The new, improved ARIA

August 1998

The most challenging of the flag–carrier turnarounds is probably that taking place at ARIA, which is attempting to find a strategy that will allow it to compete effectively with Western carriers on international routes to/from the Russian Federation.

ARIA has evolved from the two departments of the old centrally–planned Aeroflot that were responsible for international flights. It is still the main designated carrier for international services, operating to 53 foreign destinations plus 11 FSU (Former Soviet Union) points. The remaining political routes to Central America and Africa are due to be dropped.

ARIA still sports the famous Aeroflot logo (as, confusingly, do most of the other “Babyflots”), but there is a major contrast between the current airline and what used to be the world’s largest carrier. ARIA is now a modest–sized airline comparable to a minor Western European flag–carrier: its 1997 revenues are estimated at US$1.2bn.

ARIA’s fleet comprises about 110 jets, 97 of which are Soviet–built. But it achieves such poor utilisation with its Soviet–types — three to four hours a day on average — that it could conceivably operate its network with about 55 units.

Indeed, investment in Western types is central to ARIA’s strategy. Two 777s have just been taken on a seven–year lease from ILFC, while 10 737–400s are scheduled to displace more than 20 TU–134s, TU–154s and IL–62s from international routes.

However, delivery of the 737s has been delayed because of a side–effect of the economic and political crisis in Russia. When the first two 737s arrived, Russian customs imposed a punitive import tax on them despite an agreement with the government that the aircraft, financed by Exim Bank and Chase Manhattan, would be exempted.

Apparently, the necessary decree for tax exemption had been passed in the Duma, but had not been signed off by the relevant ministers because President Yeltsin dismissed the whole Russian government in May this year. However, the CEO of ARIA, Valery Okulov, who is Yeltsin’s son–in–law, raised hell and the tax problem has now been solved. A further six deliveries will take place in the near future.

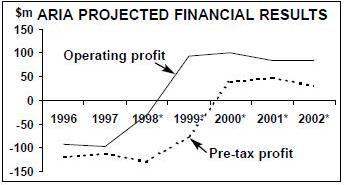

Taking on the Western equipment exposes the airline to a serious exchange rate risk at a time when the ruble is under continuous pressure, with some speculators anticipating an Asian–style collapse in the currency. Yet the airline has little choice but to accept an additional $40m per year in operating lease costs if it is to have a chance of achieving the yield increases envisaged in its business plan. Over the next five years ARIA expects its dollar yield to increase by about 2% p.a. — while traffic will increase by 8% p.a. — resulting in a net profit for the first time in the year 2000.

As ARIA’s yields are roughly half those of the AEA average, some improvement should be achievable. But first of all, for yield management to work ARIA will have to get its load factors, currently in the low 60s, up into the 70s.

ARIA’s aim is to recapture Russian passengers from Western airlines through improved service etc. Hopefully, this will then also attract Western passengers. It is using training programmes from Aer Lingus and SAS and intends to improve its schedule — for example, increasing frequencies on key routes (on Frankfurt–Moscow, Lufthansa offers 26 weekly services against ARIA’s seven). Ensuring that standard (Western) aircraft are on key routes, as opposed to a mix of Western and Soviet types, should be a big help.

ARIA’s business plan makes the right commercial noises, and the recovery path replicates the profit projections of most troubled European flag–carriers (see graph, above). The most nebulous yet also the most important aspect of ARIA’s business plan is the improvement in service quality and the successful projecting of a new improved image to Russian and Western markets.