SIA: a global superpower emerges from the Asian crisis

February 2000

Back in 1998 SIA appeared to be as shocked as the rest of the Asian airline industry by the collapse of many of the region’s economies. Its revenue growth stalled and profits came under pressure. It was forced to defer some deliveries from Boeing. "Sell" recommendations were attached to its shares. Yet SIA emerged from the Asian turmoil unscathed, and potentially stronger than ever.

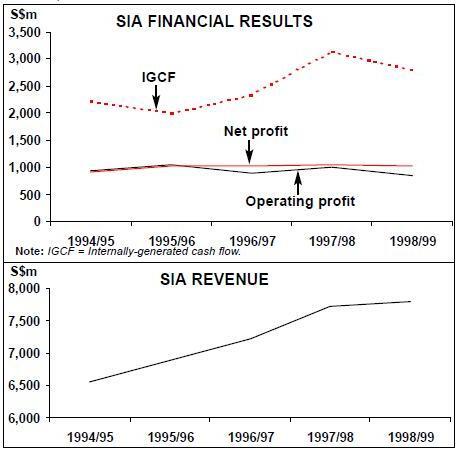

SIA Group’s operating profit margin returned to 12.3% in the six months April to September 1999, the same level as in pre–crisis 1996/97, having dipped to around 10% in the intervening period. Net profits for April to September 1999 totalled S$579 (US$345m), representing 13.4% on revenues of S$4.3bn.

On the measure of IGCF (internally generated cash flow — cash from operations, dividends from associated companies, proceeds from aircraft sales, etc) SIA’s underlying strength becomes fully apparent: IGCF totalled S$2.8bn equivalent to 35% of revenues, and had been around or above this level in the previous two years when reported profits were being squeezed.

Traffic was impacted by the Asian crisis — the number of passengers carried fell by 1% to 11.96m in 1997/98 before rising by 7% to 12.78m in 1998/99, but this was nothing compared to the 20%-plus falls at other Asian carriers. Cathay Pacific’s traffic tumbled by almost 9% in 1998.

SIA was able to manage the Asian crisis, redeploying its resources to minimise damage and seize new opportunities. The table on page 10, which breaks down revenue by region, indicates the pattern.

Intra–Asia, SIA’s revenues fell by 5% over the period of the Asian crisis. But SIA’s traffic actually rose as it captured market share from ailing Garuda and PAL and, to a lesser extent, MAS . The Asian crisis may have enabled SIA to increase its "home" market and emphasise its role as the airline of choice in the Indonesian archipelago, for intra–Indonesian services via Changi as well as international services. It also increased frequencies to Hong Kong, China and South Korea despite the depressed market conditions there. The major problem for SIA has been the continuing collapse in yield, by about 10% a year, largely caused by currency depreciation.

North American revenues grew by 10% as SIA took advantage of the liberal bilateral signed in 1997 to increase services to New York in particular. The boom in Asian exports to the US has resulted in increased freighter operations. There was a similar picture on European routes, where revenues grew by 16%: traffic has been growing at around 5% a year, and SIA appears to have been able to nearly stabilise yields.

The Southwest Pacific has shown the strongest growth — revenues up by 22%. Again part of reason was the diversion of fifth freedom traffic from Garuda and PAL, but also SIA now has an extensive range of code–shares between European and Australia/New Zealand, with Ansett, Air New Zealand and Lufthansa.

Given SIA’s success in the intercontinental markets, its frustration with the UK authorities over entry into the transatlantic market becomes understandable. The UK in January refused SIA rights to operate fifth freedom flights from Heathrow to the US, despite the fact that UK carriers have extensive beyond rights over Singapore and the US had accepted SIA’s route applications. The UK position on this issue is probably untenable, and should change with the inevitable liberalisation of Bermuda 2. But this change will be resisted to the death by BA.

Fleet innovations

SIA Group’s resilience in the Asian crisis was also supported by the performance of its subsidiary companies, notably SATS (Singapore Airport Terminal Services) and SIAEC (SIA Engineering Company). In 1998/99 SIA the airline accounted for just 64% of the Group operating profit, down from 73% in 1996/97. SIA is planning to unlock the value in these subsidiaries through an imminent flotation of probably 49% of each. SATS is estimated to be worth around S$2.3bn and SIAEC S$1.5bn, which would imply a cash injection of about S$1.9bn for SIA, though SIA has made it clear that the primary reason for the exercise is to allow the two companies to grow more rapidly. The IPOs are planned for the second quarter of this year. SIA has reinforced its position as one of the most important new aircraft customers and maintained its average fleet age at around five years — one of the few that can dictate terms to the manufacturers. Indeed, it raised order negotiating to a new level when its announced last summer that it was not only firming up options on 10 Boeing 777–200IGWs, but also had agreed to trade in 17 A340–300s, including two that hadn’t been delivered, to the US manufacturer. The deal caused great distress to Airbus, and has also left Boeing with a major headache in working out how to market the A340s.

SIA is now reported to be pushing Boeing to revive the 777–100X, a shrunk 250–seater as a replacement for the A310 on its regional routes. The closest Airbus alternative for this market is the A330–200.

The growth imperative

The other interesting development with regard to SIA’s fleet policy is the sale and leaseback of 12 747–400s over the past two years. SIA evidently decided to get these aircraft off its balance sheet as it foresaw correctly the effect of the Asian crisis on widebody resale values. SIA is unequivocally committed to a growth strategy, which has now become an alliance and acquisition strategy. In its last annual report, the company stated: "As SIA’s size increases, and as the SIA network already links Singapore with most of the major international gateways in the world, SIA’s growth will slow if it just continues growing entirely on its own ….SIA needs to seek avenues for profitable growth beyond Singapore. Investments in airlines in growing markets will provide SIA with such higher growth opportunities and produce higher profits in the long run."

One of the reasons behind this strategy is cost–related. The Asian crisis accelerated the long term downward trend in SIA’s yield. From 1990 to 1999 overall yield has fallen by 36%. As the island state has become progressively wealthier, cost pressures, particularly labour cost pressures, have mounted, meaning that the main way of cutting unit costs has been through greater productivity, and this implies producing more capacity. Staff productivity, measured in ATKs per employee, has in fact nearly doubled over the past ten years, but unit costs have only been reduced by 26%. The net result has been to push SIA’s break–even load factor up from 58.3% in 1990 to 63.7% in 1999.

Another driver towards expansion is financial. SIA has an immensely strong balance sheet, S$12.4bn of shareholders' funds and S$0.5bn of long–term liabilities according to the unaudited accounts at the end of September 1999. Cash on hand and short term investments had probably risen to S$3bn by this point, $1.6bn of which will have gone on the purchase of 49% of Virgin Atlantic last December, but which will be swelled by S$1.9bn from the sale of SATS and SIAEC.

So SIA has been facing the problem, if it can be described as such, of its high liquidity and asset strength depressing its return to investors. The solution was to embark of a S$275m share buy–back last September, initially mopping up most of the shares released by Delta and Swissair, its former partners in Global Excellence, as part of a planned S$1bn exercise over 12 months. The Singaporean government also removed the limit of 26.5% on foreign ownership of SIA stock.

The effect has been to push SIA’s share price up to S$17.5, capitalising the airline at about S$20bn (US$12bn), the highest airline valuation in the world (American is next at about US$9.5bn).

It should be remembered that SIA is majority government–owned through the state agency Temasek, which has beneficial ownership of about 54% of the shares. Temasek, which also owns parts of Singapore Telecom, DBS Bank and Neptune Orient Shipping is one of the two main vehicles used by the Singapore government to invest overseas (the other is the Singapore Investment Corporation).

In this respect SIA’s share buy–back policy is almost an admission of defeat in that it has been unable to find a better use for its funds. This, however, has not been for lack of trying. Early last year SIA appeared to have acquired a 25% stake in China Airlines, which would have been a powerful alliance for connecting southeast Asian and transpacific traffic as well as a strong positioning move in anticipation of the eventual restoration of direct flights between Taiwan and the PRC; the deal fell apart because SIA and CADC, China Airlines' main shareholder, could not agree on terms, but SIA reportedly remains interested. In March last year SIA issued a statement to the effect that it had an understanding to buy News Ltd’s 50% stake in Ansett subject to Air New Zealand not exercising its pre–emptive rights on the other half of the Australian Airline; ANZ threatened to do so and again the deal collapsed. Also last year SAir Group managed to outbid a joint offer from SIA and Lufthansa for 30% of SAA.

Future investments/alliances

At least 1999 ended successfully with the purchase of 49% of Virgin Atlantic for £551m (US$910m). The disappointment of the previous non–deals probably contributed to the full price that SIA paid for Virgin, but there were also genuine strategic synergies — a complementary route network (which will allow SIA a presence on the Atlantic even though it will not be able to operate the aircraft itself), and, perhaps more importantly, a compatible service product and glamorous image projection. Neither brand will be diluted by the alliance. Where will SIA go now in terms of investments and alliances? The following perspective draws on an analysis* of SIA carried out by an aviation consultancy specialising in this region of the world, the Centre for Asia Pacific Aviation.

The Global Excellence alliance, signed with Delta and Swissair in 1989, was an early indication of SIA global thinking. But this was ultimately an unsatisfactory agreement — too little synergy, too much a marriage of convenience. Subsequent frustrations in making airline investments, including the failure to acquire 25% of Qantas back in 1992, may have been the result of SIA demanding to get to as close to a controlling share as is legally possible.

Many Asian governments have regarded SIA’s expansion with caution, but the Asian crisis has left many carriers desperately short of funds and actively seeking investors. Foreign ownership rules are likely to be significantly relaxed in the next few years. SIA, maybe in conjunction with Virgin, has an extensive list of candidate airlines to consider (see below).

A supplementary strategy has been to establish tourism agreements with national government including the Philippines, Indonesia and Australia, offering promotional benefits and aligning SIA as the carrier of choice, in some cases usurping national airlines. In the UK, for instance, SIA attaches its name to a television advertising campaign promoting Australia.

Although it had signed code–share agreements with Lufthansa, SAS, United and Air Canada, SIA did not commit to the Star alliance until October last year, and is not due to join formally to the spring of this year. Now, because of the Virgin purchase and other factors, that final agreement is looking less clear–cut.

In global alliances, despite the rhetoric, self–interest dominates and bilateral interests will usually prevail over multilateral ones. SIA’s relationship with Air New Zealand and Ansett is a prime example — all the time it was negotiating to join Star it was establishing its own "partnership within a partnership" with the two antipodean carriers. SIA also had specific bilateral arrangements with the three main Star members, giving SIA sufficient clout to enable it to claim founding member status despite its late arrival in the alliance.

Bilateral arrangements will continue to dominate SIA’s thinking. For example, Ansett, whose international network is expanding through its code–share with SIA, recently chose SIA as its partner on the Bangkok route — even though it would have gained greater access by allying with fellow Star member, Thai International. Each time SIA, as a sixth freedom operator, is able to secure a code–share with a bilateral partner in competition with a national carrier, the more powerful its network becomes. And as code–share restrictions are gradually relaxed, the process will become easier.

SIA’s position as the sole designated Singaporean carrier gives it another competitive advantage when it come to negotiations with multi–airline countries. For example, when Ansett applied for capacity to code–share between Australia and Switzerland with SIA, Qantas also demanded increased flights but was refused on the grounds that competition guidelines required that Ansett be given a better chance to compete against the national carrier.

Ansett’s management is currently in the process of trying to negotiate an MBO, but, should this fail, SIA will very probably renew its interest in this airline. As covered in the last issue of Aviation Strategy, Ansett’s current weak financial position will be further undermined if Virgin Australia enters the domestic market. It might be more logical for SIA plus Virgin to invest in Ansett and create the new low–cost carrier from there.

SIA might even expand its interest to Air New Zealand, Ansett’s 50% parent — through Brierley Investments which has 47% of the airline. Temasek still has a small shareholding in Brierley.

When (or if) SIA’s Star’s membership becomes official, Thai will be put under greater pressure to withdraw from the alliance and seek comfort in oneworld, assuming the Thai government does not decide to offer SIA a substantial stake. Then there is MAS — the Virgin purchase could mean that Virgin will end its code–share with MAS, and switch from Kuala Lumpur to Changi. Or SIA could use the Virgin/MAS link to achieved even greater penetration of the Malaysian market.

The big question is: does SIA really need Star? Changi would become Star’s Asian super–hub, a crossroads for joint services with United to the US, Lufthansa/SAS to Europe, and Ansett/Air New Zealand to Australasia — a very powerful position.

But, as the Virgin purchase indicated, SIA seems loath to commit itself fully to Star. It is inevitably going to try to complete other airline purchases, and it will not be willing to discuss its purchasing tactics in advance with the other Star members.

Moreover, broader Singapore Inc./Changi interests motivate SIA to retain links with the other global alliances — oneworld (strongly represented at Changi) certainly, but also Air France/Delta and even Wings. Is SIA strong enough to position itself as a global hybrid, transcending the various alliances?

| 3-year | ||||

| 1996/97 | 1997/98 | 1998/99 | change | |

| North & Southeast Asia | 2,167 | 2,207 | 2,060 | -5% |

| North America | 1,482 | 1,572 | 1,625 | 10% |

| Europe | 1,342 | 1,512 | 1,554 | 16% |

| Southwest Pacific | 743 | 796 | 909 | 22% |

| India & Africa | 589 | 663 | 710 | 21% |

| TOTAL | 6,323 | 6,750 | 6,858 | 8% |

| Current | Orders | Options | Delivery/retirement schedule | |

| fleet | ||||

| 747-300 | 4 | 0 | 0 | |

| 747-300R | 2 | 0 | 0 | |

| 747-400 | 34 | 6 | 0 | Delivery in 2000-01 |

| 747-400F | 8 | 2 | 0 | Delivery in 2000 |

| 777-200ER | 13 | 38 | 23 | A340s traded in for these. |

| 777-300 | 5 | 0 | 0 | Delivery in 2000-03 |

| A310 | 18 | 0 | 0 | To be replaced |

| TOTAL | 84 | 46 | 23 |

| Fixed assets | 11.8 |

| Associated companies | |

| & long-term investments | 0.9 |

| Current assets (net) | 1.4 |

| TOTAL | 14.1 |

| Deferred income | 0.7 |

| Deferred taxes | 0.4 |

| Long-term debt | 0.6 |

| Shareholders’ funds | 12.4 |

| TOTAL | 14.1 |

| Privately owned airlines | Amount | |||

| Air Philippines | Up to 50% | |||

| Angel AL | Up to 15% | |||

| Ansett Australia | Up to 50% | |||

| Ansett NZ | Up to 50% | |||

| Asiana | Up to 50% | |||

| Korean | Seeking investor | |||

| PAL | Up to 40% | |||

| Shanghai AL | Seeking investor | |||

| Govt.-owned airlines | ||||

| Up to 40% | ||||

| Air India | ||||

| Air Niugini | Seeking investor | |||

| Biman | Up to 40% | |||

| China AL | Up to 35% | > | ||

| Garuda | Up to 50% | |||

| Indian AL | Up to 51% | |||

| PIA | Seeking investor | |||

| Thai Int. | 22% | |||

| Source: Centre for Asia Pacific Aviation | ||||