TAM: Positioning of Brazilian hybrid LCC

December 2006

TAM, Brazil’s largest airline, has a lot going for it: a low cost structure, high service quality, strong brand, profit margins that are among the highest in the industry and excellent growth opportunities. The Sao Paulobased carrier is well–positioned to benefit from strong demand growth in Brazil and to take advantage of Varig’s shrinkage in long haul international markets. Since its US IPO in March 2006 (which followed a listing in Brazil in June 2005), TAM has increased its market capitalisation by 35% and, in the words of a NYSE executive, become a "model for strong corporate governance and transparency".

But TAM still has some work to do to reduce the cost, profit and debt leverage gap with Gol and to persuade the international investment community that its business model is equally strong. Its shares have continued to trade at a discount to Gol and North American LCCs.

In recent months both TAM’s and Gol’s share prices have suffered due to investor concerns about the impact of Brazil’s ATC slowdown, Varig’s resurgence and potential excess capacity in the domestic market in 2007. When will be ATC issues be resolved? Could Varig stage a comeback now that it has been re–certified, and how much damage will it inflict on yields?

These issues were discussed at "TAM Day", the airline’s annual investor day held in New York on December 8. TAM’s CFO Libano Barroso and other senior executives outlined the airline’s growth plans and explained the key aspects of the business model, and a top official from ANAC (the new national aviation authority) helped shed light on the ATC and Varig situations.

The executives wanted to get across essentially two things. First, they argued that the market is overreacting to the ATC situation and that concerns about excess capacity in 2007 are unwarranted. The ATC slowdown is apparently having only minimal financial impact and, being a top priority for the Brazilian government, is likely to be resolved in the very short term. Excess capacity, in turn, is unlikely in a rational market where the main players (TAM and Gol) are both public companies needing to grow earnings.

Second, TAM’s management argued that the company is undervalued, which it blamed on being lumped into the "legacy" or "non- LCC" category. People like to categorise things to compare, or TAM’s business model may not be that well understood. The executives argued that, domestically, TAM is effectively an LCC, and that international growth, by reducing currency mismatch, will make the company less risky than the typical LCC.

The most riveting part of TAM Day was hearing about the extraordinary long haul growth opportunities. Because of Varig’s shrinkage, Brazilian carriers' share of international traffic to and from Brazil has fallen from 46% in 2005 to around 28% this year. In major markets such as the US, Spain, Portugal, Germany, Italy and Mexico, at least half of the weekly frequencies permitted by ASAs for the Brazilian side remain unallocated, and only 42% of the allocated frequencies in those six markets are currently operated.

Although the "New Varig" has just received certification from ANAC, it is initially authorised to operate only 13 aircraft — ten 737–300s and three widebodies (two MD–11s and one 767), serving nine cities in Brazil and four internationally (Frankfurt, Buenos Aires, Caracas and Bogota). Another four domestic cities will be added in the near term, but after that Varig will need to find more aircraft and convince ANAC that it is financially and technically capable of expanding operations. One potential problem is that, under the slot rules, Varig has only 30 days (from December 14) to take up its domestic slots and 180 days to start using its international slots; after those periods any unused slots will be "up for grabs" by other Brazilian carriers.

Great turnaround story

With Varig’s growth effectively limited and Gol concentrating on Latin American expansion (with its all–737 fleet), TAM should be able to pick and choose which long–haul markets to serve first.Calyon Securities analyst Ray Neidl, when initiating coverage of TAM in late 2005, observed that TAM was "the first to admit that it had to rapidly reform or perish, as have other Brazilian carriers in recent years". Its story is a nice contrast to VASP and Transbrasil’s demise and Varig’s bankruptcy and shrinkage.

Founded in 1986, with scheduled operations by predecessors going back to 1976, in the last decade TAM was a low–cost operator (Fokker 100s) with a well–recognised brand and reputation for warm and friendly, up–market service. Founder Rolim Amaro, who died in a helicopter crash in 2001, was always at the airport shaking hands and welcoming passengers to the carrier’s "red carpet" service.

In the late 1990s TAM attracted fresh capital from private equity funds, which enabled it to acquire a larger fleet, including A320s. However, costs got out of control and the airline also found itself "squeezed" between Varig, the dominant carrier, and Gol, a high–profile new entrant that had a different value proposition (stripped–down service and low costs).

Consequently, in late 2002 TAM re–evaluated its strategy and adopted a three–pronged approach: maintaining a service differential but focusing on what the customer really wants, lowering its cost structure and offering competitive prices.

The result has been an impressive turnaround, while the company has also grown rapidly. TAM has doubled its passenger numbers in four years, from 13.8m in 2002 to an estimated 25.3m in 2006, while reducing its fleet from 102 to 96 aircraft. The growth has been accomplished by flying more efficiently: average daily aircraft utilisation has increased from 9.4 to 12.5 hours and the average load factor from 55% to 75% in the four–year period.

In its efforts to offer attractive prices and compete with Gol in the domestic market, TAM has traded yield for higher load factors and unit revenues. Its scheduled domestic RASK (revenue per ASK) increased from 13.8 Real cents in 2002 to 20.8 Real cents in January–September 2006. In the same period, domestic CASK declined from 20.4 Real cents to 18.2 Real cents.

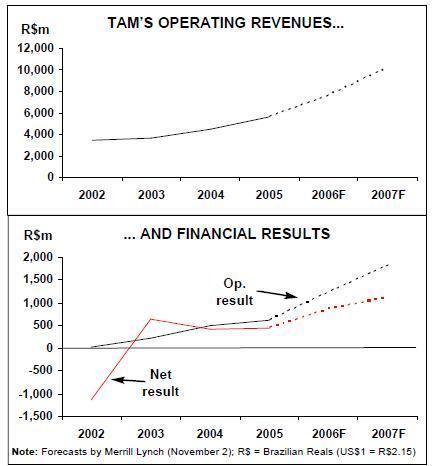

Profitability was restored in 2003. The past couple of years have seen strong revenue and earnings growth, thanks to capacity expansion, resumption of robust GDP growth in Brazil and continued cost cutting. TAM achieved an 11% operating margin in both 2004 and 2005, and this year’s will be around 16%. In 2005 it earned a net profit of R$427m (US$199m) on revenues of R$5.6bn (US$2.6bn).

TAM’s profits are now comparable to those earned by the world’s best LCCs. The management’s comparisons show that it ranked third, after Ryanair and Gol (and well ahead of Southwest, Virgin Blue, WestJet and JetBlue), in the global LCC profit margin league in the 12 months ended September 30. Its operating margin of 16% compared with Ryanair’s 23.9% and Gol’s 21.1%, while its net margin of 11.9% compared with Ryanair’s 19.9% and Gol’s 17.1%.

But TAM compares less favourably with the LCC sector in terms of debt leverage. Its long–term liabilities rose to R$3.9bn (US$1.8bn) at the end of September 2006, following a R$500m public offering of six–year debentures to finance fleet expansion (an important event since it was the first such offering by an airline in Brazil and because it gave TAM credit ratings by Fitch and S&P — global "BB"). TAM’s lease–adjusted total debt to- capital ratio, at 84%, is much higher than Gol’s 56%.

A new type of LCC

Nevertheless, TAM has made much progress in strengthening its balance sheet. For example, the current ratio (current assets over current liabilities) was 1.87 at the end of September, compared to 0.80 at the end of 2003. Cash position on September 30 was R$2,234 (US$1bn) — a superb 40% of 2005 revenues. TAM and Gol have very different backgrounds and business models. While Gol is a new entrant and a brilliant adaptation of the Southwest–style LCC model, TAM is an older–established, larger airline that offers higher service quality. But the domestic yield and cost differentials between the two airlines are surprisingly small — currently 10–15% at most — reflecting the special characteristics of the Brazilian market and environment.

First, unlike in the US and Europe, there are no real labour or airport cost differentials between airlines in Brazil, and Internet penetration is still low. Consequently, on the cost front, airlines differentiate themselves on the basis of commercial costs, aircraft utilisation, management compensation and suchlike.

Second, Brazil’s aviation market is relatively undeveloped, with huge growth potential particularly for leisure travel, if low fares are made available. No sizeable airline can afford not to provide for that segment.

Third, with 68% of air travel in Brazil being currently for business purpose (TAM’s is even higher at 75%), the airline cannot afford to ignore that segment either.

Fourth, Varig’s shrinkage has given TAM a special opportunity to attract high–yield traffic. Because of its more up–market product offering, it is believed to be pulling more ex–Varig passengers than Gol.

Going for a "dual" low–cost/service differentiation model has therefore been the obvious choice for TAM, just as it has made sense to operate both short haul and intercontinental service. However, the model should not be confused with the legacy strategy of catering for every segment; rather, like US Airways, TAM could be described as a new type of LCC or a "hybrid" LCC.

The management made the point that while strategies have changed, TAM’s mission statement has remained unaltered for the past 30 years. First, the airline wants to be differentiated through "espirito de servir" (spirit of service). Second, it strives to achieve "unchallenged domestic leadership". Third, it aims to be the "most competitive, solid and profitable airline in Latin America".

The key attributes of TAM’s business model and strategy include the following:

A growth airline:Like LCCs, TAM is a growth airline. Following 16.6% and 33.5% ASK growth in 2004 and 2005, respectively, this year’s growth is expected to be around 30% and next year’s close to 40%, when the airline plans to grow its international ASKs by 60–70% and domestic ASKs by 30%.

Since mid–2003 TAM has captured most of the market share that Varig has lost and the bulk of VASP’s, which had 8.8% of the domestic market when it ceased operations in September 2004. TAM has had the market share lead domestically since 2003 and internationally since July 2006, and it now accounts for more than half of Brazilian carriers' total RPKs in both markets. In November TAM had 51.7% of the domestic market (followed by Gol 35.3%, Varig 5.1%, BRA 3.2% and others 4.8%) and 61.2% of the international market (Varig had 17.1%, Gol 13.2% and others 8.4%). The 61.2% international share was up by 40 percentage points year over- year.

TAM is likely to retain or even grow these shares. It still has only 20% of Brazil’s total air traffic (including foreign carriers). The regulatory environment is unfriendly to start–ups. The policy is to allocate new domestic route opportunities on the basis of existing market share, while after Varig TAM is currently the only carrier with the widebody aircraft and infrastructure for long–haul expansion.

TAM has the largest domestic network among Brazilian carriers. It offers more nonstop city links, more frequencies and more daytime flights than Gol, amounting to a better schedule for the business traveller.

Also, TAM holds 40% of the slots at Brazil’s top 10 airports, which account for 70% of all passenger traffic — an important barrier to entry for newcomers and an impediment to the growth of other competitors.

TAM is well positioned to benefit from Brazil’s booming aviation market. Since only 2% of the population has flown, there is huge growth potential. This was one of the key selling points of TAM’s US IPO, with many investors wanting to participate simply because Brazil’s aviation market is so promising.

Low cost structure:TAM claims to have reduced its total unit cost (CASK) gap with Gol from 32% in 2002 to 15% this year. The airline also claims that its stage length–adjusted (and maintenance cost–adjusted) domestic CASK gap with Gol is only 10–12%. The goal is to reduce the 10–12% gap to 5% by December 2007.

In a separate presentation in early December, Gol calculated the current stage length–adjusted CASK gap with TAM at 21% (down from 28% previously, according to TAM). Gol also expects to reduce its CASK by 7% in 2007 due to commission cuts. TAM is confident of achieving the aggressive 5% CASK gap target because the "roadmap is already laid out". The savings will come from three areas: fleet and network, distribution costs and overheads.

The plan is to increase average daily aircraft utilisation to over 13 hours in 2007. TAM is also adding six extra seats to its A320s and A319s. On the distribution cost front, the aim is to increase direct sales from the current 17% to 25% in 2007 through web site improvement, fare bundles, call–centre outsourcing and developing new payment methods. The airline is bringing in–house airport check–in and other services and negotiating reductions in travel agent commissions. To reduce overheads, TAM is outsourcing non–core activities (such as IT), reassessing service standards, reducing management hierarchy, automating more processes and renegotiating contracts with suppliers.

Many of those are the sort of measures and cost cuts that have already been implemented by airlines in the US and Europe. In other words, it would seem that TAM has lots of low–hanging fruit to pick — something that bodes well for the success of the cost cutting programme.

Among the most interesting measures, TAM is working on ways to access the new (low–yield) client segment that may not have credit cards. For example, passengers will soon be able to buy a ticket through TAM’s web site and pay for it at their local lottery store. Also, TAM is working with banks to provide special credit lines that its customers can use to pay for tickets within 48–72 hours of making a reservation via the web site.

Retaining a yield premium? On domestic routes, TAM has moved from full on–board meal service to lighter fare and paying more attention to what it believes is more important to customers: punctuality, regularity, frequencies, FFP, competitive pricing and suchlike. However, it still strives to provide a better on board product and service than competitors. This has meant retaining VIP lounges, the policy of pilots and cabin attendants greeting passengers at the gate, and comforts such as 31–inch seat pitch and wider middle seats. It continues to be the only airline to offer video and audio entertainment on domestic flights. Internationally, TAM is following the regional trend of going nearly all–business class over the next year (retaining just four first class seats per aircraft).

Since it now caters for the whole customer spectrum in the domestic market, TAM recently launched a new simplified five–tier fare structure. The model is similar to the one used by carriers such as Air Canada. The fare types are priced according to the built–in benefits in terms of flexibility, refundability, lounge access, etc. Some of the lowest fares are competitive with bus fares.

In the domestic market, TAM aims to maintain a 10–15% yield premium over Gol, while achieving similar load factors as it stimulates demand with competitive fares. The yield premium over Gol used to be more than 30%.

Focus on international growth

While there is some uncertainty about TAM’s ability to retain the yield premium in the long–term, if TAM reduces the CASK gap with Gol to 5% and if it also has other LCC characteristics, such as a strong corporate culture and highly motivated workforce — which appears to be the case — there is no reason why it could not simply make adjustments to the model.TAM operates throughout Brazil, serving 48 destinations plus another 27 through alliances with regional carriers. International services cover eight destinations in Latin America — Buenos Aires and Santiago, as well as smaller cities served through Paraguaybased subsidiary TAM Mercosur — and four business routes to the US and Europe (Miami, New York, Paris and London). In addition, TAM has code–shares with American, Air France–KLM, Taca and others.

Domestic growth plans for 2007 include adding at least three new destinations, strengthening Sao Paulo’s and Rio de Janeiro’s international gateways (Guarulhos and Galeao) for the domestic market, adding frequencies in the main domestic markets out of Brasilia, Congonhas and Confins, and introducing some hub–bypass flights in the north.

The strategy is to expand selectively in high–density, business–oriented international markets. The daily London service, which was introduced in late October, is doing well with load factors exceeding 70%. A second daily flight has just been added to New York (mid–December), just six months after entering the market. A third daily flight to Paris will follow in January, and Milan will be added as a new city on March 30. TAM expects to announce another new long haul destination or an additional frequency for 2007. The airline will also continue strengthening Latin American international service, starting with a second daily flight to Santiago in January.

All of these new flights are through expansion of bilateral agreements, as opposed to replacing Varig’s service. TAM must be intensely evaluating potential opportunities that might arise from Varig losing key slots in 2007, but not all of Varig’s routes were that attractive. Frankfurt was mentioned as a desirable destination, but its is still served by Varig and TAM would need an alliance at that end, for example with Lufthansa. Portugal is not high on TAM’s list of priorities, despite the cultural links, because it is a highly seasonal and primarily charter market.

Fleet plans

TAM is currently only interested in airline–to–airline agreements on specific routes, rather than joining a global alliance, because Brazil is a final destination rather than a connecting point. However, the policy is kept under constant review. TAM’s operational fleet will consist of 96 aircraft at year–end — 10 A330s, 64 A319/320s and 22 Fokker 100s. The fleet is expected to grow to 132 aircraft by year–end 2010 through the addition of four 777–300ERs, six A330s and 48 A319/320s. The Fokker 100s will have been retired by early 2008.

In June TAM very interestingly decided to replace the 100–seat Fokker 100s with the much larger 144–seat A319s and 174–seat A320s, after long considering the A318 and the E190. The decision was based on strong domestic demand growth and an increase in traffic density, and it will help maintain low unit costs.

Another interesting fleet decision took place in late October, when TAM announced a firm order for four 777–300ERs for mid–2008 delivery (plus four purchase rights) and signed an 18–month lease with Boeing Capital for three MD–11s. The ex–Varig aircraft will be delivered between year–end and March/April and will be operated until the 777s are delivered.

TAM needed a new aircraft type quickly in order to grab new long haul growth opportunities. After also evaluating the A340–600, the airline opted for the 777–300ER based on its lower cost per seat, higher technological lifespan and larger size. TAM wanted two longhaul types for flexibility, and the 370–seat 777 created a better mix with the 220–seat A330 already in the fleet. In addition, the MD–11 lease deal was priced very attractively: the lease cost offsets the type’s fuel inefficiency, resulting in the same cost per seat as with the 777–300ERs. It was a "win–win" situation for both sides (Boeing gaining a new customer). TAM has secured in–principle agreement with Ex–Im Bank for a credit line to finance the 777s.

From 2008 TAM will operate a single–type Airbus fleet in the domestic and Latin American markets, while in long haul markets it will have a dual Boeing/Airbus fleet of 777- 300ERs and A330s (after the MD–11s have been returned). The A330s are due to be replaced by the A350 from 2012, but the status of that order is currently uncertain as TAM is in negotiations with Airbus about the delivery delays.

Financial outlook

There is some flexibility in the fleet plan to slow capacity growth if necessary. TAM could accelerate the phase–out of the Fokker 100s, and it could postpone taking five used A319/320s that it is currently negotiating.The consensus in the financial community is that Brazil’s ATC delays are a very short–term issue, likely to be solved in the first quarter and not affecting the airlines' ability to grow. However, analysts have slightly reduced TAM’s and Gol’s earnings estimates for the current (fourth) quarter and have suggested that share prices could remain under pressure until the market sees concrete solutions to the ATC issues.

Views differ on the extent that overcapacity will be a problem in 2007. TAM is confident that traffic will keep up with the supply, thanks to projected 3.5% GDP growth and demand stimulation through pricing. The airline currently predicts 10–12% RPK growth for the domestic market, an industry load factor of 68% (down from this year’s 73%) and flat yields. TAM believes that its own load factor will be 70% and that its yield will be flat in 2007. The mid–December Wall Street consensus forecast was that TAM’s revenues will grow by 21% in 2007, following 46% growth in 2006, and that its earnings per ADS will more than double to US$2.75 this year, followed by 6.5% growth to US$2.93 in 2007.

The financial community remains confident about TAM’s long term prospects. Merrill Lynch analyst Mike Linenberg suggested recently that further market share gains, especially on the international front, could result in the valuation gap with Gol narrowing further. The rating agencies also indicated recently that growth in US dollar revenues is likely to lead to a credit ratings upgrade. Currently 50% of TAM’s costs and 20% of its revenues are in US dollars, and the airline aims to increase the revenue percentage to 35%.

Interestingly, TAM’s CFO indicated that the company is studying a possible future spin–off of its "Fidelidade" FFP, as well as its MRO at a later stage. TAM was the first airline in Brazil to introduce a loyalty programme (1993), and it is now the country’s leading FFP with over 3m members and revenues of R$60m in the third quarter of 2006. The company is studying with banks how to extract more value from the FFP, and one possibility is following the ACE/Aeroplan example (except that Brazil does not have income trust funds). In the first place, TAM aims to double the FFP members through an agreement with a bank.

| Type | 2006 | 2007 | 2008 | 2009 | 2010 |

| A330*** | 10 | 12 | 14 | 16 | 16 |

| A319/320 | 64 | 88 | 103 | 106 | 112 |

| 777-300ER* | 0 | 0 | 4 | 4 | 4 |

| MD-11** | 0 | 3 | 0 | 0 | 0 |

| Fokker 100 | 22 | 6 | 0 | 0 | 0 |

| Total | 96 | 109 | 121 | 126 | 132 |