THY: Exposure to local

and global politics

April 2019

Turkey has gone through difficult times since the 2016 attempted coup against President Recep Tayyip Erdoğan and the subsequent clamp-down, arrest and sacking of those deemed responsible. THY was itself thrown a little off course: it lost the architect of its development as a global carrier, Temel Kotil, who was transferred to run Turkish Aerospace Industries; it sacked its CFO Coskun Kilic among some 200 other staff; it saw traffic growth plunge from the 15%-20% annual growth in passenger numbers of the previous ten years to a mere 6% in 2016 in which year it registered its first loss for a decade.

Then there was a constitutional referendum in 2017 which resulted in a material change from Mustafa Kemal Atatürk’s secular parliamentary democracy into an executive Presidential system, confirming Erdoğan’s grip on the political environment. This severely unnerved international investors and political neighbours — particularly in the EU which at one time had been building towards the idea of Turkey joining the bloc.

Given the events of the last three years, the EU’s relationship with the country has deteriorated and Turkey can no longer be regarded as a candidate for inclusion within the EU, even in the remotest sense. This may be damaging for the country’s long-term economic prospects.

Equally Turkey’s relations with the USA soured badly following the arrests firstly of a US consulate employee and then of an American pastor. There was a tit-for-tat indefinite suspension of non-immigrant visas. In August last year the US Treasury’s Office of Foreign Assets Control imposed sanctions on Turkey’s Minister of Justice Abdulhamit Gul and Minister of Interior Suleyman Soyluand; and then President Trump imposed punitive tariffs on Turkish exports to the US.

Since 2016, however, THY’s fortunes have recovered: in the last two years passenger growth has returned to an annual increase of 10% and it has recorded record levels of operating profit. Its apparently inexorable path to become one of the largest global European carriers seems unstoppable.

Indeed, the company’s results for 2018 were respectable, despite increases in fuel costs and lira weakness. Total revenues were up by 17% to $12.9bn (with a 15% increase in passenger revenues and a 25% growth in cargo). This was on the back of a modest 5% increase in capacity in ASK terms, 10% growth in the number of passengers and a 9% rise in demand in RPKs giving a 2.8 point improvement in annual load factors to a record 81.9%.

Passenger unit revenues were up by 8.4% (and 10.9% on a like-for-like currency basis) while unit costs increased by 9%. Excluding the impact of a 32% jump in the fuel bill, unit costs grew by 3%.

Given that the company has a substantial 25% of its cost base and only 13% of revenues in Turkish Lire it is strongly cash flow positive in foreign currencies, which in 2018 had the result of boosting profits by over $500m. Total operating profits came in at $1.2bn up by 47% from the prior year’s $794 giving a reasonable 9% margin. Net income meanwhile more than trebled to $753m up from $223m in 2017 reflecting a 6% margin.

İstanbul’s new airport

At the beginning of April, THY moved its entire operations in a single day from the old İstanbul Atatürk airport to the newly built İstanbul Grand Airport (İGA).

Atatürk Airport (based at Yeşilköy on the European Aegean coast 24km from the old centre of the city) was full and had limited opportunities to expand. Its throughput in 2018 was nearly 68m passengers, three times the volume a decade earlier, making it the tenth largest international airport and 17th largest airport for total traffic in the world. İstanbul’s second airport Sabiha Gökçen (50km from the centre of the city on the Asian side of the Bosphorus) had also been constrained: with a single runway and nominal terminal design capacity of 25mppa it dealt with over 34m passengers in 2018 up from 4m in 2008. A new domestic terminal opened in 2018 and a second runway is due to open this year to enable it to deal with up to 63mppa.

İGA, İstanbul’s new airport, is 50km north-west of the city centre on the European side of the Bosphorus near the Black Sea town of Arnavutköy. In its initial phase it has a capacity of 90mppa with a single terminal and two sets of parallel runways. By 2027 it is expected it will be able to expand to encompass eight runways and a second terminal to build capacity to 150mppa, with an ultimate potential envisaged of over 200mppa. On 6th April the IATA code IST was transferred to the new airport and the old, redesignated, limited to charter and cargo flights.

However, this move has come at a time when the Turkish economy is facing a classic debt and currency crisis. Various strange economic attempts from the Erdoğan government, and a distinctly unconvincing Finance Minister Berat Albayrak (who just happens to be Erdoğan’s son-in-law), has led to extreme volatility in the exchange rate — at one point last year the lire had halved in value to ₺6.9 to the dollar — while the Central Bank raised interest rates to 24% to try to stem the weakness. Inflation has been cruising ahead at 20% a year.

In the last two quarters the economy contracted by 1.6% and 2.4% respectively giving annual GDP growth of 2.6%, down from 7.4% in the previous year. The IMF is forecasting a continuing recession for 2019 with GDP expected to fall by 2.5%.

In an attempt to shore up the exchange rate and avoid bank failures Central Bank net foreign reserves have apparently slumped from $35bn in March to $15bn (excluding some $12bn somewhat dubious “off-balance sheet” swaps according to analysis from the Financial Times).

Meanwhile, although Erdoğan’s ruling AKP party won the majority of the vote in recent nationwide municipal elections, it lost control in the capital Ankara among other cities and, after multiple contested recounts, in the most populous İstanbul.

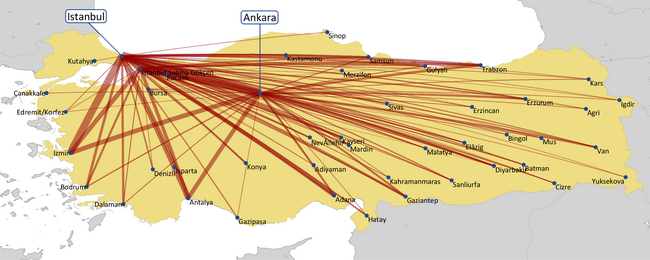

But does this matter at all to THY? It does have a large domestic system: 43% of its 75m passengers are carried on domestic routes, but we doubt that it makes any real money operating domestic services (many of the routes operated to the East of the country have a socio-political role and are public obligation routes).

Its raison d’être is in building İstanbul as a global super-connector hub to rival the Gulf 3 and 57% of its traffic by passenger numbers are international. As shown in the graphs, 75% of that international traffic transfers and 56% of the international traffic by passenger numbers transfers at İstanbul between international flights.

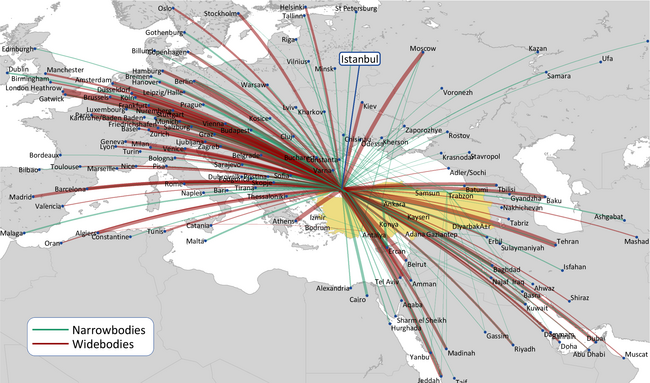

Unlike the other super-connectors (primarily Emirates) THY’s model is based on feed to/from short haul narrowbody flights. It can connect all the airports in Europe, Western India and much of Africa through İstanbul within range of its narrowbody fleet (see map). It boasts that it flies to 240 cities in 124 countries (excluding the 49 domestic destinations). Unlike Emirates it is not limited in the number of cities it can serve in Europe, and has access to 14 destinations in Germany, 10 in Italy and six in France. It can use narrowbody aircraft into many of the 55 cities it serves in Africa.

Because of this it prides itself on providing the best connectivity respectively from Europe, the Middle East, Africa and the Far East to the rest of the world (see table).

Fleet

The key to THY’s future development is the aircraft fleet (see table).

In 2018 it operated a total of 332 aircraft: 92 widebodies incorporating 55 A330s, 4 A340s and 33 777-300s; 218 narrowbodies equally split between 737s and the A320 family; and 22 freighters.

It will be retiring the last of the A340s this year and has in place orders for 25 A350s and 25 787s for delivery over the next five years, partially to replace the older A330s but mostly for growth.

On the short haul fleet it expects to take delivery of 68 737MAX and 90 A321neos over the same period.

It expects its total fleet to reach 476 units by the end of 2023, up by 50% from the 2018 level, and that this fleet growth will generate an annual average increase in seat capacity approaching 10%pa.

A challenge for the company may be that as it introduces more A350s and 787s it comes into increasing direct competition with established long haul players. The risk is that this undermines its niche position of attacking low volume routes with its narrowbody aircraft that are substantially under the radar of competitors' ambitions.

Competitor objections absent

Somewhat surprisingly, despite THY’s phenomenal growth and its positioning as a super-connector leaching traffic from established global international hubs, it has avoided opprobrium from the world’s largest airlines.

It has attacked Lufthansa’s hinterland to siphon traffic away from Frankfurt and Munich through İstanbul and yet the two carriers have a seemingly fruitful joint venture charter operator in Sun Express and through wet lease arrangements in Eurowings.

However the US major three (American, Delta and United), while they have set up a major campaign through the Partnership for Open and Free Skies to argue that the operations of Emirates, Qatar and Etihad are blatantly unfair, have seemingly ignored the fact that THY is following exactly the same operational model: providing global services that bypass traditional hubs as a government-supported airline. But unlike the Gulf three, while THY is still 49% government owned (and controlled), its shares are listed on the İstanbul exchange and it appears to be run profitably and commercially.

As THY grows along its destined path to global domination, and while Turkey continues to antagonise its trading partners in the EU and the US, the benign attitude towards its growth strategy may change.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | ||

|---|---|---|---|---|---|---|---|---|---|

| Widebodies | A330-200 | 20 | 18 | 18 | 18 | 13 | 13 | 8 | 5 |

| A330-300 | 31 | 37 | 37 | 39 | 39 | 39 | 38 | 31 | |

| A340 | 4 | 4 | 4 | ||||||

| 777-300ER | 32 | 33 | 33 | 33 | 30 | 30 | 30 | 30 | |

| A350-90 | 5 | 9 | 17 | 25 | |||||

| 787-9 | 6 | 15 | 21 | 25 | 25 | ||||

| Total | 87 | 92 | 92 | 96 | 102 | 112 | 118 | 116 | |

| Narrowbodies | 737-900ER | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 |

| 737-9MAX | 5 | 10 | 10 | 10 | 10 | ||||

| 737-800 | 110 | 108 | 99 | 96 | 88 | 86 | 82 | 78 | |

| 737-700 | 1 | 1 | 1 | 1 | |||||

| 737-8MAX | 7 | 19 | 38 | 53 | 65 | 65 | |||

| A321 neo | 2 | 21 | 39 | 59 | 77 | 92 | |||

| A319 | 13 | 7 | 7 | 6 | 6 | 6 | 6 | 6 | |

| A320 | 29 | 22 | 19 | 14 | 12 | 12 | 12 | 12 | |

| A321 | 66 | 68 | 68 | 68 | 66 | 64 | 64 | 64 | |

| Total | 234 | 221 | 218 | 245 | 274 | 305 | 331 | 342 | |

| Cargo | A330F | 8 | 9 | 10 | 10 | 10 | 10 | 10 | 10 |

| 777F | 2 | 5 | 6 | 8 | 8 | 8 | 8 | ||

| Wet Lease | 5 | 5 | 7 | 4 | |||||

| Total | 13 | 16 | 22 | 20 | 18 | 18 | 18 | 18 | |

| TOTAL | 334 | 329 | 332 | 361 | 394 | 435 | 467 | 476 | |

| Seat Capacity % change | 0% | -1% | 10% | 10% | 11% | 8% | 2% | ||

Source; Company reports.

| O&D Pairs | |

|---|---|

| Europe to the world | |

| THY | 22,356 |

| British Airways | 9,588 |

| Lufthansa | 8,004 |

| Middle East to the world | |

| THY | 9,044 |

| British Airways | 2,208 |

| Qatar | 1,980 |

| Africa to the world | |

| THY | 12,699 |

| Air France | 4,585 |

| British Airways | 3,043 |

| Far East to the world | |

| THY | 9,504 |

| United | 8,700 |

| Air China | 5,115 |

Source: THY presentation

Notes: Equidistant azimuthal projection based on Istanbul: great circle routes appear as straight lines; thickness of lines directly related to annual seat capacity.