MyTravel: troubled TO seeks LCC solution

Jul/Aug 2002

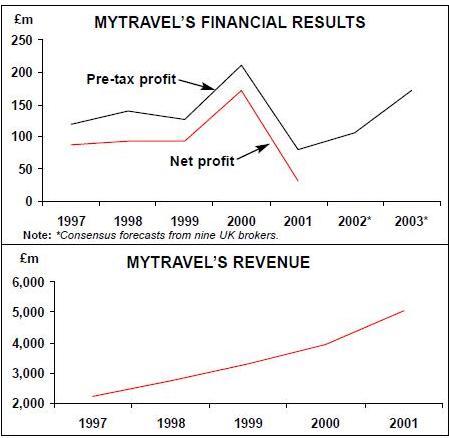

MyTravel Group, one of the world’s leading air–inclusive tour operators, is facing troubled times. Holiday bookings for the summer 2003 season are disastrous, September 11 cost the group £59m in profits, founder and executive chairman David Crossland will retire later this year, and the share price is plummeting. MyTravel’s latest move is the launch of a low–cost, low fare airline, but is this sound strategic thinking or a desperate attempt to deflect attention from problems in its core business? Until a few years ago, MyTravel — which changed its name from Airtours earlier this year — had enjoyed steady success. Airtours was founded by David Crossland in 1972, and after floating at a market capitalisation of just £28m in 1987, the company’s value rose to £2.7bn by 1999. But it was the company’s attempts to expand into other key European markets that caused the first problems. Airtours' purchase of 36% of German tour operator Frosch (FTi) in 1998/99 proved costly (see Aviation Strategy, February 2001), and 1999 saw pre–tax profits fall for the first time (see chart, right).

In 2000 major organisational changes were announced, with the German and Scandinavian business reporting directly to a new CEO, Tim Byrne, who replaced David Crossland (who stayed on as executive chairman). Profits recovered in 2000, as the group continued its acquisition strategy and finally managed to purchase the remainder of FTi, thus finally gaining operational control of the loss–making operator.

2001 also started brightly, and operating profits for April–June 2001 grew to £26.6m, compared with just £2.1m in the same quarter the year before. September 11, however, was a huge blow, although it was too late to affect the summer 2001 season as Airtours reported record operating profits of £147m for the year to 30 September 2001, a rise of 57% on the previous year. But despite attacking costs in late 2001 (1,600 jobs were axed across the group) and cutting seat capacity by 25% for the next summer season compared to a year before, the financial impact of September 11 on future trading was always going to be severe.

After initially forecasting a £10m hit to the bottom line from September 11, the eventual figure was close to £60m, due primarily to holidaymakers postponing booking decisions for the summer 2002 season.

Summer woes

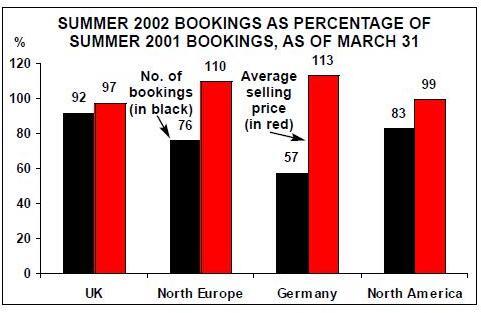

Interim results (for October 2001–March 2002) released in late May revealed that the slow start in selling holidays for the 2002 summer season was continuing (see chart, page 14) and that 1m summer holidays remained unsold, with the group being unlikely to make up the shortfall in brochure priced bookings it experienced in the first quarter.

Turnover fell to £1.7bn in the six–month period compared with £2.1bn in the same period the year before, while the interim operating loss (before e–commerce costs, exceptional items and goodwill) was £122m, compared with a £77m loss for October 2000–March 2001. Although there was some good news, such as an improvement in MyTravel’s troubled German operation, these results prompted analyst downgrades, and the share price slid to £1.52 by the end of May, compared with £2.20 at the start of the month. The shares are at £1.48 as at mid–July, giving a market capitalisation of £729m — a far cry from the heady £2.7bn valuation in 1999.

For chairman David Crossland, who is retiring in November, and CEO Tim Byrne, the problems at MyTravel run deeper than just one bad summer season. MyTravel is a truly vertically–integrated travel group. Based in Manchester, UK, it currently comprises more than 100 brands, 2000 retail travel agencies, 47 aircraft and just under 28,000 employees, and operates throughout Europe and in North America, In some respects MyTravel can be said to have had more than its fair share of bad luck. While it has steadily acquired small and medium–sized tour operators over the last few years, a mega–merger or acquisition in Europe has remained tantalisingly out of reach. In 2000, Airtours discussed a possible merger with rival European tour operator C&N Touristic, which came to nothing, and in June this year the European Court of First Instance ruled that the European Commission was wrong to block Airtours' proposed £850m takeover of UK rival First Choice in 1999. At the time the EC said that it had blocked the deal because of competition fears in the UK market, but the ECFI said that the EC had no grounds for such a conclusion.

If Airtours had taken over First Choice as proposed, its position in the UK market would be much stronger now, and it would be better able to meet the current holiday bookings slump. Although the ruling means that MyTravel will recover its estimated £2m legal costs, this is scant reward given that a bid for First Choice today is unlikely, due to the current weakness of MyTravel. On the contrary, there is speculation in the City of London that MyTravel may be the object of a bid by First Choice.

Low cost airline

At the same time as the disappointing interims were released, MyTravel revealed plans for a new strategic stretch for the group — a low cost, no–frill scheduled airline, to be launched in October 2002. Operating from "a major UK airport", the carrier will serve initially 10 international destinations with two A320s transferred from the MyTravel fleet, before expanding destinations and the fleet for summer 2003.

With this move, MyTravel wants to exploit the growth in the low cost scheduled airline sector, but at the time of their announcement the plans were met by scepticism by some of the analysts that cover the group. As MyTravel Group’s core skills and experience are clearly in the charter sector, might the new low cost scheduled airline move prove to be a stretch too far for MyTravel? The Group insists this will be a "low–risk entry" into the low cost market, but the new airline has a perhaps overly–ambitious target of being profitable by the end of its second year of operation, after projected losses of £5m in the first year.

Perhaps in order to answer some of these criticisms, MyTravel has just announced it is hiring Tim Jeans, the Sales and Marketing Director at Ryanair, to become Managing Director of the new airline (although no firm date for his appointment has yet been released). If he succeeds, Jeans will certainly earn his money, as his MyTravel staff will have to change from working in a charter environment to working in a regular scheduled operation, where low costs are paramount. Although there are some similarities, particularly in offering a no–frills service, most of the skills needed are different, as many in the low cost sector would testify.

However, before judgement can be made on MyTravel’s move into the low cost scheduled sector, a brief analysis of the traditional charter sector is needed. The charter airline industry emerged in the 1960s as the holiday market boomed in Europe, particularly to Spain, and tour operator demand for flight capacity increased likewise. In many respects, through the 1960s, 1970s and 1980s the charter airlines challenged the scheduled airlines in the same that the low cost airlines are challenging the scheduled today. For the tour operator, charter airlines offered cheap and flexible air travel — but this must be seen in the context of the traditional package holiday, where customers buy an all–in–one product.

From the 60s to the 00s

The challenge for today’s tour operator is that more and more holidaymakers are rejecting the typical package product, instead seeking to assemble their own holidays.

People are unwilling to take flights out of, for example, Gatwick airport at five in the morning in the peak summer season when the airport is packed with screaming children.

Rising living standards and the freer availability of pricing information via the internet are a real challenge to tour operators, particularly when combined with the trend by those who still book package holidays to postpone bookings until the last minute, instead of giving cash to operators up to 12 months in advance for a holiday priced far higher than those booked at the last minute.

But what does this mean for charter airlines? As the European tour operator industry consolidated in the 1980s and 1990s, most of the independent charter airlines were either taken over by the operators or went bust. The fate of most of today’s charter airlines therefore depends on the wishes of their operator owners — and as demand for more flexible packages and "better" flight times increases, then the traditional role of charter airlines must be in doubt. Of course there will always be demand for the typical package products by a hardcore of thrifty customers, who are prepared to put up with very early morning departure and arrival times based on 7 or 14–day periods, and for this demand an operator may well decide to keep a so–called "charter" operation. But for the growing number of more–demanding customers, operators may well want to develop other options — and that includes their own low cost, no–frills airline, which can depart at more sensible times and can offer more flexible departure dates for customers.

In an initial response to the greater demand for flexibility from customers, most European operators with their own charter airline started to offer seat–only capacity, and that has proved very popular with customers trying to bolt together their own holidays — MyTravel’s flight–only operation sells more than 1m seats a year. But charter flights also face a major challenge from the low–cost carriers, who in many cases offer not only better flight schedules, but also cheaper seats and slicker internet–booking capabilities.

So MyTravel is facing a double challenge: not only are traditional inclusive package- buying customers migrating to self–assembled, more flexible holidays, but also MyTravel’s answer to this problem — its own flight–only operation — is facing stiff competition from the low cost airlines.

Given these twin problems, MyTravel’s response is to set up a low cost airline of its own, in order to give those increasing number of "self–assembly" holidaymakers a different type of flight option to the charters that MyTravel currently offers. (The only other possible rationales for MyTravel’s low cost scheduled move — that it wants to earn a quick profit similar to that achieved by venture capitalist 3I with Go, or that it wants to distract attention from poor results at its core operations — can be discounted; MyTravel’s management is too smart for that.) It’s interesting to note that other major tour operators are also looking at launching low–cost, no–frills carriers — German giant Preussag, for example, is considering starting a low–cost airline in cooperation with regional airline Germania,

And the low cost scheduled airline launch should be seen in conjunction with other MyTravel moves, particularly in distribution. Airtours was a comparative late starter in the internet distribution game (way behind successful holiday/flight websites such as Lastminute, Expedia, and easyJet), but is now trying to play catch up via its MyTravel website, mytravel.com. According to MyTravel’s interim report: "Our investment in e–commerce is delivering results and accounts for over 7% of the UK internet travel agency market, without incurring any advertising expenditure." The site cost the group £10m in the six months to March 2002 — but MyTravel isn’t resting there.

The group also has plans for MyTravel TV — an interactive digital television channel to be launched later in 2002, which it claims it can do "without significant additional investment". While this latter claim may be in doubt, the move is significant because it appears that MyTravel realises it has to do more than just play catch–up with distribution via a website — a slick, easy–to–use transactional web site is not a differentiating factor any more for an airline, it’s just a minimum requirement that must be met. Some analysts may scoff at the interactive digital television plans, but proactive travel groups have to push the boundaries of distribution, even if that means taking risks.

A future for charter?

So what are the implications for MyTravel’s charter operations? Airtours had already shut down Air Belgium and, in November 2001, Fly FTi — its German charter airline — although the latter closure was primarily to do with problems at German tour operator subsidiary Frosch (FTi) and general overcapacity in the German inclusive–tour market. Instead FTi will use a variety of scheduled and charter airlines, such as Air Berlin, LTU and Aero Lloyd.

But MyTravel’s main charter capacity is operated by MyTravel Airways, the airline formed by the merger of Airtours International and Scandinavia–based Premiair earlier this year. The airlines’ combined fleet totals 47 aircraft. In March 2001 Airtours ordered 21 A320 family aircraft for Airtours International and Premiair, to replace leased aircraft as those leases expire. These 8 A320s and 13 A321s will arrive by 2004.

If the new low cost scheduled airline proves successful, then presumably there will be a further transfer of aircraft from the MyTravel Airways fleet into the new carrier. The rate of this transfer will depend on those two key factors affecting MyTravel’s core business discussed earlier — how quickly IT customers switch to self–assembled holidays, and how much further business the low cost scheduleds take from MyTravel’s flight–only operation.

It’s conceivable that in a few years' time the MyTravel Airways fleet will be reduced considerably, with MyTravel’s low cost scheduled airline providing the bulk of seat capacity at the Group. But whether the new scheduled airline succeeds or not, the long–term changes in holidaymakers' booking habits will continue, and the future for a charter airline that operates in the same way as MyTravel Airways does now looks bleak.

| 2002 | 2001 | |||

| Turnover Operating result* | Turnover Operating result* | |||

| UK | 938.1 | -50.8 | 830.8 | -87.6 |

| North Europe | 518.4 | -7.4 | 419.1 | -17.6 |

| Germany | 302.2 | -25.0 | 182.6 | -18.3 |

| North America | 340.0 | 4.3 | 280.1 | 0.7 |

| Other | 19.7 | 1.5 | 15.1 | 0.5 |

| Total | 2,118.4 | -77.4 | 1,727.7 | -122.3 |