JetBlue to make a Mint

on the Atlantic?

April 2019

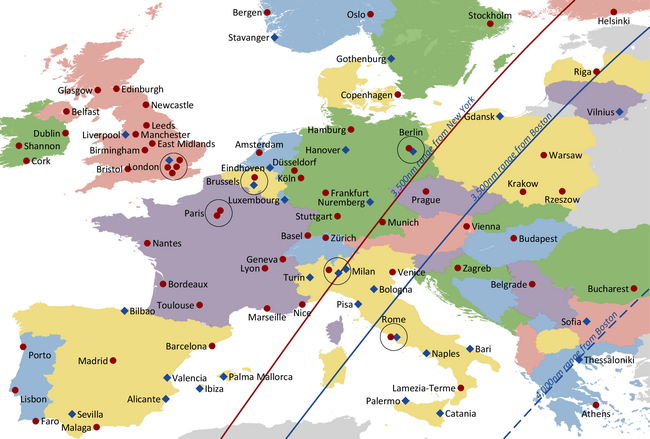

Long-awaited as the next logical development, JetBlue finally in April announced it would start services on the Atlantic. It has converted 13 of its order for 85 A321neos to the long range version and aims to serve a handful of destinations in Europe from its focus cities of New York and Boston. The hybrid low cost carrier has been a disruptive but successful force in the US market: could it have a similar impact on the oligopolistic Atlantic?

Passengers will still have to wait a bit more before before bookings become available: the new aircraft will not be delivered until 2021; the airline will have to get ETOPS certification; JetBlue will have to decide on the destination airport, and get the slots to be able to operate a reasonable service.

The long range version of the A321neo has been described as a game-changer: offering narrowbody operational efficiency at seat costs similar to new generation widebodies. Airbus' specifications show a maximum range of 4,000nm with typical capacity of 200 seats — slightly longer range than the older generation 757 — which nominally would bring most of Western Europe within range from Boston and New York. And it would do so with trip costs some 27% lower than the 757.

However, in practical terms on the Atlantic the realistic range for year round operations is likely to be somewhat shorter. The additional range is achieved by the use of an additional auxiliary fuel tank in the belly of the aircraft the modifications for which which adds weight and removes space available for passenger bags and cargo. In addition, the aircraft cruises at mach 0.78, some 10% slower than an A330 or 787.

As part of the testing process Airbus proudly announced last year that the aircraft achieved the longest single-aisle flight of 4,750nm from Mahé to Toulouse — albeit with 162 dummies on board and taking over 11 hours.

Getting the necessary

Robin Hayes, CEO of JetBlue, speaking at the UK Aviation Club on the day of the announcement, was fairly confident that the airline will get the ETOPs certification by the time the aircraft are delivered in 2021. He was less certain about sharing which destinations on this side of the pond he would target.

In a presentation at the company’s Investor day in 2016 the company had highlighted that it was present in 39 out of the top 50 domestic and international destinations from Boston with London, Paris and Dublin marked as “not currently served”. Given that London and New York are by far the largest gateways on the Atlantic it would be surprising not to try services to London.

On the company’s Q1 results conference call, Hayes described London as “the biggest metropolitan area we don’t serve” from its main hubs and said that the decision to launch service to the UK capital was “really about making our focus cities in Boston and New York more relevant.” He characterized the move into transatlantic service as “developing mature focus city markets” rather than just adding more destinations to JetBlue’s network, and added, “The investment community should be pleased about that.”

Somewhat more difficult may be the ability to acquire the relevant slots. He stated that “we’re keeping details under our hat for now in terms of where exactly we’re thinking of flying into in London, but we’re very confident that we have a path into more than one London airport”.

However, Heathrow — the airport of preference — is full, and Gatwick virtually so, and because of the 1992 EU slot allocation rules (which have been “high” on the agenda for review since 2013) it may be take some time to acquire the necessary portfolio of year round slots: if the company were to use all 13 A321s on London it may imply a need for six daily slot pairs. “We’ll bring the airplanes”, he said, "we’ll bring the low fares, we’ll bring the service. We’ll bring everything else. The thing we can’t bring are the slots. But make those slots available to new entrants like JetBlue, and you will see a profound and dramatic effect with lower fares in the market.”

As well as London he mentioned that Paris was of interest and that Amsterdam also on the radar, although he said that for the Dutch capital he had been told that there would be no slots available there “for the foreseeable future”. Just to keep everyone guessing what the real plans are, he also mentioned that the A321 could also ideally be used to access routes to regional airports in the UK and Europe, saying: “There’s gonna be a bunch of regional airports both in the UK and in Europe that this airplane will work in and we haven’t even started thinking about it yet, because we want to start with the larger airports where our customers in Boston and New York are telling us where we need to prioritise.”

In his speech to the Aviation Club, Hayes railed somewhat at the joint ventures on the Atlantic highlighting the oligopolistic nature of the regulatory-inspired market concentration. JetBlue should be used to this environment, battling as sixth largest carrier in the US against the 80% market control by the big three and Southwest. He pointed out, however, that JetBlue had been particularly successful in targeting premium markets with its Mint product on transcontinental services, almost halving competitor business class fares in doing so.

The current Mint service JetBlue operates on transcon services is operated on 159-seat A321s: 12 full lie-flat bed seats (7ft6in bed length) and 4 closed “suites” in the front cabin, 41 standard seats in “Even More Space” cabin (37in-41in seat pitch) and 102 standard seats in the “Core” cabin (33in seat pitch); complimentary food service; seat back IFE with TV and films; AC power at each seat; relatively high speed wi-fi internet access. The company stated that it plans to reimagine the product offering for the European market.

Will JetBlue’s entry onto the Atlantic be disruptive, and more importantly will it be successful? The Atlantic has been a graveyard for many wannabees from the all-business class operations of MaxJet and Silverjet at the top of the last cycle to recent casualties such as Primera (who would have been the launch customer for the A321neoLR), while financially-challenged Norwegian is struggling to make sense out of its foray into long haul low cost.

However, JetBlue is embarking on the venture focused on its strong bases at JFK and Boston; its model is based on point-to-point O&D demand (only 10% of its passengers connect, while New York-London is the strongest O&D market on the Atlantic); and it is planning to operate low capacity aircraft — with only 159 seats to fill it may even be able to make money on a wet Tuesday in February; and the routes will reflect only a small part of its network.

With the currently planned 13 aircraft it could achieve a modest 1.3% share of the seats into London. The Mint product is high quality and has been priced aggressively domestically in the US. Robin Hayes suggested that JetBlue would price similarly on Atlantic routes at around the $590 one way level ($1,180 return) — although there are some higher natural costs on the route.

In the chart we show a snapshot of the lowest business class return fares between Boston and New York and London and Los Angeles for travel at the end of May. To generalise, the fares out of London are more than twice those of the transcon routes. If JetBlue can make inroads into the corporate and SME markets it could be able to offer a highly attractive proposition.

The outlying offer in the chart is the price of tickets in the premium cabin of Norwegian’s 350-seat 787-9, which is not really comparable (seven-abreast reclining seats with 40in seat pitch) — but may go some way to explain market leader BA’s slightly more competitive offering. (It is somewhat amusing that different members of each joint venture alliance have different price points even on the same aircraft.)

Meanwhile, while JetBlue will have to wait for a couple of years before this becomes a reality, Aer Lingus — with 14 A321neoLR due in on lease from Air Lease Corporation (to be configured with 16 lie-flat business class seats and possibly 135 economy seats) — aims to be starting its Atlantic operations using the aircraft this year. It will initially be using them to replace its four wet-leased 757s (which it uses for services from Dublin and/or Shannon to New York, Boston, Philadelphia, Hartford CT and Washington). The remainder it will use for further network expansion (and it boasts the advantage of preboarding immigration controls in Dublin and that there are ten times as many Irish in the US as there are on the island of Ireland).

There are currently some 2,144 A321neos on order (see tables above). Airbus does not distinguish in its order book quite how many of these are for the Long Range variant, but we estimate it to be something around 5% of the total. Other airlines will no doubt convert.

| Airline | In service | On Order |

|---|---|---|

| Wizz Air | 2 | 182 |

| Indigo | 1 | 149 |

| Vietjet | 7 | 116 |

| AirAsia | 100 | |

| Delta | 100 | |

| American | 2 | 98 |

| THY | 5 | 87 |

| jetBlue | 85 | |

| Lion | 65 | |

| Qantas | 54 | |

| Qatar | 50 | |

| Lufthansa† | 48 | |

| Pegasus | 43 | |

| Viva Aerobus | 41 | |

| Volaris | 5 | 34 |

| Frontier | 34 | |

| Cathay | 32 | |

| Cebu Pacific | 1 | 31 |

| Korean | 30 | |

| Norwegian | 30 | |

| Avianca | 2 | 26 |

| Etihad | 26 | |

| easyJet | 5 | 25 |

| Asiana | 25 | |

| TAP | 6 | 22 |

| LATAM | 19 | |

| Gulf Air | 17 | |

| IAG‡ | 4 | 16 |

| Philippine | 6 | 15 |

| Middle East | 15 | |

| Spring | 15 | |

| Jetsmart | 14 | |

| All Nippon | 11 | 11 |

| Aegean | 10 | |

| Air New Zealand | 4 | 9 |

| Hawaiian | 12 | 6 |

| Others (16) | 40 | 8 |

| Total* | 113 | 1,680 |

Source: Airbus.

Notes: † Lufthansa 40, Swiss 8; ‡ BA 10, Vueling 6, Iberia 4, excludes Aer Lingus 14 to be leased from ALC; * excludes 76 orders and 4 in operation by undisclosed purchasers

| Lessor | In service | On Order |

|---|---|---|

| Air Lease Corp | 18 | 121 |

| Aercap | 33 | 59 |

| Avolon | 56 | |

| GECAS | 11 | 44 |

| SMBC | 31 | |

| CDB Leasing | 2 | 29 |

| BOC Aviation | 3 | 20 |

| Aviation Capital | 10 | 11 |

| ICBC | 2 | 11 |

| ALAFCO | 10 | |

| CALC | 1 | |

| CIT Leasing | 1 | |

| Total | 81 | 392 |

Source: Airline Monitor. Notes: Area of bubble directly related to number of seats ("Standard" three class configuration). Consumption figures estimated for A330-800/900, A350-900/1000, 787-10, 777-8/9.

Notes: Non-stop return fares in business class for travel end May 2019. †Operated by Delta. ‡To Newark

Source: Skyscanner.net, 26 Apr.