Trans-Tasman market: unexploited business opportunities

August 2000

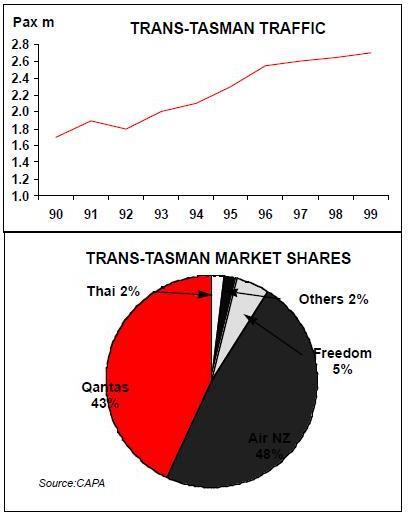

The Single Aviation Market (SAM) between Australia and New Zealand now has its first cross–border airline group following Air New Zealand’s takeover of Ansett. Air NZ itself has been 25% owned by Singapore Airlines since April. On a more limited scale, Qantas has established a franchise arrangement with Ansett New Zealand, now to be called Qantas New Zealand. With a combined market of 35m passengers a year, there are major potential; benefits for both groups (and possibly for Australian start–ups, Virgin Blue and Impulse), but there are also still business hurdles to a fully open market.

For Qantas, the way would now be clear to construct a wholly–integrated Australasian network, comprising domestic, trans- Tasman and regional services, with New Zealand domestic operations now to be accounted for by Qantas New Zealand. But Qantas already has in place most of the services it needs and will not be the main beneficiary of the Single Market.

The potential advantages are greater for the ANZAS partnership, including:

- Establishing a combined regional/ transTasman operation, capitalising on international routes out of Australia and New Zealand, and domestic networks within the countries;

- Creating a seamless service by operating between Australia and New Zealand,possibly out of domestic terminals on either side of the Tasman;

- Significantly improving aircraft utilisation and yields by setting up an interchangeable fleet system; and

- Further rationalising the joint cost base.

Air NZ has estimated a NZ$256m (US$130m) increase in annual profits will result from its combination with Ansett.

With Singapore Airlines standing by to provide capital and management support and additional fleet resources, the Air NZ group is set for a radical restructuring that should accelerate earnings growth and strengthen regional market share by 2003. Played properly, the merger of the two international/ domestic businesses could become a model for future cross–border airline partnerships.

Meanwhile, Ansett is well on the way to streamlining to a core airline with its operations stripped back to those directly related to flying and ticket sales. It has sold off its catering, express freight and other non–core business over the past 18 months, outsourced its IT requirements, and established establish a joint venture engineering company with Air NZ.

Yet, as the competitive environment heats up, the risk of internal disruption increases, in both the Australian and NZ markets, and on international routes. Air NZ’s task in bringing together two workforces with 22,000 employees, greatly differing corporate cultures and incompatible union agreements should not be underestimated. As a warning, Qantas’s merger with Australian Airlines in the early 1990s resulted in four years of employee conflict before the new relationship was bedded down. The Air NZ–Ansett evolution will not be helped in the short term by the recent sudden departure of experienced CEO, Jim McCrea.

Air NZ has however made a commitment to continue operating two separate brands within the one group — a sound decision given the strength of the Ansett brand in Australia. But, in the longer term, beyond 2003, the development of a joint image could provide a more effective group marketing presence.

Also, the Australian government has protected the Ansett brand, at least in a corporate sense, through the conditions laid down for Air NZ to acquire the second 50% of Ansett Holdings. Under these terms, Ansett and 49%-owned Ansett International will remain incorporated in Australia, and retain"substantial headquarters" there.

There is no specific mention in the approval as to which brand should be use commercially in domestic markets, although Ansett International will continue to serve most of the international routes into and out of Australia for the group.

The SAM provides the bilateral basis for an extension of beyond (fifth freedom) privileges to the other country’s airlines, though these have been resisted by Australia in the past. Air NZ remains subject to limits on its services out of Australia — a point reaffirmed by another of the approval conditions which requires international growth opportunities into and out of Australia to be "primarily exercised" by Ansett International (although that may not necessarily mean using their own aircraft). Air NZ has also agreed, under the terms set by the government, to support Ansett International’s expansion "consistent with commercial opportunities available to it".

Other approval conditions control the impact of the merger by ensuring that there are no "significant reductions" in employment at Ansett, and that regional services must be maintained. Only with Ministerial approval can regional (domestic) routes be withdrawn (an interesting evolution of "deregulation meets regional politics"). Australian interests also secure a sizeable presence on the Ansett–Air NZ board with at least one quarter of seats required to be held by Australian citizens.

Otherwise, within the scope of the government restrictions, Air NZ will have carte blanche to operate the two airlines as one in a combined domestic/trans–Tasman market.

Fleet integration

As the respective airline groups merge their operations into a single entity, the commercial demarcation which limits the Australian domestic market to Ansett and the New Zealand market to Air NZ should disappear. Both markets and the Tasman should be operated as one extended domestic system, with each airline group’s aircraft freely operating throughout the borderless market.

The resulting integration would permit innovative route structures and higher aircraft utilisation. With a sympathetic regulatory environment, the joint utilisation of fleets between alliance partners in this region could go even further than the Air NZ–Ansett collective. SIA could supply additional aircraft to Air NZ or Ansett.

Qantas and British Airways are also well–placed to interchange aircraft (an example being Qantas' recent decision to take six 767s from BA).

At present, there are no economic regulatory hurdles to this, but there are technical regulatory problems. The SAM agreement does not yet provide for mutual recognition by Australia and New Zealand of aircraft safety regulatory controls and certification: a seemingly minor hurdle, but to date an intractable one.

Australian domestic terminals for trans-Tasman flights

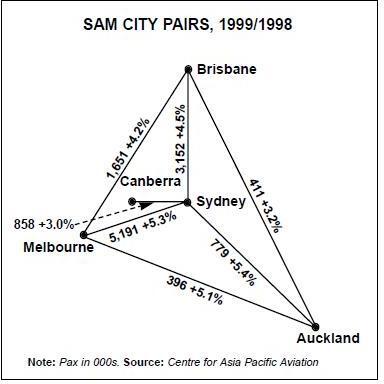

A further enhancement would be to allow trans–Tasman flights to operate into and out of domestic terminals (at present, Australia- New Zealand traffic is classified as international and must use international terminals). Some 96% of Australia–New Zealand passengers pass through three gateways, Sydney, Brisbane and Melbourne.

This would allow the development of competitive services from Australian secondary points to New Zealand. Air NZ’s subsidiary, Freedom Air, has been relatively successful in developing services from secondary point in New Zealand to Australia.

If domestic status were conferred on the Tasman, then it would be logical to remove existing customs and immigration requirements for passenger processing. Australia and New Zealand could ultimately agree to making either country a single point of entry for overseas travellers to the Australasian market, as has occurred among the EU’s Schengen states. However, these remain distant prospects.