Global Distribution Systems:

Facing up to revolution

Jul/Aug 2019

Distribution of airline and travel products is in the process of a major revolution, which could be highly disruptive to existing players. There are three companies that dominate as global distribution systems to the industry — Amadeus, Sabre and Travelport — with some 90% of the market. Some have described them as outdated dinosaurs, who charge too much, unfairly make huge profits, and whose time has come.

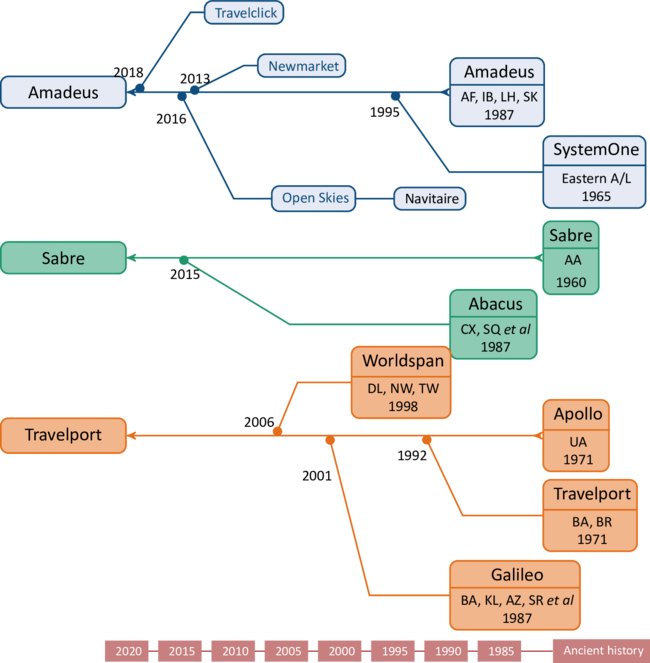

The three GDSs emerged from individual airline computer reservation systems in the 1970s and 1980s with a role of combining schedules, prices and availability of airline seats from different sources and provide this information to travel agents in real time.

With the development of the internet, new online travel agents and price comparison websites emerged, while start-up new business model airlines could reduce cost of distribution by accepting bookings only through their own websites, avoiding paying either travel agent commissions or exorbitant GDS fees.

The increased visibility of pricing provided by the internet accelerated the commoditisation of the business. The Legacy carriers followed suit: cutting travel agents' commissions, pushing bookings through their own websites and other direct channels.

However, an airline still needs to maximise its bookings, and with some exceptions maybe, cannot afford to turn off the tap to any source. An IATA survey in 2016 found that while 47% of ticket bookings were made through direct channels (33% through the airline’s own website, 2% through its mobile app and 12% via other direct channels such as call-centres), 20% still came from retail travel agents, 11% from online travel agents (OTA) and 20% from travel management companies (TMC).

Increasingly, airlines seem frustrated at the seeming inflexibility of the GDSs. The distribution systems' linear flight shopping processes have hardly changed since the regulated era of the 1970s when the first generation of CRSs emerged. They were designed when all seats in a cabin were equal; luggage, seat reservations, legroom, food and drink were all included in the ticket price; and un-bundling, ancillary sales and up-selling were a long way in the future.

The GDSs have invested in various solutions and agent tools to help airlines sell their new products, but some travel agents and airlines continue to express dissatisfaction — the services aren’t yet quite good enough for the modern airline market.

What is this revolution?

It is remarkable how slow the international airline industry can sometimes be at adapting to technological change. The method of communication for passenger booking data has hardly altered in the past fifty years: it is based on arcane teletype messaging, with fixed fields of coded information and limited adaptability.

Now, under an IATA initiative, a new system of communication, dubbed the New Distribution Capability (NDC) is being introduced based on the new fangled XML (extensible markup language, first developed in 1998 and similar to the HTML that powers the content of world wide web). This is not a platform but the definition of a “shopping” standard that can be understood and implemented in APIs (application program interfaces — a set of defined routines, functions and tools allowing computer programs to talk to each other) by any travel distributor with the capability, and can easily evolve as the industry develops. IATA describes it as a standard designed to enhance distribution.

Alongside this, IATA has developed another initiative, One Order, to create a single unified customer order record (that contains much more data than can currently be presented in the PNR). One Order is described as providing the capability to hold all the data elements associated with a traveler’s purchase, including base and ancillary products, across channels and purchase sessions, so the airline can track and fulfil what the traveller buys; and to simplify distribution.

IATA has a catchy target of 20-20-20: meaning it would like 20 airlines to be producing 20% of bookings through NDC by 2020. It looks as if it will achieve the target.

The opportunity that NDC presents includes direct API connections between airlines and third-party retailers (Travel Management Companies and Travel Agents — both retail and online) bypassing the GDSs completely — Lufthansa already offers a “direct-connect” platform to retailers which allow them to avoid its €16 charge for GDS bookings. It has stated that customer access and multi-channel push are key to its distribution policy and that it already achieves 50% of its bookings from direct and NDC methods. Other airline groups, such as IAG airlines, which is already NDC-certificated, offer similar products.

NDC also gives rise to targeted and personalised marketing, the sale of ancillary services on different airlines on a ticket that involves a transfer; and the harnessing of AI (Artificial Intelligence) and Big Data. This eases further access for new technology companies into the travel market.

GDS Evolution

Things are changing, but, this does not necessarily mean that the GDSs' days are over. The three are embracing new technology and NDC — albeit slowly and painfully — while bookings continue to be made (see chart — the jump in Sabre’s bookings data followed its acquisition of Abacus in 2015). And Amadeus and Sabre have been minimising risk by migrating their fixed data centres to cloud hubs throughout the world. (Travelport notes that is still exposed to risk with its massive ex-Delta data centre in Atlanta).

Apart from anything else, distribution is not just about data and schedules. The GDSs also offer solutions that cover a whole range of simultaneous transactions, such as payment platforms, reporting, mid- and back-office systems. Travelport has placed great emphasis on developing its eNett B2B payment system.

Further, they have all diversified into other segments of the travel distribution chain. Amadeus and Sabre offer detailed IT Solutions for airlines — passenger service systems which offer full reservation, inventory and departure control capabilities. These systems, like the booking product, charge on a transaction basis, measured in the number of passengers boarded (see chart).

Amadeus, Sabre, and Travelport have each taken different paths in recent years, and seem capable of exploiting rather than being disrupted by the Distribution. They are planning to remain entrenched in the travel marketplace.

These three are high tech software and data companies that generate strong levels of cash flow, have high levels of R&D spend. This can be attractive — Travelport was recently bought out by private equity players Siris Capital and Evergreen in a $4.4bn deal.

Source: Amadeus