US regionals: recession-proof airlines?

December 1998

US regional carriers such as SkyWest and Atlantic Coast Airlines caught everyone’s attention in the late summer when their share prices continued to surge at a rate far outpacing the US market and in sharp contrast to the falls experienced by the major carriers. As purely domestic operators, their immunity from the Asian crisis was one obvious explanation. But analysts argue that the regionals could weather a downturn better than the major carriers. Why so, and who are the strongest candidates?

Over the past decade or so, the regional airline sector in the US has grown extremely rapidly, recording around 10% annual average growth in passenger traffic. The initial impetus came when the major carriers decided to start passing unprofitable lower density short–haul routes to regional feeder partners, which could operate such routes profitably with turboprops and provide a high–frequency service. But the fastest growth rates — as high as 20–30% annually for some carriers — have been experienced over the past couple of years as the process of utilising regional jets has gathered pace.

The top dozen regional carriers in the US — American Eagle, Comair, Continental Express, Mesaba, Horizon, Atlantic Southeast (ASA), SkyWest, Mesa, Air Wisconsin, Atlantic Coast (ACA), Great Lakes and CCAIR — now account for 2–3% of industry capacity and around 7% of the total revenues.

Consistent profits, high margins

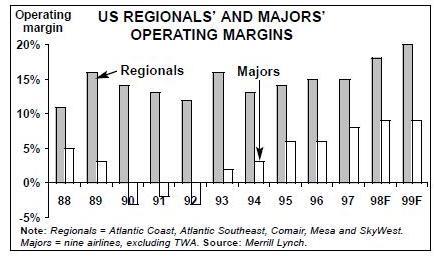

Despite their rapid expansion, the regionals have also been consistently profitable, with excellent operating margins. According to Merrill Lynch, during the 1990–91 recession when the major airlines incurred $3.7bn of losses, ACA, ASA, Comair, Mesa and SkyWest reported a combined $157m operating profit, or 13% of total sales. In fact, since 1989 those five regionals have never failed to achieve a combined annual operating margin of at least 12%.

Analyses by BT Alex. Brown and Merrill Lynch also suggest that, like Southwest’s, regional airline stocks outperform both the market and the rest of the industry during an economic downturn. Although the stocks initially fell due to fears in 1990, regional airline stocks rebounded quickly. Merrill found that the only exception was SkyWest, which remained profitable but reported a 40% decline in operating income in 1991.

But why would this industry sector be less vulnerable to recession? First, the regionals are more resilient to a demand downturn because they carry high volumes of business traffic: typically 60–70%, compared with the major carriers’ 40%. Business travel tends to be more stable in a downturn.

Second, major carriers are likely to retrench from more markets during a downturn, which would lead to new growth opportunities for their regional partners. No–one is talking about further large–scale route transfers here, just the fact that more marginally profitable routes are likely to become loss–making for the Majors when GDP and demand growth weaken.

Regionals have the added advantage of operating in local markets that have little, if any, non–stop competition. Unlike some of the major carriers — which stand to lose traffic to aggressive low–cost competitors when more consumers, worried about their disposable incomes, start shopping for lower fares — the regionals enjoy a captive market on the relatively thin routes.

Lower cost levels also enhance the regional carriers’ ability to withstand a downturn. They are generally not unionised. Their pilot salaries are typically only one quarter of the levels at major carriers ($30,000 annually, compared with $120,000). As a result, regionals like Comair need only a 42% load factor to break even, compared with typically at least 55% for the major airlines.

In contrast to the very limited domestic expansion opportunities for the major carriers, US regionals appear to have good growth prospects. BT Alex. Brown estimates that American Eagle, ACA, ASA, Comair, Mesaba and SkyWest will increase their combined seat capacity by 15.6% this year and 10% in 1999. Merrill Lynch forecasts 12% ASM growth this year and 14% in 1999 for its sample of five airlines (ACA, ASA, Comair, Mesa and SkyWest).

These growth rates are, of course, spurred by a rapid acquisition of 50–70 seat regional jets (RJs) to enhance the traditional 30–seat turboprop fleets. The first RJ entered service only five years ago (in the spring of 1993, with Comair), and the past year has seen its system–wide introduction in the US regionals.

The RJ has changed the character of the US regional airline industry just as fundamentally as the introduction of jets changed the major airlines in the early 1960s. The much longer range of the RJs (up to 1,900 miles, compared with 350 miles for the older turboprops) has opened up numerous new markets and is thoroughly reshaping traffic patterns. Whether used to replace or complement turboprops on existing routes or develop new longer–range markets, the RJs have provided a major capacity boost for the regionals.

The regional jet has led to significant productivity gains, lower costs and better service standards, while unit revenues have held up fairly well because of the lack of direct competition. Merrill Lynch estimates that the combination of “slightly lower unit revenues” and “significantly lower unit costs” (as much as 20% lower) has improved operating margins by up to 3–4 points.

The favourable cost and earnings trends will continue as the regionals add more RJs to their fleets. In mid–September American Eagle, ACA, ASA, Comair, Mesaba and SkyWest had a total of 118 aircraft on order for delivery in 1998 and 1999.

Major orders for the Embraer ERJ and Canadair CRJ from four US regionals at Farnborough in the UK ensured a continued high level of deliveries to the US regionals from 2000 onwards. These included a $2bn order from American Eagle for 75 of the 37- seat ERJ–135s plus 75 options, which will replace turboprops from July 1999 through 2004, and a $375m repeat order from Continental Express for 25 50–seat ERJ- 145s. The CRJ orders came from ACA (for 10 aircraft) and from ASA for 12 of the 70- seat CRJ–700s.

Analysts believe that the industry will have no problem absorbing all that additional capacity. This is in part because the regionals’ capacity base is still relatively small, but also because the bulk of the aircraft are expected to be deployed to replace or complement existing jet or turboprop services. Bombardier’s records indicate that only 29% of the RJs currently in service are used in the higher–risk activity of new route development.

In addition to being highly profitable, US regional carriers also have strong balance sheets. According to Merrill, they have an average debt/capitalisation ratio of 66%, compared with the major airline average of 80%. Most of the regionals have better total liquidity relative to their operating costs than the major carriers and take just as good care of their shareholders. At least ASA, Comair and SkyWest pay dividends and have share repurchase programmes in place. In late November Mesaba’s board also authorised a $30m repurchase programme through December 1999.

The regionals make particularly attractive investments at present because of their relatively low current valuations and strong earnings growth prospects. Top–quality carriers like Comair, ASA, ACA, Mesaba and SkyWest are currently trading at 12–14 times 1999 projected earnings, which is 2–3 points lower than when their shares peaked in August. Yet, according to First Call, all of those carriers have projected annual long term earnings growth rates of 15–22%. They are all rated as “buys” or “strong buys”.

However, only those regionals that have solid code–share relationships with the major carriers find themselves in that prestigious category. Mesa, which has lost several United Express contracts over the past year or so in large part because its service quality deteriorated, actually reported a net loss of 85 cents per share for its 1998 financial year ended September 30. Although the company is expected to return to profitability in the current financial year, the brokers reporting to First Call predict long–term earnings growth of only 12% and most have a “hold” recommendation on the stock.

Atlantic Southeast (ASA)

This Delta Connection carrier, which has successfully introduced a new fleet of RJs at Atlanta, is one of the highest–rated regional airline stocks. According to Merrill Lynch, it has one of the best airline balance sheets.

ASA’s net earnings actually fell marginally in 1997, to $54.5m, due to after–tax charges related to the return of its fleet of five BAe 146s to the lessor and for training and start–up expenses related to the CRJ introduction. But earnings have improved since the fourth quarter of last year.

In August ASA finally secured pilot approval for a new four–year contract, which had been in negotiation for three years and had involved federal mediators. But costs will rise as the deal, among other things, gave the pilots a 30%-plus increase in total compensation in the first year of the contract.

ASA currently operates just 13 CRJ- 200s, but continued deliveries will facilitate 24% capacity growth in 1999 and 19% in 2000. There are 45 CRJ–200s on firm order, plus 12 of the larger 70–seat CRJ–700s. Options are held on 53 additional aircraft. The CRJ–700 deliveries will begin in the fourth quarter of 2001.

Atlantic Coast (ACA)

ACA, which feeds to United along the East coast through Washington–Dulles, has been another analysts’ favourite since becoming the first United Express carrier to secure the right to operate the RJ about a year ago. It also recently began feeding to United at Chicago.

One of the fastest–growing regionals, ACA expects its capacity to increase by 65% this year and 34% next year, thanks to the addition of 23 jets. The bulk of the new air–craft will go to the Washington–Dulles hub. In October the 72–strong fleet included 12 CRJs. The jets are expected to account for half of the carrier’s capacity by year–end and 75% by the end of 1999. Since exercising options on ten more CRJs in September, ACA expects to operate 33 CRJs by the second quarter of 2001.

Despite its rapid growth, ACA continues to perform well financially. Its operating profit surged by 88% to $17.1m (21.8% of revenues) and net profit more than doubled to $10.6m in the third quarter, amid signs that the regional jet is having major operational impact. The increase in average stage length (due to jets) led to 23% declines in both unit costs and yield, while the load factor rose by 4.1 points to 58.1%. In October ACA’s flight attendants finally approved a four–year contract.

Comair

Delta Connection carrier Comair will go into the history books for pioneering regional jet operation in the US and for developing Cincinnati into an extremely profitable Midwest hub.

The airline’s third–quarter results reflect its considerable financial strength. Operating profit rose by 35% to $52.9m, which represented 27% of revenues. Net profit rose by 41% to $34.6m (18% of revenues). The load factor improved by 3.3 points to 65.7%, which was 17 points above the break–even load factor of 48.7%.

Currently the largest RJ operator with a fleet of 67 aircraft, Comair is determined to retain its leading position by becoming the first regional carrier in the US to operate an all–jet fleet in 2001. It recently signed a $1bn deal with Bombardier to acquire 50 additional regional jets — 20 CRJ–700s and 30 CRJ- 100s — plus 100–115 options, which will give it an eventual fleet of 245 RJs.

SkyWest

After feeding to Delta at Los Angeles and Salt Lake City for many years, SkyWest got its big break about a year ago when United signed it as an Express partner at Los Angeles following the termination of WestAir’s contract. The two got on so well, with United repeatedly praising SkyWest’s service quality, that since then co–operation has been expanded to San Francisco, Seattle and Portland. SkyWest is now the United Express operator along the West coast and the feeder services to the hubs have been substantially expanded.

Although SkyWest was one of the earliest RJ operators, its 69–strong fleet is still largely made up of turboprops. There are 10 RJs and another ten on option. But the carrier is still expected to achieve 25% ASM growth in 1999 and 15% the year after. The Utah–based airline, which serves 50 cities in 13 western states and Canada, reported a 71% rise in net earnings to $12.8m on $113.5m revenues in the third quarter. Operating profit rose by 59% to $19.5m.

Mesa

Mesa’s experience with United illustrated the downside of the regionals’ dependency on code–share relationships with the major carriers. After six or seven years of co–operation, over the past year Mesa and its sister carrier WestAir have lost their California, Pacific Northwest and Denver feeder contracts with United to SkyWest, Air Wisconsin and Great Lakes Aviation. The main reason appears to have been deterioration in Mesa’s on–time performance and service quality, though there had also been disagreements about remuneration and Mesa’s service reductions.

The loss of those contracts had significant impact since United Express operations represented about 45% of Mesa’s total fleet and ASM capacity. But the latest reports indicate that, after losing money for eight consecutive quarters, the resilient regional was profitable in October and its cash situation is improving.

Mesa looks likely to recover because of its profitable and expanding regional jet operation for America West at Phoenix and US Airways along the East coast and in the Midwest. It recently strengthened its position in the east by acquiring Charlotte–based US Express operator CCAIR for about $60m.

| Current Orders | |||

| fleet | (options) | Delivery/retirement schedule/notes | |

| Atlantic Coast Airlines | |||

| CRJ | 12 | 21 | Delivery by 2001 |

| Jetstream 32 | 28 | 0 | |

| Jetstream 41 | 32 | 0 | |

| TOTAL | 72 | 21 | |

| Atlantic Southeast Airlines | |||

| Emb-110 | 2 | 0 | |

| Emb-120 | 63 | 0 | |

| ATR 72 | 12 | 0 | |

| CRJ | 13 | 57 (53) | Delivery by 2002 |

| TOTAL | 90 | 57 (53) | |

| Comair | |||

| Emb-110 | 2 | 0 | |

| Emb-120 | 31 | 0 | |

| CRJ | 67 | 63 (115) | Delivery by 2003 |

| SA227 | 1 | 0 | |

| TOTAL | 101 | 63 (115) | |

| SkyWest Airlines | |||

| Emb-120 | 82 | 10 (40) | Delivery by 1999 |

| CRJ | 10 | (10) | |

| SA227 | 2 | 0 | |

| TOTAL | 94 | 10 (50) | |

| Mesa Airlines | |||

| Beech 1900D | 29 | 0 | |

| DHC8 | 1 | 0 | |

| CRJ | 0 | 15 | Delivery by 1999 |

| TOTAL | 30 | 15 | |

| Operating | Operating | Net | ||||

| $m | revenue | result | result | |||

| 3Q97 | 3Q98 | 3Q97 | 3Q98 | 3Q97 | 3Q98 | |

| AMR Eagle | *262.1 | *304.0 | NR | NR | NR | NR |

| Comair | 162.9 | 195.0 | 39.2 | 52.9 | 24.5 | 34.6 |

| SkyWest | 80.3 | 113.5 | 12.2 | 19.5 | NR | 12.9 |

| Atlantic Southeast | 99.1 | 105.0 | 22.8 | 25.9 | 15.3 | 18.2 |

| Horizon Air | 84.9 | 97.7 | 7.0 | 10.2 | NR | NR |

| Atlantic Coast | 54.8 | 78.1 | 9.1 | 17.1 | 4.8 | 10.6 |

| Mesaba | 71.4 | 71.7 | 1.0 | 1.8 | NR | 2.1 |

| Current | Orders | ||

| fleet | (options) | Delivery/retirement schedule/notes | |

| 737-200 | 13 | 0 | To be replaced by A319/20/21s |

| 737-300 | 6 | 0 | To be replaced by A319/20/21s |

| 737-400 | 3 | 0 | To be replaced by A319/20/21s |

| 737-500 | 6 | 0 | To be replaced by A319/20/21s |

| 747-300 | 2 | 0 | Leaving fleet in 1999 |

| A319 | 0 | 26 | Delivery in 1999-2001 |

| A320 | 0 | 5 | Delivery in 1999-2001 |

| A321 | 0 | 3 | Delivery in 1999 |

| A330-200 | 1 | 5 | 1 in 1998, 4 in 1999 |

| A330-300 | 3 | 0 | On 10 year leases from 1997 |

| A340-200 | 2 | 0 | |

| A340-300 | 3 | 0 | |

| MD-11 | 2 | 0 | |

| DHC8 | 4 | 0 | |

| TOTAL | 45 | 39 |

| Revenue | Operating | Operating | |

| profit | margin | ||

| Sabena | $1,081.0m | $12.8m | 1.2% |

| Sobelair | $85.5m | -$2.3m | -2.7% |

| DAT | $60.5m | $3.6m | 6.0% |

| BFSC* | $4.2m | $0.4m | 9.5% |

| Hotels | $5.8m | $1.2m | 20.7% |

| Others** | $6.3m | $6.3m | 100.0% |

| Intra-group | -$96.3m | -$20.5m | n.a. |

| TOTAL | $1,147.0m | $1.6m | 0.1% |