TAM: Brazil's domestic leader rises to international prominence

December 2008

In late 2006, when TAM held its investor day in New York following its NYSE listing earlier that year, the management was still in the education mode: trying to explain to a somewhat sceptical audience that, domestically, TAM was effectively an LCC but that it also had extraordinary long–haul growth opportunities that could make it less risky than the typical LCC (see Aviation Strategy, December 2006). TAM was still little known internationally. It was very much in the shadow of two better–known Brazilian airlines: Gol, which possessed an attractive, proven low–cost business model and superior profit margins, and old–timer Varig, which had a strong global brand, had just been re–certified by ANAC (Brazil’s national aviation authority) and was plotting a major comeback in international markets.

Fast forward to December 2008 and it is clear that there has been a dramatic reversal of fortunes. Varig is no longer present in long–haul international markets. Gol, struggling to integrate Varig, is incurring heavy losses and is temporarily in a contraction mode. And TAM is now Brazil’s only flag carrier on intercontinental routes and has retained its position as Brazil’s largest domestic airline.

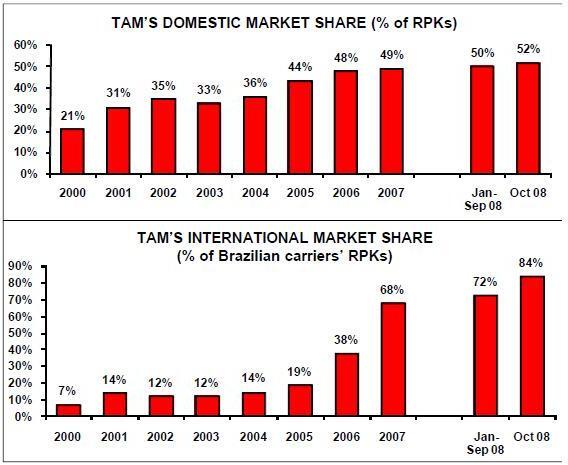

TAM’s share of Brazilian carriers' international traffic (RPKs) has surged from 18.8% in 2005 to 84.7% in November 2008. In the same period, its domestic market share increased from 43.5% to 51.7%. In just a couple of years, the airline has built an intercontinental network that includes five major European and three US cities, each with at least a daily service. And it has done it profitably, even achieving a 6.5% operating margin in the latest quarter.

Turbulent two years

While Gol is expected to resolve the Varig–related issues and return to profitability next year — and no–one is ruling out an eventual return by Varig to long–haul operations — TAM is clearly much better–positioned in the short–to–medium time horizon in terms of growth and financial performance. The past couple of years have been extremely turbulent for the Brazilian airline industry. A structural crisis began in late 2006 and lasted through the first quarter of 2008, due to continued double–digit traffic growth, problems with air traffic control, lack of government investment in aviation infrastructure over several decades and airline strategies that sought to maximise market share. ATC slowdowns and worsening airport bottlenecks led to a sharp increase in flight delays and cancellations, making travel a hassle and increasing costs for airlines.

The situation was aggravated by two fatal crashes: the September 2006 collision of a Gol 737 with a Legacy executive jet over the Amazon rain forest, which killed 154 people, and the July 2007 crash of a TAM A320 while trying to land in heavy rain at Congonhas Airport in Sao Paulo, which killed 199. After the crashes the government imposed ATC and airport restrictions, which had a severe financial impact on the airlines over an 18–month period.

TAM was hit hard by the slot and flight restrictions imposed at Congonhas, its key hub. The airline had to reorganise its network and schedules, which included transferring flights to the less popular Guarulhos Airport, Sao Paulo’s international gateway some 25 kilometres from the city. The changes reduced TAM’s average daily aircraft utilisation by about 30 minutes. The situation improved when the Congonhas restrictions were eased in late March 2008, though real solutions in the form of additional airport and ATC capacity will take years to materialise.

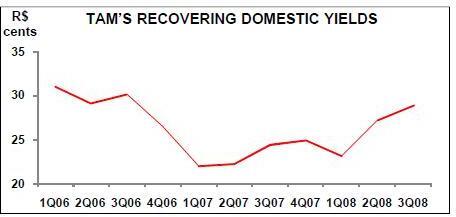

One good thing that came out of the crisis (other than the commitment to improve infrastructure) was that the airlines modified their strategies. They are now more cautious about adding capacity and focus more on profitability than market share. Calyon Securities, when noting the spectacular yield recovery in recent quarters, suggested in a recent report that TAM and Gol, which have a combined market share of around 93%, have "finally learned how to price as a duopoly".

The past two years have been turbulent in Brazil also because of Varig’s downfall and Gol’s struggle to integrate the two companies. The $320m acquisition in April 2007 caused greater problems than Gol’s management ever anticipated, partly because of the delay in getting government approval to combine the companies (finally obtained in September 2008), meaning no synergies for 18 months. Varig was unable to execute its growth plan also because of the Sao Paulo airport restrictions, while Gol has posted losses for the past four quarters. Last spring and summer, Gol shut down Varig’s remaining long–haul operation (Frankfurt, London, Rome, Madrid, Mexico City and Paris) in favour of focusing on serving markets within South America.

Gol completed the merger on September 30, launched its new combined network in October, has begun to integrate other processes and expects synergies from early 2009. The merger is likely to significantly strengthen Gol’s position within South America. In the near term, however, the combine is in a contraction mode: its domestic capacity will remain flat in the current quarter, while international ASKs will fall by 26% in the fourth quarter and in 2009.

The crashes, infrastructure problems and Varig’s downfall have been traumatic for the airlines' customers and Brazil’s image abroad probably suffered. But they created an extraordinary, profitable longhaul expansion opportunity for TAM. On the negative side, TAM is likely to face much tougher competition from the Gol/Varig combine within Latin America.

Inevitably, TAM too experienced some internal turbulence. There was a leadership change in November 2007, with Marco Antonio Bologna resigning from the CEO’s position and Captain David Barioni Neto, formerly VP–Operations, appointed as the new CEO. This move was seen as a shift in focus from financial to operational/ service matters. Bologna, with his financial background, was just what TAM needed to launch the IPOs, but global expansion and the need to maintain a service differential with Gol in Latin America called for an operational executive.

Financially in great shape

One reassuring thing amid all the turmoil has been that demand (RPK) growth in the Brazilian domestic aviation market has continued at double–digit rates: 19% in 2005, 12% in 2006, 12% in 2007 and 10.2% in January–September 2008. These rates were two or three times Brazil’s GDP growth, which so far has continued even as the US and European countries have slid into recession. October saw Brazil’s domestic traffic suddenly fall by 3.9%, but that was entirely due to Gol’s temporary 20% contraction as it launched an integrated network with Varig. TAM has seen its costs surge in the past two years, first because of the infrastructure issues and more recently because of fuel and unfavourable exchange rate developments. High pre–operating costs associated with long–haul expansion have added to the burden. TAM’s non–fuel CASK rose by 1.2% in the third quarter.

But there has been a spectacular domestic yield and RASK recovery. In the third quarter, TAM’s scheduled domestic yield and RASK both surged by 18%, while load factor remained firm despite 16% capacity growth. International performance was also highly respectable: a modest yield improvement and a nine–point increase in load factor despite 24% ASK growth.

The domestic yield surge basically represented a recovery in nominal terms to the 2006, pre–accident/ATC/airport crisis level (though in real terms the yield was still 10% below 2006's). It reflected strong demand, moderation of capacity growth and higher fares. While Gol also saw a strong improvement, TAM maintained a 15% yield premium (reflecting its higher business traffic content).

As a result, TAM remained nicely profitable on an operating basis. Its operating profit (R$186m) was up by 65% year–over–year despite 68% higher fuel costs, and operating margin rose by one point to 6.5% — one of the better margins among network carriers in the Americas. Revenues surged by 40%, with domestic and international passenger and cargo segments and the "other" category all recording 30%-plus growth.

So TAM has recovered fully from the 2006–2007 problems. This, the favourable yield trend and the continued GDP and air travel demand growth in Brazil make it well–positioned for a weaker economic environment in 2009.

Of course, like many of its competitors, TAM reported a huge net loss (R$475m or 16% of revenues) for the third quarter because of unrealised mark–to–market fuel hedge losses and unfavourable currency developments. Those two items added up to a staggering R$882m on the "financial expense" line.

An even higher mark–to–market fuel hedge loss is likely in the current quarter, given the much lower fuel prices. As of November 10, TAM had hedged about half of its fuel needs in the next 12 months at $105 per barrel. The policy is to protect 30- 80% of projected fuel consumption in 3–24 months, and the hedges are approved and monitored monthly by several board committees. Since the other half or so (20- 70%) of fuel needs remains unhedged, TAM will still benefit significantly from a decline in fuel prices.

The negative foreign currency result arose because the Real weakened against the US dollar by 18% during the quarter (or 4% year–over–year) and 50% of TAM’s total costs are denominated in US dollars, compared to only 35% of its revenues. This marked the reversal of several years of favourable currency developments. TAM does not hedge for exchange rates, so currency effects will remain a very unpredictable major component on its P&L account in the near term. However, TAM hopes to have a natural hedge in place by the end of 2009 as international growth will bring its dollar and other foreign currency revenues closer to 50%.

The long-haul opportunity

TAM’s balance sheet remains solid. Cash reserves at the end of September amounted to R$2.1bn or 21% of annual revenues, plus another R$1bn of short–term receivables. Lease–adjusted debt–to capital ratio was 94%, but there are no near–term debt obligations. Future financings are going to be for aircraft that already have pre–committed US Ex–Im Bank guarantees or are likely to get European export–credit backing. Because of Varig’s shrinkage, Brazilian carriers' share of international traffic to and from Brazil fell from 42.3% in 2005 to 28.8% in 2007. Thanks to TAM, the share has now begun to recover, but there is a long way to go to reach the desired 50%. In major markets such as the US, Spain, Germany, UK and Italy, at least half of the weekly frequencies permitted by ASAs for the Brazilian side remain unused. In particular, there is much room to grow in the large Brazil–US market, because the Brazilian side currently uses only 42 of the 126 weekly frequencies permitted by the ASA (while US carriers have taken up 105 frequencies).

TAM began its long haul expansion in 2005 and has recorded 40%-plus annual growth in international traffic in each of the past four years. The airline focuses on high–density, business–oriented markets or "the main destinations sought by Brazilians" and has forged partnerships with leading airlines at the destinations served. The long–haul network, operated from Sao Paulo or Rio Janeiro, currently includes Paris, London, Milan, Frankfurt,Madrid, Miami, New York and Orlando — the latter was added last month.

It has been a bit of a scramble to get all the needed long–haul aircraft. TAM had to even temporarily take three MD–11s, which will have been replaced by the airline’s first four 777–300ERs by around year–end. The long–haul fleet also includes A330s, A340- 500s and 767–300s — certainly much flexibility to suit different markets. TAM has 22 A350–800/900s on order, which will replace the A330s from 2013.

The long–haul strategy has been successful: the routes have become profitable quickly and frequencies have been steadily boosted. Each of the European routes has at least daily service (Paris has three). There are currently 28 and 18 weekly flights in the Brazil–Miami and Brazil–New York markets, respectively, in addition to the new daily Sao Paulo–Orlando service. The next new long–haul destination is likely to be South Africa, which TAM considers a natural point of distribution for the African continent and also a good connecting point to Asia.

Of course, TAM continues to intensely evaluate opportunities in the US market, all the more because of the recent relaxation of the ASA, which gave US airlines five new cities in Brazil, eliminated restrictions on the number of airlines and will increase weekly frequencies for each side to 154 by October 2010. Given that Latin America remains a rare bright spot in terms of international demand, carriers such as American and Delta have added many new routes to Brazil in recent months.

While TAM is yet to disclose its plans, two things are worth noting. First, it has been developing international service from secondary points such as Belo Horizonte, which now enjoys same–aircraft service to Paris and Miami via Rio or Sao Paulo. Second, there are some obvious points in the US that TAM could serve, including Los Angeles at some point.

Within Latin America, TAM has built a strong position in the Brazil–Buenos Aires market and has been able to add new cities (Santiago, Caracas, Montevideo and Lima) as ASAs have been relaxed. A number of secondary points are served by Paraguay–based subsidiary TAM Airlines (formerly TAM Mercosur), which has been fully integrated with TAM and has gone through a network and fleet restructuring this year. The unit has retired its F–100 fleet and now utilises three A320s, meaning that TAM now operates an all–A320 family fleet domestically and within Latin America. TAM has also had a commercial and code–share alliance with Chile’s LAN since 2007.

Domestically, TAM has the largest network among Brazilian carriers: currently 42 cities, plus another 37 through links with regional airlines. TAM offers more nonstop city links, more frequencies and more daytime flights than Gol, amounting to a better schedule for the business traveller. TAM also has a more up–market product, which is still the key to attracting domestic business traffic in Brazil where 70% of total traffic is business–related. Furthermore, TAM holds around 40% of the slots at Brazil’s top 10 airports — an important barrier to entry for newcomers.

While Latin American international growth prospects are promising because of the liberalisation trend that is sweeping the region (for example, Brazil recently signed open skies ASAs with Uruguay and Chile), TAM will have to fight harder to maintain its market position against the Gol/Varig combine. Gol is now focusing all of its efforts on Latin America and is implementing product differentiation with the help of Varig’s well–known brand. Varig’s FFP and premium class, which has just been relaunched as "Comfort Class", will help attract business traffic. TAM’s key challenge within Latin America will be to maintain its product/service differential with Gol.

Future challenges

Of course, TAM will have a powerful new weapon at its disposal to boost its position in Latin America and elsewhere: membership of the Star Alliance. It was officially announced in October, though it has been on the cards ever since Star expelled Varig in December 2006 and TAM subsequently signed MoUs with two Star founding members. Full integration will take 12–18 months. TAM already has code–share deals in place or imminent with Lufthansa, United, TAP, Swiss and Air Canada. Interestingly, Copa and TACA have also applied to join Star, so TAM will have new code–share partners also in Latin America. Joining Star should bring immense benefits to an airline like TAM, which is strong locally and has a great brand but is still little known internationally. The key challenge in 2009 is likely to be the economy. Many analyses have suggested that Brazil, as the strongest Latin American economy and because of other special attributes, could escape the global recession and credit crisis relatively lightly. Economists presenting at Gol’s and TAM’s investor days on November 10–11 predicted that Brazil could see 2–3% GDP growth in 2009, down from 5–6% in the past two years. However, some analysts have considered those forecasts too optimistic, and preliminary reports have indicated that Brazil’s GDP grew by only 1.8% in this year’s third quarter.

TAM’s current plans are based on the somewhat optimistic scenario of Brazil’s GDP growing by 2.3–3.5% and domestic air travel (RPKs) by 5–9% in 2009, to be followed by resumption of double–digit RPK growth in 2010. The airline is essentially maintaining its growth plans, though 2009 ASK growth rates have been reduced by a couple of percentage points to 8% domestically and 20% internationally.

There is no change in the fleet plan, which calls for the addition of 5–8 aircraft annually in the next four years. The fleet will increase in size from 125 at year–end 2008 to 151 at year–end 2013. The narrowbody fleet will grow from 101 to 117, Airbus widebody fleet from 16 to 22 and Boeing widebody fleet from eight to 12. TAM executives disclosed on November 10 that they had just closed aircraft financings with commercial banks at attractive rates, which gave them the courage to keep the fleet plan. Of course, there are contingency plans to postpone non–fleet capex, reduce aircraft utilisation and even ground aircraft in a lower demand scenario.

TAM’s earnings are currently particularly difficult to forecast because of the exchange rate volatility on top of all the uncertainty about fuel prices and the economy. But at this point analysts expect the airline to return to healthy profitability in 2009 after a modest loss this year. TAM is quite a diversified company — something that will protect it during downturns and, in the longer term, will offer opportunities to unlock shareholder value. Future spin–off candidates include cargo operations, loyalty programme and MRO.

Longer–term challenges relate to regulatory developments, infrastructure provision and the level of competition in the Brazilian domestic market. On the regulatory front, TAM’s main concern is the government’s proposal to redistribute airport slots, on which public hearings were held in November; the incumbents will fight hard to retain their slots.

Having sufficient airport capacity in the Sao Paulo area will be critical for the airlines. Solutions under consideration include a new (third) airport for the city and a new runway and terminal at Viracopos Airport, at Campinas some 90 kilometres from Sao Paulo. The government is hoping for major private sector involvement and is also studying the privatisation of Viracopos, as well as Rio’s Galeao Airport.

Another challenge is the emergence of potentially formidable new competition on the domestic scene. JetBlue founder David Neeleman’s new venture Azul was due to begin operations on December 15, initially linking Viracopos with two regional capitals, Salvador in Brazil’s northeast and Porto Allegre in the south. The fleet is projected to grow to 76 118–seat E195s at a rate of about one aircraft per month.

Azul will not be a major threat to the incumbents, because Viracopos lacks easy access to Sao Paulo and because the newcomer is likely to focus on regional markets and will not necessarily offer lower fares (if anything, it needs to have higher fares because of the smaller aircraft size). But Azul could skim off valuable premium traffic from TAM and Gol by offering frequent, nonstop flights that bypass hubs and reduce travel time, and by offering a superior in–flight service, including satellite TV. It is an interesting concept and similar to JetBlue’s E–190 strategy (see Aviation Strategy, July/August 2003). The newcomer could have negative impact on Brazil’s domestic yield environment.

Of course, Gol remains the competitor that TAM needs to watch for the most, given its lower cost structure, solid domestic market share and strengthening intra- Latin American position thanks to Varig. It seems likely that Gol will eventually take Varig back to intercontinental markets.

| In service | On order | On option Stored | ||

| A320 | 17 | 12 | 1 | |

| A321 | 81 | 33 | 8 | |

| A330 | 3 | 11 | ||

| A340-500 | 14 | 6 | ||

| A340-800 | 2 | |||

| A340-900 | 12 | |||

| 767-300ER | 10 | |||

| 777-300ER | 4 | |||

| Emb 110C | 2 | 6 | ||

| MD-11 | 1 | 1 | ||

| MD-11 ER | 1 | |||

| Total | 125 | 90 | 9 | 1 |