WestJet: Canadian LCC diversifies into long-haul international markets

December 2014

WestJet, Canada’s JetBlue-style LCC, has diversified its strategy significantly in the past 18 months. It has moved aggressively to capture business traffic, launched a regional airline subsidiary and begun seasonal transatlantic operations with 737-700s. The Calgary-based carrier is now preparing to launch widebody operations, beginning with four used 767-300ERWs in the West Coast-Hawaii markets in late 2015, with Europe/Asia following in 2016.

WestJet is probably a good candidate for growth and network diversification. It has an impeccable profit record, a strong balance sheet and ample cash reserves. It has exceeded its 12% ROIC target for nine consecutive quarters. It enjoys a relatively low cost of capital, having in early 2014 become only the second airline in North America to be rated investment-grade (after Southwest; Alaska became the third in June).

WestJet has a unique people-focused culture, an award-winning product and a strong brand. It has high productivity and efficiency levels and great cost controls.

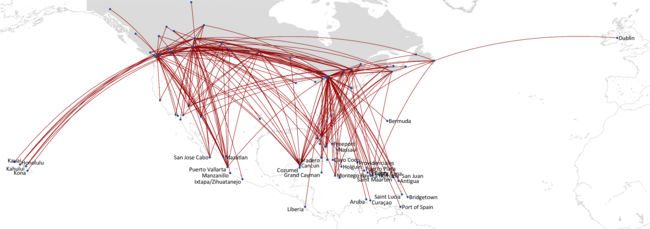

And WestJet needs new growth areas. It does not have the opportunities that US LCCs enjoy in being able to tap the huge US market for domestic and near-international expansion. It has already captured 40% of the Canadian domestic market. It is already a major player in the Canadian winter sun market to Florida/Mexico/the Caribbean. It has tested the Hawaii routes with wetlease operations and entered the key transborder business markets. Widebody operations and Europe/Asia are the next logical steps for the carrier.

But the new strategies pose many risks. First, they represent new areas of overlap with Air Canada. Competitive clashes between the two have escalated significantly in the past two years. As WestJet set up a regional subsidiary, Air Canada added regional turboprop operations. As Air Canada launched its low-cost unit Rouge for international leisure markets (July 2013), WestJet began seasonal transatlantic forays. As WestJet began tapping the business segment, Air Canada implemented successful cost cutting; the result of that has been a narrowing of the cost gap between the two airlines. According to Air Canada, Rouge has achieved 23% and 30% lower operating costs on A319s and 767s, respectively, than Air Canada.

Second, WestJet’s new strategies will help keep industry capacity growth in Canada well above the US market’s levels. Although WestJet plans to slightly moderate its ASM growth from 6.5% this year to 4-5% in 2015, analysts believe that its growth will accelerate in 2016.

Third, the cost of adding a new widebody aircraft type and destinations in new regions are likely to keep WestJet’s profit margins below those of US carriers.

Fourth, investors have questioned whether WestJet has got its capital deployment priorities right. Instead of expansion, should it not be raising its ROIC target and catching up with the US carriers’ levels?

Financial strength, some concerns

WestJet has been profitable throughout its 18-year history, except for a small operating loss in 2004. Between 2004 and 2008, WestJet’s ASMs almost doubled and its revenues surged from C$1.1bn to C$2.6bn. When recession hit in 2009, WestJet quickly reduced ASM growth to 2.6%, which helped it achieve a 9.2% operating margin that year. The past three years have seen the annual operating margin steady at around 11%.

The consistent earnings have enabled WestJet to maintain a healthy balance sheet. Cash amounted to C$1.4bn in September, 36.5% of trailing 12-month revenues. Adjusted debt-to-equity ratio was 1.49. ROIC in the 12 months ended September 30 was 13.8%.

But continued fleet spending has meant negative free cash flow, which is not likely to change anytime soon. Capex is projected to be C$820-840m in 2015.

Obtaining the BBB- credit rating with S&P has opened up attractive new debt financing options for WestJet. The first of those materialised in July: a private offering of C$400m of unsecured five-year notes that have an interest rate of only 3.3%. Being able to tap the unsecured market like that adds much flexibility to WestJet’s fleet financing plan.

But WestJet no longer stands out from the crowd in terms of financial performance. In the third quarter, six of the top nine US carriers had higher operating margins than WestJet’s 12.5%. Analysts believe that WestJet’s earnings growth will lag that of its North American peers in the next couple of years.

Capacity growth appears to be the main culprit. Industry capacity in Canada has increased at a faster rate, leading to a less favourable pricing environment (even as air travel demand has remained strong). While WestJet’s ASM growth has moderated, it still amounted to 11.1% in 2010, 8.5% in 2011, 4.1% in 2012, 8.6% in 2013 and around 6.5% in 2014.

Another negative this year has been the decline of the Canadian dollar against the US dollar (over 7% so far this year), which has increased WestJet’s aircraft leasing, maintenance and interest expenses. About one third of WestJet’s total costs are denominated in US dollars or linked to US$ indices. WestJet lacks the diverse foreign currency revenues enjoyed by Air Canada that would help compensate. And it could see demand weaken in the Canadian southbound leisure market because of the C$/US$ exchange rate.

There are also concerns about price wars in the Canadian southbound market this winter because of intensified competition. On those routes WestJet faces not just Air Canada’s Rouge but a revitalised CanJet, which has launched its own tour operator business and charter flights from Toronto to southern destinations.

However, WestJet’s earnings should soar in the near term because of the fall in oil prices. WestJet will benefit fully because it does not have fuel hedges in place.

That said, the effects of the oil price decline are more complicated for Canadian carriers, because the country is a net exporter of oil. The currency effects are a major negative for WestJet, but at this point the GDP impact seems minimal. A December 12 report from Royal Bank argued that an increase in non-energy related exports would offset the effects of lower oil prices. The report predicted that the net impact from lower oil prices in 2015 will be negligible in terms of real GDP and that GDP growth would amount to 2.5% this year and 2.7% in 2015. The report assumed WTI oil price averaging $70 in 2015.

WestJet has indicated that it will be revisiting the 12% ROIC target. It is committed to continued stock buybacks and dividends, but the bulk of the cash will go to funding aircraft deliveries. WestJet has US$6.9bn of aircraft commitments, including 65 737 MAX deliveries in 2017-2027. But the fleet plan has much flexibility built in (see table).

Cost and revenue measures

The combination of significant new cost pressures and a desire to tap the business and corporate travel segments has kept WestJet’s management busy implementing new cost and revenue initiatives.

The cost challenges arise from inflation across the board, the expense of adding new cities and aircraft types, the weaker Canadian dollar and the shorter stage lengths associated with Encore. The narrowing cost differential and increasing competitive overlap with Air Canada also call for special measures.

In 2013 WestJet initiated a new cost-cutting programme aimed at reducing annual operating expenses by C$100m by year-end 2015. It has already achieved a run rate of C$125m annual cost cuts, a year ahead of schedule. But ex-fuel CASM has still risen by 1-1.5% this year and is projected to rise by 2-3% in 2015.

Longer-term strategies to help keep unit costs in check include the substantial 737 MAX orders, a move into widebody operations and potentially increasing seating density following the installation of new slimline seats on the 737s. The seats are part of a major investment in new in-flight entertainment systems, including satellite-based Wi-Fi. Half of WestJet’s 737s will have the seats by the end of 2015, with the rest following in 2016.

The slimline seats will give WestJet a choice: either improving passenger comfort or getting a material unit cost reduction by adding six seats to each aircraft. This is because even though the seat pitch will stay physically the same, the new slimline seats “will give effectively an extra inch of knee room”.

Unfortunately WestJet is not ready to make that decision at the time of the slimline seat installation (which might be the most cost-effective time to add more seats). Instead, the carrier will wait and see how passengers respond to the new seats.

In recent years, WestJet has gone after the business and corporate segments quite methodically. First, in 2011 it made its schedules more attractive to business customers, especially in the Eastern Triangle linking Toronto, Ottawa and Montreal. Then came a multitude of product initiatives aimed at attracting business traffic or creating new ancillary revenue streams.

WestJet added premium economy seating with extra-legroom in the first three rows of aircraft in late 2012. The JetBlue-style product is sold for a fee at the gate or at a “Plus” fare in advance. “Plus” is the highest and most flexible of three fare bundles that were introduced in 2013.

Like other LCCs, WestJet is finding premium seating to be a good revenue generator. Demand has been strong, and the upgrade fee on long-haul routes was recently increased from C$45 to C$50. Revenues are running at the upper end of the C$50-80m target range.

Thanks to Plus, a co-branded credit card and other initiatives, ancillary revenues were up by 17% to C$51.4m or C$9.80 per passenger in the third quarter.

Recent months have seen important new revenue initiatives: a C$25 fee for a first checked bag and major improvements to the FFP. The latter included the introduction of rewards tiers and features such as “status match” to encourage Air Canada’s FFP members to try out WestJet’s programme.

In September WestJet fell in line with the US airline industry in charging a fee for a first checked bag. One complicating factor had been that Air Canada was not charging that fee domestically, but after WestJet’s announcement Air Canada quickly matched it. (In the US, JetBlue also added that fee in November, leaving Southwest as the lone holdout.)

WestJet’s bag fee applies to those traveling on the lowest fare bundle (Econo) within North America. There are plenty of exceptions. Only one in five passengers is affected, which could bring in up to C$100m annually. On top of that there will be the benefit of some people upgrading to the “Flex” fare category.

WestJet is committed to passing some of the benefits of the unbundling to passengers in the form of lower “Econo” fare sales, which also aim to stimulate demand. One such sale was launched immediately after the first bag fee announcement.

WestJet has many more revenue initiatives in varying stages of development that will boost ancillary revenues in the future. The most obvious ones are potential fees on Wi-Fi and inflight entertainment systems.

Growth plans

WestJet has a simple purpose: to be Canada’s low-fare leader, and to go where Canadians want to go (at least those are the aims that its executives frequently refer to).

Canadians definitely want to go the sun destinations to escape their harsh winter. The southbound leisure business will always be important to WestJet; after all, it is critical to the carrier’s seasonal aircraft deployment strategy (under which large chunks of capacity are shifted twice annually between the domestic market and the winter sun routes).

Those routes now have much competition and overcapacity, but WestJet is to some degree insulated from price wars in the package holiday segment as it gets more feed from its domestic network and carries more VFR, timeshare and second-home traffic.

The new wholly-owned regional subsidiary Encore, which WestJet launched in July 2013, is helping provide that feed, though a more noble purpose is to “liberate smaller communities from the high cost of regional air travel”. The Calgary-based unit has its own president, workforce and headquarters. WestJet chose the 78-seat Q800 turboprop over the ATR 72 for its unit and placed orders with Bombardier for up to 45 Q800s. Encore began operations in western Canada but now also serves points in the east. In October it operated 14 Q800s and over 100 daily departures to 19 destinations. Fleet is projected to grow to 25 aircraft by year-end 2015, and the 20 currently held options would deliver in 2016-2018.

WestJet considers the regional routes a “natural evolution”. Encore has stimulated demand with its low fares. About half of the 4-5% systemwide ASM growth that WestJet projects for 2015 will be at the regional unit.

While the business-oriented US markets are also important for WestJet, the carrier opted not to join its US LCC peers in bidding for the American-US Airways DCA slot divestitures. WestJet’s entry into LGA in 2012 was its first major foray into the Canada-US business market, and since then it has also added DFW to its network.

At DCA, and certainly in long-haul international markets, WestJet has long relied on airline partners. It has an “open architecture” type alliance strategy similar to those of JetBlue and Gol. It has codeshare agreements in place with 12 carriers, including Delta and American.

As an interesting twist to its network strategy, in June WestJet launched its own daily scheduled seasonal Toronto-Dublin services, operated via St. John’s (Newfoundland), a stop mandated by ETOPS rules. Those flights have been successful and will be resumed in May 2015, when WestJet will also launch its second transatlantic route, Toronto-Halifax-Glasgow. The latter offers passengers daily connections via Halifax or Toronto to/from 22 other WestJet cities in Canada.

Those services tap into the strong historical and ethnic connections between Canada and both Ireland and the UK. The markets have significant VFR traffic. And the drastically lower fares (up to 50% off existing fares) have stimulated much new demand.

WestJet has said that it sees potential to fly to four or five cities in Europe out of Atlantic Canada (probably mainly in the UK). But, mainly, it views these services as a useful learning experience in the European market as it prepares to receive its first widebody aircraft in mid-2015.

Under a July 2014 agreement, WestJet is either leasing or buying four used 767-300ERWs from Boeing. The aircraft are expected to seat 262 (including a version of Plus seating). After an initial run in North America for ETOPS approvals, the 767s will enter WestJet service in late 2015 for the winter season in the Alberta-Hawaii market, where they will replace two 757-200s currently operated by Thomas Cook. In the spring of 2016 the four aircraft will be launched in yet-to-be-specified international markets.

WestJet has said that it is considering various routes to Europe and Asia and that it will announce the 2016 destinations in mid-2015. It could be more UK cities, or Mediterranean or Asian sun destinations, avoiding the routes on which Air Canada has already deployed Rouge.

WestJet’s management has reportedly indicated that there could be more used 767-300ERs available from Boeing for further growth. But because of the riskier nature of long-haul international expansion and the tougher economics for LCCs, WestJet can be expected to grow in those markets at a measured pace.

| Fleet | Aircraft deliveries/disposals | Fleet | ||||||||

| Sep 2014 | Q4 2014 | 2015 | 2016 | 2017 | 2018-20 | 2021-23 | 2024-27 | Total | 2027 | |

| 737-600 | 13 | 13 | ||||||||

| 737-700 | 69 | 69 | ||||||||

| 737-800 | 27 | 3 | 10 | 7 | 1 | 21 | 48 | |||

| 737 MAX7 | 6 | 4 | 15 | 25 | 25 | |||||

| 737 MAX8 | 4 | 19 | 11 | 6 | 40 | 40 | ||||

| Disposals | -5 | -5 | -10 | -10 | ||||||

| Maximum 737 fleet | 109 | -2 | 5 | 7 | 5 | 25 | 15 | 21 | 76 | 185 |

| Lease expiries | -11 | -7 | -6 | -13 | -7 | -44 | -44 | |||

| Minimum 737 fleet | 109 | -2 | -6 | -1 | 12 | 8 | 21 | 32 | 141 | |

| WestJet Encore | ||||||||||

| Q400 | 14 | 2 | 9 | 5 | 16 | 30 | ||||

†Note: Analysts' consensus estimates (December 5, 2014)