Korean Air: soul of

northeast Asian aviation

December 2016

Korean Air posted its best quarterly result ever in the July-September period; has South Korea’s flag carrier fully recovered from its 2008 low?

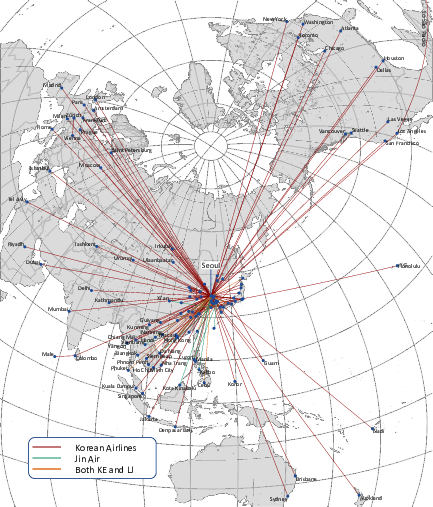

Based in Seoul, South Korea’s flag carrier was launched in 1962 as a direct replacement for Korean National Airlines before changing its name to Korean Air in 1984. Today it has around 18,500 employees and operates to 12 domestic destinations and 129 destinations in more than 40 countries globally.

As can be seen in the chart, Korean Air’s financial results have varied widely through the 21st century, but the low point was 2008 when it reported a net loss of ₩1,942bn (US$1.8bn). However, the airline has transformed itself since then, become far better at both cost control and revenue generation — for example, passenger load factor has risen steadily over the last few years (see chart), increasing from 69.8% in 2009 to 80.9% in the 3rd quarter of calendar 2016.

In 2015, despite a 3.1% fall in revenue to ₩11,545bn ($10.0bn), it recorded a 23.5% increase in operating profit to ₩883bn ($766m) representing a 7.7% margin — although it still had a hefty net loss of ₩563bn ($488m). However, Korean Air posted its largest quarterly profit in history in the July-September 2016 period, with operating profit up 34.5% year-on-year to ₩460bn ($422m) giving a near 15% margin. Revenue rose by 4.9% in Q3 2016 to ₩3,118bn ($2.9bn) — based on a 14% increase in passengers carried — and net profit reached ₩511bn ($469m), compared with a net loss of ₩508bn in the third quarter of 2015.

For the nine months to end September the company reported a 2% growth in revenues to ₩8.8tn, a 3% decline in costs and a 78% jump in operating profits to ₩942bn delivering a margin of 11%. In the period international passenger traffic grew by 7.5% in RPK terms against an increase in capacity of 5.7% giving a 1.4 point improvement in load factors to 78.7% while unit revenues fell by 2% in dollar terms. Cargo demand on the other hand fell by 3.5% in tonne kilometre terms on the back of capacity little changed on the year before, and cargo unit revenues slumped by a further 12%. Net profits for the nine months came in at ₩85bn compared with a loss of ₩810bn in the prior year period.

That net profit came after taking a ₩322bn impairment loss for Hanjin Shipping in the quarter — one of the world’s largest container shipping companies, and a sister company of Korean Air in the Hanjin chaebol, which went into receivership earlier this year. Total impairment and associate losses for the nine month period touched ₩795bn.

Korean Air bought a 33% stake in the company in 2014 and has invested a reported US$1.8bn since then in an apparently doomed attempt by the Hanjin Chaebol to survive in a cargo shipping market that has suffered from fierce competition and massive overcapacity over the last few years.

Diverse fleet

Korean Air’s fleet currently totals 161 aircraft and has a wide variety of types, comprising 40 737s, 38 777s, 29 A330s, 10 A380s, seven 747-400s and seven 747-8s on the passenger side, plus 16 747-400Fs, eight 777Fs and six 747-8Fs. On outstanding order are 82 aircraft — 30 A321neos, 30 737s, four 747-8s (one of which is a cargo version), six 777-300ERs, two 777Fs and 10 787-9s.

Most of the outstanding orders were placed in 2015, when Korean Air ordered 30 737 MAXs, two 777-300ERs and 30 A321neos — which was the biggest ever buying spree in the airline’s history. The A321neos will be delivered over the 2019 to 2015 period and the 737 MAXs from 2017, and they replace Korean Air’s eldest models among the current 737 fleet (the 40 aircraft have an average age of 10 years) and enable expansion on short-haul within Asia. On long-haul, the 787-9s were converted from an initial order of 787-8s in 2011 and the first delivery will arrive in early 2017.

In the third quarter of this year 60.4% of Korean Air’s revenue came from international passengers, with cargo contributing 19.0% and domestic passengers just 4.6%. The international share has risen by 3.2 percentage points in just 12 months and is an indication of Korean Air’s strategic priority — international capacity rose by 6.2% in Q3 2016 but traffic rose even faster — by 8.4% — leading to a 1.6 percentage point rise in load factor for the quarter, to 80.9%. In contrast, domestic capacity rose just 2.4%, though here too traffic increased at a faster rate — 8.4% — with load factor up 4.6% to 79.8%.

Most significantly, yield on international routes rose 6.1% year-on-year in the third quarter of 2016 to 8.4US¢, with domestic yield up 2.7% to 15.9¢ (though domestic revenue is a 13th the size of the international revenues).

Key markets

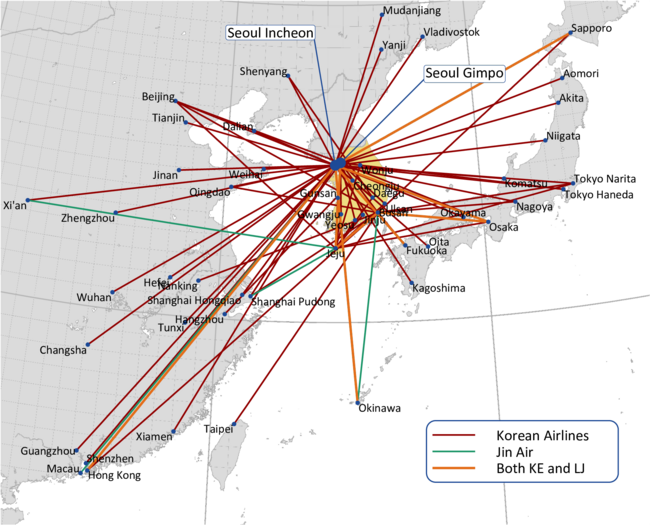

The most important overseas market for Korean Air is the Americas, where Korea-Americas routes accounted for 30% of total revenue in the 3rd quarter of 2016 — followed by south-east Asia (16%), China (15%) and Japan (11%). Revenue on routes into China are growing the fastest for Korean Air — up by 29% in July-September 2016 compared with the same quarter of 2015, with Sino-Korean Air traffic up 30%.

A five flights a week A330 route between Incheon and Delhi was launched in December this year (its second Indian route, joining a Mumbai service), and new routes for 2017 include one between Incheon and Barcelona from April, operating three times a week, and most likely a service between Incheon and Tehran — although a launch date has not yet been announced. On the other hand, two routes will be cancelled in February 2017: between Incheon and Jeddah (via Riyadh) and between Incheon and Siem Reap (Cambodia).

Given the importance of Americas revenue, the west coast of the US is a key target market for Korean Air, and extra services will be added to the existing routes between Incheon and San Francisco, Seattle and Los Angeles in 2017. This west coast expansion will be complemented by growing ties with fellow SkyTeam partner Delta. Although Korean Air already has codeshare deals with 35 airlines on more than 260 routes globally, in September 2016 Korean Air strengthened significantly its existing codeshare partnership on around 30 routes with Delta by adding codeshares on around 100 new destinations in the US and Canada and 30 destinations across Asia/Pacific region.

The two airlines have had a transpacific partnership for more than 30 years, but the expanded relationship will help Korean Air cement its position as the largest transpacific carrier out of the Americas — following the deal it operates more than 100 flights a week from 13 gateways in the US and Canada, comprising Atlanta, Chicago, Dallas, Honolulu, Houston, Las Vegas, Los Angeles, New York, San Francisco, Seattle, Toronto, Vancouver and Washington.

As part of the deal Delta will also launch a route between Atlanta and Incheon that will commence in June 2017 (and which will operate alongside an existing daily Korean Air service on the route) and add its code on flights operated by Korean Air in 32 cities beyond Incheon, as well as on Korean Air’s services between Incheon and Houston and San Francisco.

There has been speculation that the expansion of the relationship between Korean Air and Delta may lead eventually to equity stakes being taken in each other at some point. However, this seems a long way off at the moment and will depend largely on how Delta’s strategy develops under new CEO Ed Bastian. In the short-term though, this deal will certainly help Korean Air achieve better load factors on its flights into North America.

It is likely that Delta and Korean Air will move to create a transpacific immunised joint venture to mirror the ones established by American with JAL and United with ANA. Delta has been trying to put such a plan into effect with Korean for some years, but the agreement on these new code shares may bring forward a period of greater coordination. The two along with Air France set up a cargo joint venture in 2015.

Korean Air’s international routes primarily operate out of its hub operation at Incheon International airport, some 47km west of the capital and which has become the largest airport in South Korea since it launched in 2001 to partly replace Gimpo airport. In 2015 Incheon handled 49.3m passengers and 2.6m tonnes of cargo, of which Korean Air accounted for 15.4m passengers. This gave Korean Air a 31.4% share of passengers handled by the airport in 2015, reasonably ahead of nearest rival Asiana Airlines (23.2%). After that came a plethora of smaller airlines, with LCC Jeju Air accounting for 4.4% of passengers handled and subsidiary Jin Air for 3.6%.

Incheon is currently nearing the end of an expansion phase that will increase capacities to 62m passengers and 5.8m tonnes annually. This comprises a ₩4tn investment in a second passenger terminal, new cargo facilities and better ground transportation to Seoul, and is on target for completion in 2017 or 2018. Once operational, Korean Air and its fellow SkyTeam partners plan to move to this second terminal.

Another stage of expansion is expected to commence immediately afterwards, to be completed in the early 2020s. This will increase annual capacity to 100m passengers and 7m tonnes of cargo a year at Incheon, at which point it will have two more runways (bringing the total to five, including one dedicated exclusively to cargo operations).

One of the more interesting aspects of Korean Air’s base in Seoul is in its geographical position in relation to Japan, and Incheon’s positioning as a network transfer airport. Neither Narita nor Haneda in Tokyo are that attractive for transfer traffic; and in many cases Incheon provides more attractive connecting schedules from and to regional points in Japan.

Strategically Korean Air benefits from a having a huge global network — cemented by the SkyTeam alliance — but like all carriers it is facing the challenge of intense competition from LCCs. But Korean Air owns LCC Jin Air (see Aviation Strategy, November 2016), which is designed to reduce the pressure on Korean Air from the LCC segment that already has a 15% share of the international market to/from South Korea as at the end of the 3rd quarter of 2016.

The long-term importance of Jin Air to Korean Air is not clear, but an indication may be being given by the LCC’s transformation from a purely domestic airline to short-haul international routes and finally the launch of long-haul routes (in December 2015) using 777-200ERs. Although these have not yet replaced Korean Air routes; at least Jin Air provides a strategic option for its parent in the future.

Cargo troubles

The Korean Air group also has interests in other aviation and travel businesses, including hotels and aerospace (its unit collaborates with Boeing and others on defence systems) and most significantly cargo, where it is one of the world’s largest cargo operators.

In the 3rd quarter of 2016 Korean Air recorded ₩581bn ($533m) of cargo revenue, although this was 6.1% down on July to September of 2015, which is indicative of the huge competitive pressures in the cargo market at the moment. Korean Air’s cargo load factor fell by 0.6 percentage points over the 12 months to Q3 2016, to 75.6%, and more importantly yield plunged by 8.7%, to ₩257.7 (23.0¢).

Outbound cargo from South Korea fell by 6% in the 12-month period, and traffic between Korea and Europe remained flat year-on-year, while between Korea and Oceania it fell by 1%. The only good news was a 4% increase in FTKs between South Korea and the Americas (Korean Air’s largest cargo market, accounting for 43% of all revenue) — although with yields plunging, overall revenue on the American routes fell by 5% in Q3 2016 compared with Q3 2015.

The airline’s strategy is to improve profitability by “attracting high-yield cargo items” and “provide flexibility and reduce cost by using belly space of passenger aircraft”. Korean Air’s cargo fleet currently has 30 aircraft, and in September 2016 it announced a deal to sell and leaseback an order for five 777Fs, two of which remain to be delivered by the end of 2017.

Overall, Korean Air is managing to keep costs under relative control — total operating costs fell by 0.8% in the 3rd quarter of 2016, though this was largely due to a reduction in fuel prices, with fuel accounting for just 22% of total costs in Q3 2016 (₩586bn) compared with 27% (₩680bn) in Q3 2015.

Balance sheet

In terms of its balance sheet, Korean Air is relatively weak — as at the end of September 2016 it had cash and cash equivalents of ₩1.1tn ($984m) — less than 10% of annual revenues and 2.9% down on 12 months previously — while its total debt rose 3% in a year to stand at ₩16,1tn ($14.8bn). On our calculations this gives it a net debt (including capitalised operating leases) to shareholders' funds of 740%.

Its limited cash pile and poor liquidity does hold it back from making as many acquisitions as it would like — not that it has had huge success with that tactic. Korean Air bought a 44% stake in loss-making Czech Airlines in April 2013 for US$3.4bn, but although the Czech carrier returned to profitability in 2015 after drastic restructuring, the deal hasn’t brought any significant strategic benefit to Korean Air.

Korean Air has been listed on the Busan-based Korea Stock Exchange since 1966, with the Hanjin Group — a South Korean chaebol — owning around a 35% stake. The share price (see chart) has gyrated wildly in the past ten years and shown none of the performance generated from the fall in fuel prices in the last year. Today it has a market cap of around $2.3bn.

Part of the reason for this must lie with the very Korean Chaebol ownership system and Hanjin Group’s controlling stake. This traditional ownership structure involves a (family controlled) holding company with subsidiaries that have interlocking shareholdings, all designed to keep control within the family. This structure is not unique to South Korea but here it seems to be coming under increased criticism. The airlines’s management reputation has been tarnished by nepotistic scandals: Cho Hyun-ah, daughter of the airline’s CEO Cho Yang-ho resigned her executive posts at the airline and was imprisoned for endangering aviation safety after complaining about the presentation of macadamia nuts in first class service on a flight due to leave New York, causing the flight to be severely delayed.

| ₩bn | Dec 2015 |

| Equity | 2,499 |

| Intangibles | 295 |

| Shareholders’ funds | 2,204 |

| Cash | (1,079) |

| ST Debt | 6,030 |

| LT Debt | 10,138 |

| Capitalised lease rentals | 1,200 |

| Net debt | 16,289 |

| Total | 159 | 19 | 96 | |

| In service | ||||

|---|---|---|---|---|

| Korean Air | Jin Air | On Order | ||

| Passenger | 737NG | 40 | 16 | 2 |

| 737MAX | 30 | |||

| 777 | 37 | 3 | 6 | |

| 787-9 | 10 | |||

| 747-400 | 11 | |||

| 747-8I | 4 | 3 | ||

| A321neo | 30 | |||

| A330 | 29 | |||

| A380 | 10 | |||

| C Series | 10 | |||

| 131 | 19 | 91 | ||

| Cargo | 747-400F | 17 | ||

| 747-8F | 6 | |||

| 777-200F | 5 | 5 | ||

| 28 | 5 | |||

Note: Azimuthal equidistant map projection based on Seoul. Great circle routes appear as straight lines.

† 12 months to September