to a break even level in 2002. However, Deutsche Bank remains concerned that FTi still has a fundamental weakness — its size.

While negotiating at the Airtours Group level should allow the company to realise economies of scale, it may still be difficult for to become the cost leader in Germany.

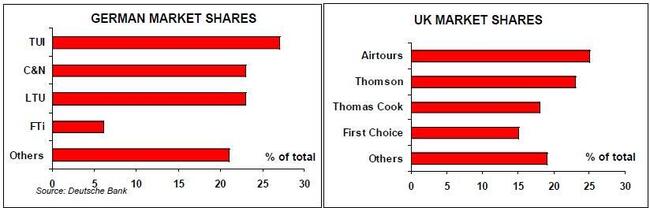

There is also a question over distribution strength — if the German retail chains prioritise sales of their parent TOs, as has happened in the UK market, then there would be negative implications for FTi. FTi has just a 6% share of the German market compared to 27% for Preussag/TUI, 23% for C&N and 20% for Rewe (20%).

There is some possibility of new consolidation in the German market involving Rewe, the part owner of LTU. Now that SAir, LTU’s other owner, is reversing its Qualiflyer alliance strategy, there might be an opportunity for Airtours to leapfrog the German competition by linking up with Rewe/LTU. The big risk is the unknown depth of the financial problems afflicting LTU.

In the meantime, FTi’s strategy is to change the split between modular and charter business from 47/53 to 55/45. Modular business essentially means scheduled rather than charter airline capacity as part of the holiday package.

Encouragingly for Airtours, the overall supply/demand balance in Germany is improving. On the demand side, the German TO market appears to be as robust as ever. In 1999, Germans spent DM 87.5bn (£28bn) on travel abroad, and the outbound market is three times larger than that of the next closest European country, the UK (which explains why Airtours has seen Germany as such an important market to penetrate). Healthy economic growth, around 2.4%, is forecast for 2001, with much of this growth consumer–driven as personal taxes will be cut this year.

The capacity outlook also would seem to be positive for 2001. Deutsche Bank sees an overall reduction in airline seat capacity of around 9%. FTi itself will reduce its aircraft fleet from six to four this year.

The actions of LTU in reducing its overcapacity will be key to an improved trading environment for the whole of the German tour operating industry. SAirGroup has already been announced that LTU will reduce its airline capacity by seven aircraft from 34 to 27. The restructuring aims to generate some DM 64m of savings in 2000, rising to DM 360m (£116m) by 2004.

C&N, having completed the purchase of UK travel agency Thomas Cook and French agency Havas Voyages, looks as if it is being prepared for a flotation by its joint owners, Lufthansa and Karsdadt Quellle. In such circumstances the group should be concentrating on increasing profitability rather than expanding market share.

Preussag, the German conglomerate, which is in the process of shifting from heavy industry to leisure services, has remarked that its capacity trend will be "stable". TUI, its tour operator (the airline division is Hapag–Lloyd) now has the leading market position in Germany following last year’s acquisition of Thomson Travel, and is unlikely to risk its margins through an attempt to gain marginal market share. Britannia itself is winding down its German subsidiary, Britannia GmbH, and will be returning all three aircraft to its UK fleet.

UK TO trends

From a wider perspective , as Preussag divests its non–core businesses in order to concentrate principally on its tourism businesses, it will probably be keen to avoid the perception that the earnings stream is volatile year to year. The UK market is now concentrated among relatively few TOs and two of the major players are now German–owned.

Airtours has about 25% of the market, compared to 23% for Thomson, 18% for Thomas Cook and 15% for First Choice. Deutsche Bank is forecasting an improvement in Airtours UK operating profits from £101m in 2000 to £141m this year based on tighter supply/demand condition.

Although GDP growth is set to slow in 2001, consumer confidence remains high and the relative strength of sterling against the Euro continues to encourage travel abroad.

Travel Services International

As in Germany, capacity increases this year should be modest for the same reasons. Preussag and C&N should be concentrating on maximising the return on their investments in Thomson and Thomas Cook rather than winning market share. First Choice’s strategy is constrained by the trend towards "directional selling"; it has been forced to invest in retail distribution, and hence is unlikely to increase its mainstream charter capacity over the next few years. Airtours’s other major investment was the US travel distributor Travel Services International (TSI), bought in March 2000 for £241m. TSI is an amalgamation of 23 travel distribution businesses, which had been built up after the group’s flotation on NASDAQ in July 1997.

The operational gearing of TSI is very different from that of a TO — it takes virtually no capacity taken at risk in any of its businesses and a significant element of costs is business being commission payments which varies directly with business transacted.

Nevertheless, TSI has been susceptible to strategic errors such as its decision to rebrand all its cruise products as "Travelco", which proved to be an expensive way of confusing customers. Despite this TSI commands a 10% market share of all cruise distribution today. With cruise capacity due to increase by about 11% a year this sector looks buoyant for TSI.

E-leisure strategy

TSI’s involvement in e–distribution comes through its brand flycheap.com. While this is a recognised brand in the US, ability to compete against those e–ventures backed by the US majors (Travelocity, Hotwire, Orbitz) is uncertain. Airtours has an ambitious strategy in the e–commerce sector, including not just the internet but also interactive TV, mobile technology. The strategy encompasses:

- The creation of mytravelco.com, an integrated travel service available to customers through multiple channels from the internet to the traditional travel agents;.

- The world’s largest leisure travel auction service via the Late Escapes web site;

- A partnership with Landmark Travel Channel Limited to broadcast mytravelco services across Europe; and

- A virtual low cost airline under the FlyCheap brand to sell travel from 52 airports in Europe mainly using Airtours capacity.

This sounds very exciting, and Airtours is determined to be at the forefront of what its sees as the electronic revolution in the leisure industry. But the key to a restoration of Airtours financial success would seem to lie in getting its very successful British TO economics established in a wider slice of the German market.

| Airtours International | |

| 757-200 | 6 |

| 767-300EREM | 3 |

| A320 | 11 |

| A321 | 4 |

| A330-200/300 | 3 |

| DC10-10/30 | 4 |

| FTi Flug | |

| A320 | 5 |

| Premiair | |

| A300B4 | 3 |

| A320 | 6 |

| A330-200/300 | 5 |

| DC10-10 | 1 |

| Air Belgium | |

| 737-400 | 1 |

| Total | 52 |