Airport Pipeline:

A Round-the-world tour

December 2015

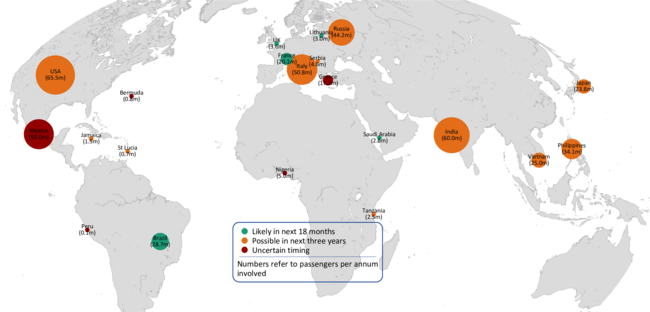

At this year’s Global Airport Development (GAD) conference in Amsterdam, there was a session outlining a pipeline of possible airport transaction deals expected round the world. The potential deals were presented in three categories: green to show those likely in the next eighteen months; yellow those probable in the next three years; and red those possible but uncertain (highlighted on the map). We reproduce the pertinent points here.

The likely transactions, some of which are already in process:

- France: following the success of the partial sale of Toulouse in 2015 (which according to the delegates at GAD was voted the deal of the year), both Nice Côte d’Azur and Lyon St Exupéry are shortly expected to be opened to concession investments, despite (in the case of Nice) significant local political opposition.

- Lithuania: the airports are up for sale to outside investors on a concession basis, despite the lack of a national or base carrier and notwithstanding the proximity to and competition with airports in Latvia.

- In the UK, GIP is in the process of eliciting bids for its investment in London City airport. It bought the stake in 2006 for an estimated £750m when the airport handled 2mppa. Now with a throughput of double that, and despite the constraints as a city centre STOLPORT and restrictions on expansion and growth, the sale prices rumoured suggest a valuation to EBITDA of heady proportions.

- Brazil is expected to start its third round of airport concession sales. The first attracted bids of atmospheric proportions. Given the somewhat weaker economic environment in the country it may not be so this time.

- At the smaller end of the scale Saudi Arabia is expected to conclude a PPP deal for Abha regional airport with a throughput of 2.6mppa.

The possible transactions in the next three years include:

- In the USA: a potential private involvement in development at LaGuardia, which once under way could lead to private redevelopment of Newark’s Terminal A. Meanwhile potential bidders for a land sale and retail development at Denver have apparently been identified. The US surprisingly perhaps has kept out of the trend towards airport privatisation — the only successful one being San Juan, with the attempts to sell Midway failing.

- In the Caribbean the World Bank is involved in various small projects to bring in private investors in Jamaica and St Lucia (while a similar project in Bermuda in North America, where the Government is currently reputed to be consulting with advisors, is a bit further away).

- In India there are plans for a new 60mppa airport in Mumbai in a PP transaction, while the next stage of airport privatisations are under discussion.

- In Italy there are ongoing sales expected of secondary airport stakes.

- In the Philippines there are plans for a medium term concession to upgrade Manila’s Ninoy Aquino International Airport through a PPP deal covering a current throughput of 34mppa.

- Russia is looking (despite recent failed attempts) to consolidate the shareholding, merge and privatise Sheremetyevo and Vnukovo airports.

- In Vietnam there are plans for a PPP to build a new 25mppa airport to serve Ho Chi Minh City.

- Serbia is looking to privatise the airport in Belgrade (now a "hub" for the Etihad Equity Alliance) via a long term concession.

- Japan is expected to start the process for private concessions for other airports after the success of selling Kansai to a consortium of Vinci and Orix (the sole qualified bidders). It was a little surprising that no other Japanese institutions were interested in that deal and the Japanese Government must be hoping that better interest can be generated in the next round.

- Looking at more risky deals, there is a possibility that Tanzania will be offering a private concession for the airport in Dar es Salaam.

Longer term more uncertain deals include:

- Greece: a possible resumption of plans to privatise a majority stake in Athens Spata. In spite of all the political upheaval in the past two years Fraport’s bid to acquire the portfolio of Greek regional airports appears now to have been finalised at what seems to be an EV/EBITDA multiple of around 18 times (respectably in line with recent good airport transactions but may be a bit high for constrained island and regional airports).

- Peru: a handful of regional airports slated for sale

- Nigeria: a PPP concession expected for a new 5mppa airport to serve Lagos.

- Mexico: Government may seek PPP investment at some stage for redevelopment in Mexico City.