LAN-TAM merger: Latam Airlines launches into tough climate

Jul/Aug 2012

Chile’s LAN and Brazil’s TAM closed their long-awaited European-style merger deal on June 22, creating Latam Airlines Group S.A., the region’s first “world-class global airline group”. With low costs, a highly diversified business model, dominant position regionally and minimal network overlap between the airlines, Latam could be a perfect vehicle for tapping Latin America’s promising long-term growth potential.

But Latam faces many short/medium-term challenges. First of all, the global economic climate is dismal, while fuel prices remain high. There is much uncertainty about the resolution of Europe’s troubles.

Brazil, Latin America’s largest air travel market, has seen a dramatic slowing of economic and air traffic growth this year, while competition domestically has continued to increase. TAM saw its earnings fall sharply in the first and second quarters and, like its main rival Gol, has been scrambling to scale back growth plans.

LAN, in turn, is affected by a cargo slump this year, reflecting weaker demand and increased competition in that segment. Cargo accounts for as much as 24% of the Chilean carrier’s revenues. Partly because of it, LAN has posted lacklustre results for the past two quarters.

As an added setback, LAN has lost its investment-grade international credit ratings. When the merger closed Fitch assigned LAN/Latam a junk-grade “BB+” rating, down two notches from LAN’s former “BBB” rating, essentially because TAM has a weaker credit profile, including a heavier debt load.

Since Brazil and cargo are two key areas where Latam hopes to grow and obtain merger synergies, analysts fear that slowdowns in those areas could delay integration efforts and make the promised synergies harder to achieve. The ratings downgrade will mean higher financing costs at a time when the airlines have significant air

When the merger plans were announced in August 2010, the economic environment was very different. LAN and TAM were keen to act quickly to take advantage of the robust conditions that existed in many Latin American countries. They also wanted to combine from positions of strength.

But it took the airlines almost two years to complete the transaction, compared to the original target of 6-9 months (which probably was a little ambitious). Regulatory delays were partly to blame. The deal went through a thorough antitrust scrutiny, though the authorities ruled in a reasonably timely fashion (Chile’s TDLC took eight months and Brazil’s CADE gave its final decision three months later, in December 2011). But it was clear that the airlines themselves also struggled to put together and close what was an extremely complex transaction.

LAN and TAM face the challenging task of integrating operations. Even back in 2010 many sceptics argued that it could not be accomplished successfully. First, LAN-TAM is not a full takeover; the airlines will maintain separate operating certificates, brands, headquarters, governance structures, values and culture. Second, the ownership/control structure is unusual because of the involvement of two families (Chile’s Cuetos and Brazil’s Amaros) and because of the need to comply with Brazil’s foreign ownership restrictions. Third, analysts have expressed concern about what they call a “culturally difficult” relationship between Brazilians and Chileans. It seems likely that execution risks for this type of merger are magnified in a tougher economic climate.

Finally, the global alliance decision, which Latam expects to make “in the coming months”, will have negative repercussions regardless of which way it goes. For example, opting for oneworld (LAN’s exist

Not surprisingly, Latam has had an unenthusiastic reception in the investment community. The exchange offer for TAM’s shares had to be extended by ten days to meet the required threshold. Most analysts have kept a “neutral” rating on Latam shares, amid concerns especially about Brazil, execution risk and the promised synergies possibly not materialising.

Then again, LAN and TAM already had relatively healthy stock market valuations, reflecting their traditional strengths. When the merger closed, Latam’s $3.5bn market capitalisation made it the highest-valued airline in the world (running neck-and-neck with Air China).

Of course, Latam’s longer-term prospects remain excellent. If the combine can integrate successfully while managing through the near-term economic challenges, it should be uniquely well positioned in both the passenger and cargo segments to benefit from robust demand growth in Latin America, boosted by surging disposable incomes and swelling ranks of middle classes.

Latam explained

LAN and TAM completed what is essentially a European (AF-KLM, BA-Iberia) style merger, though Avianca and Taca also used that model in 2009. The all-stock transaction consolidated the economic interests of LAN, TAM and their affiliates under a single parent entity, which will coordinate and align activities for all group holdings, so that they can integrate, capture synergies and offer “seamless passenger and cargo service across the continent and around the world”. LAN and TAM will continue to operate as distinct airlines and their CEOs will have “real autonomy to run the business”.

The deal was structured to comply with Brazil’s laws that limit foreign ownership in airlines to 20% of the voting shares (which may be raised to 49% in the future). There was no change of control at either airline. While Latam now holds substantially all of TAM’s total stock (economic interest), the Amaros retain 80% of TAM’s voting stock.

The relations are governed by shareholder agreements. The controlling shareholders of LAN and TAM agreed to a governance model to “jointly manage all strategic decisions” relating to the alignment of Latam activity.

Of course, it was not a merger of equals; LAN acquired TAM. LAN became the holding vehicle of the combined operations, changing its name to Latam and retaining its listings on the Santiago Stock Exchange and on the NYSE. TAM’s stock was delisted in Sao Paulo and New York. The transaction was carried out through an exchange offer, in which TAM’s shareholders were invited to exchange each share they held for nine-tenths of a share in LAN. Those shares were converted to Latam depositary receipts, delivered in the form of BDRs in Brazil and ADRs in the US. About half of the Latam shares are now held by the public; the other half is held by four major investor groups, with the Cueto family having the largest stake (around 25%). Latam Airlines Group is headed by LAN’s former CEO, Enrique Cueto, as CEO. TAM’s vice-chairman Mauricio Rolim Amaro became the group’s chairman.

Contrary to initial speculation, there never was much political opposition to the deal in Brazil. Also, the slot/route carve-outs imposed by the regulators were modest, reflecting the mere 3% overlap between the networks. LAN and TAM were required to cede two pairs of slots at Sao Paulo’s Guarulhos Airport to airlines that wanted to operate Sao Paulo-Santiago flights; however, as of August 13 no airline had expressed interest in those slots.

Latam includes LAN Airlines and its affiliates in Peru, Argentina, Colombia and Ecuador; LAN Cargo and its affiliates (ABSA in Brazil, MAS Air in Mexico and Linea Aerea Carguera in Colombia); TAM S.A. and its units TAM Linhas Aereas, TAM Mercosur, TAM Airlines (Paraguay) and Multiplus S.A. (TAM’s FFP).

The combination provides passenger services to some 150 destinations in 22 countries and cargo service to 169 destinations in 27 countries. At year-end 2011, the airlines had a combined fleet of 310 aircraft and some 51,000 employees. Last year LAN and TAM had combined revenues of $13.5bn and carried 60.3m passengers.

These statistics made Latam the first Latin American airline group to reach the world’s “top 15” rankings in terms of both revenues and passengers. In the Latin American context, the merger has created a dominant player. In terms of 2011 revenues, LAN-TAM is three times as large as the second-ranked Gol and 35% larger than Gol, AviancaTaca and Copa combined (see table, above).

Latam accounts for about 40% of international passenger traffic within South America. The combine is the second-largest operator by passengers on South America-US routes (after American) and the third largest on South America-Europe routes.

Latam is, first of all, a response to the many large airline mergers and immunised alliances completed in recent years around the world, as well as the Avianca-Taca merger closer to home. Second, the merger is aimed at capitalising on and taking full advantage of Latin America’s long-term growth potential. Third – and this was a key reason for LAN, the merger filled a gaping hole in the Chilean carrier’s network: Brazil.

Because of Brazil’s tight foreign ownership restrictions, LAN has not been able to establish an effective airline unit there – a strategy it has used successfully in other South American countries. Acquiring TAM was the perfect solution: it has given LAN not just entry but a very strong position in Brazil’s domestic market, where TAM carried 38.7% of the passengers in May (slightly less than Gol/Webjet). Enrique Cueto recently described the Brazil access as an “historic opportunity”, noting that 40% of Brazil’s population (some 80m people) belong to a middle class that is just starting to travel by air.

LAN also saw great benefits in bringing TAM Cargo to its own cargo empire, which is already the largest in Latin America. Combining LAN’s global cargo network and expertise with TAM’s Brazilian market presence should mean some very attractive growth opportunities.

LAN has made it clear all along that this merger will be a growth vehicle. The airlines earlier talked about three initial primary growth areas for passenger operations following the merger: new services to Europe and Africa from Brazil, supported by increased feed from the Southern cone; new services to the US from Lima (Peru), supported by increased feed from Brazil; and new hubs that could connect to Europe and the US.

While cost savings are anticipated, the LAN-TAM union contrasts with the European mergers in that it is not aimed at cutting costs. The emphasis on growth will limit the need for headcount or aircraft reductions. Both LAN and TAM are already lean, with relatively low unit costs.

Anticipated synergies

LAN and TAM expect their combination to generate $600-700m additional annual pretax income, beginning in the fourth year. Some $170-200m synergies are expected in the initial 12 months, which would offset the $200m one-time costs that are mostly expected in year one.

The $600-700m target, which was announced in January 2012, is substantially more than the originally envisaged $400m annual synergies. The upward revision reflected updates and additional analyses carried out with the help of consultants. The synergy target accounts for 4-5% of combined 2011 revenues and is in line with other recent industry transactions.

About 60% of the synergies are expected to be generated by revenue increases (40% from passenger operations and 20% from cargo); the remaining 40% would come from cost savings.

On the passenger side, LAN and TAM are anticipating a $255-260m annual revenue boost resulting from the combination of their networks and the addition of new flights. Another $15-25m will come from the consolidation of their FFPs and the sharing of best practices in that area.

Combining TAM Fidelidade and LANPASS will create a powerful FFP, though the airlines have not yet indicated how that might be accomplished. Fidelidade is much larger and has been a listed company in Brazil since TAM spun it off in 2009. After the merger closed, LAN and TAM immediately began allowing passengers to earn and redeem miles/points over the complete networks and senior-level members to access all lounges and preferential services.

On the cargo side, LAN and TAM anticipate $120-125m in additional revenues attributable to new services and best practice sharing.

The $240-290m annual cost savings are slated to come from the following: consolidation of airport functions ($30-35m); leveraging economies of scale in contracts ($70-100m); streamlining of corporate overhead and some functions ($20m); efficiencies of common IT platforms ($65-70m); economies and efficiencies of scale in maintenance ($20-25m); and efficiency of combined sales and distribution processes ($35-40m).

As a result of the merger, Latam’s revenues are nicely diversified, with international passengers accounting for 34%, Brazil domestic 27%, other domestic 11%, cargo 17% and loyalty programmes 6% of the combine’s total revenues.

The scale benefits resulting from the merger include being in a stronger position to negotiate aircraft orders with the manufacturers and network agreements with large European and US airlines. The airlines will also enjoy more flexibility in terms of aircraft financing regimes.

There has been concern about potential execution risk arising from the unusual ownership structure, but the airlines have presented much evidence of their compatibility. They have a long history of collaboration. In 1998 LAN, TAM and Taca placed a joint order for Airbus aircraft in order to secure better prices – the reason they have similar aircraft in their fleets. They share the same values and strategic vision. The economic interests of the two families are supposed to be aligned, and there are the numerous shareholder agreements.

But it remains to be seen how well things will work if there is a need for painful measures. Most analysts expect at least delays in the execution of the merger. LAN’s recent record in that respect is not very encouraging; in addition to the delays in closing the merger deal, the Chilean carrier has experienced difficulty and delays in turning around its LAN Colombia unit.

Of course, there are optimists and those that focus on the longer term. LAN’s management team is regarded as the very best in the industry. LAN is famous for its diversified and flexible business model, and the addition of TAM should only strengthen those attributes. Together the airlines may be better positioned to deal with the effects of slower economic growth in their region.

Near-term financial challenges

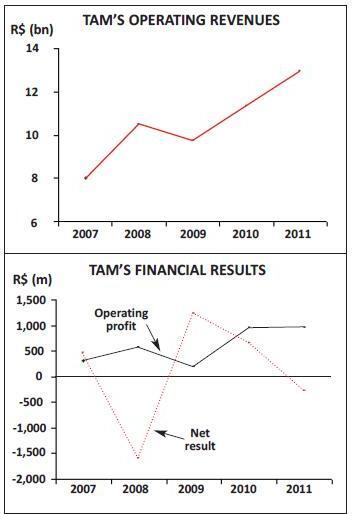

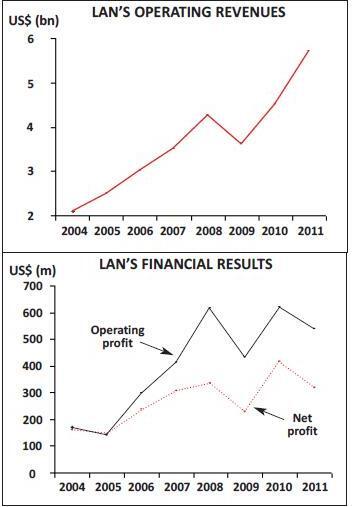

LAN has a strong track record of profitability going back to the early 1990s, though it has seen earnings dip sharply during recessions. It has grown rapidly in the past decade, quadrupling its revenues from $1.4bn in 2001 to $5.7bn in 2011. The revenues are nicely diversified across several economies and LAN has less foreign currency mismatch between revenues and costs than the Brazilian carriers. LAN had double-digit annual operating margins in 2007-2010 and a very healthy 9.4% margin in 2011.

TAM, which is 37% larger than LAN in terms of 2011 revenues ($7.8bn) and 67% larger in passengers, used to be consistently profitable but has incurred annual net losses in two of the past four years (2008 and 2011). The losses were mainly due to the Brazilian real’s depreciation against the US dollar, and TAM has continued to be profitable on an operating basis, albeit at lower margins than LAN. Last year’s operating margin was 7.5%.

This year, however, TAM’s results have deteriorated sharply as a result of higher fuel prices and weak domestic demand in Brazil. TAM only achieved a 2.3% operating margin in the first quarter and its net earnings fell by 22%. This was despite robust revenue trends in the international passenger segment.

The weak domestic demand has been mainly the result of higher fares. TAM and Gol have curtailed capacity growth, which has resulted in a healthier yield environment. This is usually a positive development for airlines, but the Brazilian market is highly price-sensitive. An added problem is that the smaller carriers, which now account for more than 20% of the domestic market, continue to grow rapidly.

TAM’s second-quarter results were weak, despite a 14.3% improvement in domestic yield. The results were also grossly distorted by unfavourable foreign exchange developments, the marking-to-market of fuel hedges and other accounting adjustments. Operating margin was a negative 8.8%, reflecting a 16% surge in CASK due largely to the real’s 23% depreciation. The staggering R$928m net loss included R$846m of foreign exchange losses.

Latam executives said that one of the key group objectives is to try to reduce the volatility of TAM’s financial results caused by external factors such as foreign exchange and fuel hedges. The combine is considering moving TAM’s aircraft to the Latam balance sheet, where assets too are denominated in US dollars (eliminating the imbalance with costs) and financing all future aircraft deliveries at the group level. From next quarter, TAM’s fuel hedges will switch to hedge accounting and all hedging will be done at the consolidated level.

But the biggest concern from Latam’s point of view is the slowing economic growth in Brazil, which could have further dampening effect on travel demand. Brazil’s GDP is expected to expand by just 2% this year, down from 2.7% growth in 2011. This could mean domestic air travel demand growing only in the mid-to-high single-digits in 2012, after 16-24% annual growth in 2009-2011.

Latam’s strategy for TAM’s domestic passenger operations is to maintain capacity discipline (ASKs down 2-3% in 2012) and try to boost profitability through higher load factors, better yield management and cost and efficiency improvements. June and July already showed positive trends, with TAM’s domestic traffic rising by 10% and load factor surging by 8.5 points to 81.4% in July. Latam executives attributed TAM’s outperformance to better revenue management and pricing strategies and said that they were “optimistic about opportunities in the Brazilian market and expect significant improvements in the short-to-medium term”.

LAN’s operating and net profits also fell sharply in the second quarter, to $37m and $5m, respectively. Operating margin was only 2.6%. The weak results were blamed on a difficult environment in the cargo business, continued costs in the development of LAN Colombia and one-time payments to unions related to the completion of contract negotiations.

LAN has felt the effects of the euro-zone crisis and the global economic slowdown mainly in its cargo business, which has seen weaker demand (mainly in the southbound market to Latin America) and increased competition. LAN’s passenger operations have continued to perform well, recording 14.4% revenue growth in the second quarter, compared to a 6% decline in cargo revenues.

The cargo slowdown concerns many analysts, but LAN has managed the situation well. It has not added any new freighters since January 2011, while belly-hold capacity has been effectively reduced by the higher passenger load factors. In the first quarter, LAN’s cargo capacity was up by only 2.3% while traffic rose by 1.5%. In the second quarter, cargo ATKs fell by 3.3% and RTKs by 2.2%. In May LAN revised down its capacity plans for cargo: ATKs are now expected to grow by 3-5% in 2012, compared to 7-9% previously. LAN Cargo will take delivery of two new 777 freighters in September/October, but the aircraft are partly for replacement and will offer significant efficiency improvements over the 767Fs.

Among the first integration moves, Latam is consolidating LAN subsidiary ABSA Cargo’s and TAM Cargo’s Brazil operations. ABSA’s two 767-300Fs are being transferred to TAM Cargo, which has a stronger brand in Brazil. In turn, TAM Cargo’s international operations are being blended into LAN Cargo’s and ABSA’s operations. Latam is also investing to upgrade cargo infrastructure in Brazil. Latam hopes that these moves will improve the results of the Brazil cargo operations and increase the planned synergies.

The combined passenger traffic statistics that Latam reported for June and July offer cause for optimism. Passenger demand remains solid in the region overall. In July, Latam’s system RPKs rose by 7.9%, consisting of 2.6% growth in international traffic, 24.7% growth in the group’s “Spanish speaking operations” (Chile, Argentina, Peru, Ecuador and Colombia) and 10.1% growth in Brazil. International passenger traffic accounted for 49% of the Latam’s total passenger traffic. Latam expects its system passenger capacity to increase by 3-4% this year, made up of 12% growth at LAN and a 1-2% reduction at TAM.

In the short term, analysts expect substantial earnings volatility because of the integration process. The current consensus forecast is that Latam’s earnings will decline from last year’s 96 cents per ADR to 52 cents in 2012, subsequently rising to $1.27 in 2013.

Balance sheet considerations

The ratings downgrade by Fitch reflected not just TAM’s higher debt levels but LAN’s somewhat “constrained cash holdings”. At the end of March, TAM’s cash reserves were 13.4% and LAN’s 4.7% (or 8.2% including credit facilities) of lagging 12-month (LTM) revenues. Fitch felt that LAN’s credit metrics had deteriorated over the past two years as a result of the implementation of its strategic fleet plan.

But LAN still has a solid financial position, with practically no short-term debt and the potential to tap other liquidity sources. LAN’s long-term debt relates mainly to aircraft financing and is at low interest rates, reflecting its former investment-grade credit rating.

According to Fitch, on a pro-forma basis, Latam had $12bn of combined lease-adjusted debt at the end of March. The adjusted debt/EBITDAR ratio was 5.2 times (LAN’s was 4.7 and TAM’s 5.7), which the rating agency considered “high”. Fitch expects the ratio to deteriorate to 5.5-6 by year-end, as Latam takes on more debt, but after that merger synergies will help improve the ratio to 4.5 by year-end 2013.

Fitch calculated that LAN and TAM had a combined $1.5bn in liquidity at the end of March — 11.2% of LTM revenues or 0.9 times the total short-term debt of $1.7bn. The agency viewed this as “low for the rating category”, though it noted the alternative sources of liquidity, including aircraft pre-delivery deposit funds of around $800m. Fitch does not expect Latam to improve its liquidity from the 10-15% range in the near term, as free cash-flow is likely to remain negative in 2012 and 2013 mainly because of the fleet spending.

Latam’s leadership hopes to recover the investment-grade ratings “in a couple of quarters or maybe a year”. But Fitch made it sound quite tough, indicating that “positive action” on the rating would only result from a combination of the following: reducing the debt/EBITDAR ratio to 3.5 or below; maintaining liquidity consistently around 25% of LTM revenues; having enough liquidity to cover at least two times the debt payments due in the next 24 months; and improving free cash-flow generation to neutral or positive.

In an effort to recover the rating, Latam has decided to cut dividends for a time. It is also evaluating obvious options such as selling a stake in Multiplus, the loyalty programme in which TAM still has a 73% stake. Other options include paying off debt, selling more shares or selling other assets. When asked in the 2Q call about the possibility of an equity offering, Latam’s CFO responded that “maybe in the second half of 2013, if necessary”.

Latam would really benefit from investment-grade ratings because both airlines have kept their substantial aircraft order books unchanged. LAN’s plans are particularly aggressive: net addition of 43 aircraft in 33 months. LAN is looking to grow its fleet from 151 (including 14 freighters) in March 2012 to 194 by year-end 2014. In the same period, TAM will grow its fleet from 156 to 169 aircraft.

Fitch estimates the combined net aircraft capex at $7.9bn in 2012-2014, or $2.5-2.9bn annually – rather high even by global airline standards. Fitch did consider the plan ambitious but also felt that the risk was counterbalanced by LAN’s great track record in correctly anticipating demand, its focus on profitability (instead of market share) and its flexibility, both in terms of adjusting fleet size thanks to the staggered expiration of leases and ability to reassign aircraft to different markets.

As to the fleet strategy, LAN is adding mainly A320s and 767-300s and disposing of A318s and A340s. It will receive two new 777Fs this year and will take delivery of the first two of 32 ordered 787s in late 2012. It has also ordered 20 A320neos for delivery in 2017-2018.

LAN will be the first airline to operate the 787 in Latin America. The aircraft will initially fly between Santiago and Buenos Aires, Lima, Los Angeles, Madrid and Frankfurt, replacing A340s and 767s in those markets. It will free up A340s for expansion in the Australia/New Zealand markets.

TAM, too, is growing its Airbus narrowbody fleet and continuing to take more 777-300ER deliveries. The airline is committed to deploying the 777s on its European routes and will also take that aircraft to Miami in October.

The LAN and TAM fleets are already fairly streamlined and broadly compatible and there is not much scope to rationalise them, but Latam’s leadership has mentioned that it may seek to reduce the number of aircraft types.

The global alliance decision

One of the toughest decisions still facing Latam is the choice of a global alliance. LAN is a longtime member of oneworld, while TAM has been a member of Star since 2010. One of the conditions imposed by the Chilean and Brazilian antitrust regulators is that LAN and TAM may not belong to more than one global alliance after the end of a 24-month period following the closing of the merger.

It is a pity that the regulators ruled out the potentially interesting solution of LAN and TAM belonging to different alliances, because none of the alternatives seem that good. If the choice is oneworld, there could be serious negative effects for TAM and the Brazilian market — a key growth area and a top priority for Latam.

Choosing Star could be impossible, or at least extremely problematic, because of the Chilean antitrust authority’s ruling that Latam could not belong to the same alliance as AviancaTaca (which has just joined Star).

When the merger closed, Latam’s leadership stressed that joining oneworld was not a foregone conclusion and that there were “several options”. Industry observers have suggested that the options may include TAM becoming independent, LAN and TAM going for the third alliance (SkyTeam) or AviancaTaca leaving Star. In the second-quarter call, Latam executives merely stated that all the different options had been evaluated, that no definite decision had yet been reached, and that there was a need to “clarify” the matter by the end of the year.

| Latam | Gol | Avianca-Taca | Copa | |

| 2011 Revenue (US$bn) | $13.5bn | $4.5bn | $3.7bn | $1.8bn |

| 2011 Passengers (m) | 60.3 | 36.2 | 20.8 | 7.7 |

| Destinations (YE 2011) | 150 | 100 | 76 | 59 |

| Aircraft (YE 2011) | 310 | 121 | 94 | 73 |