Labour gap closes, infrastructure gap widens

February 1998

The good news is that Europe’s leading flag–carriers have almost closed the labour cost gap on their US counterparts.

The bad news is that the overall operating cost difference is greater than ever. The samples Aviation Strategy has examined comprise: British Airways, Lufthansa and KLM, and American, United, Delta and Southwest — the largest and/or the most commercial airlines on both sides of the Atlantic. If we had expanded the European sample to include the reforming state–aid–ers, Europe would appear less competitive but adding the other US carriers to the sample would probably make little difference to the US position. To minimise exchange rate distortion we have used average 1997 rates throughout the analysis. The various airlines are weighted according to their revenues in 1997. In addition, 1997 is denoted as provisional as the data used refer mostly to the first nine months of the year.

Having got the methodological details out of the way, we can outline some of the key trends.

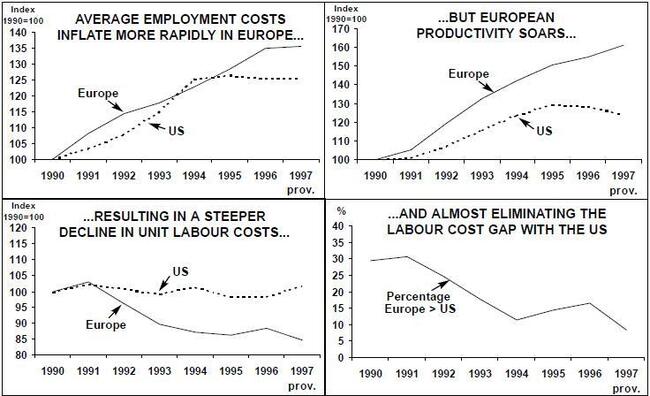

From a lower base, European average employment costs (salaries plus social costs) increased in parallel with the US until 1994 when the US carriers managed to control wage increases (by offering job security, fleet expansion incentive etc); European costs have continued to grow so that today there is an insignificant difference between the two cost levels — $59,000 per employee in Europe and $61,000 in the US.

The European carriers' great success has been in containing employee numbers while expanding capacity, resulting in a surge in the ATK per employee productivity measure. In the US the slight decline in this ratio in recent years reflects a restoration of staffing to levels that are adequate for customer service. It should not be forgotten, however, that the US industry was very much more labour–efficient to begin with, and even now a US airline employee produces 14% more ATKs than a European.

Nevertheless, the net result of the trends in remuneration and efficiency is that the unit labour costs of the leading European airlines are now just 8% above those of the US carriers.

This contrasts with a gap of around 30% in the early 1990s.

Alas, successes on the European labour front have not filtered through to the bottom line.

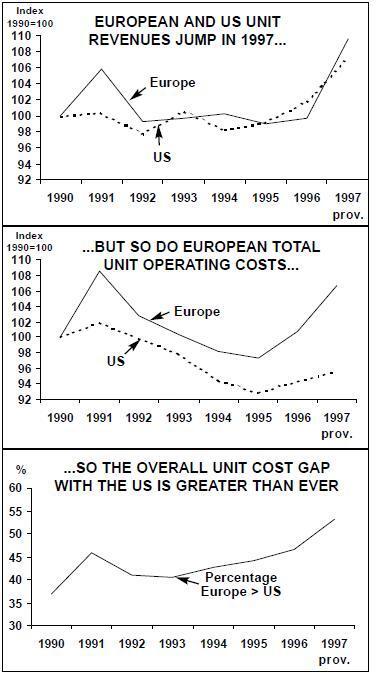

Having remained fairly stable throughout the 1990s, units revenues ($/ATK) leapt up in 1997 for both the US and the European carriers as they finally managed to take advantage of a tight supply/demand situation and push prices up. Yield and capacity management tools have been used to great effect.

Unfortunately, European overall unit costs have tracked unit revenues quite closely, whereas US unit costs have just edged up. The effect was to cause the unit cost gap, which had shown signs of narrowing in the mid 1990s, to expand again. In 1997 Aviation Strategy estimates that unit operating costs for the leading European carriers were 53% higher than for the US carriers, a greater difference than in the early 1990s.

Part of the reason for this unexpected result was a regional divergence in fuel prices. In 1997 the European carriers were paying about 15% more than the US airlines for jet kerosene, whereas in the early 1990s there was scarcely any difference between the two regions.

But the real culprits lie hidden in "other operating costs", which in Europe have been growing at an apparently innocuous 3% p.a. during the 1990s but which have remained completely static in the US. This category includes such diverse elements as rentals, commissions, catering etc, but it is the cost items that lie largely outside the airlines' control that have been causing the most concern — airport charges, en route fees and ground handling costs.

Indeed, over the next few years the key aeropolitical issue within Europe is likely to be the deregulation of the aviation infrastructure.

Jürgen Weber, the new AEA chairman, states that he is going to concentrate on high airport charges, protectionist ground handling regimes (Frankfurt has just been given three months to dismantle its near–monopoly on ground services) and an integrated Euro- ATC. Resistance and diversionary tactics from governments and others with vested interest in maintaining the $1 is inevitable.