Allegiant Air: Venturing into the Pacific

Jul/Aug 2010

Allegiant Air, a Las Vegas–based LCC, has achieved fame for its unusual but highly profitable strategy of operating cheap fuel–guzzling MD–80s in low–frequency service between small cities and popular leisure destinations and deploying Ryanair–style revenue strategies. Now the airline wants to replicate the successful US mainland formula in the transpacific market with 757–200s.

After operating only MD–80s since March 2002, when it emerged from Chapter 11 with its current strategy, Allegiant is now doing what many LCCs contemplate but usually back away from: acquiring a second fleet type and venturing into long–haul markets.

In March Allegiant signed an agreement to acquire six used 757–200s for the purpose of serving Hawaii, which the MD- 80s cannot reach. The first two aircraft arrived that same month, the next two are expected in November–January and the final two are due in late 2011. The airline is currently in the process of training and getting the FAA approvals (adding a new aircraft type to its certificate and obtaining ETOPS certification) and hopes to be able to launch service in the first half of 2011.

Allegiant intends to serve Hawaii exactly the same way as the mainland destinations: with limited frequencies from small or medium–sized cities that do not currently have nonstop service. It is likely to fly to Honolulu and Maui from cities west of the Rocky Mountains.

Many LCCs would be hesitant to make this type of move for reasons that are well documented – loss of single fleet cost efficiencies, the added complexity of long haul, the hassle of getting ETOPS, difficulty of earning satisfactory ROC, to name just a few. But the move makes much sense for Allegiant, as the carrier’s president Andrew Levy explained recently at BofA Merrill Lynch’s annual transportation conference.

First, Hawaii seems to fit perfectly in Allegiant’s business strategy. It is the largest US leisure market not yet served by the airline – in Levy’s words, the “ultimate leisure destination, same as Las Vegas, perhaps”.

Expedia with wings

Allegiant is particularly excited about the significant ancillary revenue opportunities offered by Hawaii. The longer visits (typically 7–10 days) and the longer stage lengths give the airline more opportunity to sell hotels, car hire, tours, tickets to attractions, etc. Such ancillary revenues are the highest–margin business and should make a meaningful contribution to the success of the service. Allegiant is more than an airline: it is in the business of selling travel. In the words of its management, it is “Expedia with wings”. It has the ability to access and sell inventory for hotels, cars and other third–parties at wholesale rates, sell it combined with an air seat and manage the margins as it sees fit. In Las Vegas (its first and most important destination city), Allegiant is the largest distributor of hotel rooms. Third–party activities contributed 18% of its pre–tax income in the past year.

The airline considers this to be a good time to enter the market, with airline capacity from the West Coast to Hawaii still being down on 2007 levels and hotel occupancy rates being less than desirable. Levy noted that hotels in Hawaii were “just lining up on our doorstep to help them sell their inventory”.

Allegiant has also spotted gaps on the air route map that it can fill – good potential markets that have no existing service. One of the airline’s defining characteristics is that it avoids competition. It wants to provide a product that nobody else is offering. It has head–to–head competition in only 10 of its current 143 routes. Where there is competition, it is invariably the other airlines that have stepped on Allegiant’s turf, such as AirTran on a few routes in the East and Alaska in the West. Levy suggested that other airlines see Allegiant as an “annoyance, not a threat”. Of course, as with Southwest, it is all about demand stimulation.

It seems that Allegiant got a good deal on aircraft. The ETOPS–equipped 757- 200s, which the airline will operate with 215 seats, are sister ships and have been in service with a single European operator. Allegiant expects to spend just $75- 90m in total, or $12.5–15m per aircraft, through 2012 acquiring and preparing this fleet for service.

Allegiant is buying the 757s for cash but expects to finance some portion of the purchase. One recent financing attempt actually failed when the company had to withdraw a $250m bond offering in May due to adverse market conditions. Those proceeds would have also funded some MD–80 acquisitions and debt due this year and next. But no doubt there will be other opportunities. In the meantime, Allegiant is sitting on a very comfortable $249m cash cushion (43% of annual revenues).

The airline believes that it committed to the 757 purchase at the right time in the market, when the asset values were at a trough. This means that should the Hawaii strategy fail, Allegiant could probably already sell the aircraft for a higher price.

Airline within an airline

A recent report from Raymond James suggested that the profitability of the Hawaii operation is likely to be as good as or better than the current network’s because of the greater potential to sell higher–margin ancillaries. The analysts also made the point that it is a large domestic market opportunity with lower risk than potential new services to Mexican and Caribbean beach destinations, which would require one–stop customs clearance to return passengers to their small origin–cities in the US. Allegiant believes that it can avoid much of the complexity that adding a new aircraft type would bring to a network carrier because of the way it isolates aircraft. The six–aircraft 757 operation, which will account for about 14% of Allegiant’s total seats, will be “almost like its own little airline”, with aircraft, crews and mechanics all based in Hawaii.

At this point it is not clear if crew and flight scheduling will allow the 757s to always return to their base at night – a strategy that Allegiant uses with the MD- 80s that reduces maintenance and crew overnight costs – but that will certainly be the aim with the Hawaii operation.

Importantly, the airline recently reached agreement with its non–union pilots to fly all narrowbody aircraft (MD- 80s and 757s) at the same pay rates (the pilots secured profit–sharing in return). Allegiant has a significant cost advantage against all other US carriers. To illustrate its lead in terms of labour efficiency, it has only 34 FTEs (full–time employees) per aircraft, compared to the runner–up AirTran’s 60–plus FTEs.

Allegiant has no intention to offer connecting or through flights to Hawaii, because it does not want to get into through–pricing. However, its nationwide footprint in terms of small origin cities and seven larger destination markets (three in Florida, Los Angeles, Las Vegas, Phoenix and Myrtle Beach) should provide connecting opportunities and therefore feed to the Hawaii services.

Allegiant is both nimble and extremely profit–oriented – perhaps in part because its management owns more than 20% of the company. This means that markets that do not achieve profitability or are at below–target levels do not sit around very long.

The low acquisition cost of the 757s will make possible the same flexible capacity approach as with the MD–80s. The airline micro–manages capacity, tailoring flight frequencies to the needs of the market on a daily and seasonal basis. It has meant very low average daily aircraft utilisation and many aircraft in storage for future use, but it has been a particularly valuable attribute in an era of volatile fuel prices.

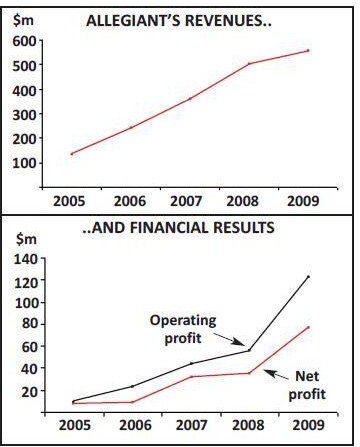

Allegiant has grown at a disciplined, steady rate since 2002, taking nine years to get to 50 aircraft. It has been consistently profitable. In its toughest year, 2008, it still had an 11% operating margin. In its best year, 2009, it had a 21.9% operating margin, while posting a $76.3m net profit on revenues of $558m. The 1Q10 operating margin was 21.4%.

The 757–200 programme will not affect Allegiant’s MD–80 growth plans (and the type is not a replacement for the MD–80). The airline is in the process of purchasing another batch of 10 at an average in–service cost of $4m. This will increase the MD–80 fleet from the current 50 to 60 by the end of 2011. Levy said that the airline expects to add more MD–80s beyond 2012.

The mainland niche is showing no sign of reaching its limits. This year’s system capacity growth (without Hawaii) will be 8.6–9%. Apparently new cities such as Myrtle Beach have been among the best–performing markets. Levy said that, apart from the long–term, the feeling was that the MD–80 route map could be tripled.