JetBlue: At last,

closing the margin gap with peers

Jul/Aug 2015

The lofty second-quarter profit margins reported by US carriers have generally failed to impress airline investors, who remain concerned about negative unit revenue trends. As a result, US airline stocks remain down in the dumps after falling sharply in the spring.

But JetBlue Airways has been an exception. New York’s hometown airline (the fifth largest US carrier) has bucked the negative industry trend and continued to report PRASM growth: 4.5% in Q1 and 1.4% in Q2. The latter outpaced the industry by as much as seven percentage points.

As a result, JetBlue was the best-performing US airline stock in January-July. The price surged by 46%, compared to a 10% decline by the NYSE Arca Airline Index (XAL).

The combination of enormous fuel cost savings, good cost controls and the PRASM improvement will mean JetBlue reporting extraordinary profit growth for 2015. Analysts’ consensus estimates see JetBlue’s EPS surging by 163% this year, compared to 35%-116% EPS growth for the four largest US carriers.

JetBlue’s PRASM trends are all the more remarkable given the carrier’s relatively brisk ASM growth, which is expected to be at the higher end of the 7-9% guidance, following 5.1% growth in 2014 and 6.9% in 2013. Although Southwest is also stepping up its growth this year, to 7% from 0.5% in 2014, the top three carriers will see 2.5% ASM growth at most.

JetBlue has had an eventful 12 month or so; the key changes have been the following:

- New leadership

Robin Hayes (formerly JetBlue’s president, ex-BA) took over as CEO from Dave Barger when the latter’s contract expired in February 2015. Barger had faced some pressure not to seek a new contract because of criticism from the financial community over JetBlue’s lagging margins, ROIC and share price performance.

JetBlue had already implemented a sweeping management reorganisation in the spring of 2014, which had included the departure of COO Rob Maruster. And it had strengthened critical areas by promoting Marty St. George to SVP Commercial and bringing an airline analyst from Credit Suisse (Kevin Crissey) to the role of Director Investor Relations.

The management changes were interpreted as a shift in culture that would focus more on costs and margins and be more investor-friendly, rather than customer-friendly.

- New plan to drive shareholder returns

At its investor day in November 2014, JetBlue unveiled a “long-term plan to drive shareholder returns”, which included measures to boost revenues, reduce capital commitments and maintain a competitive cost position.

JetBlue aimed to strike a compromise between pleasing Wall Street and remaining true to its core values. In addition to boosting profits, free cash flow and ROIC, the measures would enhance the airline’s “product advantage and service-oriented culture”. CEO Robin Hayes stated: “JetBlue’s core mission to inspire humanity and its differentiated model of serving underserved customers remains unchanged”.

The revenue initiatives outlined in the plan were expected to generate $400m-plus in additional annual operating income beginning in 2017.

As part of the plan, JetBlue announced the deferral of 18 Airbus aircraft orders from 2016-2018 to 2022-2023 — a move that will reduce capital expenditures by $900m through 2017.

JetBlue also announced a commitment to maintain ex-fuel CASM growth below 2% through 2017. In the longer term, unit costs would benefit from strategies such as upgauging the fleet with larger A321s and increasing the number of seats on the A320s by 15 or 10% (to 165).

- New revenue initiatives

In the past year, JetBlue has had numerous new revenue initiatives in various stages of development. There is “Mint”, the premium transcontinental product launched in June 2014 that has caused quite a stir in the market (see Aviation Strategy, June 2014). There is “Fly-Fi”, which JetBlue claims is the fastest in-flight wifi product in the industry. There is the older-established “Even More” extra legroom product that offers “industry-leading comfort and value”.

In June 2015 JetBlue also revamped its fare structure. It now has three branded fare bundle options known as “Fare Families” (Blue, Blue Plus and Blue Flex), each of which has different offerings, such as free checked bags, reduced change fees and additional FFP points. It is an alternative approach to the static fees employed by many other airlines.

JetBlue also talked about a revenue initiative called “A320 cabin refresh”. It means outfitting the A320 fleet with a cabin similar to the A321’s highly acclaimed cabin.

Given all of those changes, JetBlue faced intense questioning from analysts on its second-quarter call on exactly which revenue initiatives or strategies might help explain the sudden PRASM strength.

The answer was a surprise: core demand strength, reflecting JetBlue’s exceptionally strong route network and revenue management. In addition to “strong execution”, the executives mentioned maturation of the network and the benefit of having limited exposure to softer global markets and unfavourable currency developments.

The Mint routes represented only 7% of JetBlue’s ASMs and the premium seats on those routes only 0.7% of ASMs in 2Q, so the overall PRASM impact was marginal. And many of the other revenue initiatives are too new to show much impact.

Core network strength

As JetBlue executives put it in the second-quarter call: “A big chunk of the benefit has come from a lot of the network investments we have made over the last several years, especially in Latin America”. All six of the carrier’s focus cities — New York, Boston, Fort Lauderdale/Hollywood, LA/Long Beach, Orlando and San Juan — were profitable and had margin expansion in 2Q.

Whether it is due to luck or smart earlier network decisions, JetBlue has benefited this year from having minimal exposure to the worst competitive hotspots, such as Dallas and Chicago.

This year JetBlue has benefited from competitive capacity reductions in its key markets. As a result, the airline has seen exceptionally strong PRASM performance especially in the Caribbean/Latin America region.

Thanks to Mint and competitors’ capacity reductions, JetBlue is also doing extremely well in the transcon market. Even the more marginal transcon routes, such as those from FLL, are now solidly profitable.

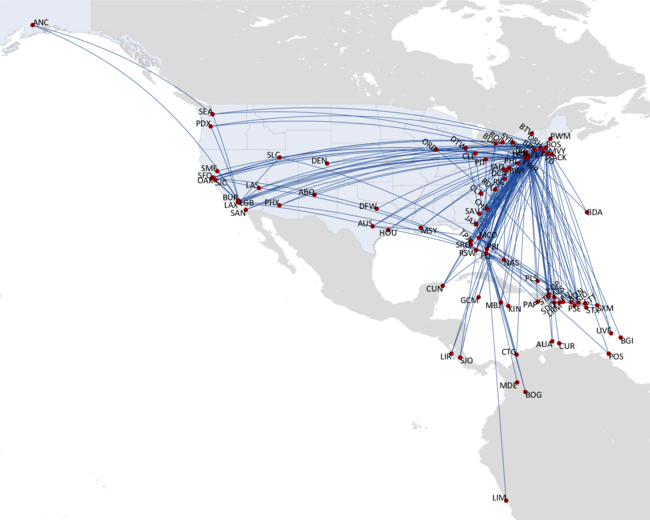

JetBlue is predominantly a point-to-point carrier, with most of its routes touching at least one of the six focus cities and 86% of its customers flying on nonstop itineraries. Its route network now covers 90 cities.

JetBlue’s greatest strength is its position in New York, the nation’s largest travel market. JetBlue is the second largest operator at JFK in terms of domestic capacity (36% of the seats), and it serves all five New York area airports.

Having spotted an opportunity in 2009 to grow in Boston, JetBlue is now Logan’s largest carrier, with 26% of total seats and almost 60 nonstop destinations. Boston was a major and risky investment but it is paying off handsomely. More growth is in the pipeline in Boston as JetBlue works towards a target of 150 daily flights.

The Caribbean/Latin America region (including Puerto Rico) has been a huge success story for JetBlue. The markets have year-round demand, have matured quickly, generally require minimal up-front capital and are nicely profitable. Almost a third of JetBlue’s capacity is now in that region (compared to 26% on the transcon). JetBlue is already the largest US carrier in the Caribbean, dominating markets such as Puerto Rico and the Dominican Republic.

JetBlue has called the region “a natural out of New York”. However, much of the growth now focuses on FLL (the lower-cost alternative to Miami) or on adding service to a destination from multiple focus cities. FLL now offers 40-plus JetBlue destinations and is seeing both domestic and international growth, with eight new cities launching in late 2015 or 2016.

This year’s highlight is the addition of Mexico City to JetBlue’s network in October (its 35th destination in the region). The airline will operate daily A320 flights from FLL and Orlando.

JetBlue has been exceptionally successful in the US-Colombia market since first venturing there in 2009; it now operates to Bogota, Cartagena and Medellin. Lima (Peru) followed in 2013. A third South American country, Ecuador, looks set to follow in first-quarter 2016 (FFL-Quito).

JetBlue has long eyed South American markets such as Brazil but its A320s or A321s do not have the range. But the potential future availability of the A321LR may have brought such plans, as well as flights to Europe, a little closer (more on that below).

On the alliance front, JetBlue’s focus has shifted from signing up new interline partners (now around 40) to deepening existing relationships (typically into codesharing).

Interestingly, JetBlue executives noted the positive effect Boston is having in many of its partnerships. For example, the combination of JetBlue’s growth in Boston and the performance of its partnership with El Al in New York led the Israeli carrier to add Boston to its network in June. El Al was the sixth existing or new partner of JetBlue’s that began operating to Boston. In other words, JetBlue is arguing that its growth is adding competition not only in the US but also in its partners’ long-haul international markets.

In recent months JetBlue has been vocal in criticising the larger carriers’ immunised JVs, going as far as calling for a review of the consumer benefits of such deals. “Left unchecked, this US government-sanctioned collusion will continue to stifle innovation and competition in international aviation and will directly harm JetBlue and consumers”, the carrier wrote in its recent Gulf subsidies row related submission.

Of course, JetBlue can be expected to side with the Gulf carriers because Emirates, Etihad and Qatar are among its codeshare partners. But JetBlue is also concerned about some of the Latin American alliance developments, such as Delta/Aeromexico’s ATI application, given the slot constraints at Mexico City. JetBlue itself found it hard to secure slots at MEX for its planned services.

Fleet considerations

JetBlue operates a 209-strong fleet (19 A321s, 130 A320s and 60 E190s) and has another 121 aircraft on firm order. In the past two years, the airline has deferred some orders (to reduce and smooth out near-term deliveries) and begun a switch to larger gauge aircraft (A321s).

All of the deliveries through 2017 are A321s. JetBlue operates the type in two seating configurations — regular and lower-density Mint. The planned expansion of Mint will mean JetBlue converting some of next year’s A321 deliveries to the lower-density version.

JetBlue has flexibility to switch any of the Airbus orders for other variants of the A320 family. That raises the interesting prospect that JetBlue could become an early customer for the longer range version of the A321neo that Airbus is now pitching as an alternative to the 757. The A321LR is still under development but could be available from 2019.

In recent months, JetBlue executives have gone on record to say that they are seriously interested in the A321LR, which would offer full commonality benefits with the existing Airbus fleet and facilitate expansion into markets further afield.

In the first place, JetBlue would use the aircraft for a push deeper into South America. JetBlue is currently not considering flights to Europe, but many of its customers have asked for such routes, so it may only be a matter of time.

Closing the margin gap

JetBlue has always been successful in the marketplace, inspiring customer loyalty much like Southwest and WestJet have done. Now JetBlue is proving that it is possible for an up-market, middle-sized, non-niche LCC to be also financially successful if it has the right route network and revenue strategies.

JetBlue’s operating margin surged from 9.4% to 17.5% in the second quarter, meaning that the carrier effectively closed the margin gap with its peers. If the significant projected revenue growth from the new initiatives materialises, JetBlue could start outperforming the industry in margins in the next couple of years.

The signs are promising. Mint, which is currently available only on two transcon routes out of JFK, has won JetBlue many new corporate customers. It has significantly improved transcon margins. So JetBlue is bringing Mint to the Boston transcon markets in March 2016, as well selected Caribbean routes out of New York and Boston this winter.

Early results from the June fare revamp are also encouraging. JetBlue expects the move to generate at least $65m in incremental operating income this year and more than $200m annually by 2017.

However, the new strategies add complexity and could be challenging to execute. For example, while JetBlue sees many opportunities for Mint, in the Caribbean markets it will have to balance the incremental revenues from Mint against the significant economic benefits of operating A321s in the regular higher-density configuration.

The risks also include potential negative feedback from customers. The fare options clandestinely introduced first checked bag fees at JetBlue (for the cheapest “Blue” option). But paying for baggage has largely become accepted practice for US travellers; Southwest is now the lone holdout in that regard.

JetBlue hopes to mitigate a potential consumer backlash to the increased A320 seat count by maintaining a better than industry average seat pitch (it will be installing “lighter, more comfortable” seats) and by upgrading the interiors to include larger seatback screens, etc. A similar product on the A321s has generated positive customer feedback.

So JetBlue is very bullish about the future payoff of the A320 “seat densification” project, which is expected to begin in mid-2016. It is likely to have a highly favourable impact on unit costs and be a “very ROIC positive way to increase capacity”.

The A320 project will help offset longer-term cost pressures in areas such as labour and maintenance. One risk area is pilot costs, because JetBlue’s pilots unionised in 2014, but talks are still in the early stages and there is no near-term impact.

For the time being, JetBlue’s unit cost performance remains exemplary. In 2Q non-fuel CASM inched up by only 0.6%, and the full-year prediction is 0-1.5%.

JetBlue is using the oil windfall, in the first place, to strengthen its balance sheet. It is opportunistically prepaying debt and buying many aircraft with cash. Its interest costs have declined, leverage ratios have improved and as many as 46 of its aircraft are now unencumbered. S&P, Moody’s and Fitch have all raised JetBlue’s credit ratings this year.

Notably, JetBlue entered into an “accelerated share repurchase” with Goldman Sachs in June, paying $150m for an initial repurchase of its shares. But JetBlue executives described it as a “policy, not a commitment”; the programme is mainly aimed at offsetting dilution from stock issuance to management and employees.

So JetBlue is behind its peers in returning capital to shareholders. No-one is bothered about that, though, because the strong liquidity (25% of annual revenues) and accelerating profit and free cash flow generation mean that it is only a matter of time before JetBlue catches up.

| at end June 2015 | Aircraft in operation | Firm Orders† | Delivery Schedule |

| A321 | 19 | 27 | 2015-2018 |

| A320 | 130 | ||

| E190 | 60 | 24 | 2020-2022 |

| A321neo | 45 | 2018-2023 | |

| A320neo | 25 | 2020-2022 | |

| Total | 209 | 121 |

Note: Analysts' consensus forecasts (Aug 5, 2015)