Delta: one of the US industry's star performers

December 2000

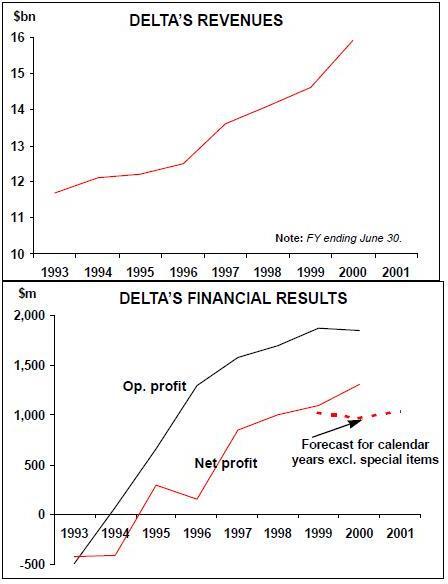

Delta has been one of the US industry’s top profit performers this year. Its operating income of $525m and a net profit of $273m (excluding special items) in the September quarter accounted for 12.1% and 6.3% of revenues, which rose by 13.5% to $4.3bn. Although net profit before charges fell slightly, it was a great achievement in a challenging fuel environment. A reduction in share count actually led to a 9% gain in per share earnings excluding charges, from $1.91 to $2.08.

However, the latest results were boosted by the inclusion of Comair, which Delta acquired in November 1999. Comair, the biggest and the most successful of the independent US regional carriers, earned a net profit of around $143m on $882m revenues in 1999. The results of Atlantic Southeast, which was purchased in May 1999, were consolidated into Delta’s in the third quarter of last year.

Excluding the Comair impact, Delta’s September quarter earnings benefited, first, from higher demand, a strong pricing environment and a new revenue management system introduced in April. Unit revenues rose by 5.6% as all operating regions reported gains.

Second, Delta benefited from an excellent fuel hedging position, having covered 60% of its needs in the second half of this year. While fuel costs still rose by 45% to $533m, without hedging that figure would have been $160m higher. This meant that total unit costs (excluding Comair, ASA and unusual items) rose by just 6%.

Third, Delta derived substantial savings from reduced commissions and increased use of lower–cost distribution channels. Those savings offset a 16% hike in labour costs and meant that non–fuel unit costs rose by only 2.6% — well below industry average. Delta is in great financial shape, having achieved double–digit operating margins for five consecutive years and net income exceeding $1bn for three consecutive years. The company had $1.9bn in cash at the end of September, though long term debt is relatively high ($4.4bn).

Delta also pays regular cash dividends and has repurchased $2.2bn worth of common stock since 1996. The latest of the buybacks ($500m) was completed in the first quarter of 2000 specifically to redistribute a $711m pretax gain from the sale of Priceline.com stock in 1999. Over the past year or so, the strategy of "monetising non–core assets" has raised another $500m or so from the sale of stakes in former partners SIA and SAirGroup and part of a holding in Equant.

With continued favourable revenue trends and a strong forward fuel hedging position, Delta’s earnings are expected to rise in 2001 (the company is changing its FY to calendar year, as of December 31, 2000).

This year’s earnings before charges will decline marginally, though a reduced share count will mean higher per–share earnings. The latest First Call consensus forecast is a profit of $7.32 per diluted share in 2000, up from $6.94 in 1999, and $7.88 in 2001.

Analysts have long argued that Delta’s stock is well undervalued relative to both its net asset value and earnings potential. In late October Merrill Lynch analyst Michael Linenberg picked Delta as an extreme example of a company where net asset value (he calculated it at $11bn or $90 per share) and market value ($41 per share) were "completely out of sync". Although the price has since then recovered to around $50, the company is still trading at only 6.2 times the First Call 2001 earnings estimate. Delta’s longer–term prospects are particularly promising in light of cost savings anticipated from e–commerce and strategic initiatives made over the past year or so to strengthen position in various markets. The only cloud on the horizon is the pilot situation — see below.

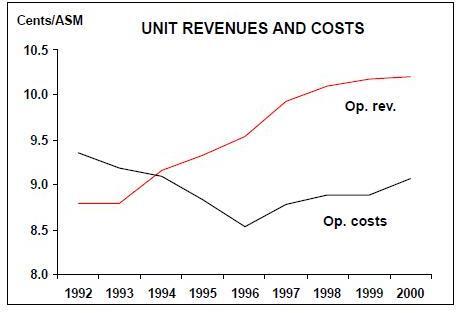

Unit revenue and cost trends

Delta’s unit revenues have improved steadily since the mid–1990s, when service standards suffered as a result of cost cutting. In recent years the carrier has fairly consistently outperformed the industry in revenue per ASM growth. This reflects success in restoring on–time performance and mending customer service, which CEO Leo Mullin made his top priority soon after taking up his position in 1997.

The good operational performance standards achieved in 1999 have been maintained. This year Delta has continued to rank among the top three major carriers in the key DoT service quality criteria — on–time performance, least customer complaints and fewest mishandled bags. In January–August it came second or third in each, up from ninth or tenth in 1997.

In the early part of this year Delta appeared to be falling behind its competitors in unit revenue growth, but over the past six months the gap was again positive. This is attributed to a new revenue management system, which is generating $5m in incremental revenues a month. Since the full benefits ($15–20m extra revenues a month) will not be realised until perhaps the middle of next year, Delta has the potential to outperform the industry in unit revenue growth in the coming months.

The 1994–96 "Leadership 7.5" project made Delta the lowest cost major network carrier in the US. That position has been maintained, despite industry–leading pay. Leo Mullin believes that the main reason is limited unionisation — only pilots or 16% of the workforce are unionised — which has helped maintain a productivity advantage. Delta’s unit costs were 9.07 cents and 9.14 cents per ASM in the FY ended June 30 and the September quarter respectively.

This compares with an average of a little over 10 cents for United, American, Northwest and Continental in the latest period. Mullin estimates that Delta currently has an 8% non–fuel CASM advantage over the other large network carriers.

The company expects to maintain or increase that gap, in the first place, because it is one of only three US carriers with a material fuel hedge position for 2001. It has hedged 42% of its requirements next year, all at $18 per barrel, and 25% of fuel needs in 2002. Next year’s hedges are expected to save around $300m.

Pilot talks

In the longer term, Delta hopes to maintain its unit cost advantage through fleet simplification, tight cost controls, high labour productivity and e–commerce and other strategic initiatives. Negotiations with the pilots began early (September 1999) by mutual agreement, but economic issues have only been tackled since early October when ALPA put forward its proposals. Evidently, Delta’s pilots waited for the ratification of the United pilot deal, which greatly raised the salary bar for all subsequent pilot talks in the US.

Fleet simplification

The pilots are seeking a 29–49% increase in pay over a three–year contract — some 5- 8% above United’s rates — as well as limits on RJ flying and elimination of the dual wage system with Delta Express. In its counter proposal, the management offered a complex eight–year contract under which pay would initially exceed United’s but fall behind in subsequent years, and much of the later increase would be tied to performance, productivity and company profitability. Analysts estimate that a new contract based on United’s wage levels would raise Delta’s labour costs by around $1bn in 2001. In mid–November, amid signs that Delta’s pilots might start taking United–style job action such as refusing to fly overtime, the two sides requested federal mediation beginning on December 1. Rather unusually, to maintain a sense of urgency (and avert job action during the busy holiday travel period), they asked for a 90–day deadline (February 28) on reaching agreement. Delta continues to achieve significant cost savings through fleet restructuring and modernisation. There are still many 727s and L–1011s in the fleet, though they are being phased out at a fairly rapid rate as new 737s, 757s, 767s and 777s are delivered.

E-commerce strategy

There are also plans to retire early (over the next 6–8 years) the MD–90 and MD–11 fleets. The carrier is in the middle of a 100–week span to take almost weekly deliveries of those aircraft types. The first 767–400, for which Delta was the launch customer with an order for 21 plus 40 options, entered service in October and will replace the L–1011 as the long–haul domestic aircraft. A recent Merrill Lynch research report called Delta "undoubtedly the leader among the Big Six airlines in terms of making technology work", while one magazine survey named it one of the "top 50 web smart companies". The carrier has invested over $800m in the past three years in developing technology initiatives.

As a result, 10% of its total ticket sales already come through its web site, up from 5% a year ago. Commission expenses have fallen to 4% of passenger sales in the latest quarter from 5.6% a year ago. Future savings from web site sales will be substantial, because the cost of ticketing a passenger through delta.com is just $2, compared to $34 if the ticket is sold via a travel agent. In addition to Orbitz (the first multi–airline travel web site), Delta’s e–commerce initiatives over the past year have included MYOB Travel (a site dedicated to the needs of small business travellers), a partnership with e–Travel (to help corporate customers purchase directly from Delta’s reservation system) and an alliance with SoftNet Systems (to offer wireless broadband Internet services).

Strategic expansion

In August Delta formed its "e–Business" unit, which it stressed would not be a separate company, to "help shape and execute e–business strategy" in respect to B2C, B2B and B2E and "maintain position as an e–leader". Recently the company named heads for each of the three divisions, which will be in charge of Delta’s entire range of current and future activities related to the Internet and other emerging technologies. Delta was either very perceptive or very lucky in selling most of its Priceline.com stock for a huge profit before its value, like that of many other dotcoms, collapsed. In a recent SEC filing, Delta said that it may sell its remaining 5.3% stake, which could pave the way for it to join Hotwire.com. Another thing that has distinguished Delta from its competitors over the past year is the enormous effort it has put into strengthening its position in different types of markets. This has included acquisitions (Comair and ASA), further development of specific products (Delta Shuttle and Delta Express), major investments in airport facilities in key markets like the Northeast, rapid expansion in Latin America and, of course, catching up on the international alliance front with the formation of SkyTeam.

Rather like some retail conglomerate, Delta now talks of having the "full range of product lines" — mainline, Shuttle, Delta Express, Delta Connection and SkyTeam — and of "putting the right product in the right markets". The different products are increasingly scheduled to complement one another at any given airport.

Regional operations

The effect is to make Delta look even more formidable domestically than it already was (with its domination of Atlanta, the world’s largest airport, and with strong hubs also at Cincinnati and Salt Lake City) and suggest that it has caught up internationally. The acquisition of Comair and ASA gave Delta the largest RJ fleet in the world, making it uniquely well–positioned to take advantage of growth opportunities in regional markets. Its earnings have already been boosted by the 20% operating margins generated by those two carriers.

Delta Express

Earlier this year a massive order was placed for 94 CRJs and 406 options for the Delta Connection carriers, which already have 200 RJs in their fleets — about 35–40% of the US RJ total. Comair’s Cincinnati operations are now all–jet, while ASA is rapidly replacing its turboprops with RJs at Atlanta. ACJet, a new subsidiary of independent regional partner ACA, is building RJ feeder service for Delta at New York LaGuardia. Low–cost carrier Delta Express, launched as a separate business unit in October 1996, has been expanded at a steady pace in Northeast–Florida markets. It is not a major profit generator, but its good operational reliability and customer appeal have helped Delta retain low–fare markets.

Delta Shuttle

Northeast investments

However, Delta’s leadership remains extremely concerned about Southwest Airlines, which has expanded its capacity to Florida by 38% over the past year and in June announced an order for up to 290 737s. Florida is of special concern to Delta because it accounts for 30% of its revenues. Delta Express' "discount airline cost structure" makes it "our most important weapon in these potentially crippling encounters". In order to retain the key high–volume, high–yield Northeast markets in the face of service enhancements by competitors, Delta has beefed up its Boston–New York- Washington Shuttle service and is re–fleeting it with new–generation 737–800s. The aircraft facilitate improved reliability and roomier, state–of–the–art interiors. By the end of January, all of Delta Shuttle will be 737- 800s. Delta has announced plans to invest $1.6bn in terminal expansion and redevelopment at New York JFK to "establish our primacy in the world’s largest aviation market". If approved by the Port Authority, work would begin in June and be completed by 2004. This would considerably strengthen Delta’s position as the leading transatlantic airline from New York, currently serving 20 cities in Europe on a daily nonstop basis.

UAL/US Airways

A $350m terminal improvement project, announced a year ago, is also due for completion in 2004 at Boston’s Logan International — another potential growth market. Like at JFK, Delta plans to bring to Boston its full product range, including Delta Express and some international services. Response to While carriers like American have said that they remain open to acquisition and merger possibilities if a United/US Airways merger takes place, at present industry talk focuses more on the tempting prospect that valuable US Airways assets might go on the block. Mullin said at a recent conference that "if there is bargaining or an auction, you can be sure that Delta will be there", adding that the company has 15 or so markets on its shopping list.

Delta believes, first, that its strong East Coast position would enable it to compete just as successfully against UAL than US Airways.

Latin American expansion

Second, there would probably be a three–year time lag before consolidation would have real impact, during which Delta would cement its strategic advantages. Third, if acquisitions become necessary, Delta’s strong industry position would ensure that there would be options. The company describes its foray into Latin America, which began in April 1998, as a "wonderful strategic move". It has already captured an 8–9% share of the traffic carried by US airlines and is achieving a 15% operating margin, which makes Latin America Delta’s most profitable region.

The focus has been on building nonstop service from Atlanta to the key Latin American cities — the latest additions are Santiago (November) and Bogota and Rio (December) — while new service to Mexico and the Caribbean has also been added from JFK and Cincinnati. There are applications pending to at least Buenos Aires and Montevideo. Long–standing code–sharing with Aeromexico has been substantially expanded, and an LoI on a marketing relationship was recently signed with ACES.

SkyTeam

Delta is also talked about as a potential equity partner for Aerolineas, but it is very doubtful that it would invest in that carrier. The global alliance formed in June with Air France, Aeromexico and Korean Air (see Aviation Strategy, July 2000) has had a promising start. SkyTeam has secured number two position behind Star, and Mullin suggests that those are the only two global alliances that are "materially working".

Moreover, "we have the hub capacity and the expansion potential to grow to number one".

CSA Czech Airlines will be the first new member to join SkyTeam (April 2001).

Attracting more members will be crucial, but Delta and its partners are lucky in that, even though they left things rather late, the unstable condition of other global alliances is likely to mean defections. Thai, which may not be able to remain in Star, would make a good Southeast Asian partner for SkyTeam.

Mullin believes that over the next couple of years SkyTeam will have the opportunity to pick up the "4–5 additional partners" that it desires. A Star–style 15–16 member alliance is considered too complicated in terms of decision–making.

While SkyTeam does not envisage cross equity holdings, Delta is keeping an eye out for opportunities. The likely pre–sale breakup of the two CINTRA carriers next year could provide an opportunity for Delta to buy into Aeromexico. Another possibility is Air India, for which Delta and Air France may bid jointly.

| In operation | On order | |

| 727 | 86 | |

| 737 | 68 | 101 |

| 757 | 116 | 5 |

| 767 | 106 | 16 |

| 777 | 7 | 6 |

| L1011 | 47 | |

| MD-11 | 15 | |

| MD-80 | 120 | |

| MD-90 | 16 | |

| Total | 581 | 128 |