Vueling Airlines: In the eye of a Spanish storm

December 2011

It has been a tough 2011 for Vueling Airlines — rising fuel prices, a Spanish economy in deep recession, stagnant domestic demand and increasing competition from Ryanair and other LCCs has resulted in significant falls in both operating and net profit for the first three–quarters of the year. Are there better times ahead for Spain’s third–largest airline?

Founded in 2004 and based in Barcelona, Vueling Airlines operates around 1,400 flights a week to 13 countries and 59 destinations, all but one of which are in Europe (the exception being Marrakech). Its domestic network covers 21 cities and it has seven bases in Spain: Barcelona, Seville, Madrid, Malaga, Bilbao, Valencia and – during the summer season only – Ibiza.

After merging with Clickair in July 2009 (see Aviation Strategy, November 2009), Vueling spent much of the following 18 months in what it calls a “consolidation mode”. In 2010 Vueling recorded a 66% rise in net profits to €46m, based on a 32% rise in revenue to €797m and a 35% rise in passengers carried to 11 million, thanks largely to the Clickair merger. The airline started to grow again this year, with its fleet increasing from 36 aircraft in the summer of 2010 to 50 today, accompanied by an increase in the workforce through 2011 of 400.

Indeed in the first three–quarters of 2011 Vueling recorded a 9.2% rise in revenue to €687.4m, of which 89% was ticket revenue and 11% ancillary revenue. During the period capacity rose 6.8% year–on–year — driven by new routes operated for Iberia and by new international bases — but this was outpaced by a 9.3% increase in traffic, resulting in a 1.7 percentage point improvement in load factor, to 75.3%.

Profits tumble through 2011

However, operating profit for January- September 2011 totalled €29.8m, compared with €67.6m in the first three–quarters of 2010, and this was due largely to a 41% rise in fuel costs, to €195.7m. Net profit fell similarly, from €50.4m in 1Q–3Q 2010 to €21.4m in January–September 2011.

Thanks to fuel prices, Vueling is having to work very hard to just to keep its overall costs level – in the third quarter of 2011 CASK rose just to Euro cents 5.81, comparable to the Euro cents 5.80 it recorded in the second quarter of the year. But this was achieved via a steep reduction in non–fuel costs from Euro cents 4.08 in 2Q to Euro cents 3.92 in 3Q (a 4% reduction in just one quarter), which negated a steep rise in fuel CASK from Euro cents 1.72 in 2Q to Euro cents 1.88 in 3Q. Looking at a longer time frame, fuel CASK has risen steadily each and each quarter from Euro cents 1.22 in 1Q 2010 to 1.88 in 2Q 2011. If that fuel cost keeps rising Vueling will pretty soon run out of scope for further non–fuel cost savings, and improvements in the Euro/Dollar exchange rate will not be sufficient to offset a further rise in fuel prices.

The good news is that fuel costs appear to be stabilising at the moment, and Vueling’s fuel hedging has had some effect in dampening down the effects of rising fuel prices through the year. As at mid- November 81% of Vueling’s fuel needs for the rest of the year had been hedged at US$884 per tonne, with 43% of 2012 needs hedged at US$980 per tonne.

Of course regardless of what happens to fuel, there have been and will be continuous cost–cutting programmes at Vueling. Alex Cruz — managing director of Vueling since 2009 (he was previously CEO of Clickair) — says cost–cutting is part of the “DNA” of Vueling, with no less than 75 separate initiatives through 2011. An initial target of taking out another €13m of annual costs by the end of this year was raised to €16.7m as 2011 progressed, and 98% of this improved cost savings target has already been realised, with Vueling saying that — crucially — almost all of these new cost savings are “sustainable and will be maintained”.

Stretching the business model

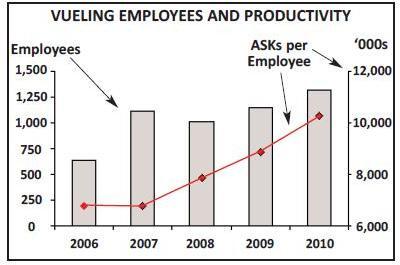

Beyond that though, how much more structural cost can be taken out is a debatable point. Although productivity has risen steadily over the last few years (see chart, right) and Vueling is a LCC, recently Cruz spoke about “breaking all the commandments of the low–cost bible,” whether it’s targeted services and products for business travellers, using landing bridges rather than buses to deliver passengers to aircraft, or operating mainly to primary airports.

While there is a strong leisure passenger focus, the airline has been targeting business travellers for the last few years, and Vueling’s latest business product is called Duo, which includes an in–flight snack and drink, an empty middle seat and preferential boarding. This joins Vueling’s go! and flex fares, which offer a more basic business product.

Vueling also has what it calls a “balanced distribution strategy”, with both direct web sales and indirect sales via travel agents. Fares booked on all offline distribution methods are 40% higher than fares booked online, and although costs are higher for offline sales the net boost from offline sales (compared with online) is still significant. Against that, however, needs to be considered the loss of ancillary revenue from offline sales (since almost all ancillary revenue comes from services booked through the Vueling website, despite the best efforts of Vueling to persuade offline channels to sell ancillary services).

As part of a growing emphasis on improving average revenue and increasing the airline’s attractiveness to business passengers, since 2010 Vueling has been improving its connection services for Vueling business (and leisure) passengers connecting onto other Vueling flights or to long–haul services at both Madrid and Barcelona. Naturally Barcelona is the priority, and since 2010 schedules have been adjusted to improve frequencies and connections, with a 55minute gap between connecting flights and with passengers being charged a €5 connecting fee. The trick of course is to do this without layering on too many additional costs, and Vueling insists that its network will continue to expand on a point–to–point network basis only.

The long–haul connections specifically derive from connection agreements with carriers such as Avianca and LAN, and Vueling says it is being approached for connection agreements by “a large number of airlines”. Vueling executives admit that this is straining the core skills of the airline, and so the prospect of joining any global airline alliance is distant at the moment.

Nevertheless, the connection policy has been successful, and in the third quarter of 2011 connecting passengers rose almost fivefold compared with the same quarter in 2010, rising from 75,000 to 369,000. Of those, 224,000 were connected from one Vueling flight to another, and 145,000 were connected between a Vueling flight and a service from another airline.

Iberia deal

At Madrid Barajas, Vueling’s presence has also been boosted by a temporary eight month contract won in April this year to operate seven Iberia routes (to Lanzarote, Fuerteventura, Malaga, Alicante, Majorca, Bucharest and Warsaw), which is part of International Airlines Group attempts to reduce the losses of Spain’s flag carrier on short–haul. As part of the contract Vueling sub–leased six A320s from Iberia, which were repainted with Vueling livery and which boosted Vueling aircraft stationed at Madrid to nine.

That deal was subsequently extended in the 2011/12 winter season, although all the original routes that Vueling operated were taken back by Iberia, with three new routes replacing them (to Amsterdam, Copenhagen and Berlin). As a result some of the aircraft borrowed by Vueling have been returned to Iberia.

However Willie Walsh, chief executive of IAG, says that using Vueling (as well as Air Nostrum) is not a “structural solution” to the challenges faced on short–haul at Iberia, as while it worked fine on routes where transfer and premium passenger numbers are relatively low, IAG is looking for a permanent solution that offers the greater “connectivity” needed by Iberia – which directly implies that attempts by Vueling to improve connections are nowhere near sufficient for the needs of the Spanish flag carrier.

Iberia has been in negotiations with SEPLA, the Spanish pilots union, during 2011 in an attempt to establish a low cost operation out of Madrid, but talks have proved problematical, and the return of all the summer routes operated by Vueling back to Iberia was seen as an attempt to placate the union and help persuade them to agree to new working practices at a low–cost offshoot. Nevertheless, in late November Iberia appointed Luis Gallego — previously chief operating officer at Vueling since 2009 — as chief executive of Iberia Express, the title of its new low cost short- and mediumhaul operation based out of Madrid Barajas that will begin services in March 2012 using four A320s owned by its parent, rising to a fleet of 13 by the end of that year.

Inevitably Vueling has found it harder (i.e. more expensive) to operate out of Spain’s largest airport than at Barcelona, with Cruz admitting that a hub–based operation “is a big step from all aspects frankly, from a culture perspective, IT systems, commercial, etc”. The Iberia routes are in addition to the seven routes that Vueling already operates out of Madrid, including Paris and Rome. Just 3% of all Vueling passengers flew through Madrid in 2010, although that will rise to 6% or more this year thanks to the services for Iberia.

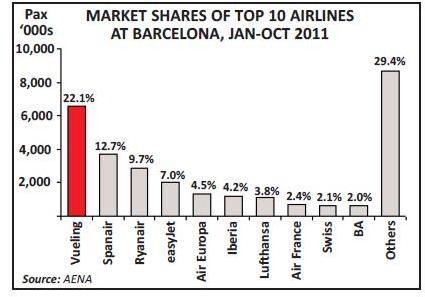

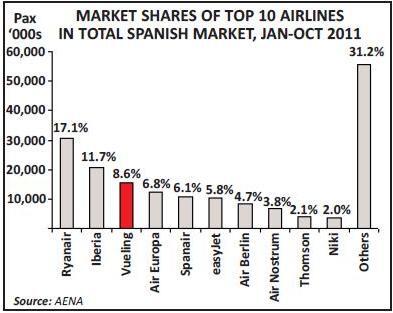

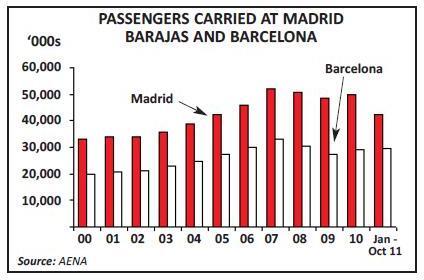

Nevertheless, Barcelona will remain the key priority for Vueling. The airline has a 22.1% market share at Barcelona El Prat (see chart, above), and Vueling’s (and other airlines’) growth at Barcelona means that airport is slowly but surely catching up with Madrid Barajas in terms of importance within the Spanish market. As can be seen in the bar chart, (on left), the gap in terms of passengers carried is closing, and the table, (see page 14), reveals that in just three years passengers carried through Barcelona expressed as a percentage of those flown through Madrid has leapt by 10 percentage points, from 60% to 70%. Indeed in each of the two most important markets – domestic routes and Spain–Europe – Barcelona airport has closed the gap with Madrid Barajas by 13% over the last three years. Although Madrid has slightly widened the gap with Barcelona in terms of long–haul services, it’s no exaggeration to say that the day when Barcelona becomes more important as an airport than Madrid Barajas is not impossible to contemplate.

At Barcelona, over the winter season Vueling is adding five new routes, including to Copenhagen and Aalborg. A Barcelona- Cardiff route will launch in March 2012, operating three times a week; Vueling also operates to London Heathrow and further routes into the UK are likely to be announced next year. A number of other routes have been cancelled though, including between Barcelona and Jerez, and from Seville to La Coruna and London. Overall capacity this winter will increase 8%, with international capacity up 16% and domestic just by 1%.

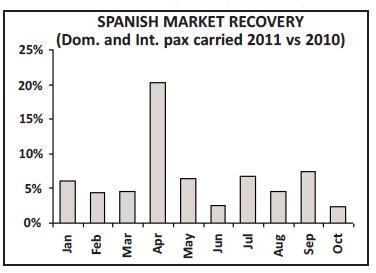

That imbalance comes about because it has been a difficult year for all Spanish airlines domestically given the poor Spanish economy, and Cruz has admitted that the beginning of the year was “very weak”. Although the overall numbers of passengers carried in the Spanish market is recovering well in 2011 (see chart, right), the disparity between domestic and international traffic is significant, and poor domestic demand is being exacerbated by overcapacity on certain internal Spanish routes. Indeed domestic passengers carried at Vueling were up just 1% in January- September 2011, compared with a 10% rise in passengers carried on international Vueling flights.

Hence Vueling’s focus on expansion of European routes. The airline’s first venture into operating bases outside of Spain came in 2007, when it opened an operation at Paris Charles de Gaulle, though this was closed down the following year prior to the merger with Clickair. But it tried again by opening bases at Toulouse–Blagnac and Amsterdam Schiphol in April 2011, and in both of these markets, in the third quarter of 2011 60% of passengers originated in the foreign country (rather than Spain).Vueling is also looking to open other bases outside of Spain (Paris Orly is being considered, subject to being able to acquire sufficient slots), although all the indications are that Vueling will be relatively cautious in its overseas expansion strategy for the moment.

Order due soon

Vueling operates a fleet of 49 A320s and a single A319, all of which are on operating leases and which have an average age of nine years. Earlier this year Vueling said that it would continue to operate an exclusively leased fleet for another two or three years, but after then date it would gradually introduce owned aircraft.

An order for new aircraft will be placed in the first quarter of 2012, with the first aircraft arriving in 2013 or 2014 to replace aircraft as their leases expire. Although there are hints of a large order, it’s also possible that the initial order may be for a smaller amount of aircraft, as Vueling may remain cautious in its outlook given its relatively poor performance in 2011. And though Boeing aircraft will be under consideration, Vueling is much more likely to place an order for Airbus models, although the Bombardier CSeries is apparently also geing analysed. Whatever the model, those new aircraft will be acquired through finance leases and sale and leasebacks, with a target of 50% of the total fleet being under non operating lease structures by 2018.

Looking to the future, Vueling originally said the Iberia deal would help the airline achieve a 15% rise in passengers carried this year (with most of this growth out of Madrid), but this forecast has now been revised down to 10% thanks to higher fuel prices, with a forecast 6% rise in ASKs in 2011. RASK and cost per ASK (excluding fuel) in 2011 are likely to be similar to 2010, but because of the hike in fuel costs, while Vueling is on target to make an operating profit in 2011 this will be much reduced compared with 2010.

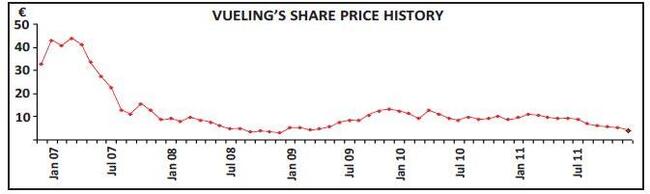

The pressure that Vueling is under this year has continued the airline’s poor run on the stock market. After an IPO on the Madrid stock exchange in December 2006, apart from a brief period at the start of 2007 the share price has been drifting steadily downwards ever since (see chart, above). During 2011 the share price has more than halved, and as at late November the price of €4 gave Vueling a market cap of €120m. That won’t worry 46% shareholder Iberia too much, but perhaps what is of more significance is the fact that as at the end of September 2011 cash and cash equivalents had fallen to €28.8m, compared with €63.9m just three months earlier and €121.3m at the end of 2009. On the other hand long–term liabilities rise to €185.9m at the end of September 2011, compared with €165.1m at the end of 2Q and €127.7m at the end of 2009. The cash and liabilities figure are by no means at levels that cause undue concern, but the downwards movement in cash and the upwards trend in liabilities are unwelcome trends.

The biggest challenge of all to Vueling comes from Ryanair, which opened a base at Barcelona airport in September 2010, to add to existing competition from easyJet and Spanair. Ryanair also operates from two Catalan airports – Reus (south of Barcelona) and Girona (north of the city) – but the El Prat operation has put real pressure on Vueling, with Ryanair now having built up a network of 28 routes there, of which eight are in direct competition with Vueling services. Thanks to this move, plus its many other Spanish routes, Ryanair is now the leading airline in the Spanish market (see chart, left), leaving Iberia far behind – although Vueling is in a very respectable third place in terms of passengers carried.

The long–term aim for Vueling remains to increase its revenue and passenger base substantially — and potentially be on the look–out for acquisition opportunities — but until the Spanish economy improves the airline will continue to battle through a tough period where the main focus will be to maintain profitability in the face of adverse external threats.

(Jan-Oct 2011 pax by flight country of origin/destination)

| Madrid Barajas |

Barcelona | Barca as % of Mad Jan-Oct 2011 |

Barca as % of Mad 2008 |

|

|---|---|---|---|---|

| Domestic | 14,668 | 10,722 | 73.1% | 60.3% |

| Europe | 18,397 | 16,694 | 90.7% | 77.5% |

| North America | 2,636 | 843 | 32.0% | 36.9% |

| Latin America | 4,761 | 211 | 4.4% | 16.1% |

| Other long-haul | 1,939 | 1,038 | 53.5% | 56.6% |

| Total | 42,401 | 29,508 | 69.6% | 59.5% |