TUI Travel and Thomas Cook: Managing the declining charter sector

Jul/Aug 2010

Europe’s remaining “Big Two” tour operators — TUI Travel and the Thomas Cook Group — are adding capacity back to their summer 2010 and winter 2011 holiday programmes after years of capacity reduction. Is this the start of a recovery for Europe’s charter industry, or is it merely a blip in the continuing decline of the All Inclusive Tour (AIT) market and its associated airlines?

Structural factors have been analysed in depth by Aviation Strategy previously (see June 2005 and December 2007 issues), and there is little or no evidence to suggest anything fundamental has changed in those trends.

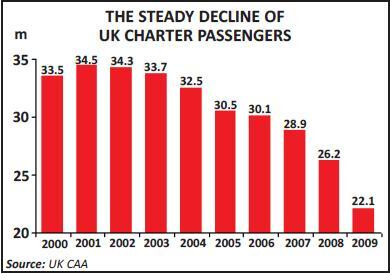

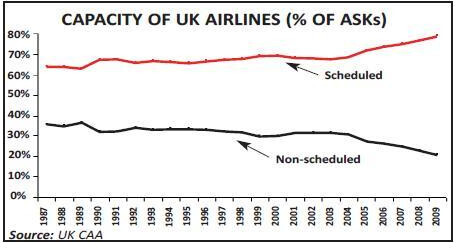

Indeed looking at the UK, the largest outbound charter market in Europe, the data is clear (see charts, below and page 9). Whether in terms of capacity or by number of passengers carried, the market appears to be continuing its downwards trend – and particularly so in the last two years.

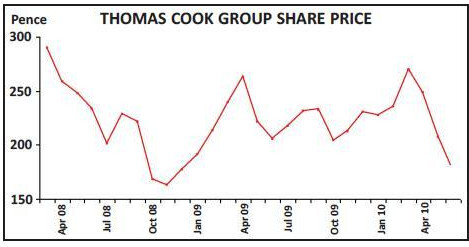

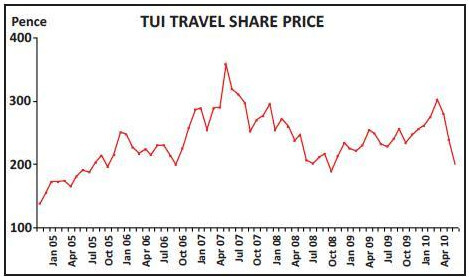

On the other hand, the European Travel Commission said in its Q1 2010 report that, “after a dismal 2008 the recovery from the great recession is underway”, although there “are reasons to be cautious”, and indeed analysts are getting optimistic about the medium- term prospects for both Thomas Cook and TUI Travel. Some analysts recently upgraded target prices for the Big Two due to expected improvements in revenue through this year and next, and the growing confidence of both TUI Travel and the Thomas Cook Group, which has been reflected through substantial bond issues and other refinancing over the last few months.

That revenue optimism is based on better capacity management at the Big Two. They both scaled back seats and holidays sharply during the recession but now are cautiously adding back AIT capacity as consumer confidence rises.

Of course these capacity changes are much easier to make now that there are only two large players left in the charter industry; it would be reasonable for either set of management to assume that its main rival will also come to the same conclusions as it makes, and do the sensible thing in terms of capacity changes. That’s a major difference with previous downturns, where at least one of the dozen or so medium–sized tour operators would always break ranks and not cut back capacity in line with others, but rather dump holidays onto the market at prices that effectively destroyed any chance of shoring up margins (and as a by–product encouraging customers into the bad habit of expecting last–minute holiday bargains every summer).

TUI Travel

The big question is whether the tentative capacity increases at the Big Two are implemented at the expense of the improved margins that have been seen over the last year or two. Do the Big Two have a real chance of both increasing capacity and maintaining margins in the medium–term, and so preserve a profitable charter industry in Europe through the long–term – even if it is a niche industry relative to the scale of the AIT market of the 1970s and 1980s? Based in Crawley in the UK, TUI Travel arose from the merger of First Choice Holidays and the tour operating division of TUI AG in 2007. Today it carries more than 30m customers a year from 27 outbound markets, employs 50,000 people and operates a fleet of 157 aircraft.

In the financial year ending September 30th 2009, TUI Travel recorded revenue of £13.9bn, 0.5% down on a year earlier, and made an operating profit of £37m, compared with an operating loss of £184m in 2007/08. However, TUI Travel made a net loss of £24m (though this was substantially better than the £267m net loss of the previous year), thanks largely to what TUI called “separately disclosed items” of £340m, which included £143m of merger costs, a £124m impairment charge on write–down of Corsairfly’s 747s and £32m of costs for the sale of TUIfly’s scheduled network to Air Berlin.

Air Berlin bought TUIfly’s scheduled operation in October 2009, following the collapse of a proposed deal earlier that year in which each would have taken a 19.9% stake in the other (with TUIfly planning to wet lease 17 aircraft to Air Berlin for 10 years). Instead Air Berlin has now acquired the former TUIfly scheduled network of 100 routes between 45 city destinations, and as part of this deal TUI Travel agreed to either buy a 9.9% share in Air Berlin for €33.5m (which it would subsequently sell over a period of time) or pay €15m to Air Berlin (in effect paying it for taking the scheduled network off its hands). Subsequently TUI Travel decided to buy the 9.9% stake in Air Berlin.

This transaction saw 13 TUIfly aircraft transferred to Air Berlin prior to the 2009/10 winter season, leaving TUIfly with a core charter fleet of 25 aircraft for the summer 2010 season.

The rationale from TUIfly’s point of view was that it was making a substantial loss on these scheduled city routes; in the year to September 2008 TUIfly made an operating loss of €35m, with the majority of this believed to be due to scheduled services.

In its latest financial report, for the six months ending March 31st 2010, TUI Travel saw revenue fall 9.2% to £4.9bn, due largely to reductions in capacity, with an operating loss of £364m compared with a £412m loss in the first–half of the 2008/09 financial year. Net losses for the half–year were £319m, 9.6% worse than a year earlier.

However the second quarter result was much improved year–on–year, with the operating loss reduced by £47m thanks to the disposal of the scheduled flying business in Germany, merger synergies and better demand for holidays across Europe. It must also be noted that almost all western tour operators post a loss in the first–half of the year, with most profits coming in the second half — the main summer holiday season.

Management now believes that continued cuts in capacity at TUI Travel over the last four years have gone far enough, with capacity out of the key UK market rising by 5% in the winter 2010/11 season, the company says. Much of this will be from holidays starting from regional UK airports, and is largely sparked by increasing consumer confidence in the UK, Peter Long, TUI Travel’s chief executive, said: “We have seen enough demand in the second half of the past winter and for the summer of 2010 that we will put back a proportion of capacity for next winter." Winter capacity out of the UK had fallen from 2m holidays in 2006/07 to 1.4m in 2009/10, and in the last winter season (2009/10) sales were down 13% (following a 13% fall in capacity, as a reaction to the recession), although average revenue per holiday was up 11%.

This summer TUI Travel is seeing recovery in demand in most markets, and as of May overall summer bookings were 7% up year–on–year, thanks to a trend for customers to book summer holidays earlier and better consumer confidence.

As of May, revenue out of the UK for the summer season was up 14% compared with the same point last year (after a capacity increase of 3%), while out of Germany revenue was down 2% year–on–year. Summer capacity out of the German market is down slightly, and TUI is seeing less consumer confidence in Germany than in the UK and other European markets, such as Scandinavia, so it will remain more cautious about returning capacity to the German outbound market.

Unsurprisingly, the closure of large parts of European airspace in April thanks to the Icelandic volcano eruption hurt TUI Travel hard, although trading recovered quickly once it ended. Nevertheless it resulted in 175,000 cancelled holidays and the repatriation of 180,000 holidaymakers across TUI Travel, which will cost the group an estimated £90m in the third quarter of this financial year, the company says – though it (and other tour operators) is discussing potential compensation with relevant governments.

However, the volcano crisis may be opening up an opportunity for TUI Travel. In a call with analysts after the interim results, Peter Long said that TUI Travel was now looking to market itself more aggressively to consumers in terms of the difference in booking with it (as a tour operator) as opposed to taking a flight with a LCC, a difference that he said became very clear to some holidaymakers during the volcano crisis. He said that “if you try and get behind a website of a low–cost carrier and make contact with them, it’s impossible; you cannot communicate with these guys. We think we can take the moral high ground because we look after our customers better, and this is very much an opportunity for us to talk about the benefits and shout about the benefits of a package holiday”.

Overall, TUI Travel’s first–half performance was in line with expectations, and the interim dividend rose 7% as the company said it was on target to make profits of more than £450m in the financial year to September 30th 2010. TUI Travel is of course still attempting to drive down costs, and reports indicate that TUI’s First Choice and Thomson brands have been forcing Spanish hoteliers to significantly reduce their rates for the 2011 season. The summer 2011 season also begins earlier, with package holidays starting in late April, which coincides with Easter next year.

TUI Travel’s long term–debt stood at £1.9bn at March 31st 2010 (compared with £2.6bn a year earlier), although as with most tour operators it’s current liabilities that are more significant, as they include trade payables (such as hoteliers for the key summer season), and they stood at £5.2bn at the end of March 2010 (compared with £5.4bn a year earlier). Cash and cash equivalents were £402m at the end of the half–year, down from £583m a year earlier.

In April TUI Travel raised £400m through a seven–year bond (with a coupon of 4.9%) that can be converted into approximately 9.4% of TUI Travel’s share capital. The company also secured £150m of new banking facilities in April, which came on top of a £350m convertible bond raised in October last year (at a 6% coupon). TUI AG subscribed for half of the latest bond issue in order to prevent dilution of its 54.9% shareholding in TUI Travel.

The funds are needed as TUI Travel has to repay £600m of loans to TUI AG over the next 18 months (£450m of which is due in December), but the company is also on the look–out for higher–margin, niche acquisitions (such as in UK student holidays); since the 2007 merger TUI Travel has spent more than £200m on at least 45 acquisitions.

TUI Travel also wants to fund growth in emerging markets in eastern Europe as well as further afield (such as China, India and Brazil). It has already set up a series of joint ventures in the Russian market, where Long says “there is an appetite for western brands”. Hence a TUI Russia brand has been launched, as well as a Russian website for internet bookings — although Long says that at the moment “Russians tend to turn up and pay for their holidays with a suitcase full of cash”.

TUI Travel’s fleet is split between seven separate airlines, because although carriers such as Hapagfly and Hapag–Lloyd Express have been merged into TUIfly, plans to merge all of TUI’s airlines into TUIfly have not come to fruition.

Last September TUI Travel also scaled back its existing order for 23 787s down to 13 aircraft. When they eventually arrive the type will replace 17 767s currently with four of TUI Travel’s airlines, although that rationalisation will take several years to complete. For short and medium–haul, the 737–800 is the group’s preferred aircraft as it has the best capacity (180 seats) for the charter market, and the group’s 27 757s (“workhouses”, as Long calls them) will also be phased out over time.

The key to the TUI Travel fleet is flexibility – most aircraft are on leases (it has made a major push to sell and leaseback its previously owned aircraft in the last few years), with an appreciable number ending every quarter, and Long says that the company will “never have a whole order book equivalent to our current fleet”. Extra capacity — if needed — will come from leased aircraft.

The group’s largest airline is based in the UK, where First Choice Airways and Thomsonfly merged to become Thomson Airways in May last year. Headquartered in Luton, Thomson Airways carried 11.2m passengers in 2009 and has a fleet of 60 assorted aircraft that operate out of 24 UK airports to a variety of holiday and city destinations around the world.

In Germany, TUIfly operates a fleet of 25 737s to more than 80 global destinations, while Zaventum–based Jetairfly has 13 Boeing aircraft and is owned by Jetair, TUI’s Belgian tour operator. TUIfly Nordic is based in Stockholm and operates seven aircraft from Scandinavian airports to medium and long–haul destinations, while ArkeFly is based at Schiphol and operates six aircraft for the Dutch subsidiary of TUI. TUI Travel also part–owned Jet4you, a Moroccan LCC based in Casablanca that operates six 737s, but in a recent MoU a majority stake has now been taken over by Royal Air Maroc. Finally, the group also owns a total of 35 aircraft that appear not to be formally assigned to any of its airline brands on a permanent basis.

However, the biggest question marks for TUI Travel’s fleet are over Corsairfly, based in Rungis and which operates seven aircraft to more than 60 destinations out of France. Corsairfly made an operating loss of £24m in the financial year ending September 2009, and after an urgent analysis of the business TUI Travel identified a number of issues, including the size of aircraft and an “inflexible” business model that results in large volumes needed “to achieve acceptable load factors”.

Essentially the 580–seat capacity of Corsairfly’s five 747–400s are too big for the charter market and forces the airline into lower frequency on its routes, which often leads to stopovers and which in turn reduces customer appeal. In addition, the 747s are ageing and the “legacy fixed cost base” of the aircraft also gives rise to substantial maintenance and fuel costs. To make matters worse the 747s operate to Caribbean destinations, which is a very competitive market out of France (for example rival Air Caraibes operates a secondary hub out of Paris Orly), and the net result of all these factors is that average selling prices on 747 seats are too low.

Thomas Cook

TUI Travel is therefore restructuring the airline in an attempt to increase yields and return the airline to break–even. In May Corsairfly announced it would make a quarter of its workforce redundant (around 380 positions) over a two year period, while the carrier will also reduce capacity via withdrawing three of the 747–400s and replacing them with smaller aircraft — A330s or 767s are likely candidates. The remaining 747s will be refurbished, the company adds. Thomas Cook Group is the company that arose from the merger of Thomas Cook AG and the UK’s MyTravel Group in 2007. Based in Peterborough in the UK, it employs around 31,000, has more than 3,400 own or franchised travel agencies and takes more than 22m customers a year on holiday with a fleet of 94 aircraft.

Just under 53% of Thomas Cook Group was held by Arcandor, the former owner of Thomas Cook AG, but in June 2009 Arcandor filed for bankruptcy, allowing it to reorganise before an imminent deadline to repay €710m worth of loans. Although the Thomas Cook Group accounted for almost 60% of Arcandor’s revenue and almost all its profits, the holding company said the filing would not affect the travel operators’ operations, and indeed that appeared to be true, with the creditor banks that effectively owned Arcandor managing to sell their stakes in Thomas Cook in the second–half of 2009, with the result that 100% of the tour operator group’s stock is now freely floated on the London stock exchange.

In the last full financial year – the 12 month period to the end of September 2009 – the Thomas Cook Group saw revenue rise to £9.3bn (compared with £8.1bn in the previous financial year — only an 11 month period because of the merger), with operating profit of £164.2m (£134.7m in 2007/08) and net profit of £18.3m (£43.6m in 2007/08).

Manny Fontenla–Novoa, the CEO of the Thomas Cook Group, insists his company has adapted well to changes in demand, and that its performance “demonstrates the resilience of the package holiday”. The group is looking to grow in selected markets and is apparently negotiating a potential acquisition in Russia (reported to be Intourist). It is also building up ancillary revenue streams such as financial services while at the same time continuing to focus on cost–cutting and rationalisation; for example, it has centralised all accommodation purchasing to enable greater discounts from suppliers.

In the first half of the 2009/10 financial year (the six month period ending March 31st 2010), Thomas Cook saw revenue fall 5% to £3.3bn, again due largely to reductions in capacity. Operating losses improved by 12.8% to a loss of £202.6m, while net losses totalled £252.2m (compared with a £309m in the same period in the previous financial year). In the key UK and Ireland business unit, revenue rose slightly to £1bn in the six month period, but the underlying EBIT worsened by £7m to a £116m loss.

In winter 2009/10 total group bookings fell 9%, in line with planned capacity reductions, although average selling prices rose by 7% in the UK market and by 12% in the northern Europe market.

For the summer season, out of the UK bookings were up 1% year–on–year as at May despite a 3% fall in capacity, with average selling prices up 2%. The group says this is also partly a reflection of a trend in the outbound UK market away from higher priced but lower margin long–haul package holidays to lower priced but higher margin mediumhaul holidays. On the other hand the Thomas Cook Group is facing foreign exchange pressures due to the continuing weakness of sterling.

In Central Europe (which includes the key German market) bookings are up 1% but average selling prices were down 3% after a 3% rise in capacity and a decision to pass on lower flight and accommodation costs to customers. However, “margins have held firm”, and the last four weeks prior to the May report had seen a 10% surge in bookings out of Central Europe.

As with TUI Travel, the volcano crisis affected Thomas Cook, with 177,000 holidaymakers stranded overseas, costing the group an estimated £70m. The group also said that the Greece situation had hit recent booking out of both the UK and Germany to that destination by at least 24%.

In April and May, like TUI Travel, the Thomas Cook Group took advantage of improving fundamentals to refinance around £1.7bn of funding. It raised £650m through two bond issues – one a five–year €400m issue at a coupon of 6.75% and one a seven–year £300m issue at a coupon of 7.75% (which was higher than an original target of £465m due to higher than anticipated demand from investors). In addition the group refinanced £1,050m of banking facilities through a £200m loan and a £850m revolving credit facility, both of which are at a margin of 2.75% over Libor and run for three years but which can be extended for another two years.

These sums will be used to refinance a €1.8bn syndicated loan taken in 2008 that will mature in May 2011. Cash and cash equivalents stood at £427.6m at the end of March, 11.2% higher than a year earlier. Long–term debt was £1.1bn (£1.4bn a year earlier), and the all–important current liabilities stood at £4.5bn, compared with £4.6bn in March 2009.

Altogether Thomas Cook has five airline brands operating 94 aircraft, the largest carrier being Manchester–based Thomas Cook Airlines, which incorporated MyTravel Airways after their parents merged in 2007.

Thomas Cook Airlines carried 8.2m passengers in 2009 to more than 60 holiday destinations in Europe and on long–haul, using a fleet of 41 aircraft ranging from A320/321s to A330s, 757s and 767s. With that wide range of models, the Thomas Cook Group in general appears slow in driving through fleet rationalisation.

Thomas Cook Airlines Scandinavia is based in Copenhagen and prior to 2007 was known as MyTravel Airways A/S. Today it operates 12 Airbus aircraft, with eight on short–and medium–haul and four flying to long–haul destinations, while Thomas Cook Airlines Belgium operates seven A320s out of the Benelux market.

In Germany, Thomas Cook bought 75.1% of Condor in 2007 and acquired the remaining shares from Lufthansa in February 2009 for €77.2m after the German flag carrier exercised its put option. Based in Frankfurt, Condor operates from nine German airports to more than 60 charter destinations around the world with a fleet of 22 757s and 767s. However Condor is now selling and leasing back its 13 757–300s, which are being marketed on its behalf by BAE Systems. Sister airline Condor Berlin also operates 12 A320s out of Schönefeld airport.

The Condor operations are reported in the Thomas Cook Group as the “Airlines Germany” business unit, and in the six months to the end of March this year it recorded revenue of £444.3m, 5.9% lower than a year earlier. Underlying operating loss was £8.5m, compared with £3.6m in the same period a year earlier. In “anticipation of a tough winter”, seat capacity was reduced by 6.6% out of Germany, most of that on long–haul. But seats sold fell just 4.4%, thanks to a 2.3% increase in load factor, although average yield was down 5% in the period. Thomas Cook talks of “pressure in the market place to reduce prices”, following the fall in fuel prices, but summer 2010 bookings on Condor were up 4% year–on–year as of May, helped by a rebound in demand for long–haul flights – although competition has led to an overall 3% fall in yields.

| Thomas | MyTravel | Th. Cook | |||||

| Cook Airlines |

Airways Scandinavia |

Airlines Belgium |

Condor | Condor Berlin |

Total | ||

| A320 | 9 | 2 | 7 | 12 | 30 | ||

| A321 | 4 | 6 | 10 | ||||

| A330 | 6 | 4 | 10 | ||||

| 757-200 | 17 | 17 | |||||

| 757-300 | 2 | 13 | 15 | ||||

| 767-300ER | 3 | 9 | 12 | ||||

| TOTAL | 41 | 12 | 7 | 22 | 12 | 94 | |

| Thomson Airways |

TUI Travel |

TUIfly | Jetairfly | Corsairfly | TUIfly Nordic |

ArkeFly | Jet4you | Total | |

|---|---|---|---|---|---|---|---|---|---|

| A320 | 5 | 5 | |||||||

| A321 | 2 | 2 | |||||||

| A330 | 2 | 2 | |||||||

| 737-3/4/500 | 4 | 2 | 3 | 9 | |||||

| 737-700 | 9 | 1 | 3 | 13 | |||||

| 737-800 | 13 | 21 | 24 | 6 | 3 | 3 | 3 | 73 | |

| 747-400 | 5 | 1 | 6 | ||||||

| 757-200 | 25 | 2 | 27 | ||||||

| 767-300ER | 11 | 2 | 1 | 3 | 17 | ||||

| 787-8 | 5 (13) | 5 (13) | |||||||

| TOTAL | 60 | 35 (13) | 25 | 13 | 7 | 7 | 6 | 6 | 157 (13) |