Investors seeking airports

December 2010

Dublin was the venue for the latest GAD “Investing in Airports Summit” where the elite of this sector’s investors and financiers were invited to assess future industry trends as well as observing at close quarters the impact of Ireland’s property/construction/ banking collapse.

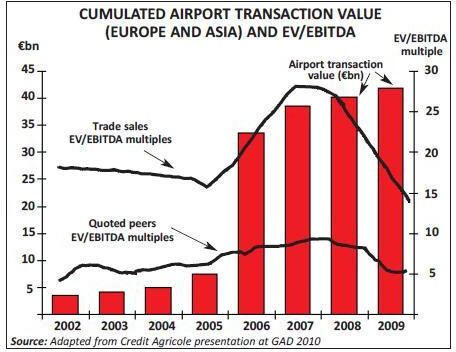

The trend in privatising, buying and selling airports has tailed off abruptly post–Lehman – the graph below, compiled from data presented by Gherardo Baruffa of Credit Agricole, shows that 2005–07 was the peak of airport acquisition process, with €31bn of assets bought and sold over three years. Pricing was exhibiting bubble–type tendencies by 2008 with EV/EBITDA multiples reaching around 28 for majority stake transactions, while debt/EBITDA leverage hit 15. Today the equivalent ratios would be around 14 and 8. The only significant transaction in 2010 was YVRAS’s purchase of Peel Airport Group (Liverpool plus two smaller airports). Simon Morris of LeighFisher speculated that state capitalism has taken over – a market in which airport deals were mainly made between state or quasi–state entities.

Yet the impression from the banks was that they were very willing to come back into commercials transactions, naturally under different deals structure conditions and under different pricing terms (150–250bps, twice the boom–time margin, for senior debt, according to Arturo Ricio of HSBC). The question is: where are the deals going to come from?

Nothing seems imminent, but there is a wide range of possibilities. In the UK the Competition Commission–driven break–up of BAA will eventually come through with the sale by Ferrovial of Stansted plus Glasgow or Edinburgh. The French regional airport process appears to be moving forward in a Gallic manner. In the US, however, the process that stalled with the failure of the financing for Chicago Midway seems to have stopped altogether (with the one exception of Puerto Rico). By contrast, there are a number of projects emerging in Eastern Europe, Russia and the CIS. More speculatively, Japan’s regional airports, of which there are about 90, could be privatisation targets as part of the process of liberalising the domestic aviation industry. Greece, desperate for funds, is looking for mechanisms to first corporatise, then sell its 30–plus regional airports.