Air France franchisees: what's the longer-term aim?

February 2000

In a sudden flurry of activity Air France has consolidated its regional partner airlines by taking majority equity stakes. There are logical reasons for the purchases, but is there a long–term strategy?

In mid–January, Air France announced that it was subscribing to an issue of convertible bonds from Dijon–based Protéus Airlines which on conversion would give it about 42% of the carrier. Air France also reached an agreement with Protéus’s shareholders, which gives it the option of eventually buying 100% of the capital. Funds from the issue are to be used to effect a merger between Protéus and Lille–based Air Flandre (which will become the Protéus Group).

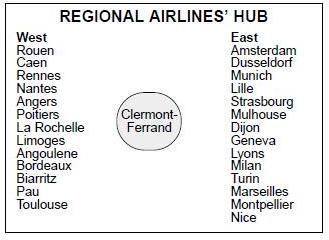

A few days later Air France revealed that it had bought 70% of Regional Airlines from the majority owners, the Dubreuil Group (supermarkets,etc.) The transaction valued the Clermont–Ferrand–based airline at Ff400m ($60m).

At the same time Air France went out of its way to reassure its main franchisee airline, Brit Air, which operates out of Nantes and Lyons, by announcing an extension of its franchise agreement to the end of 2007. (The other Air France partner is Corse Mediterranée, 20% owned by Air France, which has a niche role to/from Corsica.)

Until fairly recently mainstream airline thinking about regional operations was: outsource them as far as possible to lower cost operators with local expertise, maintain a degree of competition among the regional partners to keep costs in check, use them to build feed and take the parent’s brand into new markets. So why now the switch to a consolidation strategy?

For Air France probably the main consideration was encroachment on its home territory by competing Euro–majors. BA owns Air Liberté which had a code–share with Air Flandre. Swissair has a controlling stake in Montpellier–based Air Littoral from Lufthansa and has in effect taken over AOM. Regional had entered alliances with various carriers but seemed to be edging closer to KLM. Air France was left with close ties to only two of the French regional players — Brit Air and Protéus — which together operated only about 30% of domestic French regional capacity (measured as seats on aircraft of under 100 seats).

Weakness equals strength

The relative financial weakness of some of franchise partners was ironically becoming a source of negotiating strength — if Air France did not agree to attractive terms on franchise fees or wet lease rates, the risk was that the partners would succumb to competition from other regionals or would seek funding from other Euro–majors. Air France evidently decided that it had to consolidate to protect its market.

Moreover, the regionals needed a stronger capital structure if they were to fulfil their plans for developing their regional jet operations. For perspective, Protéus Group’s annual revenues are about Ff550m ($83m), its commitment on Emb 135 and 145s totals over $300m; Regional Airlines'revenues are about Ff1.2bn ($180m), its commitments on Emb 135, 145 and 170s, about $280m. .

A new role?

Now that Air France has greater ownership control (although the existing managements are to stay in place) what will be its strategy for the regionals? At present, the French regionals do not have a big role feeding traffic into CDG2. Air France domestic feed traffic at CDG comes from its own services to the main provincial cities — Bordeaux and Toulouse in the southwest of the country and Marseilles and Nice in the southeast. Point to point traffic from those cities to Paris Orly is served by La Navette, a shuttle operation which has been developed from the former Air Inter network, and which competes with Air Liberté, AOM and the TGV train.

The regionals connect cities in the west of France — like Brest, Nantes and Rennes as well as Toulouse and Bordeaux — with cities in the east — like Strasbourg, Lille and Avignon as well as Marseilles and Nice. They are also increasingly extending their services into Germany, Switzerland and Italy.

These routes are dominated by business travellers and generally have very good yields, but traffic volumes on many of the city pairs are very thin.

The solution adopted by Protéus and Regional has been to build west–east hubs at St. Etienne (just outside Lyons) and Clermont–Ferrand (in the Massif Central, headquarters of Michelin) in addition to their point to point services. These hubs are designed in the US style to connect banks of aircraft, 19–seat turboprops in Protéus’s case and 35–seaters and regional jets in Regional’s case. The economics of the St. Etienne hub must be questionable, given the limited volumes of connecting traffic and the relatively low aircraft utilisation. Regional has achieved greater mass at its hub, but it appears that it was still loss–making in 1999.

For Air France the focus must be on increasing feed to CDG2 where it risks losing slots if it or its partners cannot use them. This implies a restructuring of the regional networks with much more emphasis of routes to Paris (and to the secondary hub at Lyons Satolas).

As shown in the table on page 3 , the Air France partners now have 48 regional jets on order compared to 43 in the whole of the French market at present. This could represent the basis for the creation of a European version of Comair, the highly successful US regional which has just been bought out by its franchisor and Air France’s transatlantic partner, Delta (pages 13–17). Unlike BA or KLM, Air France has not attempted to create a low–cost subsidiary, but it does have a break–through agreement with its pilots union whereby it can outsource from the parent airline all jet operations of less than 100 seats (up to a percentage of total ASKs).

Key issues for Air France then become:

- Does it decide to merge the various regionals to achieve a harmonised management structure but risk losing local skills?

- Does it persist with the west–east hub strategies?

- How does it co–ordinate the regionals with its own domestic services and La Navette?

- Is there scope for further consolidation, for instance, by buying into its foreign franchisees like Jersey European or Gill Airways?

- How does it ensure that the regionals' costs, particularly crew costs, do not inflate?

- Should it consolidate and rationalise the regional jet orders?

There are important implications for BA and Swissair as well. Neither of their French airlines, Air Liberte and Air Littoral, is making money at present. So how could they withstand increased competition from a restructured Air France regional operation?

| Turbo- | 35-50 | (On | 100-seat 150-seat | Total | ||

| props | seat jets | order) | jets | jets | ||

| Brit-Air | 10 | 17 | (7) | 5 | 0 | 32 |

| Proteus | 21 | 1 | (12) | 1 | 0 | 23 |

| Flandre Air | 20 | 0 | (10) | 0 | 0 | 20 |

| Regional Airlines | 20 | 10 | (19) | 0 | 0 | 30 |

| Corse Med. | 6 | 0 | 0 | 3 | 0 | 9 |

| Air France Group | 77 | 28 | (48) | 9 | 0 | 114 |

| AOM | 0 | 0 | 0 | 0 | 13 | 13 |

| Air Littoral | 17 | 15 | 0 | 6 | 0 | 38 |

| Swissair Group | 17 | 15 | 0 | 6 | 13 | 51 |

| Air Liberte | 6 | 0 | 0 | 16 | 10 | 32 |

| BA Group | 6 | 0 | 0 | 16 | 10 | 32 |

| Total | 100 | 43 | (48) | 31 | 23 | 197 |

| Source: ACAS. | ||||||