Norwegian Air Shuttle: Unusual ways to create an LCC

December 2008

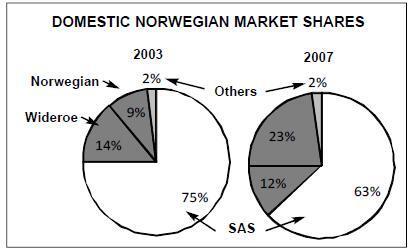

There have been many hopefuls who have set up low cost carriers in the past decade hoping to create a small fortune out of running an airline. When SAS finally acquired Braathens SAFE in 2002 to create what it may have seen as its natural monopoly in one of its domestic backyards in Norway, little did it realise that it would pave the way for a successful such carrier to enter the void it created in the market place.

Norwegian Air Shuttle had originally been founded in 1993 and had acquired the regional and commuter activities of the then failing Busy Bee, which had acted as an feeder for Braathens, and continued to operate commuter routes in Western and Northern Norway as well as various flying ambulance services. By 2002, no doubt after various rows with SAS (and it still has some outstanding court cases against recent dirty tricks from the Scandinavian flag carrier), Norwegian re–established itself as a low cost carrier in direct competition with the Scandinavian flag carrier.

It was helped in this by two main factors: the desperation of the leasing companies to place equipment in the downturn following 2001, and the Norwegian government’s decision to outlaw frequent flier incentive programmes on domestic routes. With an initial fleet of 4 leased 737–300s it started operations in the autumn of 2002 on the four main domestic trunk routes based in Oslo; to Stavanger, Trondheim, Bergen and Tromsø. To qualify as a potentially successful low cost carrier it also chose a particularly tasteless aircraft paint design.

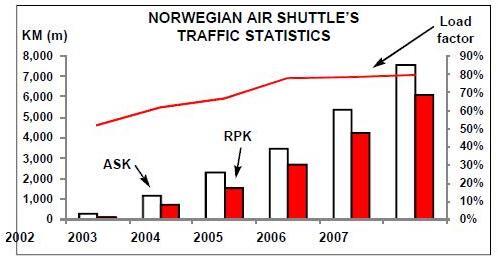

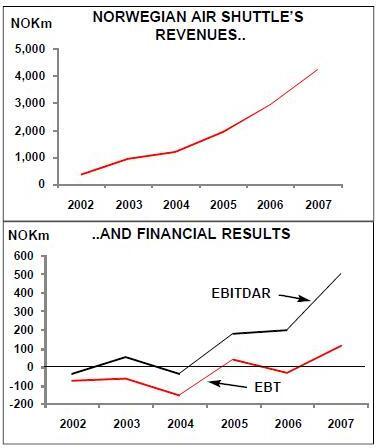

In 2003, its first full year of operations, it achieved revenues of NOK800m (€80m) and carried 300,000 passengers on those four routes and, remarkably, floated on the Oslo stock exchange. Five years later it has 156 routes, 40 aircraft, 7 bases, 7m passengers (the same amount of traffic that Ryanair carried in 2000) revenues of over NOK7bn, and has picked up a 40% share of domestic traffic on the prime trunk routes. On an underlying basis it even appears profitable. It is also now probably the third largest LCC (if you don’t count Air Berlin) in Europe after Ryanair and easyJet — even though its stock market capitalisation of nearly NOK1bn (€100m) is dwarfed by the other two.

One of the beauties of the operational business model is the country in which it is placed. It tends to get ignored — usually for practical reasons — but Norway is a very dynamic air travel market. The absolute population of around 4.7m may be low in relative terms, but there is a very high standard of living, the terrain is difficult and distances between population centres great. This creates a significant propensity to travel by air and there is a large element of business travel domestically; two of the main domestic trunk routes (Oslo to Bergen and Oslo to Trondheim) are the fourth and sixth busiest routes in Europe. Having built up the strength of opposition to the entrenched flag carrier, it might be said that Norwegian has built a niche base of traffic from which to expand.

Its expansion has been rapid. In 2006 it took the daring step of establishing a base in Warsaw. It has taken a little longer than expected, but the operation there appears to be starting to produce reasonable results (despite what one would have thought would be linguistic difficulties), and has the benefit of being a far lower cost operation than the Norwegian core.

In July 2007, it reached an advantageous agreement to acquire the poorly performing Swedish carrier FlyNordic from Finnair with which it had already been operating code shared routes. This it has now rebranded as norwegian.se and, as it replaces its ageing MD80s with 737s and applies its own operating philosophy, is gradually turning round. Interestingly it also provides an entry into the Swedish charter markets, while there is also an understanding with Finnair to feed into Helsinki.

Recently, on the failure of Sterling after the financial crisis (and particularly the Icelandic crisis) — with whom it had also been operating non–competitive code share deals — it was swiftly able to move into Copenhagen to fill the void there, albeit only with a handful of routes to start with: completing its encircling attack on the flag carrier enemy at SAS on the core of that airline’s intra–Scandinavian triangular capital route network.

In the past few years Norwegian, as many others, had found the acquisition of aircraft a trifle difficult, while being somewhat exposed on leasing older generation (and thirsty) equipment. This necessitated among other things the expensive wet–leasing of equipment (from such as the now failed Excel) to ensure that it could operate the routes it wanted.

Early in 2007 it signed a leasing deal for 11 NG 737–800s for delivery from 2008–10; and in late 2007, it finalised an order with Boeing to acquire 42 737–800s — with an option for a further 42 aircraft — for delivery from 2009 onwards. Quite remarkably (and no doubt luckily) it was able to raise NOK400m in August of this year through a fully underwritten rights issue to fund the equity element of the aircraft acquisition.

It may be said that Norway is hardly the best place to hope to create a truly low cost operation: but this has not stopped CEO Bjørn Kjos developing unusual ways to ensure that his company does have a low cost base. Whereas, true to the norms of creating a low cost carrier, Norwegian’s unit costs are about half of its main flag carrier competitor, at 54øre per ASK, they are still possibly some 40% higher than those of Ryanair. Among other things he managed to get the government to pay for part of the cost of cabin crew training — through accreditation of the training programme as vocational higher education.

Recent results

More zanily perhaps, last year he set up an internet bank (in which Norwegian retains a 20% shareholding) primarily acting as a credit card issuer, and helping to reduce credit card fees, but also creating the back–bone of a loyalty programme otherwise forbidden domestically. Furthermore earlier this year the company announced plans to set up a mobile phone company — no doubt to take part in and save costs of the glorious revolution of allowing (and charging) for mobile phone operations while in flight. While the rest of the industry suffered badly in the September quarter — primarily because of the exceedingly high fuel price in the summer — Norwegian’s results were not all that bad. Total group capacity in ASK was up by 42% (up by 35% at the traditional norwegian.no operations and with production at the newly acquired Swedish operation nearly trebled — although it was only in the group for two months in the prior year period — and now accounting for nearly 35% of the group’s total capacity).

The company has been gradually increasing the length of haul on its international routes (it even flies to Dubai — 7.5 hours on an LCC 737!) and as a result has further managed to increase aircraft utilisation: now over 11 hours/day at the traditional norwegian.no operations and just under 10 hours/day in Sweden.

The load factor dipped in the quarter by six points but yields increased by 6.5% year on year and the underlying unit revenues improved modestly.

Total revenues, helped by a near doubling in ancillary revenue sales per passenger (to a still modest NOK61/pax, but influenced by baggage charges and fuel surcharges) jumped by 50% to NOK2bn. Despite the high fuel prices unit costs were on a par with prior year levels: although fuel unit costs jumped by 49% year on year (and in the quarter accounted for 40% of total unit costs), controllable non–fuel unit costs fell by 16%.

As a consequence, profits were surprisingly up in comparison with the prior year; EBITDAR by 21% to NOK321m (giving a 16% margin), EBITDA by 35% to NOK228m and EBIT by 30% to a tad under NOK200m. This was even in spite of an increase in wet lease costs as a result of delays in delivery of one 737 but was helped to a noticeable degree by support from the fair value marking to market of currency hedges. At the EBITDA level the Swedish operations still managed to provide a loss of some NOK40m while the Warsaw base virtually broke even. On a like for like basis, adjusting for currency and fuel prices, the company suggests that it could have achieved an ebitda of nearer NOK400m — although that does not take account of the fuel surcharges it imposed through the summer period.

Rights Issue

However, this quarter’s good results does not quite make up for the poor performance in the first half of the year. For the nine months to end September the company’s EBITDAR fell by nearly 50%, while at the operating level the group has accumulated losses of NOK138m. In the third quarter, the company booked an additional NOK390m income because the hedge contracts it took out on the decision to buy the new 737–800s from Boeing became inefficient (as defined by our wonderfully arcane IFRS accounting rules). Consequently, the group has an accumulated net profit for the nine months of NOK140m — 40% up on last year.While the rest of the airline world was quietly despairing and the financial markets were nervous before the fall, Norwegian quite remarkably but successfully raised NOK400m in a fully underwritten rights issue in August. This 1 for 2 issue at NOK34.80 effectively increased the outstanding share capital by half at a (then) modest discount, and the cash raised is being used to provide the equity for the acquisition of the first ten 737–800s being bought from Boeing: the first pre–delivery- payment financing on these aircraft was released in the September quarter.

Outlook

At the end of the quarter the company had cash and near cash balances of NOK480m. There was actually an operational cash outflow of NOK312m in the third quarter, despite the increase in EBITDAR, mostly because of a delay in credit card processing payments and a fairly high reduction in air traffic liabilities for technical reasons. Since the quarter end the company has disposed of and restructured its dollar hedge position which will now have boosted cash by a further NOK325m to produce NOK800m balances; equivalent to just over 10% of annualised revenues this should be a reasonable cushion. In these tough times Norwegian Air Shuttle however is in an unusual position. At the time of the third quarter results presentation the management stated that it had not seen any deterioration in booking trends because of the financial crisis. Indeed, while others have seen severe declines in traffic in the past few months it has not been doing that badly, with reasonable performance in October and in November it saw capacity up by 29%, load factors off by a mere 1 point and a 9% increase in yields. (It must be said that it is being helped in this by SAS’s 10% withdrawal of capacity).

As the new aircraft come into the fleet in 2009 (as long as it gets the deliveries in time) the company will be discarding the older leased equipment. It has signalled a marginal growth in ASKs next year — with reductions in Sweden (as it tries to get the old FlyNordic operations on a reasonable footing), a focus on shorter haul and higher yielding routes and a reduction in "typical" weekend leisure destinations.

This will have a natural knock–on effect of increasing unit costs — but the group is nevertheless guiding for static performance with costs per ASK projected at around NOK0.54 (while presumably still looking at $70/bbl oil). As usual the unknown quantity will be the yield performance — but as the lowest cost producer in a high cost (and relatively niche) area it should win through. Given the dynamic way this company reacts to the market it will leap into other opportunities created by other failing carriers. In the meantime, it may even manage to show that being a bank or mobile phone company is the real way forward for the industry.

| NOKm | 2008Q3 | %ch | 2008 9Mos | %chg |

| Revenues | 1,971.9 | 48.9% | 4,611.7 | 49.7% |

| EBITDAR | 321.4 | 21.2% | 244.8 | -48.4% |

| EBIT | 228.5 | 35.8% | -39.4 | -116.1% |

| EBT | 193.4 | 29.6% | -139.0 | -172.5% |

| Net profit | 414.4 | 443.2% | 141.5 | 33.4% |

| Pax | 2,100,400 | 17.1% | 5,623,214 | 19.8% |

| ASK | 3589 | 53.8% | 8746 | 60.8% |

| RPK | 2936 | 46.1% | 6953 | 57.6% |

| Load Factor | 82% | -4%pt | 79% | -2%pt |

| Length of haul (km) | 1,398 | 24.8% | 1,236 | 31.5% |

| Unit revenues | 0.55 | 1.9% | 0.53 | -5.6% |

| Unit costs | 0.49 | -1.9% | 0.53 | 2.0% |

| Avg rev per pax | 938.80 | 27.2% | 820.11 | 24.9% |

| Cost per seat | 679.00 | 22.4% | 657.56 | 34.1% |

| Rev per seat | 767.99 | 20.9% | 651.98 | 22.4% |

| Ancillary revenue per pax | 53.7 | 85.8% | 53.7 | 85.8% |