New entrants end regional jet and turboprop duopolies

December 2009

Following the exit of several manufacturers in the 1990s, the regional jet and turboprop markets have both become duopolies: Bombardier and Embraer in the former category and ATR and Bombardier in the latter. But — at long last — the grip these companies have on the regional jet and turboprop markets is set to be broken.

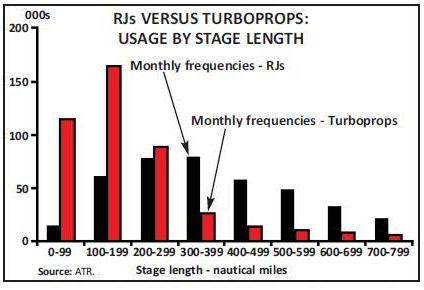

The markets for regional jet and turboprop aircraft have experienced varying fortunes in recent years. At the beginning of this decade there were some in the industry predicting the demise of turboprops altogether, since the aircraft had a reputation for providing a somewhat “agricultural”, noisy flight experience.

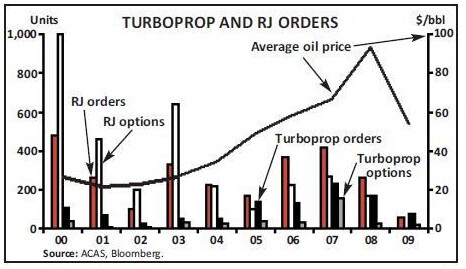

However, the rise in fuel prices since 2004/05 and the advent of an improved passenger experience aboard the likes of Bombardier’s Q400 and the ATR–500 series of turboprops has led to a revival in the type. The rejuvenation of the turboprop segment over the past decade is illustrated in the chart below, where turboprop orders have increased as oil prices have risen.

As a result, the turboprop market — currently controlled by Bombardier and ATR — may be boosted by Embraer, which is contemplating re–entering a market that it vacated at the beginning of the decade following the end of the production run for the Emb–120 Brasilia.

As for regional jets, the sector has evolved from the smaller 40–50 seat Embraer ERJ 135/145 and Bombardier CRJ 100–700 models into larger variants that can seat close to 90–100 passengers. For example, Embraer’s ERJ–145 (which was particularly successful in the North American regional marketplace) has now been replaced by the E–Jet family, which seats between 75 and 100 passengers.

Despite this shift in focus towards larger aircraft, regional jets have largely been ignored by the key driver of growth for short–haul flights — the LCCS. Rather worryingly for RJ and, to a lesser extent, turboprop manufacturers, almost all the major LCCs around the world have opted for A320 family and 737NG aircraft rather than purchase regional models.

Optimistic manufacturers

Southwest, JetBlue, Gol, Ryanair, easyJet, Wizz Air and AirAsia have a combined fleet of more than 1,200 aircraft and outstanding orders and options for a further 1,100 aircraft (accounting for a significant portion of the backlog for Boeing and Airbus) — yet of these only JetBlue has ordered either RJs or turboprops (see table, page 6). Yet while disappointing for the RJ manufacturers, this has not dampened their optimism since the core underlying demand for RJ aircraft from non–LCC regional airlines appears solid, and the table on page 9 shows the outstanding orders and options for the various new entrants/manufacturers in the RJ and turboprop sector. Indeed the overall market is so buoyant that the surviving RJ incumbents — Bombardier and Embraer — will soon face a situation where the number of RJ manufacturers may return to the number that existed in the 1990s, through the emergence of up to four new RJ producers based in Russia, China, Japan and The Netherlands. With three of the new entrants (China’s ACAC, Russia’s Sukhoi and Japan’s Mitsubishi) likely to garner significant home market support, this may leave a smaller market for the remaining competitors.

Over the next few pages Aviation Strategy takes a look at the prospects for the main RJ and turboprop types.

- Bombardier C-Series

Bombardier launched the C–Series at the Farnborough Air Show in 2008, during the middle of the current economic downturn and without a firm launch customer, although Lufthansa eventually confirmed a deal for 30 units of the 110–130 seat RJ, intended to replace the BAe 146 in its SWISS subsidiary. The C–Series is remarkable in that it will be the first aircraft to employ Pratt & Whitney’s PW1000G geared turbofan (GTF), which P&W is hoping will replace conventional turbofan engines. The C–Series fuselage will borrow heavily on the 787 design philosophy, with advanced composites being employed on 46% of the aircraft, and this is expected to result in a 20% fuel burn advantage over current aircraft and up to a 15% improvement on operating costs.

Bombardier believes that the 100 to 149–seat segment of the market is the “cornerstone” of today’s mainline fleet and represents the next large market growth opportunity for airlines. There are currently 5,600 aircraft in service in the 100–149 seat category and Bombardier believes this will rise to 8,600 over the next 20 years. This market had formerly been populated by aircraft such as the DC9/MD–80 and 737 classic families, which were replaced (in the case of the 737) with larger capacity derivatives (737NG) that are optimally engineered for the 150–190 seat segment. Despite the introduction of the 737–600 (and A318) to cater to the smaller scale of the segment, the operating economics of that aircraft type have proven to be unattractive to airlines. But with the C–series able to carry 110–130 seats in two class configuration, Bombardier will find itself competing with Airbus’s highly successful A319 and Boeing’s 737–700.

Bombardier’s encroachment into the low end of Airbus and Boeing territory with the C–Series may be seen as a natural development considering that the president of its commercial aircraft business is Gary Scott, who was very influential in defining the 737NG family at Boeing.

Bombardier is optimistic about the future for the C–Series, and the replacement market that it is targeting is shown in the table, right. Bombardier even believes that it can still capture market share in Russia alongside the state–sponsored Sukhoi Superjet 100 (SSJ). According to Bombardier’s representative in Russia, the Russian market for RJs will be close to 400 units over the next 10 years, and Bombardier is hoping that the fact it can also offer airlines a turboprop offering (Q400) in addition to RJs will be a strong selling feature. However, there is little if any type rating commonality between its RJs and turboprops, and Sukhoi — as part of the larger Russian parent company United Aircraft Corporation (UAC) — will also be able to offer customers products ranging from the Superjet through to the upcoming (2016) UAC MS–21 narrowbody aircraft designed to replace the Tupolev 154 and 204 and compete head on with the 737NG and A320 family.

- Embraer E-jets

The Embraer E–Jets series (E170–E195) entered into production in 2000, and more than 600 of the type have been manufactured to date. Embraer is already currently considering options for a replacement model, which could consist of new engines on the current platform or a possible move upwards into the 150- seat segment (which would catapult it directly into the path of Airbus and Boeing). A decision is expected to be made in the next 12–18 months.

- Sukhoi Superjet 100

Russia’s Sukhoi Civil Aircraft was the first jet manufacturer in an emerging economy to announce plans to compete in the jet market segment. The maiden flight of the Superjet 100 (SSJ), formerly known as Sukhoi Russian Regional Jet (RRJ), took place in May 2008, and following successful completion of factory flight tests in October 2008 the first delivery to launch–customer Aeroflot is expected to take place in the next few months.

Sukhoi produces both military and civil aircraft and is 99.7% owned by the Russian aerospace holding company United Aviation Corporation (UAC). The Putin administration has invested considerable political and financial capital into the merging of the disparate entities of the ‘Soviet’ aerospace sector into UAC, and the SSJ — like China’s ACAC ARJ21 — should be seen as a first step to gaining global market traction in the build–up to the production of the Irkut MS–21 140- 190 seat A320/737 competitor around 2015/2016.

The Sukhoi civil aircraft subsidiary, which manufactures the SSJs, is 25% owned by Alenia Aeronautica of Italy, while a sister entity called SuperJet International is owned 49% by Sukhoi and 51% by Alenia. Superjet International is responsible for marketing (and customising) the aircraft to Western and all other global markets, as well as providing training and worldwide after–sales support and services; these have traditionally been the areas that have prevented Russian aircraft from gaining more traction outside of home markets.

Sukhoi also aims to piggy–back on ATR’s global network, and its “blue chip” supplier involvement should provide considerable credibility to the Superjet programme.

The aircraft is produced in two key variants — the smaller SSJ 100/75 (78 seats) and the larger SSJ 100/95 (98 seats) — plus VIP and cargo versions of the Superjet 100. The Superjet is expected to have a 10–15% operational cost advantage over its closest competitors from Bombardier (CRJ) and Embraer (ERJ) and an enticing list price of $28m. Currently, the SSJ has generated 143 orders and 80 options, mostly from Russian customers, and Sukhoi hopes to sell approximately 700 of the aircraft in North America, Europe, Latin America, Russia and China.

While there has been a delay in the programme of approximately one year, it is believed that the contract Sukhoi has with launch customer Aeroflot contains fairly punitive late delivery penalties as well as fines for failing to meet acceptable quality standards. Ingosstrakh Investments has estimated that the total penalties for both late delivery and failure to meet performance requirements could be up to 20% of a total contract size of approximately $800m.

Sukhoi is also contemplating whether to introduce a larger, stretched version of the SSJ 100, which would catapult them firmly into the part of the market that Bombardier is aiming at with the smaller version of its upcoming C–Series.

- China’s ACAC ARJ21

With its ARJ21, China’s AVIC I Commercial Aircraft Company (ACAC) is the second new entrant into the regional jet market. ACAC, based in Shanghai, is a consortium of six companies and aerospace research institutes formed in 2002. It includes the Shanghai Aircraft Research Institute, the Xian Aircraft Design and Research Institute and several aerospace companies: Chengdu Aircraft Industry Group, which is responsible for the construction of the nose; Shanghai Aircraft Company, which will carry out final assembly; Shenyang Aircraft Corporation, which is manufacturing the tail unit; and Xian Aircraft Company, which is responsible for manufacturing the wings and fuselage. General Electric is supplying CF34–10A engines for the ARJ21; the CF–34–10 has been around since 2002 and is used on Embraer’s ERJ 190/195 models.

ARJ has stated that it has more than 200 orders for the ARJ21, although some are LOIs or MOUs. The launch customer is a subsidiary of Shenzhen Airlines called Kunpeng Airlines which, in December 2007, signed a firm order for 50 ARJ21s, with options for 50 more. Kunpeng is due to receive its first ARJ21 by the end of 2010.

ACAC has also signed a deal with China National Aero–Technology Import and Export Corp to help market the aircraft overseas, although it is difficult to see this aircraft gaining much traction without a parts and support network in place. The first foreign company to place an order was GECAS, with orders for five of the type and options for 20 more.

From a design standpoint the ARJ is not particularly innovative, using what will essentially be 10 year old GE engines on an airframe with a striking resemblance to the outgoing 717 (itself a derivative of the MD80/DC9 aircraft dating back to the 1960s).

However, as plans were unveiled at the Asian Aerospace Expo in Hong Kong in September 2009 for a new narrowbody aircraft called the C919 in the 130–200 seat segment, the ARJ–21 can be seen as a stepping stone for Chinese aviation. The success or failure of it should be measured not solely on numbers of units sold, but also on the lessons learned from the model that can be incorporated into other programmes such as the C919.

- Japan’s Mitsubishi MRJ

Mitsubishi Heavy Industries (MHI) is entering the regional jet marketplace with its Mitsubishi Regional Jet (MRJ), which will be the first Japanese–made passenger aircraft since production of the turboprop YS–11 ended in 1973. MHI established Mitsubishi Aircraft Corp as a joint venture with Toyota, Mitsubishi Corp, Mitsui, Sumitomo Corp and the Development Bank of Japan in April 2008, with a capitalisation of ¥3bn (US$30m) — with a plan to increase the capital to ¥100bn as operations develop.

The MRJ is still in the development phase, with the first aircraft likely to be delivered in 2013. MHI is aiming to make the MRJ around 20% more efficient than the currently–produced aircraft from Embraer and Bombardier, largely through the extensive use of advanced lightweight carbon fibre technology. Like the CSeries, the MRJ programme will use P&W’s PW1000G geared turbofan. The MRJ recently won an order for 50 firm plus 50 options from US–based Trans States Holdings, which owns regional carriers Trans State Airlines and GoJet Airlines. Japan’s All Nippon Airways Co., the first buyer of the regional jet, has placed an order for 25 aircraft, including 10 options.

- Netherlands Aerospace “Fokker100 NG”

Dutch–based “Rekkof” (Fokker spelled backwards) is part of Panta Holdings BV, previous owner of VLM Airlines prior to its sale to Air France in 2008. It is exploring a re–launch of the Fokker F70, which ceased production back in 1996, but little concrete information has emerged from the company, and some form of Dutch government support may be necessary.

- Q400 ‘X’

Bombardier clearly has the most to lose in the turboprop segment with the Toronto–produced Q400 having the largest current market share, despite some recent public relation hiccups relating to landing gear mishaps. Bombardier therefore faces considerable pressure to introduce a larger variant to the current 78–seat model, and under consideration is a Q400 ‘X’ version that will essentially be a stretch of the current platform, with a seating capacity of 90.

This will be achieved through two “plugs” that will extend the fuselage both forward and aft, while strengthened main landing gear and brakes will be added and the current PW150A engine on the Q400 would be used with an upgraded propeller. Although there is no official confirmation of this programme yet, potentially the aircraft could be in production by 2013 or 2014.

- ATR 42/72-600

In October 2009 ATR officially unveiled its first -600 series ATR turboprop, with entry into service expected for early 2011. The -600 series differs from the -500 series through new avionics in the cockpit and modified P&W 127M engines. The engines will provide an additional 5% thermodynamic power, which will allow for improved capability in hot and high conditions as well as increased payload capacity.

ATR is using the European Commission’s Emissions Trading Scheme (ETS) as a means of promoting its aircraft to European operators, since from 2010 all aircraft operators flying from/to European airports will be mandated to monitor and report their CO2 emission and RTK data, with the EC soon set to announce the allowed emission threshold based on the average value of emissions for the period 2004–2006. 85% of the allowed emissions will be credited to aircraft operators according to their RTK (higher RTK will bring more emission credits) and the remaining 15% will be auctioned. ATR states that its 72–600 model burns 40% less fuel per seat mile than a comparable RJ, and ATR has already booked orders for 59 of the new aircraft (for five ATR 42–600s and 54 ATR 72–600s).

- Embraer turboprop

Embraer started life as a commercial aircraft producer with the successful EMB110 Bandeirante and EMB120 Brasilia models, the latter of which ceased production in 2001. Embraer has already completed some "pre–concept" studies on a turboprop capable of carrying 100 passengers (10 seats larger than the proposed stretched Q400X) and expects to make a decision on whether to develop such an airframe within the next 12 to 18 months. Frederico Fleury Curado, Embraer president and CEO, says: “We definitely have a much higher focus on the issue than in the past.”

Part of Embraer’s consideration is whether a new turboprop might prove a good substitute for 50- seat RJs (such as its own ERJ 135/145 model) when they eventually become obsolete. Luiz Sergio Chiessi, Embraer market intelligence VP, says that the location for growth in the turboprop market is “mainly in Europe” and says that a major consideration for airlines will be the aforementioned Emissions Trading Scheme, in addition to the future cost of oil.

- AVIC MA60/MA600-700 turboprop

Jet prospects

AVIC 1’s MA60 50–seat turboprop saw its first deliveries back in 2000 and is a distant relative to Antonov’s AN26 cargo aircraft. During the intervening period it has received 122 orders, of which 15 have been delivered to Africa, with Zimbabwe and Zambia among the buyers. The MA60 is the first and only model of the MA series on sale, but the replacement MA600 is expected to be delivered to a launch customer by the end of 2012. According to AVIC, development work has already started on the MA700, an aircraft targeted mainly at markets in Europe and America.. There seems to be disagreement about exactly how much demand there will be for regional jets over the next two decades. Mitsubishi sees a market for 5,000 aircraft whereas Embraer estimates demand at between 2,600 and 4,300 aircraft. Sukhoi expects demand for up to 5,500 RJs and ACAC 3,000 (with one–third coming from China itself), whereas Bombardier’s market outlook forecasts a total market size of 12,100 aircraft in the 60–149 seat segment over the next 20 years.

These forecasts are key, because their accuracy (or otherwise) underpins whether there will be room for five or even six major competitors in the RJ segment in 2013, when all may be producing aircraft. If demand is not as high as some predict (or even if it is) which manufacturers will survive?

Assuming the Fokker NG project doesn’t get off the ground, of all the new entrants the Mitsubishi MRJ is the most likely to fail for several reasons. First, it has a much smaller domestic market and ‘sphere of influence’ than either the Russians or Chinese, and therefore it has to compete for the remaining market on merit against two firmly entrenched incumbents — Embraer and Bombardier.

In addition, it would enter the market several years after both Sukhoi and ACAC, and by 2013 may face a competitive landscape that includes soon–to–be–released re–engined A320 and 737s, Bombardier’s C–Series, and aircraft from Embraer, Sukhoi and ACAC. Mitsubishi has also not had a great track record in delivering large scale aerospace projects, as witnessed by the costly failure that was the F–2 fighter jet.

Conversely, the ACAC ARJ21 is the new model most likely to succeed: ‘China Inc’ has decided that aerospace final assembly is a key industrial project and the Chinese have shown in recent years that they are prepared to go to great lengths to back national champions. In addition, a large percentage of the overall RJ market over the next 15 to 20 years is expected to be in China – estimates vary between 20% and 30%.

And the fact that most aircraft in China are ordered by a centralised entity (the Civil Aviation Administration of China — CAAC) ensures that the domestic market will remain captive and protected from competition that is almost certainly stronger on merit. The ACAC project — up until this point — has also experienced fewer difficulties and has only been delayed by approximately six months; a snip when compared with the Sukhoi and larger 787 and A380 developments.

However, as the RJ segment becomes more competitive and ever larger types encroach on the narrowbody market currently dominated by Boeing and Airbus, the reaction of these manufacturers will go a long way in determining the fate of many of the new RJ programmes. While Boeing did not effectively replace the inherited MD80/717 design from the McDonnell Douglas acquisition, it will likely not want to cede the market occupied by its smallest 737 variants to the newcomers.

In fact, there has been increasing speculation that both Boeing and Airbus will offer a ‘warmed up’ version of their current narrowbody products with the newest geared turbo fan engine technology in advance of the expected all–new narrowbody replacements due sometime in the 2020 decade.

| Fleet | Orders | Options | Types | |||

| Ryanair | 197 | 115 | 102 | 737 | ||

| easyJet | 163 | 80 | 88 | A319 | ||

| Wizz Air | 26 | 115 | 12 | A320 | ||

| Gol | 86 | 93 | 19 | 737 | ||

| Southwest | 544 | 92 | 737 | |||

| AirAsia | 45 | 115 | 50 | A320 | ||

| JetBlue | 150 | 90 | 136 | A320 (30), | ||

| Total | 1,211 | 700 | 407 | E190 (60) | ||

| No. in | Years of | |

|---|---|---|

| service | production | |

| 737-300/-500 | 1,661 | 84-99 |

| DC9, MD80, 717 | 1,273 | 65–81, 79–97, 99–06 |

| A318/A319 | 1,100 | 96– |

| 737-600/-700 | 1,016 | 98– |

| BAe-146 & Avro RJ | 230 | 82–02 |

| Fokker 100 | 223 | 86–97 |

| Orders | Options | Major clients | |

|---|---|---|---|

| Sukhoi | 143 | 80 | Aeroflot (30), Malev (15), ItAli Air (10) |

| ACAC 21 | 228 | 20 | All domestic orders excluding GECAS (5) & Lao Air (2) |

| MRJ | 65 | 60 | Trans States (50 - LOI), ANA (15) |

| C-Series | 50 | 50 | Lufthansa (30), Lease Corp (20) |

| ATR 42/72-500 | 59 | 10 | Air Nostrum, Air Tahiti |

| Fokker NG | 0 | 0 | Marketing to current F70/100 operators |