US LCCs: Star performers and puzzling trends

Jul/Aug 2006

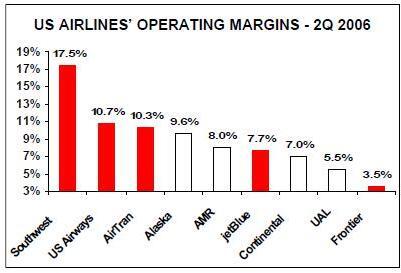

The newly solvent US legacy carrier sector turned in a highly respectable performance in the second quarter in light of the record high fuel prices: operating margins were in the mid–to–high single–digits, up by a uniform three–to–four percentage points. However, the LCCs' results were more interesting, given the greater variation and some puzzling trends.

At one extreme, there were the star performers. The three most profitable US airlines in the second quarter were LCCs, and they all saw the greatest margin improvements. Southwest increased its industry lead with a spectacular 17.5% operating margin, up from 13.2% a year earlier. US Airways consolidated its position as the hottest newcomer — a new type of "hybrid LCC" since its September 2005 merger with America West — with a 10.7% operating margin. AirTran Airways, in third place with a 10.3% margin, returned to double–digit profits not seen since 2000.

Normally it would not come as a surprise that LCCs outperform the legacy carriers. But wasn’t this supposed to be the year when the legacies take their revenge and capture the biggest RASM improvements with the help of their more sophisticated yield management systems?

In contrast to the three star performers, however, JetBlue — the former high–flyer — saw its operating margin decline to 7.7% from 9.3% a year earlier. And Denverbased Frontier, while staging a turnaround from a marginal loss in the same period in 2005, still only achieved a 3.5% operating margin.

The LCCs' second–quarter results reflect three things. First, with the notable exception of Southwest, which still has reasonable fuel hedges in place, the high fuel prices are having a significant impact on the bottom line of LCCs, just like the legacy carriers.

Second, while all US airlines have benefited from a robust domestic revenue environment — reflecting industry capacity cuts and strong demand — and most have been able to increase profits because revenue growth has more than offset the higher fuel prices, it was LCCs that saw the biggest RASM gains in the second quarter. However, Frontier was an exception due to unique circumstances.

Third, while most US airlines had non fuel costs well under control, JetBlue’s non fuel CASM surged by an alarming 9% in the second quarter. As a result, its profits declined despite extremely healthy RASM growth.

Why the LCC RASM success?

US Airways' mainline RASM surged by 21% in the second quarter; the increase was 23.8% if only the pre–merger East Coast network was included (the AWA routes saw 16.3% RASM growth). Southwest’s unit revenues were up by 17.5%, AirTran’s by 16.8% and JetBlue’s by 15.6%. These rates were significantly higher than the 11–12% seen by American and Continental in their domestic mainline operations.

The LCCs outperformed, first of all, because many of them have heavy exposure to the East Coast, which has seen the biggest industry capacity cuts over the past year, including a major shrinkage by Delta. The main beneficiaries were AirTran and US Airways, which have significant network overlap with Delta. In particular, AirTran has been helped by Delta’s heavy cuts at the Atlanta hub that the two share.

In contrast, Frontier saw only an 8.2% RASM improvement in the second quarter, because it operates in the West and because it faced Southwest as a new competitor in Denver. Since entering the market in January, Southwest has tripled its daily fights from Denver to 32. United, which had previously removed capacity from Denver, has shifted it back to facilitate a strong competitive response to Southwest. Despite evidence of the famous "Southwest effect" (demand stimulation), the result has been excess capacity in the Denver market.

Another new development on the RASM front is that Southwest has played a leading role in fare increases. This year, for the first time in memory, Southwest has initiated numerous modest fare increases in an effort to offset fuel price hikes. Its average fare was up by a significant 15.5% to $107 in the second quarter — apparently without ill–effects because demand has been so strong. In addition to helping Southwest attain unusually strong 2Q RASM growth, the low–fare leader’s price hikes have paid significant industry revenue dividends.

Third, according to JP Morgan analyst Jamie Baker, there is some evidence that short–haul LCCs like Southwest are seeing a shift from driving to air travel in short–haul markets, as the price of unleaded petrol has soared. Some recent revenue data from regional operations has supported that hypothesis, though in some cases the RASM increases are probably the result of continued restructuring, including aircraft down–gauging.

Fourth, the LCCs' RASM performance may also reflect improved revenue management. Calyon Securities analyst Ray Neidl suggested in a research note that the better yield management skills of the former AWA management, which took over running the combined company known as US Airways, may partly explain the RASM surge in the old US Airways network.

There is evidence that the new revenue strategies introduced by JetBlue in recent months are working, although the airline’s impressive 2Q RASM performance also reflected industry capacity cuts and shorter stage lengths associated with the E190s.

Back in April, following its first–quarter loss, JetBlue identified revenue management as the key part of its business requiring overhaul. The premise of the previous model, which worked well when crude oil was at $20–30 a barrel, was to keep costs and prices low and make substantial profits on volume and growth, but JetBlue decided that it must now sacrifice some load factor to the yield. That has meant moving towards conventional yield management and more complexity in its pricing model — strategies that European LCCs like Ryanair have used successfully since their inception.

The initiatives introduced by JetBlue’s revamped revenue management team have included fare bucket adjustments and selected fare increases, including raising the highest fare (used on peak and sold–out flights) from $349 to $399. As a result, JetBlue’s average fare increased by 15% or $17 to $128 in the second quarter — more than the $5–10 the management talked about in April. The load factor fell by 5.5 points; this was against the industry trend, but JetBlue could afford the decline since the resulting 82.2% was similar to competitors' load factors.

With the exception of JetBlue, which has some non–fuel cost issues to work out, US LCCs have kept non–fuel cost increases in check and maintained a significant CASM advantage over legacy carriers by improving efficiency and productivity. However, the legacy carriers' sharp cost cuts in the past few years have slightly narrowed the CASM advantage.

According 2Q stage length–adjusted ex–fuel mainline CASM comparisons provided by JP Morgan (with the CASM figures apparently adjusted to US Airways' average stage length of a little less than 1,000 miles), the difference between the highest–cost carriers (United and Continental, both 8.9 cents) and the lowest–cost carriers (AirTran 5.0 cents and Southwest 5.2 cents) was a very meaningful 3.7–3.9 cents. On a stage–length adjusted basis, JetBlue’s ex–fuel CASM (6.2 cents) was a full cent higher than Southwest’s. Frontier’s CASM (5.9 cents) was also lower than JetBlue’s. US Airways was in the middle of the pack with ex–fuel CASM of 7.1 cents — lower than the legacy network carriers but higher than LCCs'.

When fuel costs are included, the CASM picture is not pretty. With US airlines paying typically 27–33% higher average fuel prices per gallon in the second quarter, total CASM surged by typically 8–12%. JetBlue’s total CASM was up by as much as 17.8%, though Frontier escaped with a mere 3.2% hike because it managed to reduce non fuel costs by 6%. For the record, US Airways' 2Q total CASM was 11.06 cents, AirTran’s 9.99 cents, Frontier’s 9.39 cents, Southwest’s 8.83 cents and JetBlue’s 7.83 cents.

With hybrids such as US Airways emerging, and now that many LCCs are moving towards legacy–style revenue strategies, it is becoming harder to categorise US airlines. As one industry figure noted recently, all airlines now have to be low cost — relative to the revenues that they produce.

US LCCs have continued to grow rapidly. In the second quarter, both JetBlue and AirTran recorded year–over–year ASM growth of over 23%, while Frontier’s capacity increased by 19%. However, Southwest’s 7.2% was below its customary 10% rate, and US Airways' capacity declined by 9% because of the merger.

Strong growth is set to continue for the time being at least at AirTran and JetBlue, which anticipate 25% and 20–22% ASM increases, respectively, for 2006. Frontier is poised to grow its capacity by 15% this year. Southwest’s full–year growth is expected to be about 9%, while US Airways will see a 5.8% decline. With no aircraft deliveries other than E190s scheduled until 2009, US Airways will not be a growth airline for several years.

But much will obviously depend on fuel price and RASM trends. Fuel prices are expected to remain high. While a broadly favourable revenue environment is also expected to continue into and probably through 2007, there are some concerns related to future capacity addition and the LCCs' strategies.

The key questions related to LCC prospects include the following:

- What happens when legacy carriers such as Delta resume capacity addition? There are some concerns about the potential impact of Delta’s 4Q plans on LCCs such as AirTran.

- Will Southwest continue to press for higher fares, benefiting everyone? Or will it find other ways to offset its waning fuel hedges?

- Will US Airways find its progress hampered by serious trouble with its labour groups who insist on getting their fair share of the profits?

- What will be the effect of increased competition between LCCs on individual carriers?

- Will Virgin America take to the air, and if so, will it have much negative impact on JetBlue and the transcontinental market generally?

- Will LCCs keep debt leverage in check?

- To what extent will LCCs participate in the future industry consolidation process?

Southwest

Southwest reported record quarterly net earnings of $273m (excluding accounting adjustments), up 87%, on revenues of $2.45bn, which rose by 26%. The results were attributed to a 5% reduction in competitors' capacity in Southwest markets and the longstanding fuel hedging programme, which saved the airline $225m in the quarter. In addition to strong yield and RASM improvements, the load factor rose by 5.5 points.

However, Southwest’s average fuel price surged by 39% (though, at $1.42 per gallon, it was still much less than what other airlines paid) because the fuel hedging programme is gradually winding down. After modestly adding to the later years' fuel hedges in the second quarter, Southwest is currently 73% hedged for the rest of 2006 at $36, 65% hedged in 2007 at $41, 38% in 2008 at $40, 34% in 2009 at $44 and 12% in 2010 at $61. The airline said that it has "insured ourselves with years of price protection that will allow time" to make changes.

Southwest has many initiatives under way to conserve fuel, including plans to install Blended Winglets on 90 future 737 deliveries, and to improve productivity and efficiency and maintain cost competitiveness. Among other things, employees per aircraft has fallen steadily from 91 to 69 in the past four years.

CEO Gary Kelly sees "tremendous opportunities" to grow the route system. Washington/Dulles will be added as the 63rd city in early October — it will complement Southwest’s nearby Baltimore operations. Initial plans call for 12 daily flights to four cities. However, Kelly said that, because of the need to add flights in existing markets, the company needs additional aircraft before it can "even think about adding new cities".

Consequently, Southwest is currently pursuing additional used aircraft on top of its Boeing order commitments, which include 34 737–700s this year, 35 next year and 78 in subsequent years, as well as 116 options and 54 purchase rights. The airline said that it could easily use another 20 aircraft in the near–term based on anticipated demand in Denver, Las Vegas, Chicago, New Orleans, St Louis, Kansas City and Reno.

Southwest foresees solid revenue trends for the next several quarters and expects to "easily exceed" its 15% earnings growth goal for 2006. It has also set a 15% earnings growth target for 2007. The intention is to delay fare increases as long as possible and "use them only to offset soaring jet fuel increases", because "we know from experience that you can only raise prices so far".

Southwest is currently testing assigned seating in the San Diego markets. It would be a major departure for the airline, which has benefited greatly in the past 35 years from the efficiency of its existing boarding process.

Southwest has an excellent liquidity position, with $3bn in cash at the end of June and an unused $600m revolving credit line. The company repaid $99m in debt in the second quarter and plans to repay $470m in the second half. Southwest has also completed a $300m share repurchase programme that was authorised in May.

US Airways

US Airways posted a net profit of $305m on 14.1% higher revenues of $3.2bn for the second quarter. The result compared with a combined $46m net loss reported by the old US Airways and America West for 2Q05 and was twice as high as the $150m profit projected by the pre–merger models. CEO Doug Parker attributed the strong results to the September 2005 merger, which "has improved the earnings power and viability of both companies". The profits were impressive in light of the $183m additional fuel costs incurred as a result of the price hikes.

While US Airways will not be able to maintain 20%-plus RASM growth, the company expects to report a profit for 2006 even at the current fuel prices. The cash position is strong ($3.2bn) and the only aircraft deliveries before 2009 will be 25 E190s. US Airways' efforts focus on completing the integration of the two entities and accomplishing that without labour or service problems. The airline still needs to obtain a single operating certificate, convert to a single reservations system and reach final agreements with labour groups. The aim is to complete most of those tasks by the second half of 2007.

The biggest challenge is on the labour front, namely combining the contracts of the two pilot and flight attendant groups without increasing labour costs. The pilots issued a strongly worded response to the 2Q profit announcement, saying that after contributing billions of dollars in cost savings (during two Chapter 11 visits that preceded the merger), they will no longer tolerate the company "posting substantial profits on the backs of the pilots". The pilots cautioned that "if US Airways management intends to capture all the planned synergies of this merger and have any chance of enjoying labour peace, bankruptcy–era bargaining tactics need to end". The knowledge that pilots wanting their fair share have brought down many airlines in the past is one of the factors that has kept a lid on US Airways' share price.

CEO Parker recently reportedly sounded out Delta’s leadership about a merger, but Delta made it clear that it intends to emerge from Chapter 11 as a stand–alone airline. In the 2Q call Parker merely said that US Airways has an obligation to consider a merger with Delta or Northwest because "tremendous value can be created through consolidation". Parker pointed out that, by bringing together AWA, with a market value of $200m, and $800m in new equity, the merger created a company that now has a market capitalisation of $5bn.

AirTran

After disappointing 1Q results, in the latest period AirTran nearly tripled its net profit to $32m on revenues of $528.2m, which were up by 44%. The airline was greatly helped by Delta’s capacity shrinkage, which analysts estimated at about 16% in AirTran markets in the second quarter.

AirTran continues to pursue aggressive growth, but the bulk of it is adding frequencies in existing markets (lower–risk growth) — only two new cities are introduced this year. The current aim is to serve fewer but larger cities in an effort to establish a greater market presence and spread costs. Calyon Securities analyst Ray Neidl, who recently raised his recommendation on the company to "buy" on value grounds, suggested that AirTran is "reaching competitive market mass" and therefore becoming more attractive to business travellers.

However, Raymond James analyst Jim Parker, who downgraded AirTran to "market perform", expressed concern about Delta’s plans to reverse some of its earlier cuts in the fourth quarter by adding 12% capacity in AirTran markets. Parker also noted that double–digit RASM increases were unlikely to continue in the third and fourth quarters in light of AirTran’s planned 20%-plus ASM growth.

After taking its final two 717s in the second quarter, AirTran’s fleet at the end of June consisted of 87 717s and 32 737s. In the latest period, the airline exercised options for 24 additional 737–700s for delivery in 2008–2010, completing the 100–aircraft order placed in the summer of 2003.

AirTran’s non–fuel CASM will continue to decline as the mix of the larger 737s in the fleet increases; eight more aircraft are scheduled for delivery in the second half of this year. The airline also aims to keep costs down by increasing productivity, such as gate utilisation, across its system. Cash balance at the end of June was an ample $439m.

JetBlue

Following losses in the fourth quarter of 2005 and the first quarter of 2006, JetBlue reported a marginal $14m net profit on revenues of $612m for the latest period.

Revenues were up by 42% but the profit was flat. The airline delivered on its RASM promises but disappointed in terms of non fuel CASM. The 9.3% increase in non–fuel CASM was driven by an 8.4% decrease in average stage length (to 1,253 miles), charges related to stock compensation, rental costs on a new JFK terminal and lower–than–anticipated initial E190 utilisation.

CEO David Neeleman said that the "Return to Profitability" plan, announced in April, was on track. After deferring some aircraft orders in the spring, JetBlue has signed LoIs on the sale of five of its older A320s, which will be withdrawn from service by September/October. Cost cutting efforts, which are part of a targeted $60- 80m in profitability improvement by year end (also including revenue initiatives), are running slightly ahead of schedule. Following Southwest’s and AirTran’s lead,JetBlue is in final stages of negotiations with several GDSs.

A key part of the financial recovery strategy is to add short haul flights with the growing E190 fleet and cut back on long haul. However, recent city additions have included a wide variety of markets. In the second quarter, the airline added Bermuda, Portland (Maine), Jacksonville and Pittsburgh, followed by Charlotte and Raleigh in July. Near–term expansion will include Nashville, Aruba, Houston, Sarasota, Tucson, Columbus and Cancun (Mexico).

On the positive side, and in contrast with AirTran’s situation, Delta’s capacity reductions in JetBlue markets are expected to accelerate in the second half of this year. According to Neeleman, in the fourth quarter industry capacity is set to decline by 19% out of New York and by 26% out of Boston.

Nevertheless, JetBlue provided extremely lacklustre earnings guidance. The company anticipates operating margins of only 4–6% and 2–4% in the third quarter and full–year 2006, respectively, while the pre–tax result is likely to be break–even (between -1% and +1%). In light of its stunning fall from a high–flyer with industry–leading profits to the least profitable US airline without a clear reason, analyst views on JetBlue are understandably divided, though recommendations are mostly "hold" or "sell" on valuation grounds. Merrill Lynch’s Linenberg suggested that the franchise is a solid one and that JetBlue is merely experiencing growing pains, which he views as temporary. But JP Morgan’s Baker cautioned investors to recall that JetBlue’s peak margins occurred "not only during the airline’s relative infancy but against the backdrop of meaningful legacy carrier mismanagement". In other words, Baker was suggesting that JetBlue might not be able to return to strong margins now that the legacy carriers have got their act together.

Neeleman conceded in the 2Q call that next year will be a critical year for JetBlue. Analysts have suggested that 2007 will be a year in which the airline either returns to decent profitability or scales back growth plans.

One point of concern is that JetBlue has now officially backed away from its long–stated 75% lease–adjusted net debt–to–capitalisation ceiling, which it has persistently exceeded. CFO John Harvey stated in the 2Q call that the ratio will be close to 80% by year–end as at this point there are no plans to raise equity. The airline was previously believed to be considering an equity offering this autumn, but a decline in the share price has evidently made it hesitant to further dilute existing shareholders. JetBlue is still expected to have a healthy cash position at year–end, with a liquidity ratio of 23%.

But JetBlue may have to pay higher borrowing costs as S&P, once again, cut the company’s credit ratings after the 2Q results. The agency cited a weakened financial profile, with only modest improvement expected this year.

Frontier

Frontier has the industry’s weakest earnings in the second quarter (the airline’s first fiscal quarter), but at least it returned to profitability with a net income of $4m, compared to a $2.7m loss a year earlier. This was despite the record fuel prices and significantly escalated competition at its Denver hub, where it earns 90% of its revenues. Denver saw a 6.8% hike in industry capacity — the highest ASM increase of any US hub — as new–entrant Southwest, United and Frontier all added capacity.

Frontier’s revenues rose by 27.8% to $302.1m. Its load factor was up by 3.5 points, reflecting strong demand stimulation resulting from Southwest’s entry, but the 8.5% RASM improvement was among the weakest in the industry.

The brightest spot was non–fuel cost containment, which was achieved despite a 2.5% reduction in the average stage length to 917 miles. Non–fuel CASM fell by 6.1%, which was attributed mainly to continued cost benefits of operating a single mainline aircraft type. The fleet currently includes 54 A319s/A318s, plus nine CRJ–700s operated by Horizon as Frontier JetExpress.

Frontier is poised to continue expanding and diversifying its route network. In recent months it has launched a five–per–day service on the competitive Los Angeles–San Francisco route and become the first US LCC to fly to Canada (RJ service to Calgary). It is planning further expansion to Mexico, after recently receiving approvals to operate Denver–Guadalajara and seasonal San Diego–Cancun and Kansas City- Cabo San Lucas service. The airline has also secured six additional gates at Denver, to bring the total to 22 next year, to facilitate growth.

Frontier expects similar profitability in the current quarter, helped by low double–digit RASM growth. So far the airline has fared reasonably well in direct competitive clashes with Southwest, achieving higher load factors than Southwest on most routes. However, analysts are concerned because competition at Denver is set to intensify, which is likely to mean marginal profitability at best. Southwest is currently present in 18% of Frontier’s markets, and that percentage can be expected to grow steadily. Frontier’s stock is mainly rated "sell" or "neutral" — views that analysts say are likely to be maintained until the capacity situation changes or Frontier comes up with a good strategy to deal with Southwest and a more aggressive United. Otherwise, Frontier has ample resources — $276.5m in cash or 26% of annual revenues — to fight competitive battles.