SIA: Its continuing struggle

with declining yield

December 2018

Significant decline in operating and net profit at the SIA Group during the first half of 2018/19 was partly the result of one-offs and rising fuel prices — but also due to ever-falling yield. Is Singapore Airlines caught between maintaining its traditional prioritisation of premium products and building up a substantial LCC business?

In the first half of SIA’s 2018/19 financial year (the six months ending 30 September 2018), the Group saw revenue rise by 2.5% year-on-year to S$7.9bn (US$5.9bn), based on an 5.8% increase in mainline passengers carried, to 10.2m. Mainline capacity growth of 2.6% in the first-half of the year was surpassed by a 6.0% rise in RPKs, leading to 2.7 percentage point rise in passenger load factor, to 83.6%.

However, operating profit during the six-month period fell by a hefty 44.1% to S$426.0m (US$317.8m), with net profit totalling S$214.7m (US$160.2m), compared with S$649.7m in April-September 2017.

While it should be noted that comparisons with previous financial years are affected by the SIA Group being required by the Singapore stock exchange to adopt IFRS accounting standards from April 2018 — which resulted in a restatement of 2017/18 results and a reduction in book values for aircraft — the huge fall in profitability was due mainly to rising fuel costs. Despite hedging this was up by S$379.4m/US$283.1m (+20.4%) over the half-year compared with H1 2017/18 — although other cost categories rose faster than revenue growth year-on-year, including aircraft maintenance (+5.6%) and advertising (+7.2%). And at the net level the Group took a S$175m (US$135m) one-off loss from changes to its KrisFlyer FFP (S$115m) and compensation for changes in aircraft delivery slots (S$60m).

To complete the bad news, the Group recognised an increase in share of losses totalling S$97m from associated companies during the half-year — mostly due to Virgin Australia (in which the SIA Group still owns 20%).

Almost all of the Group’s operating profit in H1 came from the mainline (S$418m/US$312m), although this was down 39.3% year-on-year. SIA Engineering contributed a S$22m operating profit but both SilkAir and Scoot racked up operating losses of S$3m and S$10m respectively, compared with net profits of S$22m and S$5m in April to September of 2017.

Yield and cost trends

While profitable, the mainline is facing tremendous challenges, summed up by the continuing decline in yield, which — as the chart shows — has been falling more or less continuously for a decade as competition from other network carriers (particularly the Super-connectors) and the LCCs has increased.

In response, the Group has unleashed wave upon wave of transformation actions (aka cost cutting) that have slowly but steadily reduced mainline unit costs. The problem is that unit revenue continues to fall too, and the gap between the two is razor thin.

In a challenge faced by many other legacy carriers, SIA is in effect “scraping the barrel” in terms of finding substantial cost savings over and above what it has already implemented. One area still be to be exploited fully is the fleet.

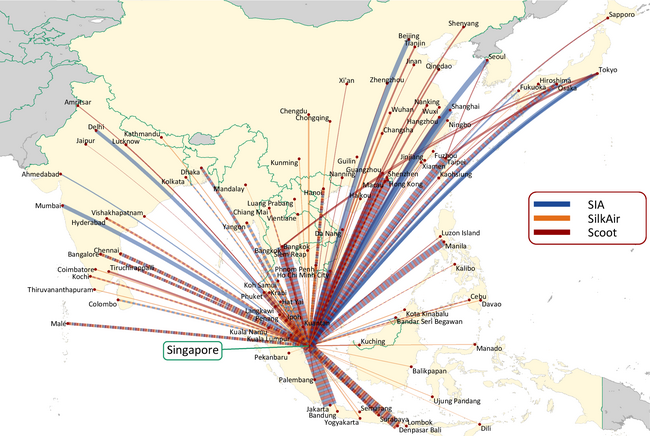

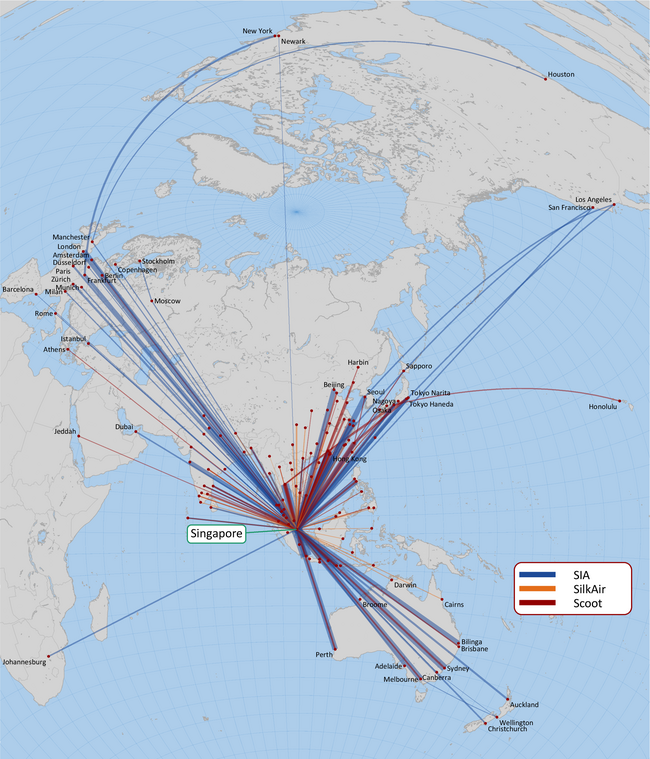

SIA mainline operates to 64 destinations in 31 countries out of its hub at Singapore Changi, and its fleet totals 111, comprising 19 A330s, 21 A350-900s, 19 A380s, 13 777-200s, 32 77-300s and seven 787-10s. The fleet has been overhauled over the last few years and has an average age of seven years, but further change is coming given the outstanding firm order book of 99 aircraft (see table). This includes 39 A350-900s, 20 777-9s (with deliveries starting in 2021), and 40 787-10s.

The new aircraft will replace the older A330s and 777s (for example, the 777-200s have an average age of almost 16 years) as well as fuelling growth; overall mainline capacity will grow at around 5% in the full 2018/19 financial year (ending 31 March 2019).

During the July-September 2018 period the mainline received the last of its A380 orders as well as two of seven A350-900ULRs on firm order. SIA was the launch customer for the model, and the airline started the world’s longest non-stop route, between Singapore and Newark, in October 2018, followed by a non-stop Singapore-Los Angeles route in November 2018. The aircraft can operate for up to 9,700nm — or more than 20 hours non-stop.

The mainline continues to expand long-haul in general; in September 2019 it plans to launch a Singapore-Seattle service using A350-900s that will be its fourth non-stop route to the US market.

By the end of the current financial year the mainline will receive another 11 new aircraft (seven A350-900ULRs, three A350-900s and a 787-10), and after disposing of three ageing A330 and 777 aircraft will see its fleet increase to 119.

The SIA Group’s cargo business operates seven 747-400 freighters (less than it used to have and indicative of the tough cargo market in general) that serve 19 cities in 13 countries.

Premium fixation

The group’s continuing and long-held strategy is prioritising premium traffic. For example, SIA’s latest A380s have 471 seats in four classes — six “suites”, 78 in business class, 44 premium economy and 343 economy seats. The suites each have a full-flat bed and leather chair, and the first two suites in each aircraft can convert into a double bed.

But is this continued focus on premium really viable in the long-term? Despite enhancing its traditional first-class and business products and services through revamped cabins and lounges, overall yield continues to decline. The downward trend in unit revenues has, however, been somewhat mitigated by a gradually improving load factor (see chart).

While there is an argument that if the Group didn’t continue to invest in premium then its yield decline would be even steeper, the wider point is that management may be too focused on premium, failing to capture the fast-growing price-sensitive Asian traffic volumes. Despite the growth of Scoot, the share of the SIA Group (including Scoot) of the total Asia/Pacific market has hardly changed over the last year — 10.9% of the total passengers carried by the 36 airlines reporting to AAPA.

SilkAir merger

The merger of short/medium-haul airline SilkAir into the mainline SIA was announced in May this year although the implementation timetable appears long. SilkAir will first undergo a S$100m upgrade of its cabin products that will include new lie-flat seats in business class and the installation of seat-back in-flight entertainment systems in both business and economy classes.

According to the Group this will “ensure closer product and service consistency across the SIA Group’s full-service network” before SilkAir is merged with the mainline (after which the SilkAir brand will disappear). But the cabin upgrades won’t start until 2020 “due to lead times required by seat suppliers”, and the merger will only take place once an unspecified sufficient number of SilkAir aircraft have had cabin upgrades.

Based at Singapore Changi, SilkAir currently operates a two-class service to almost 50 regional destinations in 16 countries, comprising 10 destinations in Indonesia, nine in China, eight in India, three each in Malaysia and Thailand, two each in Australia, Cambodia, Myanmar, the Philippines, Vietnam and Laos, plus Hiroshima, Malé, Kathmandu and Colombo.

It operates a 32-strong fleet that includes two A319s, eight A320s, 17 737-800s and five 737 Max-8s, with an average age of four and a half years. Planned ASK growth is around 4% in 2018/19. On order are 32 737-MAXs, although these may be transferred to Scoot, while the A320 family aircraft are gradually being replaced.

The airline is struggling; in the April-September 2018 period yield was 10.6S¢/RPK, compared with 11.4S¢ in H1 2017/18. Units costs of 8.4S¢ were 0.1S¢ higher than a year ago, while unit revenue of 8.1S¢ was 0.3S¢ down, leading to a significant increase in break-even passenger load factor, from 72.8% a year ago to 79.2% in H1 2018/19 — and significantly above its achieved load factor for the half-year, which was 75.8%.

Could the SIA Group have made the wrong strategic decision here — might it have been better to merge SilkAir with LCC Scoot, with the benefits that the LCC model will bring to overall unit costs and traffic growth?

Scoot potential

LCC Scoot was launched in 2012 and operates medium- and long-haul routes from its base at Changi to 65 destinations in China (18 destinations), India (seven), Malaysia (six), Thailand (six), Indonesia (five), Australia (four), Philippines (four), Japan (three), Taiwan (two), Vietnam (two) plus Dhaka, Athens, Berlin, Hong Kong, Macau, Malé, Jeddah and Seoul. Berlin — its second European destination — was launched in last June.

Scoot has 44 aircraft — two A319s, 24 A320s, 10 787-8s and eight 787-9s, and on order are 38 A320neos, two 787-8s and two 787-9s. The first of 39 A320neos on order was received in October this year, and through to 31 March 2019 Scoot will receive six more A320s (two new ones and four currently sub-leased to IndiGo), with overall capacity growth for 2018/19 being 16% year-on-year.

Scoot has already taken over some services from the SIA mainline (such as to Jeddah), enabling routes that were marginally profitable under mainline operation to (presumably) become more profitable when operated by an LCC. More group transfers will occur between April 2019 and mid-2020 (the Group announced a list of such changes in late November), though in terms of Scoot and SilkAir’s respective route networks, there is relatively little overlap. Out of Changi the two airlines double-up only on 14 destinations, with India having the greatest overlap (both airlines serve Bangalore, Chennai, Hyderabad and Kochi). Partly, though, this is the result of many routes already having been transferred from SilkAir to Scoot (such as between Changi and Hangzhou, Kuching, Kalibo, Langkawi and Palembang), though SilkAir has also taken over a route to Yangon from Scoot (in October 2017).

But even Scoot is struggling to break-even at the moment — in the first-half of 2018/19 revenue rose by S$139m, thanks to a 13.5% rise in passengers carried, to 5.2m. But unit costs rose above unit revenue by 0.3S¢, and with a break-even load factor of 91.1% the airline didn’t come close to posting a profit (passenger load factor for the six months came in at 86.4%).

Scoot absorbed SIA Group subsidiary Tiger Airways in July 2017; the LCC was based in Changi and previously operated 25 A319s and A320s to almost 40 destinations in Asia), with a single class. But with the integration of Tiger now complete, Scoot is looking to further growth — and this includes long-haul. Routes to Athens and Honolulu were launched in 2017, and a four-times-a week service between Changi and Berlin started in June 2018; this operates alongside routes to Düsseldorf, Frankfurt and Munich that are flown by SIA. The long-haul routes use 787s that Scoot operates in a two-class configuration — economy and ScootBiz — with the latter product having 21 seats on the 787-8 and 35 seats on the 787-9.

Scoot also owns 49% of Thailand-based LCC NokScoot, which is a joint venture with Nok Air (it owns 51%), the LCC offshoot of Thai Airways International. Based at Don Mueang international airport in Bangkok, it operates five 777-200ERs to nine destinations in China, Taiwan and Japan in a two-class configuration — “ScootBiz” and economy — and will add five 737-800s to its fleet by the end of calendar 2019.

The SIA Group also owns 49% of Vistara, a full-service Indian joint venture with Tata Sons (which owns 51%), part of the Tata Group — the giant Indian conglomerate. Based at Delhi’s Indira Gandhi airport, Vistara operates 22 A320s to 22 domestic destinations in a two-class configuration. It aims to add 50 A320 family aircraft and six 787-9s to its fleet as it gears up for international operations for which it has applied to the Indian regulatory body for approval.

Within Asia, SIA Group’s strategy is to dominate certain markets — the SIA Group is the largest foreign airline in terms of destinations served in Australasia, while it also has a major presence in the Chinese (29 destinations served) and Indian markets.

Group CEO Goh Choon Phong points out that, according to IATA projections, by 2025 “India will be the third largest travel market in the world, and China will also overtake the US to be the number one. We are so close to these two markets and obviously believe that those are the markets that we absolutely must have a strong presence in”.

Strategic choices

Yet despite this logic, the Group appears to be sticking with prioritising the preservation of premium traffic at the mainline, with expansion of the LCC model a second priority. The opportunity to start incorporating LCC practices first into SilkAir and then even into the mainline appears to be disregarded; instead only a few routes are being transferred to Scoot, but quite sluggishly. It was not a binary choice — LCC practices could have been adopted by SilkAir while keeping two classes (as Scoot does on long-haul).

Looking to the rest of the 2018/19 financial year, SIA says that “headwinds continue to persist in the form of cost pressures from significantly elevated fuel prices, as well as keen competition in key operating markets”. Despite this, the Group stubbornly remains loyal to its strategy of prioritising premium business, though the market’s view on this is clear — as can be seen in the graph SIA’s share price is about a third lower than it was in 2007, and a weak rally in early 2018 has petered out, with the price now hovering around historically low levels.

To some extent, the SIA Group is insulated from the full effects of fluctuations in its share price as Temasek Holdings — the Singaporean state holding company — owns 55.5% of equity. But if the mainline’s premium business starts sliding, then its shareholders may demand that the Group’s overall strategy be revisited.

| 2019 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| at end March | 2014 | 2015 | 2016 | 2017 | 2018 | in | out | @ye | On order | Options | |

| Singapore Airlines | 777-200 | 16 | 13 | 11 | 11 | 8 | -1 | 7 | |||

| 777-200ER | 13 | 12 | 10 | 10 | 8 | -5 | 3 | ||||

| 777-300 | 7 | 7 | 6 | 5 | 5 | 5 | |||||

| 777-300ER | 22 | 25 | 27 | 27 | 27 | 27 | |||||

| A380-800 | 19 | 19 | 19 | 19 | 17 | 3 | -1 | 19 | |||

| A330-300 | 26 | 29 | 28 | 23 | 21 | -4 | 17 | ||||

| A350-900 | 1 | 11 | 21 | 3 | 24 | 36 | |||||

| A350-900ULR | 7 | 7 | |||||||||

| 787-10 | 8 | 8 | 40 | 6 | |||||||

| 777-9 | 0 | 20 | 6 | ||||||||

| SIA Total | 103 | 105 | 102 | 106 | 107 | 21 | -11 | 117 | 96 | 12 | |

| Cargo | 747-400F | 9 | 8 | 9 | 7 | 7 | 7 | ||||

| SIA Cargo | 9 | 8 | 9 | 7 | 7 | 0 | 0 | 7 | |||

| SilkAir | A319 | 6 | 5 | 4 | 3 | 3 | -1 | 2 | |||

| A320 | 16 | 13 | 11 | 10 | 9 | -1 | 8 | ||||

| 737-800 | 2 | 9 | 14 | 17 | 17 | 17 | |||||

| 737 MAX-8 | 3 | 3 | 6 | 31 | 14 | ||||||

| SilkAir total | 24 | 27 | 29 | 30 | 32 | 3 | -2 | 33 | 31 | 14 | |

| Scoot | 787-8 | 2 | 4 | 6 | 10 | 10 | |||||

| 787-9 | 6 | 6 | 6 | 2 | 8 | 2 | |||||

| 777-200 | 6 | 4 | |||||||||

| A319 | 2 | 2 | 2 | 2 | |||||||

| A320 | 24 | 21 | 21 | 22 | 8 | -4 | 26 | ||||

| A320neo | 2 | 2 | 37 | 11 | |||||||

| Scoot total | 6 | 30 | 33 | 35 | 40 | 12 | -4 | 48 | 39 | 11 | |

| Group Total | 133 | 162 | 164 | 171 | 179 | 36 | -17 | 198 | 166 | 37 | |

Source: Company reports. FYE March

Notes: Equidistant map projection based on Singapore (great circle routes appear as straight lines). Thickness of lines directly related to number of seats operated.