FastJet: First mover in sub-Saharan LCC market

December 2012

Africa’s new LCC start-up, Fastjet, began operations on November 29th. Flying two A319s from Dar es Salaam in Tanzania to the two domestic destinations of Mwanza and Kilimanjaro, Fastjet carried nearly 7,000 passengers with an average load factor of 85% in its first week of operations. Fastjet has emerged quickly from the sub-Saharan region of Africa as it has been transformed from a software company to operating airline in just over a year.

Rubicon Diversified Industries (RDI) was set-up as a software company in 2006. In 2011, it disposed of its software assets, changed its name to Fastjet plc, following an AGM vote and aligned the company strategy to become an intra-African LCC. At the same time, the Africa-oriented conglomerate Lonhro felt that the value of its airline, Fly540, had been lost in the group’s diversified operations. In mid-2011 it began a process to realise Fly 540’s potential.

On 18th November 2011, RDI, now a cash shell, undertook a placing of 40 million new shares at 1 pence. Simultaneously, Lonhro became a 50% shareholder in RDI. At the same time, RDI reached an agreement with Sir Stelios Haji-Ioannou, easyJet’s founder, whereby he would be issued with 5% of RDI’s share capital, a further 10% option and a royalty fee in return for a ten year licence agreement, the passing over of the FastJet brand in 2022 and the provision of ongoing consultancy service. RDI then undertook a £9m capital raise in December 2011 in order to provide working capital for development of the business proposition. Lonhro then injected its aviation assets (two aircraft plus accumulated Fly540 losses) into RDI at cost. Lonhro agreed to value the RDI shares at 4.8 pence, which effectively meant that RDI shareholders acquired the Lonhro aviation assets at a material discount. Sir Stelios is providing three elements to the new vehicle – the Fastjet name; his time as a non-Executive Director and some ongoing consultancy services. In return he will receive

Potential

According to Daniel Stewart analyst Michael Campbell, “if the operator hits its target of having more than 10 A319s in operation in 2013 and is able to achieve a load factor rate of between 70% — 75% we expect the business should show a healthy profit for 2013.” The growth strategy proposed by CEO, Ed Winter, is in the short-term to have all three A319s fully operational in the coming weeks to cater for an anticipated holiday surge. As of now, flights to Kenya and Uganda are advertised as “coming soon” but already bookings for the existing Tanzanian routes are being taken into March 2013.

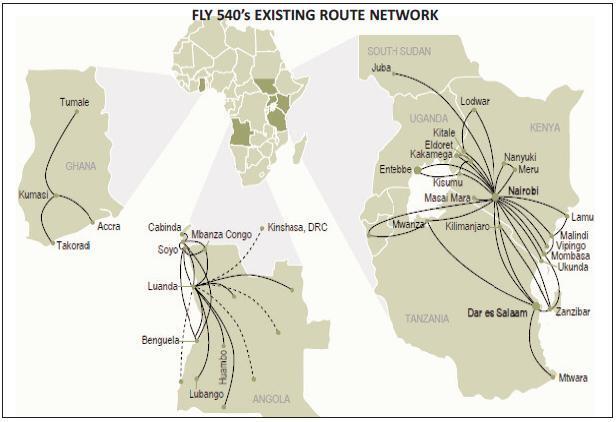

Fastjet’s ability to use Fly 540’s existing AOCs in Kenya, Tanzania, Ghana and Angola, means it can launch “new” routes and grow much more quickly than would usually be the case for a start-up, (see route network map, page 9). The existing network and the use of African political and business contacts, which Lonhro has been maintaining in Africa for over a century, means access to important politicians and decision makers, no doubt smoothing bureaucratic and administrative processes for Fastjet.

There is experience and historic LCC knowledge with the presence of Sir Stelios, Ed Winter, Richard Bodin and Angus Saunders on the board, which together with Stelios’ preference for return generation rather than market share gains should make Fastjet an attractive prospect for investors.

Fastjet should also be able to negotiate attractive supplier terms and conditions. The brand should enable Fastjet to achieve better terms and conditions with airports and employees; generate material free

The involvement and cooperation of Sir Stelios and easyGroup comes at a price, the NPV of his ten-year brand royalty payment is US$24m. The benefits of having Stelios on board though could be substantial – for example, a 5% “Stelios” discount on a future large aircraft order (say 200 units at a gross list price of $1bn) would deliver a further $50m of savings.

The African market

FastJet is launching into an area of huge market potential. The African air market is small, fragmented and under-developed, one seat per annum per 13,000 people compared to 2.5 seats per person per annum in the US. Demand ought to be driven by population growth, above global average GDP growth, an emerging middle class (350 million in 2011), air travel liberalisation and poor road and rail infrastructure. African countries have inefficient flag carriers or none at all. Departing seat capacity out of the Economic Community of West African States (ECOWAS) region is 100-times less per head of city population than daily departures out of London.

FastJet has early network optionality, it has AOCs and expansion opportunities in Ghana (an immature market), Kenya and Tanzania (where it will compete with Kenya Airways in a developed, competitive market) and Angola (a restricted market with Fly540 and a state-owned airline operating). FastJet believes that these existing markets are comfortably big enough to take at least 20 A319s.

Average fares are high in Kenya and Tanzania due to incumbent inefficiencies, high in Ghana due to lack of supply and high in Angola courtesy of its one state-owned carrier. Yields in these countries are usually over US$20 cents per kilometre and often over US$40 cents, a successful LCC will be aiming to emulate easyJet’s 2011 yield of US$9 cents per kilometre.

FastJet will, at least initially, lease its fleet – keeping control over the rate of expansion with a flexible delivery schedule reflecting market demand – with an expected 24 A319s operating by December 2014, rising to 30 by December 2015.

FastJet’s unit costs will initially be high going through the start-up phase but are expected to fall following the developmenttrend of successful LCCs. FastJet is estimated to incur ex-fuel unit costs of US$8.2-8.8 cents per kilometre (US$13.8 cents including fuel) in 2013, after which costs are expected to fall due to a fleet of low unit cost A319s, higher asset utilisation (5.5 rotations per aircraft per day), a drive for ancillary revenues and a shift towards internet booking.

A bonus for FastJet is the “first mover” effect, there are no established African LCCs and existing incumbents are either Government owned network carriers or operate small, high-cost regional aircraft. FastJet could effectively be the first “people’s airline”.

LCCs can generate good EBITDAR margins (easyJet’s around 24% and Ryanair’s at 36% from 1997-2001) by cherry picking high return routes (e.g. Ryanair’s Dublin to London), fighting different business models (network carriers) and inefficient work practices (e.g. labour terms and conditions). Two added peculiarities to the region may well work in Fastjet’s favour: there is a lack of seasonality, which should enhance margins and second, few airports have night curfews, which should enable better asset utilisation.

In December Fastjet announced it is currently in negotiations with the management, directors and provisional liquidator of 1time, the South Africa low cost airline that ceased trading last month. 1time’s fleet includes MD-82s, MD-83s and MD-87s, but according to Ed Winter, restructuring plans would see a rapid re-fleeting with A319s. With Board, parent company, and Regulatory approval there is a possibility that 1time will be bought quickly, rebranded and the existing South African network prove a timely and complementary fit to Fastjet’s pan-African strategy.

Striking further afield, Ed Winter has confirmed that Fastjet has been in preliminary talks with Emirates, to “potentially create a partnership”. Emirates currently flies to 24 destinations in Africa and Jean-Luc Grillet, Emirates senior VP in charge of commercial operations for Africa, has said: "We are willing to work with Fastjet. It is an independent carrier and that makes our work easy." Stelios and fellow board members will welcome these talks.

Clearly, there are risks involved for Fastjet; airlines are risky and Africa is risky. Political instability and competitor reaction seem to top the list.