2012: A muddled outlook

December 2011

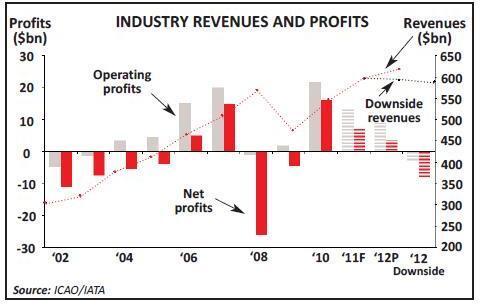

IATA recently published its latest financial forecast for the airline industry. Unusually the trade group has not altered its forecast for industry profitability in the current year – still expecting the airlines worldwide to return net profits of some $6.9bn in 2011 (a little less than half the 2010 level). It has however reduced its forecasts for 2012 to show net profits for the industry halving again to $3.5bn. In addition, because of the uncertainties on the global economic front, it has called this its central forecast, and introduced a downside scenario under which it suggests that the industry would again slump into losses – in excess of $8bn – felt across all regions, but none more so than Europe, which would be expected to account for more than half of the total net losses.

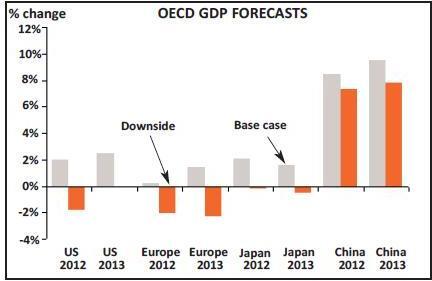

IATA appears to base its downside case following the recent analysis and medium term outlook from the OECD. In this, the Inter–Governmental forum highlighted the extreme uncertainties in global economies, emphasising not only the current unpredictability of the possible outcomes of the crisis in the Eurozone but also those relating to fiscal policy in the United States. It has named its central economic forecast a “muddling through” projection, in which “disorderly sovereign defaults, systemic bank failures and excessive fiscal tightening are assumed to be avoided”. Under this base case the Euro area may encounter a mild recession in 2012 (or might just be able to avoid one) before seeing a recovery in 2013, while the US could see reasonable 2% GDP growth in 2012 accelerating slightly in the following year; but with global growth subdued in the OECD economies and below trend in the major emerging market economies. The downside scenario from the OECD is far more pessimistic. Should the Eurozone experience a full–blown and cascading banking crisis, and this is combined with the assumption that the US retain its restrictive fiscal policies currently enshrined in legislation, both areas could enter another period of lasting recession and drag performance in the rest of the world down further. The OECD estimates a resulting impact of slower world economic growth in the order of 1.8% in 2012, with the US, Euro and Japanese economies showing GDP growth some 3.8%, 2.25% and 2.2% respectively below central case forecasts for 2012. It would even expect China’s rate of growth to be affected – down by 1.1% and 1.7% against base case assumptions in 2012 and 2013.

Although there are distinct signs of China’s economic growth rates waning, most pundits appear to believe that the country will avoid a “hard landing”, with the expectation that recent fiscal easing will be followed by another round of stimuli to maintain the rate of economic growth at the 8–10% level. If this weren’t depressing enough, other risks are surfacing and there are signs appearing of protectionism and trade–war tensions: with a row developing perhaps between the US and China over the latter’s introduction of taxes on the import of SUVs and other high fuel capacity motors; while closer to home there are increasing indications of intentions for tit–for–tat measures against the EU’s unilateral introduction of aviation into the European ETS from January 2012 (while the result from the legal challenge before the international courts is unlikely to be decided before July next year).

IATA’s central case scenario for the industry assumes a global increase in passenger traffic of some 4% in 2012, flat freight performance, no change in yields (passenger or cargo) and world economic growth of 2.1%. At the same time it assumes fuel prices through 2012 to average $99/bbl (from $112/bbl in 2011). Even on the central case for the world economy, the yield assumption appears to us to be a little optimistic – although premium traffic has been holding up in the run–up to the end of the year, there is likely to be softness in the early part of next; while current pressures on fuel stocks along with continued problems in the Middle East suggest that the fuel price assumption may be a little below possible levels (even the OECD “muddle through” case is assuming Brent crude averaging $110/bbl in 2012, while other forecasts are proposing a return to nearer $130/bbl through the year). As a result the central case from IATA may be a little optimistic. The group’s downside case is based on world economic growth of a mere 0.8%, no growth in passenger demand and a 4.7% decline in cargo, combined with a 1.5% fall in yields in both segments and a fuel price averaging $85/bbl.

This downside scenario may not cover the big risk: the shock to the system of a full blown banking crisis would surely have a greater impact on world trade (the OECD’s downside case assumes a 5.5% reduction), which as in 2009 could have a substantive downward pressure on air freight volumes and premium demand; and the airlines would all be falling over themselves to pay passengers and packets to get on board. Further, IATA states that its forecast for the Asian area assumes supportive elements from strong domestic performance in China; but then this could be undermined should the Chinese economy not avoid a hard landing next year.

The OECD and IATA notes were each published before the recent summit meeting of European leaders put together to attempt to provide a credible swift resolution to the region’s woes. Although the resulting “Merkozy” plan may work, and the individual Eurozone nations may be able to enshrine the fiscal rules the summit called for within primary legislation fast enough to create credibility, the ECB is steadfastly refusing to wander from its legal brief and buy sovereign bonds. It will only lend to banks to enable them to do so – i.e. increase their exposure to sovereign debt of countries facing credit rating downgrades at a time when their own balance sheets are strained and they may be forced to mark such sovereign assets to market, further increasing their need for equity. It will not do much to improve inter–bank liquidity which is what is really needed. As Fitch Ratings stated (the third largest of the ratings agencies), as it put six of the Eurozone countries' debts on negative watch, a comprehensive solution may well be “technically and politically beyond reach”. This may then significantly increase the likelihood of the implosion of the Euro towards the Allemano–Franco core.

The saviours for the world economy may lie in the emerging markets. The last decade has seen a continual shift in favour particularly of the BRICs, and this extended crisis in Europe, and possibly the US, is only exacerbating the trend and perhaps bringing forward the day that China becomes the world’s largest economy. However, the exports of these countries need end consumers for their products; and if the developed economies cannot buy, they will have to develop domestic consumption.

Here they are helped by demographic trends in the development of their own middle class – defined broadly as those who have more than a third of their income available to spend after necessities. In 2010 it has been estimated that there were around 160 million Chinese middle class – the second largest such behind the USA but just a little over 10% of the population – and it is assumed that this group is now starting to grow exponentially. By 2020, it has been estimated that the middle class in China will account for over 40% of the population (nearly 600 million people and more than the total EU population), and rise to 70% (1 billion people) by 2030.

Some economists have argued that spending also increases exponentially once GDP per head breaches the $6,000 level (on PPP). Middle class consumption in Asia/Pacific has been expected to grow from 23% in 2009 to 43% of the world total by 2020. China reached this level of per capita GDP in 2008 and according to IMF figures is likely to see this doubled by 2015, going through the $10,000 mark in 2012 or 2013 – and for aviation propensity to travel by air increases dramatically once above this level; even after recent growth the Chinese propensity to travel by air is still only around the world average of 0.2 trips per head per year, and as long as internal and outbound travel restrictions be eased there is the opportunity for major growth in outbound tourism.

Meanwhile, the outlook for 2012 through the crystal ball is pretty opaque — but we will still have a go at some predictions:

- Greece leaves the Euro. This will escalate pressure on the other ClubMed countries in Europe to do likewise and confirm the feared banking crisis and a disorganised recession. Ryanair and easyJet and other LCCs will make a killing on supplying pent–up demand for cheap holidays.

- One of the Gulf super–connectors – in fear of maturing organic growth of their models – will buy a European airport to provide FBO fifth–freedom hub services on the Atlantic and generate squeals of protectionism from the major European legacy carriers.

- LATAM finally decides which alliance to plump for. Do they really care? Star, oneworld and SkyTeam may do — but they will have to prove their case.

- Spain restarts the privatisation of Aena. Portugal keeps the taps on TAP privatisation.

- British Midland finally gets sold to British Airways aka IAG with EU Commission collusion. Virgin left in the cold again (Etihad having preferred airberlin). Lufthansa still loses money on the deal.

- EU rescinds inclusion of aviation in the European ETS under pressure and in face of retaliatory measures from the rest of the world (OK that is perhaps a wish for a feeling of schadenfreude – but the levels of compensation would be interesting).

- China really starts buying infrastructure assets in Europe.

- The airline industry muddles along as usual.