The new Thomas Cook Group

December 2007

The EC approved the merger of Thomas Cook and MyTravel in May, even though it said there would be significant overlap in the package holiday market in the UK and Ireland. However, the EC was acutely aware of the structural decline of the AIT market and had been criticised previously for blocking a bid by Airtours (which has since become MyTravel) for First Choice in 1999 after its decision was overturned in 2002 — too late for that deal to happen.

The new Thomas Cook Group (TCG) is listed on the London stock exchange and is a gigantic concern, employing 33,000 and with 3,000 travel agency outlets and almost 50 hotels and resort properties around the world. This year TCG will have revenue of just under €12bn and carry around 19m people on holiday, with most of that business originating in the European market.

However, MyTravel (previously known as Airtours) almost collapsed in 2003, and although it had gradually recovered since then, according to some analysts Thomas Cook had the upper hand in the merger negotiations with MyTravel, in which TCG is owned 52% by German retailer Arcandor (formerly known as KarstadtQuelle, and which acquired the 50% of Thomas Cook that it didn’t previously own from Lufthansa in January 2007 for €800m) and 48% by the former shareholders of MyTravel.

TCG was formally launched in June, but over the next few months a string of senior MyTravel executives announced they were leaving the merged group, including Peter McHugh, who was previously the CEO of MyTravel and then joint CEO of TCG. The last ex–MyTravel senior executive to go was John Bloodworth, formerly the managing director of MyTravel UK and (briefly) the new CEO of Thomas Cook’s UK and Ireland operation, who resigned in September after what was called a "difference in management approach".

Those differences are believed to stem from the strategic emphasis of TCG’s two founding partners, with the new group saying it will operate different business models in the various territories it operates in. In the UK, the primary business model will be "vertically integrated charter tour operations, based on airline ownership, committed air capacity and controlled retail distribution", but in continental European markets, "different market conditions make the vertically integrated model less effective" — which means that group–owned charter airlines are no longer considered a prerequisite for successful tour operations on the continent, unlike in the UK.

This apparently contradictory strategy will have profound effects for the group’s airlines, which pre–merger operated a total fleet of 97 aircraft, although this has already been trimmed back to 92 as of December 2007 (see table, below), of which a majority are leased.

In the UK, the Thomas Cook/MyTravel merger saw the group’s airlines (Thomas Cook Airlines and MyTravel Airways) come together under the Thomas Cook Airlines brand from November of this year. Manchester–based Thomas Cook Airlines dates back to 2000 when JMC Airlines was formed from the integration of Flying Colour Airline and Caledonian Airways, the respective airlines of Carlson Leisure and Thomas Cook (which merged in 1998).

JMC was renamed as Thomas Cook Airlines in 2003 and in 2006 the airline carried 4.9m passengers to more than 60 European and longhaul holiday destinations. Prior to the merger it operated a fleet of 24 aircraft, including three A320s, three A321s and 18 757s. MyTravel Airways operated a fleet of 19 aircraft, and the disappearance of MyTravel Airways as a standalone airline ends an entity that started life as Airtours International in 1991 before absorbing European Airways in 1993 and merging with Danish airline Premiair under the name MyTravel Airways in 2002. TCG’s combined UK fleet initially totalled 43 aircraft, but the enlarged Thomas Cook Airlines will not remain at that size despite the group’s commitment to retain a vertically–integrated operation in the UK. TCG says that the merger of MyTravel Airways and Thomas Cook Airlines will deliver significant savings thanks to reduction in overhead and direct operating costs, and that a reduction in the size of the combined fleet should be achievable — although the extent of that shrinkage is not yet known.

A clue, however, is given by the cuts that TCG is pushing though at its UK operations outside of the airlines. 35% of TCG revenue comes from the UK, but of the 33,000 staff employed by MyTravel and Thomas Cook pre–merger no less than 18,800 were in the UK, where the two companies had a substantial 950 travel agencies.

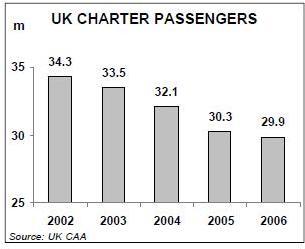

The merger document for Thomas Cook/MyTravel admits a "relative decline in demand for package holidays" in the UK, and figures from the UK CAA show just how rapid that decline is — passengers carried by charter airlines have gradually fallen from 34.3m in 2002 to 29.9m in 2006 (see chart, below).

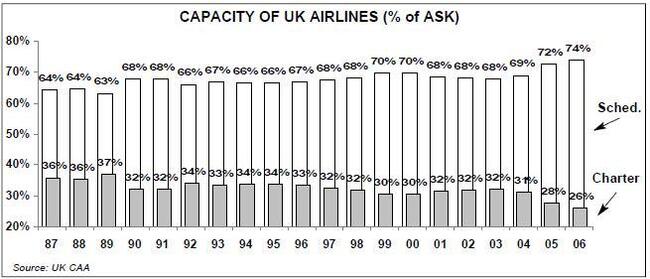

Put another way, charter capacity as a percentage of all UK airline capacity has declined from 37% in the late 1980s to just 26% in 2006 (see chart, right).

Therefore it’s no surprise that TCG is pushing through huge cuts in its operations in the UK, with around 150 travel agencies being closed and up to 3,000 staff losing their jobs. Though it’s an unscientific comparison, applying a similar size of reduction to aircraft capacity would see the UK fleet trimmed by around six or seven to 36 or 37 aircraft, which could be achieved easily as current leases expire.

TCG’s situation in the UK was not helped by the doubling of airport passenger duty in February 2007 as well as by the impending changes in the UK government’s scheme that insures against the collapse of tour operators. The previous system relied on bonds paid by tour operators themselves, but this hasn’t raised enough money to fund compensation claims, and the new scheme from April 2008 instead levies a £1 fee on all passengers booking a package holiday.

This will raise at least £25m a year, but some tour operators are unhappy at the scheme (which will be run by the UK CAA) as it still does include LCCs, with which many customers book flights that are bolted on to accommodation bookings.

In Germany, TCG announced a deal to sell Condor to Air Berlin in September (see Aviation Strategy, November 2007), which is in line with TCG’s new "asset–light" and non–vertical strategy in the country, which helps reduce risk and maximise flexibility (although, ironically, TCG now says it expects Condor to post record profits for the year to the end of October 2007).

However, in November 2007 the Bundeskartellamt — the German competition regulator — said it was deepening its investigation into the proposed deal, and this "second phase", as the regulator puts it, will not be completed until February 2008. Worryingly for Air Berlin, some observers believe this is possibly an indication that the Bundeskartellamt has serious concerns about the sale (since Air Berlin also owns LTU, another large German charter airline).

But assuming the deal is approved, while the sale will generate cash for TCG, reduce its asset base and offload a substantial €451m of financial obligations at Condor (comprising €266m of pensions and €185m of debt) what does this mean for TCG’s aviation capacity out of the German market? TCG says that Air Berlin will remain a "long term strategic partner, providing Thomas Cook with continued access to flying capacity", but the deal does make TCG vulnerable to changes in Condor’s pricing, particularly if TCG offloads its shares in Air Berlin after the proposed lock–in period expires in February 2011, perhaps in order to give shareholders a special dividend.

Condor started back in 1956 and for one brief (and confusing) year in the early 2000s changed its name to "Thomas Cook — powered by Condor". It operates 35 aircraft on charter flights to 80 leisure destinations, of which more than 40 are long haul (and largely to North America, the Indian Ocean region and the Caribbean). It will carry at least 7m passengers in 2007, of which 40% will be on behalf of Thomas Cook. The rest of Condor’s capacity is either sold direct via seat–only sales (36%) or to other tour operators (24%, with 6.6% sold to Alltours, 5.7% to TUI, 3.2% to Rewe and 8.5% to other companies).

As Condor has always operated on an "arm’s length" basis to Thomas Cook, its sale to Air Berlin can be regarded as a sensible move given the long–term decline of the AIT market (assuming TCG can always access the capacity it needs out of the German market at a sensible price), and the deal is perhaps an indication of what may happen in the UK in the longer–term. Elsewhere in continental Europe, TCG has six A320s at Thomas Cook Airlines Belgium and 10 A320s, A321s and A330s at MyTravel Airways Denmark, and also owns 50% of Turkish charter airline SunExpress, which operates 14 aircraft. The future for these airlines depends largely on how successful the new TCG will be. TCG talks about "improving the value proposition" to customers, which means a wider choice of distribution channel, and offering "more exclusive" accommodation. Interestingly, TCG says that in the next couple of years it plans to replace its traditional mass of printed brochures with a new system, which will replace lengthy price tables in brochures (which holidaymakers find confusing) with "continuously–updated" dynamic price calculations.

Whether that will arrest the structural decline in the AIT market remains to be seen, and in the short- and medium–term much more critical for the group’s future (and the future of its airlines) will be the cost savings that TCG hopes to achieve.

TCG originally forecasted merger synergies of at least €140m a year, (although there will be one–off integration costs of up to €185m), and in November TCG upgraded this to €200m, to be achieved sometime in the next 18–24 months.

Those savings may be ploughed back into acquisitions — TCG has been linked with a potential bid for Swiss operator Kuoni, which has built up revenue on independent travel and niche areas, although interest is denied by TCG, and Kuoni says it would fight off any hostile takeover bid. However, TCG also says that it is seeking shareholder permission for €375m worth of share buy backs in mid- 2008, which while pleasing to hard–pressed shareholders also reduces the cash pile for acquisitions, and implies that TCG’s management can’t see significant value–adding opportunities at the moment. Indeed despite TCG’s bullishness, the market has been unsure about the success of the merger.

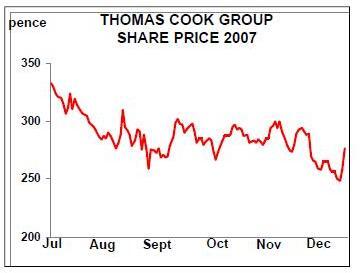

TCG’s share price has drifted down from the 333p of its June debut to 250p in early December, although the December trading statement now appears to be sparking a revival (see graph, above).

In that trading statement released in mid- December, TCG said that early indication for summer 2008 bookings out of the UK were good, with bookings and average prices ahead of 2007, even though 2008 capacity out of the UK will be lower (by an estimated 5%) as the group was "adjusting the combined flying programmes to exit unprofitable business and optimise yield management". TCG says bookings out of Northern Europe for summer 2008 have also started strongly, although — ominously — TCG declines to give any guidance for summer 2008 bookings out of Continental Europe. The German market is more difficult for TCG because of overall overcapacity, and alongside a reduction in its own capacity TCG is also increasing commission to German travel agents in order to encourage them to sell more TCG packages.

Alongside the trading statement, TCG released unaudited pro forma results for the year to the end of October 2007, and revealed a provisional set of financial results that were higher than market expectations.

While revenue fell by 1% to €11.7bn over the year compared with 2005/06, operating profit rose 26% to €375.3m, and of that €121.5m came from the UK (+36% year–on–year) and €109.7m from Northern Europe (+18%). But whereas the "Airlines Germany" segment (i.e. Condor, which TCG is selling) saw its unaudited operating profit rise 79% in 2006/07 to €68.1m, profits at Continental Europe (which includes the vital German market) were virtually flat at €99.5m. While TCG made an overall operating margin of 3.2% (compared with 2.5% in 2005/06), there was a strong contrast between the 9.2% margin in the Northern Europe market, the 8.9% margin of the soon–to–be–gone Airlines Germany/Condor, and the 2.6% and 2.2% margins in the UK and Continental Europe respectively. So while analysts were impressed with the overall figures, the margin situation in the key UK and Continental Europe markets is still not great, and where those margins go in the current financial year will be a crucial indicator of the success (or otherwise) of the enlarged TCG’s strategy, and whether the group can really achieve a stretching target of at least a €620m operating profit in 2009/10. While TCG aims to increase revenue from independent travel to 25% of total targeted revenue of €13bn in 2009/10, TCG will still be dangerously exposed to the mass package travel market (which will still represent 72% of all revenue in 2009/10, compared with 80% in 2005/06). Any improvement or erosion of margins in the key mass AIT markets of the UK and Germany will have significant effects on TCG’s overall performance, and hence on its long–term future.

| Thomas | |||||

| Thomas | MyTravel | Cook | |||

| Cook | Airways | Airlines | Condor | ||

| Airlines | Denmark | Belgium | Condor | Berlin | |

| A320-200 | 10 | 2 | 6 | 13 | |

| A321-200 | 4 | 5 | |||

| A330 | 7 | 3 | |||

| 757-200 | 16 | ||||

| 757-300 | 2 | 13 | |||

| 767-300ER | 2 | 9 | |||

| Total | 41 | 10 | 6 | 22 | 13 |