Blue Sky: why take the risk?

December 1997

In setting up its low–cost subsidiary — code–name Blue Sky — British Airways is defying analysts who believe that it cannot succeed because it has no competitive advantage in this market, and that serious damage will be inflicted on BA’s brand image. So what lies behind BA’s apparently risky decision?

Blue Sky will have most of the characteristics of a low–cost carrier — 737–300 fleet (just two to begin with), 100% direct sales, no frills — but it will recognise pilot and other unions. Great emphasis is put on the fact that it will be a separate business, based at Stansted airport and totally differentiated from BA’s mainline business.

The low–cost operators see Blue Sky as a thinly–disguised attempt to drive pesky upstarts from the market. As Stelios Haji–Ianniou of easyJet put it in his usual understated manner:

"Their only possible reason for starting BA CHEAPO is to eliminate smaller competitors … and then increase their fares again!".

It is true that some of the new entrants will be forced into bankruptcy — the fate of almost all the first wave of new entrants in the US and now many of the second wave who have suffered from a post–ValuJet crisis of confidence. But it is highly unlikely that predation is BA’s aim. It has suffered enough embarrassment in the courts already.

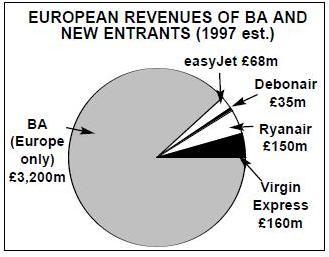

The US experience shows that once a low cost market has been created it does not go away, although the participants will change and the keenness of price competition varies in line with the economic cycle. The new entrants in the UK–Europe markets are still tiny in revenue terms compared to BA (see pie chart) but the number of passengers they are now carrying — about 7.2m for 1997 — is 6m up from 1993 while BA’s European traffic over the same period has increased by just 2.5m. Add in the 5m passengers now carried on Eurostar, and BA’s concerns about being left out of a growth market seem more substantive.

It is likely that most of the low–cost carriers' growth has come from generating new traffic (first time flyers, people travelling more frequently or to destinations that they would not otherwise have tried). But when the aviation cycle moves into its downward phase more of their traffic growth is likely to come from diversion from the full service airlines.

A US DoT investigation of the impact of low cost carriers during 1988–1995 may well have relevance for the European market. During this period (from a peak market to the recovery phase after the deep recession) total domestic passenger growth was 68m, which resulted from an increase of 83m in markets where low–cost carriers were present and a decrease of 15m in other markets. It is a fairly good bet that we are close to the peak of the aviation cycle at present.

Another lesson from the US is that, although low–cost subsidiaries were established in response to low–cost carriers, they had a great impact on full service competitors, frequently driving them out of the market. This was the case with Shuttle by United which resulted in USAir (as it was then) and Delta abandoning the California market. Delta Express is now undermining USAirways in the eastern seaboard. Meanwhile, Southwest continues to expand in both regions.

Perhaps Air France, Lufthansa, Alitalia and Iberia will eventually have as much to fear from Blue Sky as easyJet, Debonair and co.

BA’s decision to launch its subsidiary must be associated with its airport strategy. Its successful transfer of Latin American and African services to Gatwick has proved that operating from Heathrow is not always a pre–requisite for profitability (and it also suggests that slot give–ups at Heathrow may not prove to be as expensive as claimed). The next stage has to be establishing a presence at Stansted before one of its rivals realises the potential of this underutilised airport.

Properly marketed, the benefits of Stansted relative to Heathrow could more than counterbalance the lack of frills in the air. On a very good day a trip from the City of London to central Paris will take 200 minutes, only 20% of which will be on a plane. For the 43% taken up by ground transport to and checking in at the London airport, the Stansted Express and Stansted Airport eclipse the tube and Terminal 2.

Business travellers have other critical requirements, namely frequent flier miles. These are provided by US subsidiaries like the United Shuttle, Delta Express and on regional feeders like American Eagle. But if Blue Sky provides British Airways Air Miles, then can it really claim to be a completely distinct operation and brand from its parent?

Already there is a successful model for an independent airline combining low–cost operation under the BA brand — Gatwick–based Cityflyer, which operates in full BA livery, shares some of BA’s facilities and purchases FFPs benefits from its parents. Cityflyer has a niche role taking the BA brand into markets that are too small for the parent to serve profitably.

As BA is willing to lease out its brand to an airline in which it has no equity stake nor management control, it seems illogical that it is so insistent that Blue Sky will be branded in a completely different way from the parent (which itself consists of seven sub–brands). The most coherent strategy would surely be to use Blue Sky to sell the BA brand, or elements of the brand, into the low–cost market.

BA’s reluctance to embrace this option is probably less to do with worries about brand dilution than with the practicalities of matching the cost levels now being achieved by the new entrants (details in following article) without offending unions or provoking law suits